A 10 Trillion Dollar Opportunity

We need to look at web3 & crypto beyond exchanges, speculation & "gambling"

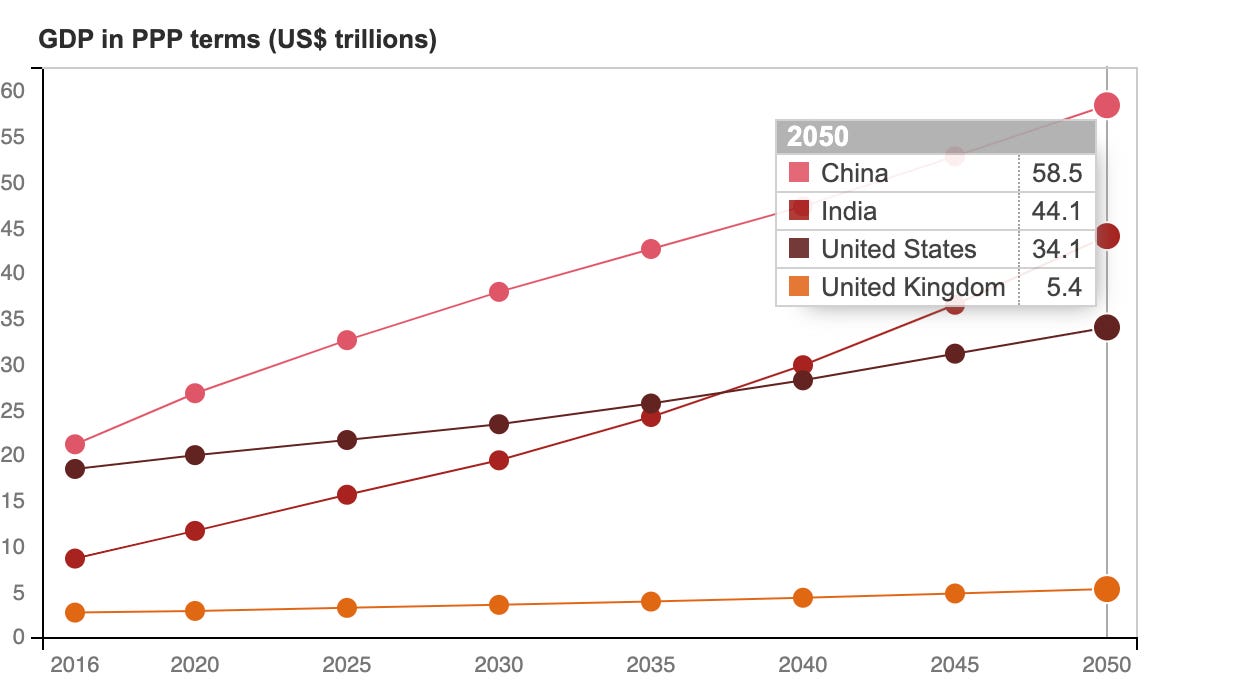

Today, India celebrates 75 years of Independence. It is a fair assessment to say that we, as a nation, have made tremendous progress since 1947. So much so that, India is expected to surpass the US and become the 2nd largest economy by 2050.

In this essay, we’ll argue why we should think of web3 & crypto as an opportunity for Indians to earn global wages - from India. This is great both for the people who will earn significantly more than what local markets offer & for the country which will see net capital inflows into its economy.

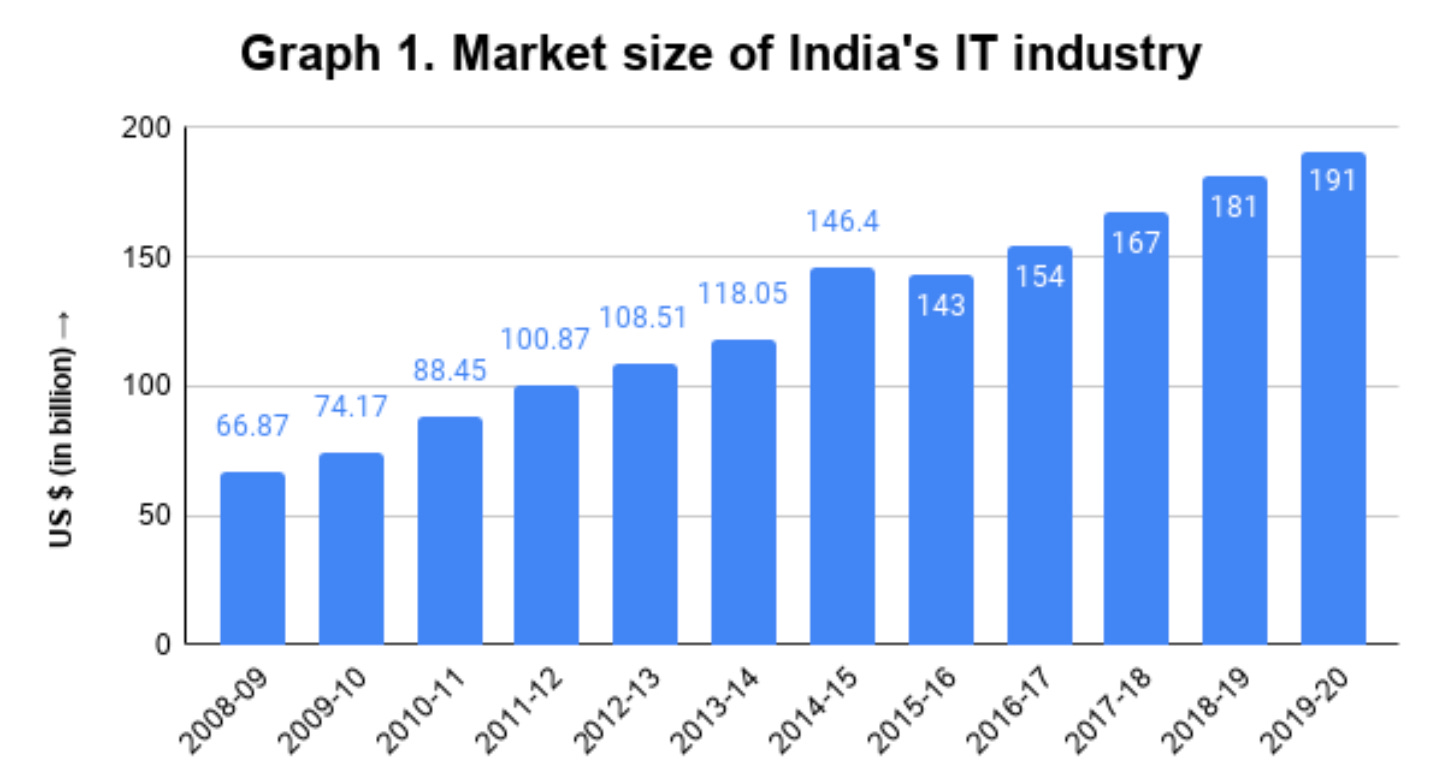

Before looking forward, let's look back at one of the key drivers of the India story - Software & Information Technology. According to this article, India’s IT firms have captured 55% of the global outsourcing market. They generate over $200bn in income, bringing home 43% of India’s forex revenue. They are the largest private sector employer, providing 50 Lakh jobs in India. They also provide over 16 Lakh jobs in the US, adding more to the American economy than the top 20 states combined. To put it in perspective, the Indian IT industry has grown 3x in size over the last decade. This is impressive beyond imagination.

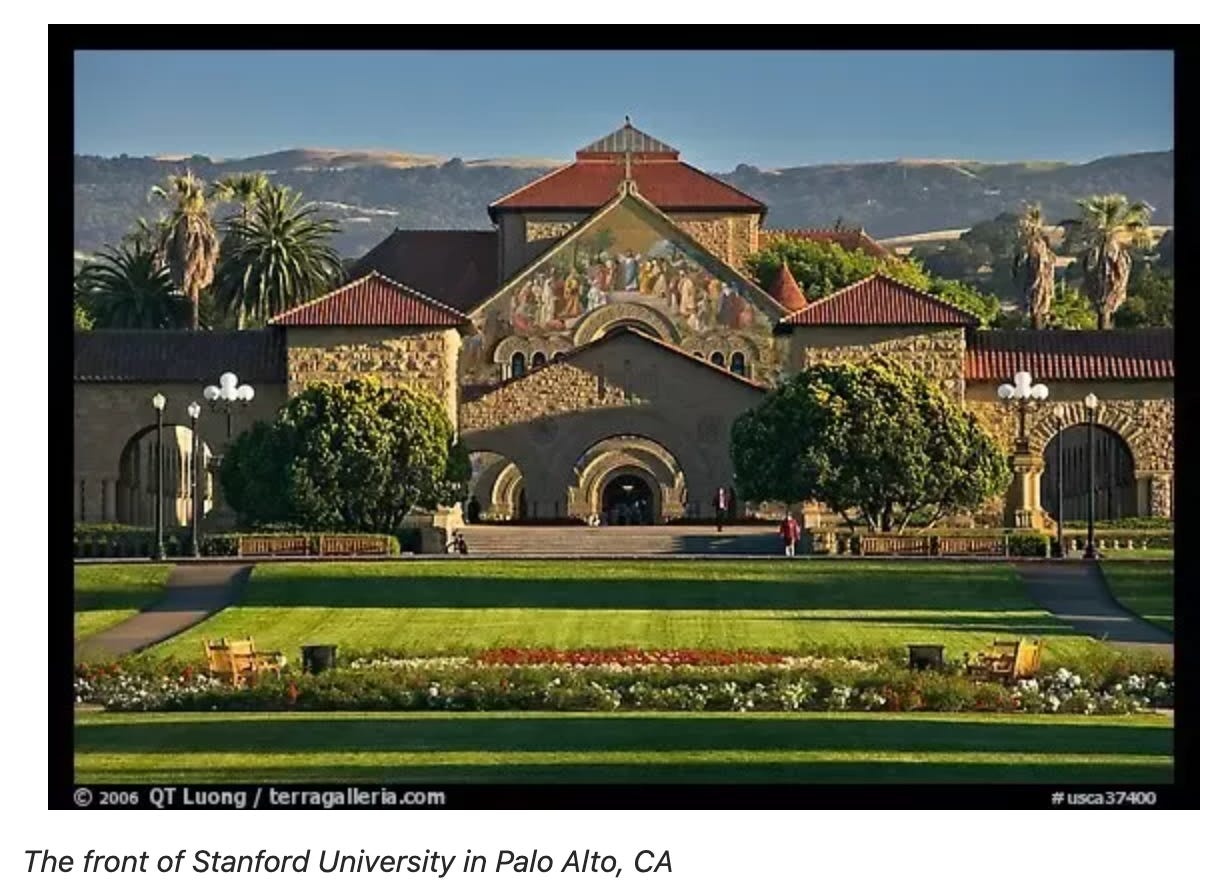

However, for a lot of Indians - the golden ticket to a better life has been access to the USA. It is no secret that the golden era of tech was geographically restricted to small parts of the US - Silicon Valley. The internet is littered with theories on why this was the case, I found this answer on Quora pretty comprehensive. I'll paraphrase some key points from it. Firstly, the presence of high-quality universities like Stanford & Berkeley. In the 1990s, the US was emerging victorious from the cold war. Research & development in technology was a critical tool in this war & these universities became hubs. A physical concentration of the cutting edge hardware, brightest minds & capital was a precursor to the Silicon Valley we know today.

Secondly, California was already home to giants like HP & Intel. The Intel IC chip made computers faster, cheaper, and more accessible than ever. Both these companies poured billions back into the universities that gave them their initial startup capital. And no doubt provided belief and inspiration to everyone in physical proximity to them. Finally, accessible education and a happy climate. It is said that California's community college system provides affordable technical education at scale to everyone in the region. It had pleasant, sunny weather & vast open lands. I did find it odd that good weather made it on this list of heavy hitters, but one look at the Bombay vs Bengaluru vs Delhi twitter debates confirms this is important ;)

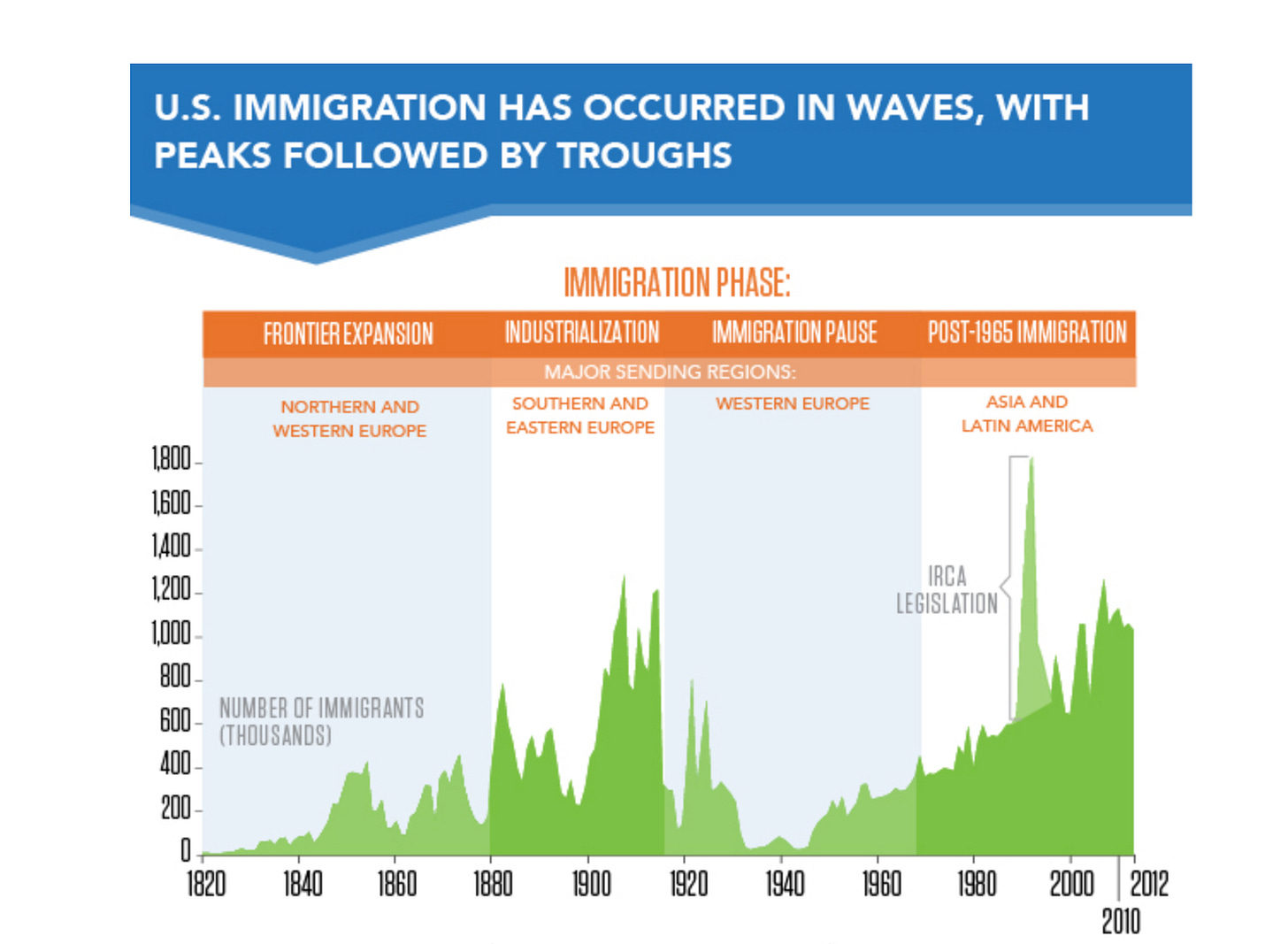

Coming back to our point - if you wanted access to global opportunities & wealth, the US was the place to be. As if on cue, the US govt. announced favorable immigration policies for skilled workers (H-1B) in 1990. This was probably a move in enlightened self-interest because it was a big shift from historical policies that favored white Europeans, relatives & those “in the know”. The US realized that attracting the best minds from all over the world would consolidate its position as a global leader and help counteract any upcoming alternate centers of power. And no one was complaining. For the next 3 decades, migrating to the US was a global aspiration to create a better & richer life for people from Asia & LatAm.

Following our liberalization in the early 1990s, Indian universities & IT services firms became the launchpads for anyone who wanted to move to the US. The playbook was, that you took up a job at any IT services firm which had US clients, worked your way into an opportunity to go "on-site" and got the coveted H1B visa. This was a dual-intent visa that allowed you to work and even immigrate, unlike other work-specific visas. It was also possible to switch employers in the US while holding this visa. This also made it less important which company you joined in India, to move to the US. A former boss of mine told me he had to come back to India and serve a court appearance because he broke a "bond" he had signed with his employer in India. He said it was worth it. The other approach was that you completed a B.Tech degree (engineering) and applied for a master's program in the US. There was a dedicated H-1B quota & a few years of exemption for certain STEM master’s programs.

The H-1B visa had an amazing product-market fit with Indians. We were skilled in engineering, ready to work hard & fit in. The US wanted the world's best. It is no surprise that 73% of all H-1B Visa holders in the US are Indians.

The “Indian techie making it in America” is a common idea. Let’s take it one step further and attempt to estimate exactly how much value was unlocked by the Indian community that migrated to the US & worked in tech. There are three ways we will do this:

Stock comp based: Total stock comp * % earned by Indians

Market cap based: Total tech market cap * % ESOP * % earned by Indians

Income-based: Median Indian household wages * # of households

As an MBA, it is my moral obligation to inform you that all of these calculations are incorrect. Each approach has its own pros & cons. I hope that by approaching the problem from three distinct approaches we can arrive at some common ground to build on for the rest of this essay.

TL;DR: The 1.2m Indians who work in US tech earned anywhere between 100 - 300 billion dollars in the last decade. It works out to anywhere between $350,000 to $1,000,000 per household.

Stock Comp Based

Step 1. How much did tech companies payout in stock-based comp?

We can get this info at a company level from here. For simplicity, we’ll take the total paid out by the top 5 companies & multiply it by their relative market cap to estimate the total. That works out to $800bn paid out in stock compensation by US tech companies in the last decade.

Let's take a small detour to understand why tech companies pay out so much in stock comp. Internet businesses have done a much better job of sharing wealth with their employees than traditional businesses. To see exactly how much better, just compare the top tech companies with a non-tech peer of your choice here. The key reason for this is that the 2nd most valuable asset for tech companies was the creativity of their employees (any guesses for what's #1 ? ). They didn’t make money by having physical monopolies through control of natural resources or lobbying for licenses. The infinite leverage of technology meant that an idea cooked up by one person at their desk could instantly be distributed to the world and become a multi-billion dollar business. Tech companies quickly realized that sharing upside with employees (via stock ownership) is the best way to create a much larger pie. Anyway, back to our "calculation".

Step 2. How much of this did Indians earn?

We estimate this by assuming taking the % of Indians in the workforce & assuming the payout was evenly distributed. This is obviously not the case but a reasonable assumption given Indians have progressed sufficiently across all levels in tech. The Indian Tech CEO is another popular cultural meme.

Multiple surveys indicate that Indians make up 10% of the tech workforce. With a 12m total workforce, that implies 1.2m Indians work in tech. This works out to roughly 50% of the Indian community in the US. Seems reasonable.

This works out to $80bn earned by Indians through tech stocks. I'm going to round this up to $100bn because wages data indicates that Asian tech workers earn more than their counterparts.

This approach completely ignores the meaningful cash component of tech earnings. I was unable to verify whether this is the amount paid out on exercise or the net value created. Feels like the former. Hence, this should be thought of as the lower bound of our estimate

Market Cap Based

Step 1. What is the total market cap of US tech companies?

As per companiesmarketcap, it is $15.4T.

Step 2. How much of this is owned by employees via stocks over the life of the company?

Tech companies typically have a 15-20% ESOP pool. This shrinks as they get bigger. So let’s go with 15%. This equals $2.3T in employee ownership. Applying a 10% Indian ownership ratio gives us $230bn in value captured by the Indian tech community.

This approach assumes ownership based on the current market cap. Real stock ownership would likely be lesser than this because people would have sold through the course of the year.

Income Based Approach

Step 1. What’s the median household income of Indians in the US over the last 10 years?

As per this report, it is 2x of the median US household income & currently at 132k. The median US household income has grown from 50k to 65k in the last decade. So we’ll assume 100k as the median annual household income for the last decade.

While this figure is reported for all Indian-led households, we’ll assume it is the same figure for those working in tech. This should be fine since tech is one of the higher-paying professions.

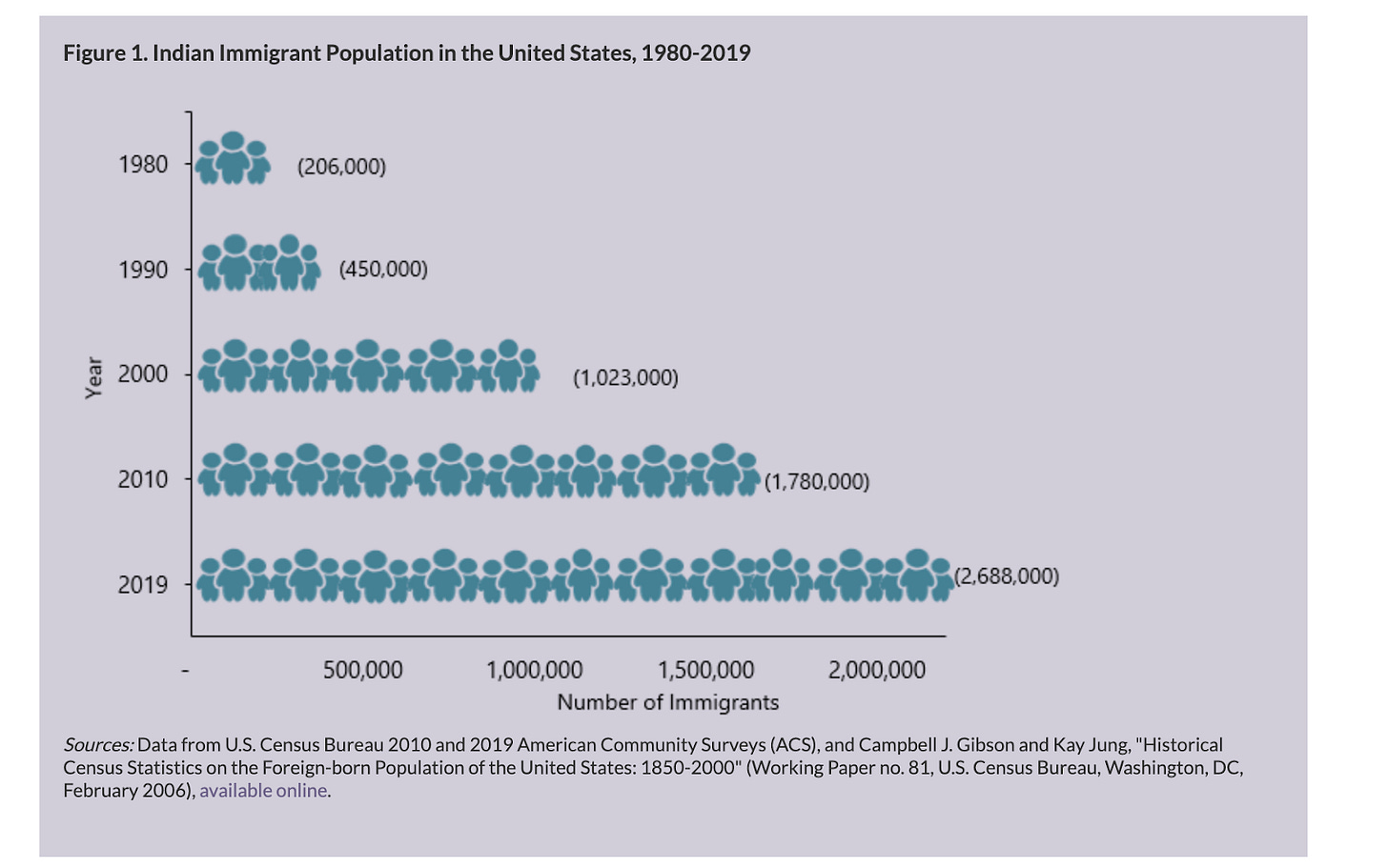

Step 2. How many Indian households are in the US?

The total community is 2.7m strong. With our assumption that 50% work in Tech we get 1.35m people. Taking 4 people per household, that is 340k households. Totaling up to $350bn of earnings over the last decade.

Once again, TL;DR: The 1.2m Indians who work in US tech earned anywhere between 100 - 300 billion dollars in the last decade. It works out to anywhere between $350,000 to $1,000,000 per household.

The world is flatter than ever. Because the internet makes all markets global. Today, information exists in a global market. Anyone can publish text, audio, and video content to anyone in the world. Conversely, anyone can consume content produced anywhere in the world. Similarly, capital markets are more accessible too, as an Indian you can invest in global stocks. But this is not as seamless as information markets. You need access to capital to invest, there need to be regulated products you can buy, etc. Similarly, labor is at the far end of the spectrum. Because, until recently - you needed to pack up your life and move to another country.

It cannot be understated how high the barrier to accessing global opportunities is. You have to take a one-way ticket across the world and settle in a completely new country where you don't speak the language or know anyone. And hope you can make a life there. All of this while dealing with massive uncertainty. The H-1B has a fixed quota of <100k/year and it is a lottery. You get a fixed number of tries and can't meaningfully influence the outcome based on skills, good behavior, etc. We have all heard stories of friends who can't travel until their passports are stamped, people who had to relocate because their visa tries at the lottery ran out and relatives who were burnt out and came back from isolation and loneliness. Add to this the fact that the rules of the game can change at any point in time. Even if you're there and have an H-1B you can't work at early-stage startups or start-up on your own, because the cost of keeping the visa is high. And you're reminded of your outsider status by practices like companies having to advertise vacancies to locals before filing for your H-1b. Despite all this, there is no doubt that the H-1B has been an effective tool for creating value for immigrants & America. We've already seen the impact on immigrants, but this article highlights the benefits to the US. H-1B workers have contributed $27b annually to social security, spent $76b at local businesses & invested over $12b in American businesses.

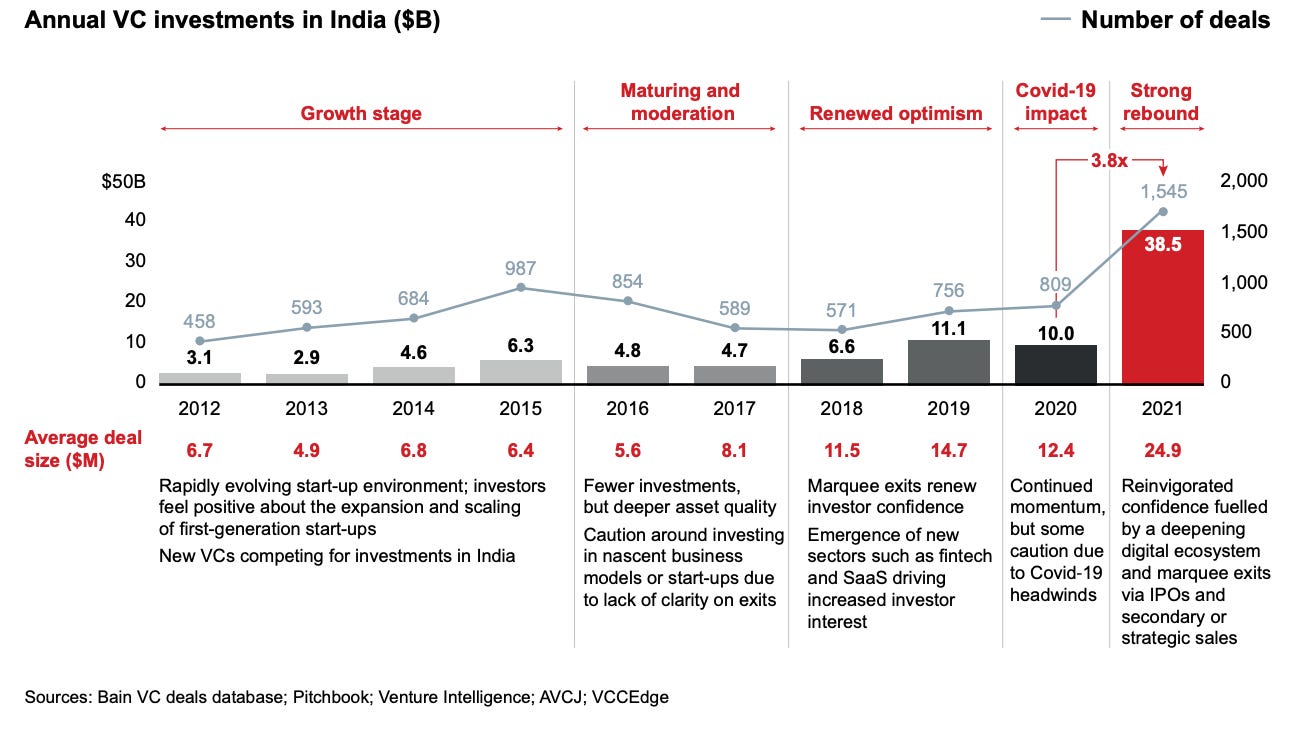

A time of global opportunities. Times have changed & moving abroad is no longer the only viable way to access global opportunities and wealth. There has been an influx of venture capital in India over the last decade. Here are some interesting stats from a Bain report on venture funding in India. The size of the venture industry has grown from $3bn to $40bn. The number of deals/year has increased from ~100 to 1500. The average deal size has increased 4x, from $6.7mn to $25m.

This has created a startup boom in India allowing young & talented builders to pursue opportunities for wealth creation from home. It started off with bringing international business models home, through companies like Flipkart & Ola. Followed by companies like Zerodha, Razorpay & Cleartax which found businesses unique to India first. And now upcoming startups like Meesho & Khatabook are being cloned globally. We are now seeing ESOP buybacks from funded startups, creating India's own wave of tech millionaires.

Covid has accelerated the remote work. When people were forced to work without physical proximity, they realized they could. While there are still challenges that need to be worked out, it is no doubt a trend here to stay. Employees can ditch commutes and get more time with family. Better yet, can continue working from their hometowns or exotic locations instead of having to migrate to overcrowded and expensive cities. Companies can tap into a deeper, global workforce. We will see new models of work emerge where companies ditch HQs and set up satellite offices that enable teams to effectively collaborate. A direct consequence of this will be that Indians will be able to work with global companies from home. We'll see this play out over the next decade.

Crypto. A third key force at play is the emergence of crypto & web3. As the traditional world finds ways to pivot to this emerging trend of remote work, Crypto was global and remote from day 1. The open source & permissionless nature of crypto rails meant that it attracted contributors from all over the world. These contributors are paid in-network tokens which allow them to keep a part of the upside from their work.

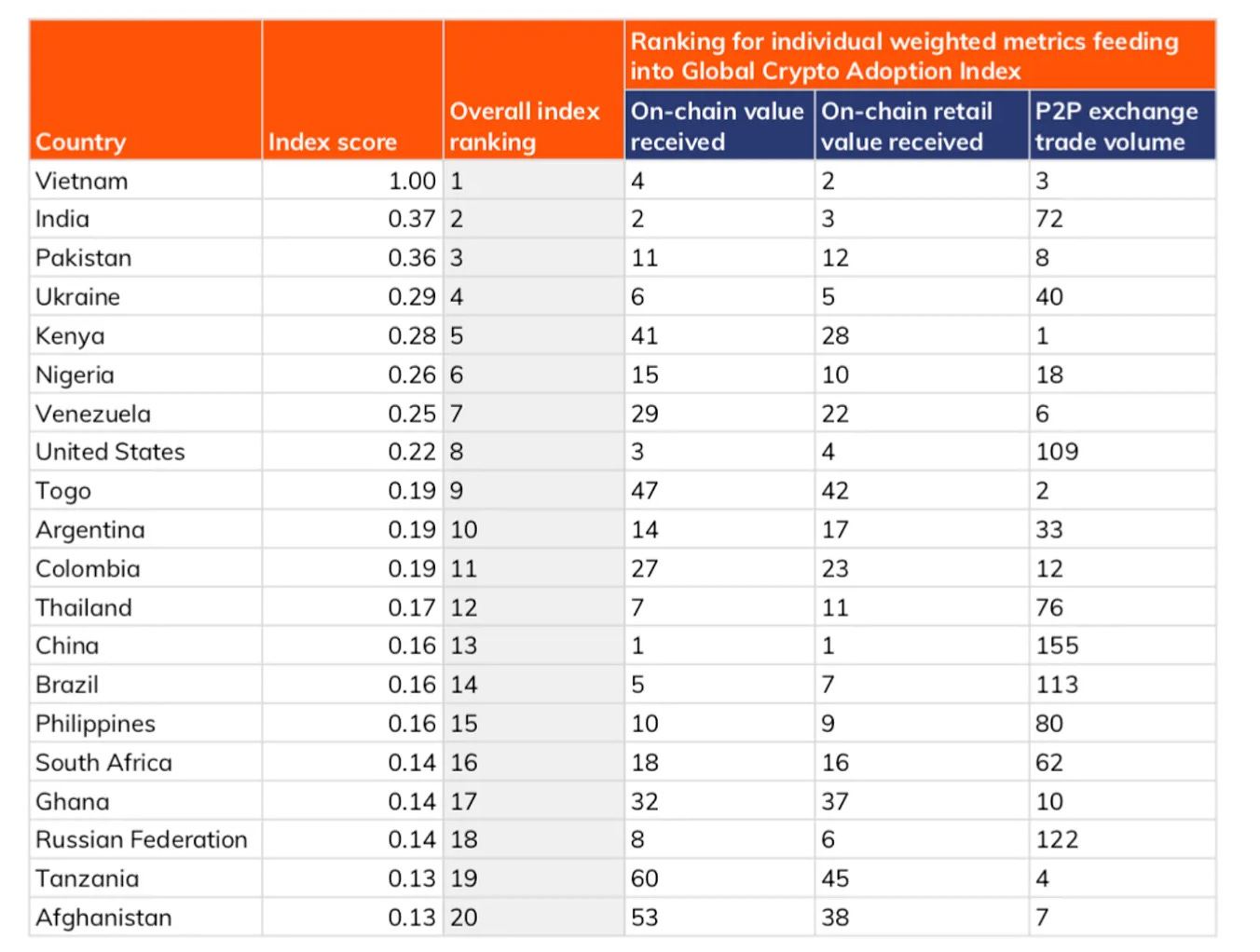

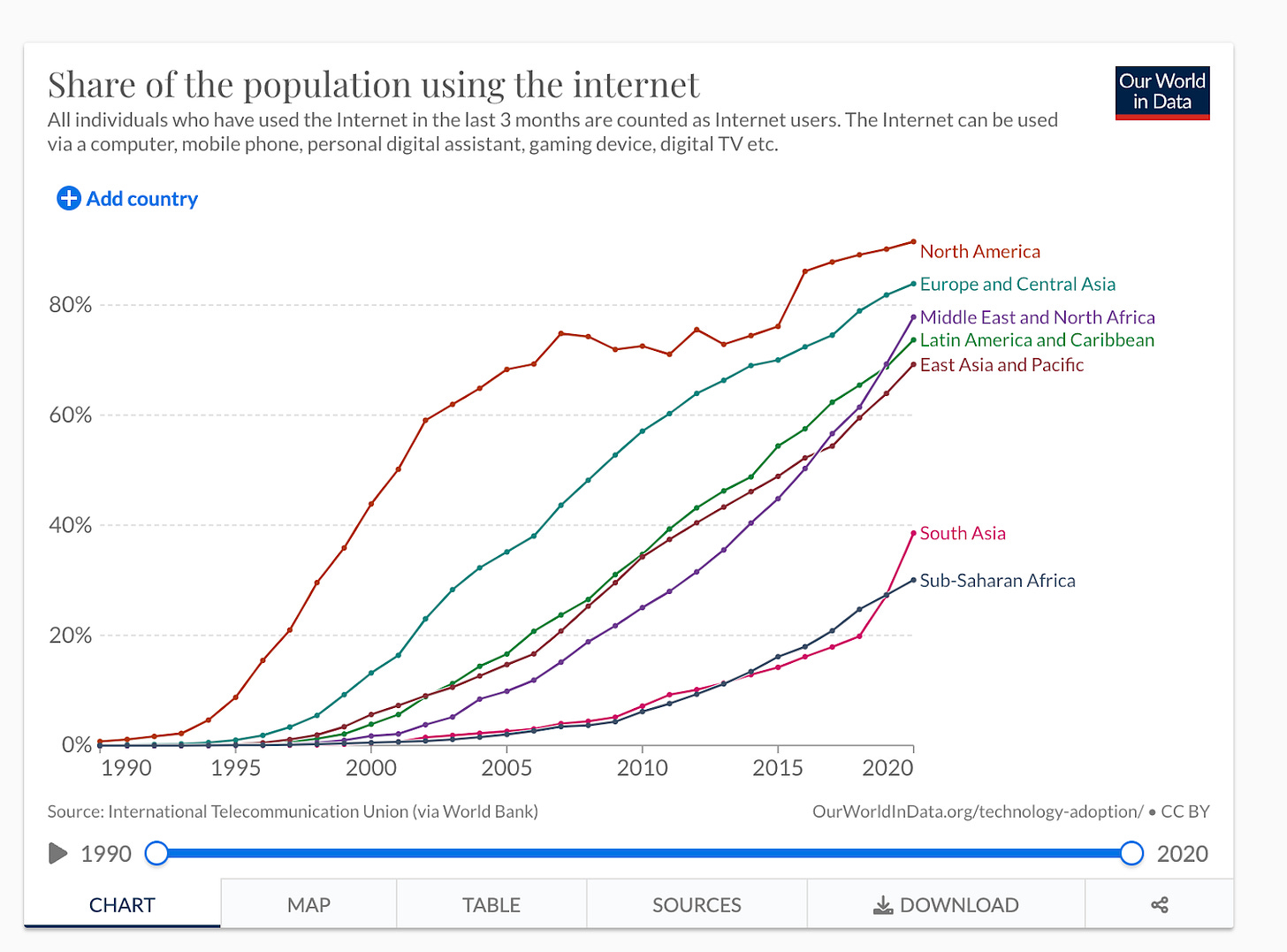

This is why the crypto adoption graph doesn’t look like the internet adoption graph - where the internet gradually spread from the west to the east. Crypto users are globally distributed from day1. The web3 & crypto landscape is being built from scratch, now. You see, when the first internet revolution started in the late 90s & early 2000s - we weren’t on the scene yet. Less than 5% of India had access to the internet. We didn't have the cloud. Developer tooling & resources were expensive and limited. Venture capital was scarce. The importance of physical proximity was significantly higher. Now, we are only constrained by our ideas & execution. Everything else is abundant.

Working in web3 early on is a golden opportunity for Indians. It is a new and emerging space. There are no established giants or experts. You can level up based on your skills instead of through the corporate hierarchy. Projects are born remote-first & global. People are ok working with pseudonymous contributors. You don't have to deal with visa quotas & other archaic immigration rules & cultural biases. And ownership through network tokens is the default.

Just how big of an opportunity is this? Time to run some incorrect but hopefully useful calculations again. The global economy is estimated to be worth $300T by 2030, up 3x from 100T today. With technology playing an even more important role it is safe to assume that it will continue to drive at least 20% of this value, if not more. If we assume this is 40%, this works out to $120T of value created through technology. Just like the internet, crypto has the potential to permeate into the underlying technology fabric across all industries. If this is true, we can assume crypto will play a meaningful role in the creation of this $120T. We had 0.1% of Indians participate in the internet boom. If even 1% of Indians participate in the crypto boom - that’s 10m contributors instead of the 1m immigrants who made it to the US. Crypto also puts a lot more value in the hands of contributors, so we can safely assume it’ll be more than the 15% ESOP pools. So let’s assume 30% of the value created trickles down to contributors - that is $36T. Indians get 1/3rd of this, it is $10T of value created over the next decade. For context, our GDP in 2030 is estimated to be $40T. We can also estimate this by assuming that global wages are now accessible to Indians irrespective of where they are. We can have 10m citizens earning ~$100k/year instead of it being restricted to the 1m migrants. This is our $10T opportunity.

However, a key lever to unlock this opportunity is the clarity of regulations. Unlike what the mainstream media will have you believe - most people working in web3 and crypto are not looking to run scams, evade taxes or undermine the rupee. And exchanges are not the only way to hold your crypto either. We need regulations designed to help businesses and contributors manage crypto payments for their services. Help retail investors participate without getting scammed. Our existing regulations are not built for new concepts like self-custody of assets or people earning in capital assets. For e.g. a contributor who is paid in crypto should easily be able to report their income, pay taxes and offset losses/gains from changes in the value of their tokens. Similarly, we need to build KYC, capital controls & AML protections into self-custody solutions.

One of the biggest criticisms of Indians who migrated abroad was the impact of brain drain on our country. I'm not passing any moral judgment. But, we have an opportunity to retain our brightest minds & attract large-scale global capital into the country. This will not only unlock massive value for our citizens but strengthen our economy & forex reserves. As big of a win-win as it ever gets. It will be a shame if we squander this away by labeling crypto as "gambling" & forcing people to exit the country in pursuit of opportunities, yet again. Last time - we didn’t have a choice, this time we do.

You can read this essay & follow me on-chain via wordcel.club

Cover image source: My BMC Instagram (Yep)

Disclaimer: This post is not financial or investment advice. It is meant for informational & educational purposes only. Please do your own research about risks and compliance before buying, investing/ or trading.

Excellent read!

Hey Aditya!

Great Read. It is a great perspective and put my thoughts about crypto in the right direction.

1 correction to the article- *India is projected to be a 10 Trillion Dollar economy not 40 trillion* But nevertheless if Crypto is going to become huge we Indians are going to have a larger portion of it.