Lessons from BONK

A new playbook for airdrops, capital formation and community. Not financial advice.

A few disclaimers before we begin:

This is not financial advice or an invitation to buy, trade, or speculate, etc. on BONK or any other tokens. I personally currently don’t hold any BONK, have never held BONK.

Please do your own research and always read this exclusively from a builders’ POV – particularly around how tokens launched right can help catalyse community, open source development, etc.

Finally, this post is also not an endorsement of the BONK team – I don’t personally know them, and I’m interested only in an analysis of what was done publicly and verifiable on-chain.

With that out of the way – let’s discuss the key insights from BONK.

The Low Float, High FDV Trap

BONK was launched in response to a peculiar problem the Solana ecosystem faced in the previous cycle – financially sophisticated investors encouraging projects to launch with a low float and high FDV. These tokens had two key characteristics:

A small % of the total supply was actually being traded

Majority circulating supply was controlled by a small group of insiders and not on the market

As you can imagine, this strategy was employed to offload tokens onto unsuspecting retail investors or used as cancerous collateral across various lending and borrowing protocols.

BONK employed the counter-narrative. They claim to have directly airdropped 50% of total supply to artists, traders, developers, etc who they deemed have been active on the network. I suspect even the core team behind the project hasn’t fully anticipated the second order impact of this.

Here’s an excerpt from their ‘Bonkpaper’:

Better Distribution?

First, let’s verify the team’s core thesis - did they achieve fairer distribution of the token?

TL;DR: Based on Solscan & Coinmarketcap data, it looks like they did.

Top 10 BONK holders control only 39% of the circulation supply, compared to the 70-90% range other comparable tokens have. Also notice that their decision to airdrop half the total supply means that their Market Cap/FDV is much better than most other projects.

At face value, both these things mean that it is much harder for a small group of insiders to manipulate the BONK price compared to any of the other tokens - because supply concentration is much lower and significantly higher % of the total supply has been unlocked.

BONK also has a much better active holder/all holder ratio compared to other tokens. I’m borrowing Solscan’s definition of Active Holders here, which they claim is whether the wallet signed any transaction over the measurement period. We’ve used a ballpark average of active users in the last week or so.

Obviously this number is currently inflated because of recency bias, the token price going vertical, idle wallets, in-app tokens, etc. However from my cursory scan the only token I could find with a better active / total holder ratio was USDC.

If you feel there is an error in the analysis please let me know (nicely) and we’ll make appropriate updates. Based on this it seems reasonable to say that, for now, the team achieved their stated core thesis of widely distributing a token to the most active people within the Solana Ecosystem.

What next?

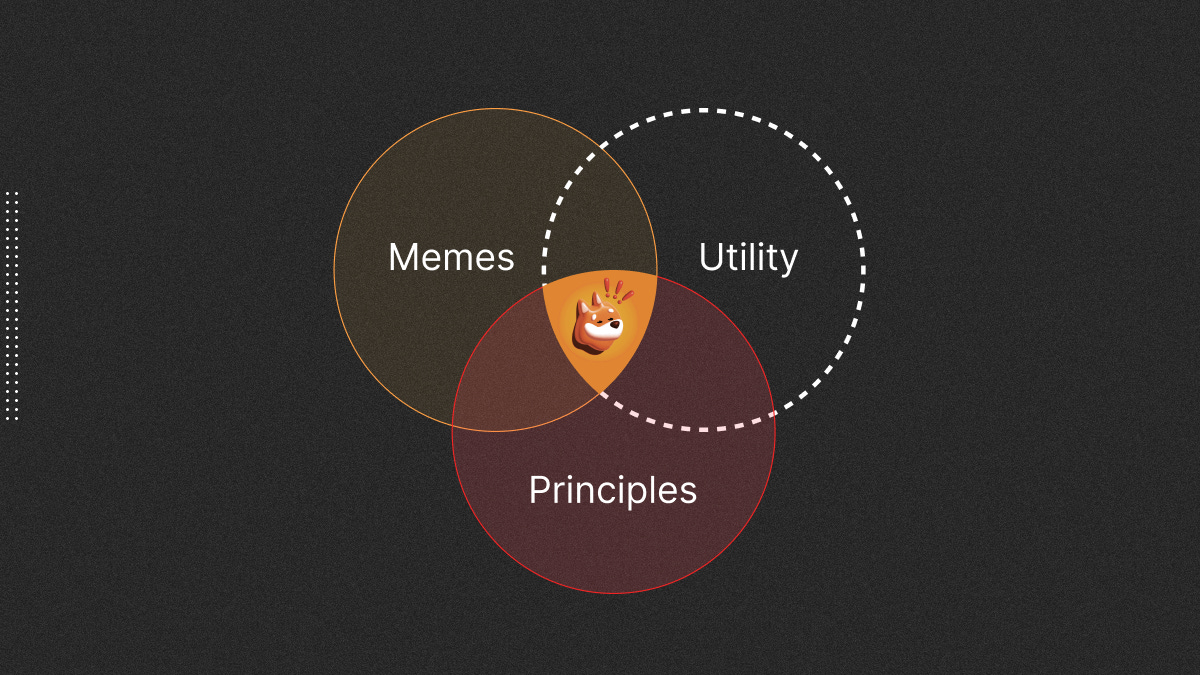

Widespread Adoption, Usage & … Memes

Love it or hate it, you can’t ignore BONK. BONK has also become the point of convergence for many rallying cries across the ecosystem.

It is thought of as the people’s token - liberating the community from parasitic VCs.

It refutes the narrative that Solana is a dying community with 75 developers.

It demonstrates that Solana has achieved escape velocity from its initial backers.

It shows the sophistication of the underlying technology and the DeFi apps built on top of it.

It is obvious that BONK doesn’t perfectly capture any of these ideas. There are better examples to substantiate each of these claims. But it appears that BONK is at least temporarily a cultural schelling point – demonstrating the importance of the right memes at the right time.

Projects are tripping over themselves to integrate it into their products. Within a few weeks of its launch you can already use BONK:

In DeFi apps like Orca,Tulip, Raydium, Jupiter, Solend, Vyper, Switchboard, Solape, Dual Finance, etc.

To transact & pay via Coinable, Helio, Wagmi, Hey Wallet, Streamflow, Backpack, etc.

In gameplay via Aurory, Boibook, Famous Fox, Photo Finish, Quackpot casino,etc.

To buy NFTs on Solsea or burn them on Sol Incinerator or

To compete in the BONK track in the ongoing Sandstorm hackathon

Soon you’ll be able to buy a Saga or Spaces merch.

5 Lessons from Bonk

In this section, we’ll review 5 key lessons from BONK and attempt to distil them into actionable insights for future token launches.

Airdrops to producers, not just users. Airdrops are a widely used but highly ineffective web3 native marketing tool. Based on the linked post, ~7% of wallets retained their UNI airdrop & only 0.6% increased their holding.

BONK is probably the first time we’ve seen utility emerge after the airdrop. We’d attribute this to the fact that producers (ie., developers and artists) were explicitly included in the airdrop. Once the airdrop was completed, it created a competent and incentivized group that could contribute to the project. It is likely that nimble teams will build tools that allow for segmentation and targeting based off on-chain, github, discord, etc activity; e.g. Slise & Airdropr.

If you’re building a mobile application you may want to airdrop all the Saga pass holders. Or airdrop Flare holders if you’re looking to bootstrap a DeFi app. And airdrop to Glasseaters, Superteam members or DeansListers if you’re looking to find developers, contributors, etc.

Community Creativity > CXO Committee. Projects should be more aggressive with giving away their community allocations early on. The logical option is to have the core team gate an allocation process. BONK isn’t the only project to dedicate a large part of their total supply to its community. Most projects do this but with one key difference - the community tokens are allocated gradually over a period of time & at the continuous discretion of early team members and perceived insiders.

For example, GRAPE is one of the more vibrant communities on Solana & has allocated 60% of their total supply for their community. However, only 1% of it was airdropped upfront. They’ve launched multiple initiatives like grape.art , DeansList, AthensDAO, etc and are at the frontier of on-chain governance. And yet, we’re left wondering if there is massive potential in the treasury just waiting to be unlocked?

While the core team does seem to be actively giving up control to its community, the approach so far, is different from the airdrop tactic adopted by the BONK team. This phenomenon isn’t unique to GRAPE, it is the same for most tokens, as you can see from the Market cap/FDV table earlier in this essay.

It has the potential to galvanise collaborative development & steer the community towards common goals like building open source. Friction is the enemy of iteration. Apply a basic targeting criteria & frontload unlocked tokens to community. This can help earn trust, much like CRED’s approach of paying salaries at the start of the month.

Memes are cultural genes. Declaring what you stand for upfront and clearly is a bat signal to attract like minded contributors. Here’s an excerpt from Vitalik’s 2020 end notes that makes this point.

“If a project having a high moral standing is equivalent to that project having twice as much money, or even more, then culture and narrative are extremely powerful forces that command the equivalent of tens of trillions of dollars of value.

And this does not even begin to cover the role of such concepts in shaping our perceptions of legitimacy and coordination.

And so anything that influences the culture can have a great impact on the world and on people's financial interests, and we're going to see more and more sophisticated efforts from all kinds of actors to do so systematically and deliberately.”

Token Burns as a value accrual mechanism. BONK launched with a comically large supply, abundant distribution & a narrative of chasing contributors. This meant that anyone burning BONK was indirectly supporting builders by creating scarcity of the token. Burning BONK has become a popular method to signal your commitment to the ecosystem and its builders. This offers a meaningful alternative to this being just a meme coin or worse — a meme coin larping as a governance token.

Protect Crypto Civilians. If you frontload an airdrop, there is a high chance that the token price will crash after an initial surge. It is important for community members with a voice to over communicate this and ensure they don’t make the next batch of people exit liquidity and restart the same vicious cycle they seek to escape. Apart from the initial selection criteria, this should be done continuously via tweets, contextual nudges on DEXs and most importantly - avoiding CEX listings entirely.

Thanks to Akshay BD for inspiration & sharing feedback on drafts of this essay. Credit to Yash for the cover image. Opening image credits to the Bonk Twitter account.