Deep Dive: Capx & Community Bonds

A balanced approach to fundraising from your community

One of the biggest promises of crypto and web3 is it opens up access to ownership upside to a lot more people. Public blockchains have tokens natively programmed in. These tokens can be used to pay fees, accrue value & gate access. Holding & using tokens is easier & more useful than traditional equity. Equity has no applications beyond representing ownership. It is also separate from the underlying product or platform, for e.g. holding AirBnB shares doesn't seamlessly allow you to stay at one.

This is a major paradigm shift. Ownership is not restricted to founders, investors & a few early employees. Contributors, developers, community members, creators & even consumers can have meaningful ownership of a product or network.

But, this shift brings its own challenges. Because it is easy to raise capital from the internet, a lot of people did it. This resulted in the ICO boom in 2017. Many of these people were looking to make a quick buck - raising funds in the name of projects & then disappearing. In other cases, projects failed despite good intentions. This resulted in retail investors being more cautious. It became harder to raise public funds without a working product or past credibility. To be clear - increased caution is a good thing. It signals maturity from a newly created class of investors.

As the technology & use cases emerged, private capital started to flow in. Venture & hedge funds, angel investors, and large institutional investors operate differently from the current retail investor. Professional investors have larger time horizons and higher risk tolerance. They also bring credibility to early projects and unknown teams. Founders increasingly started raising private capital before doing public sales. In 2017, a public sale happened on day 0, before a product or community existed. Now, projects wait for anywhere between 6 - 18 months before opening up token sales to the public.

Fundraising in web3 & crypto will mature over the next few decades or so. Community & retail investors will get increasingly sophisticated. We're seeing early signs of this in the form of gaming & investment DAOs. Crypto native private investors recognize this shift too. Many of these funds are setting up research teams, running validators, building deep technical skills, etc. All of this is in pursuit of keeping up with evolving fundraising landscape. It seems unlikely that either retail or institutional capital will edge out the other. Instead, they will each find their place in an increasingly open fundraising environment. In the short term, the more sophisticated private investors will continue to enjoy early and exclusive access. A few savvy communities will start operating as efficiently as their professional counterparts. No one knows what the end state will look like. But it feels like we will head towards a more accessible and level playing field compared to what we have today.

With this in mind, I spoke with Vaibhav Tyagi about what they are building at Capx, including their latest product - Community Bonds (CBDs).

Let's dive in.

Capx: Making secondary markets great again

Here's the Capx mission statement from their website.

"We at Capx are building the infrastructure & tools to make the secondary markets of crypto - more efficient and accessible. Our ecosystem comprising of Capx Liquid, Capx Exchange and Capx Lend will make these markets more accessible for the community to participate and the projects to build on top of it"

To understand what this means, let's first understand how the fundraising process works & the importance of vesting. Simply put, a project receives cash from investors and provides them with tokens. The idea is that as the project delivers, the tokens become valuable - making everyone who holds them rich in the process. To ensure that the founders and investors are committed to this for a reasonable period of time - tokens come with time-bound lockups. This prevents anyone from immediately dumping the tokens. It also signals the seriousness of the founding team to the investors. However, this means that founders & investors often have a major part of their wealth locked up. Their first product, Capx liquid, addresses this problem with wrapped vested tokens (WVTs). It enables the discovery and trading of these locked-up tokens.

First off, as an outsider to the world of investing - ngl, I found this a bit odd. Why would you want to create liquidity for something that was supposed to be illiquid by design? On digging further, I learned that there are three reasons why someone would want to sell locked-up tokens:

Secure principal (and some upside) from short-term price appreciation

Liquidity needs that are unrelated to the health of the project

Loss of conviction in the project as an investor

These are legitimate use cases. In fact, it is common practice in traditional companies to carry out the sale of unvested stock. This happens to make room for new investors (early, smaller investors exit this way) or create some liquidity for founders and early team members. Although uncommon, it is also a tool for investors with more conviction to enter and replace existing ones who may have lost conviction. In the absence of proper infra for this in the crypto space, founders and investors resort to opaque p2p & OTC deals. This creates three problems - price discovery, operations & information asymmetry.

WVTs can solve the first two of these problems. Tokenizing these illiquid positions makes it easy to quantify & price them. Anyone can then trade these on the Capx exchange or any other DEX. To be clear, the project token & rights associated with it still remain locked. What you are trading with these WVTs is ownership of the locked tokens. However, it is non-trivial to solve the problem of the asymmetry of information. In the long term, if sufficient verified information comes on-chain it is possible to establish a source of truth. This makes project performance available to anyone. We are far from there today. Currently, the team is expecting sophisticated investors to be trading in WVTs. They are well equipped to carry out their due diligence.

Using Liquid & WVTs. There are two ways in which projects can use Capx liquid to issue WVTs. The first one is through a no-code interface. The team only needs to upload the token allocation details (addresses, amounts, price, schedules). In the background, the tokens get locked up in an escrow contract & WVTs are issued against them. This approach works well for teams that want out-of-the-box features. It minimizes development required from the project. The second option is to build on top of the liquid smart contracts. Because these are open source, anyone can use them. You don't need to speak to anyone from Capx (i.e. permissionless ). This works better for more custom use cases. Liquid is live on Ethereum, Polygon & Avalanche. Their focus on being multi-chain means that projects can issue WVTs across all networks they are deployed on in a single raise.

Capx Exchange & Lend are two other products the team is working on. These are logical extensions to liquid. Once you’ve created a new asset you want to create infrastructure to enable its trading & lending. You are not restricted to using just their exchange or lending platform. Like any tokens, these can be traded or used as collateral across the Defi ecosystem. You can also build on top of these smart contracts for any custom implementation you may need. These projects are yet to be fully launched.

Broader Applications of WVTs. The infrastructure for pricing & trading locked-up positions opens up a lot of use cases for projects. For E.g. projects prefer to provide governance rights & revenue share only to holders of time-locked positions. The fact that these positions can now be traded makes it easier for people to hold them without worrying about liquidity needs. A great example of a project that has independently implemented such a mechanism is the Lifinity DEX. Their main token is LFNTY, but if you want a share in revenue you need to hold veLFTNY (locked for up to 4 years). You can convert 4-year locked LFNTY to xLFNTY and trade it. It is non-trivial to implement this but using Liquid & WVTs projects can do this out of the box. (This is not financial or investment advice to buy Lifinity tokens.)

A multi-chain tool. The team at Capx believes that in the long run products and services won’t be confined to a single chain. Just like we don’t care whether an app today is hosted on AWS, Azure, or some other service, we won’t pick and choose products based on their underlying blockchains. This is why they’ve been focused on launching their products across many different chains which have developers, projects, and users.

Now we’ll look at their newest product & the focus of today’s essay - community bonds.

Community Bonds

Community bonds (CBDs) are a financial instrument designed to enable projects to raise early capital from their community. These provide fixed returns (paid in project tokens) & limit the impact of price volatility.

A tradFi analogy for CBDs is to think of them as convertible notes. These are hybrid instruments that provide a fixed return against investment. But also come with the option to be converted to company equity before maturity. This allows investors to observe and measure company performance before taking on the risk that comes with equity. The key difference, however, is that convertible notes are paid out in cash by default, reducing exposure to project risk significantly. That isn’t the case with CBDs.

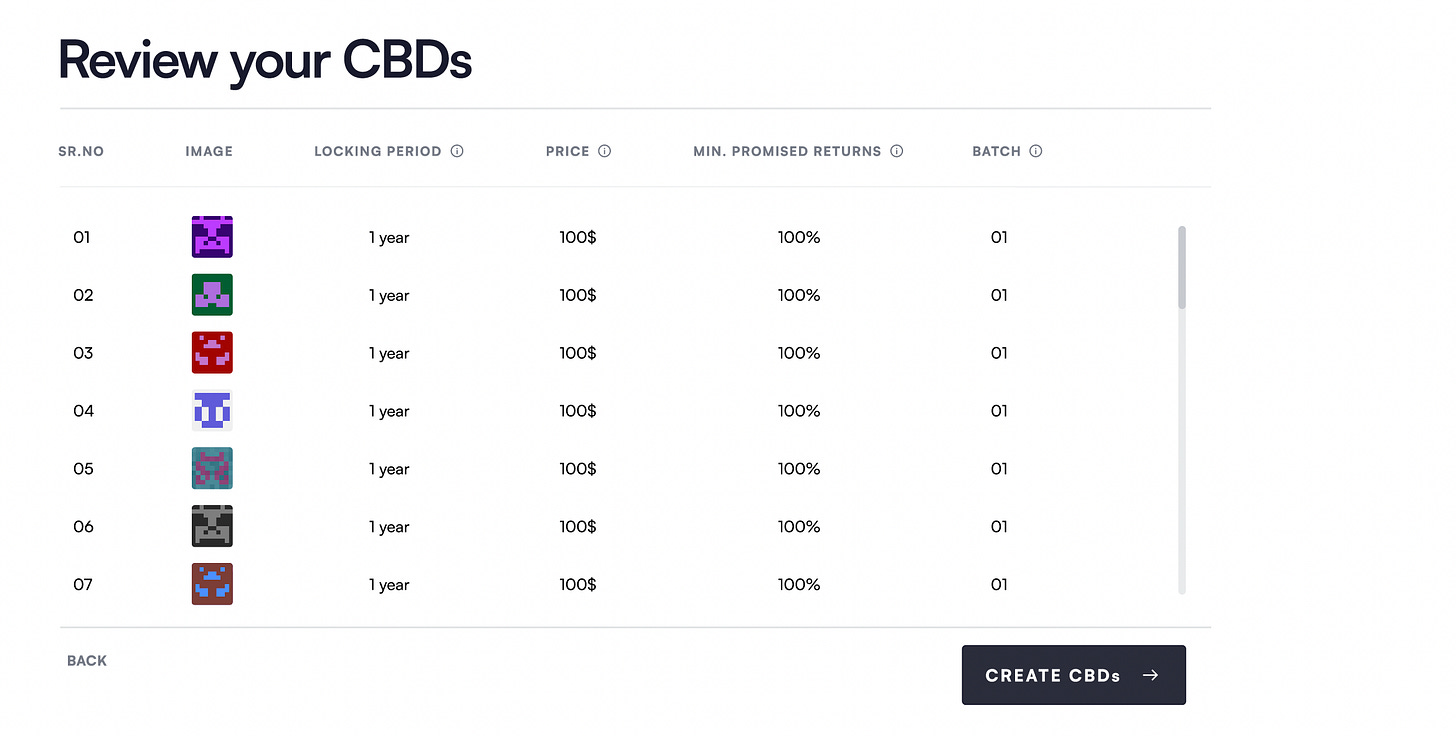

The initial price of a CBD is determined by the total funds to be raised & the # of CBDs to be issued. For example, if you are raising $10k and issuing 100 CBDs then the starting price per CBD = 10,000 / 100 = $100. The project also needs to specify the lock-up period & the promised return. CBDs can be issued by projects before or after they have conducted token generation & sales. Let’s look at each of these cases.

Before Token Generation & Sales

Funds raised by a project without a token are deposited in an escrow smart contract. The founder/core team can set redemption milestones. This specifies what % of total funds raised can be withdrawn after a particular goal is achieved. CBD holders vote to confirm that a milestone is achieved. If the vote passes, those funds are accessible to the project.

Token Generation & Lock-up

Now let’s look at what happens once a project issues tokens. This could happen either after or with the sale of CBDs. The project is required to lock-up tokens in an escrow contract to guarantee that CBDs are redeemable. The tokens locked up cover not only the principle but also the return owed, i.e. if you sold CBDs at $100 with a 200% return, you need to lock up $300 worth of tokens in the contract.

A working example

Let’s work through a few possible scenarios to better understand the returns CBDs provide. Assume a project has issued a CBD with the following specifications:

Issue price: $100

Lockup period: 1 year

Return: 200%

This means, that at the end of one year the CBD holder is entitled to $300 worth of project tokens. The exact number of tokens you receive will depend on the token price at the time of maturity. Assume that the token was trading at $10 when you bought the CBD. Here’s what happens if the token price goes up, down, or stays the same.

The fixed nature of the return means that you get fewer tokens if the price goes up and more tokens if the price goes down. Here’s what the return profile of CBDs looks like compared to just holding the token.

As you can see, a CBD reduces the volatility of returns given fluctuations in the token price. If the token price goes down or remains the same, you’re better off holding a CBD. If the token price increases, your upside is capped to the return promised by the CBD.

CBDs help balance exposure

The best way to think about CBDs is as a way to manage risk. If you’re a retail investor bullish on a project or a contributor earning from a project - you don’t want to only hold CBDs. Just like you don’t want to only take a cash/stable-coin or token compensation. You can read more about risk management in a previous post on earning in web3 by Kash Dhanda.

Product Walkthrough

Now that we’ve understood how CBDs work conceptually, let’s go through the process a project will need to follow to create its own CBDs.

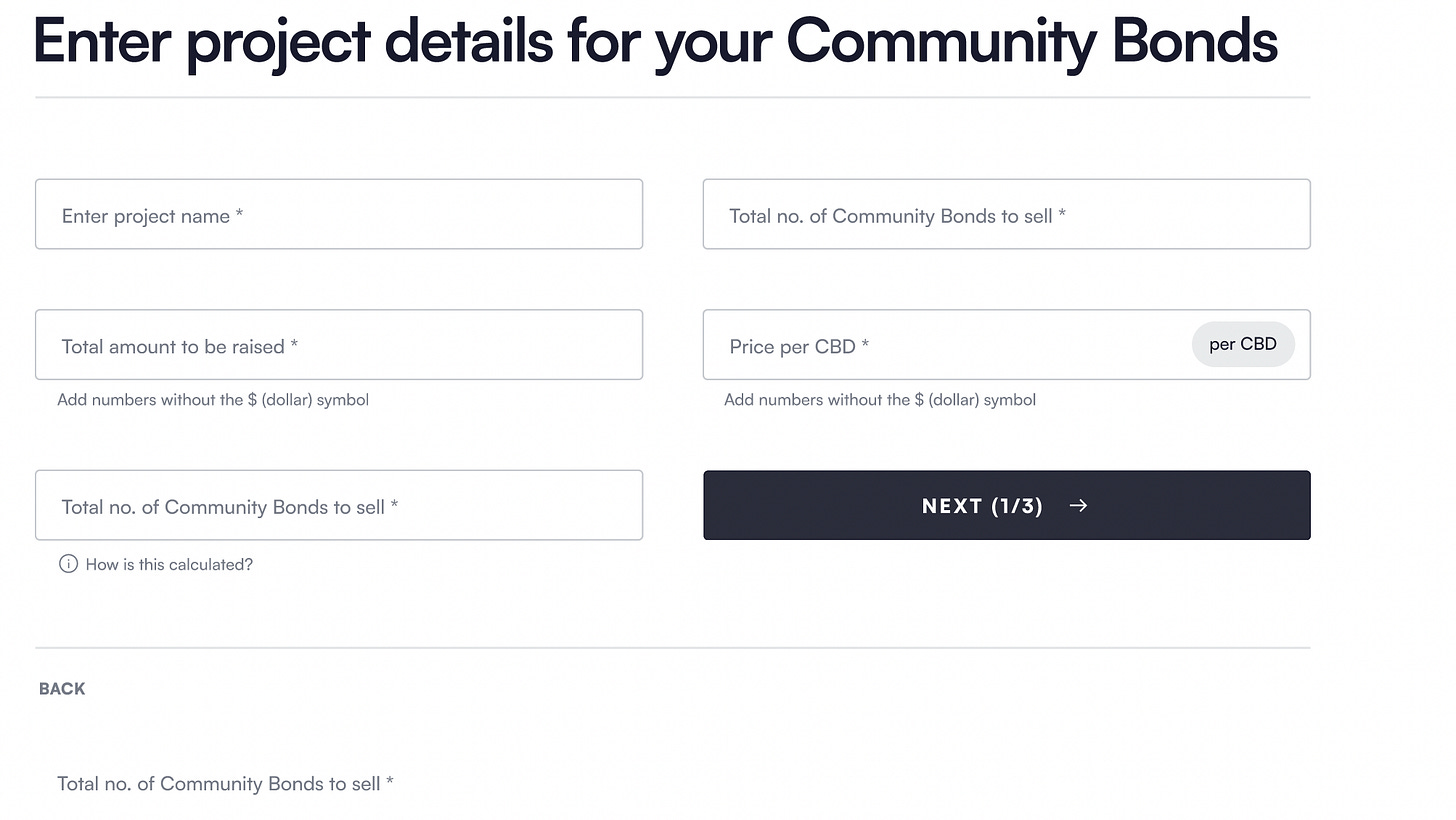

Step 1. Specify 2 out of 3: how much you want to raise, how many CBDs you want to issue & the price per CBD.

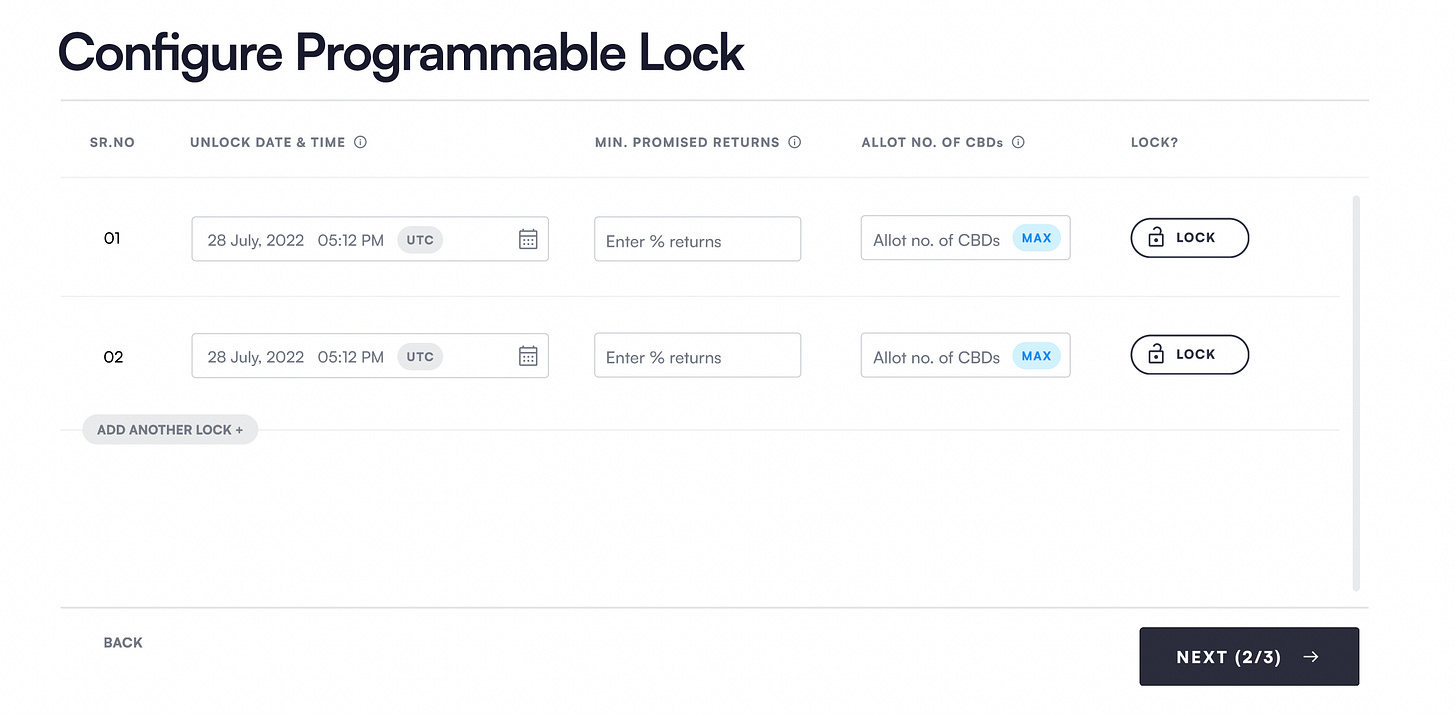

Step 2. Specify the locking period(s), the corresponding rate of return & the number of CBDs to be allotted per configuration. This means projects can issue CBDs with multiple configurations in a single drop.

For example: out of 1000 total CBDs,

300 can have a 3-month lock-up with a 100% return

700 can have a 1-year lock-up with a 300% return

Step 3. Make them truly unique and special to your community by adding custom artwork.

Step 4. You’re good to go!

Risks & Safeguards

Nothing is entirely risk-free. While CBDs help manage volatility, there are a few things to consider.

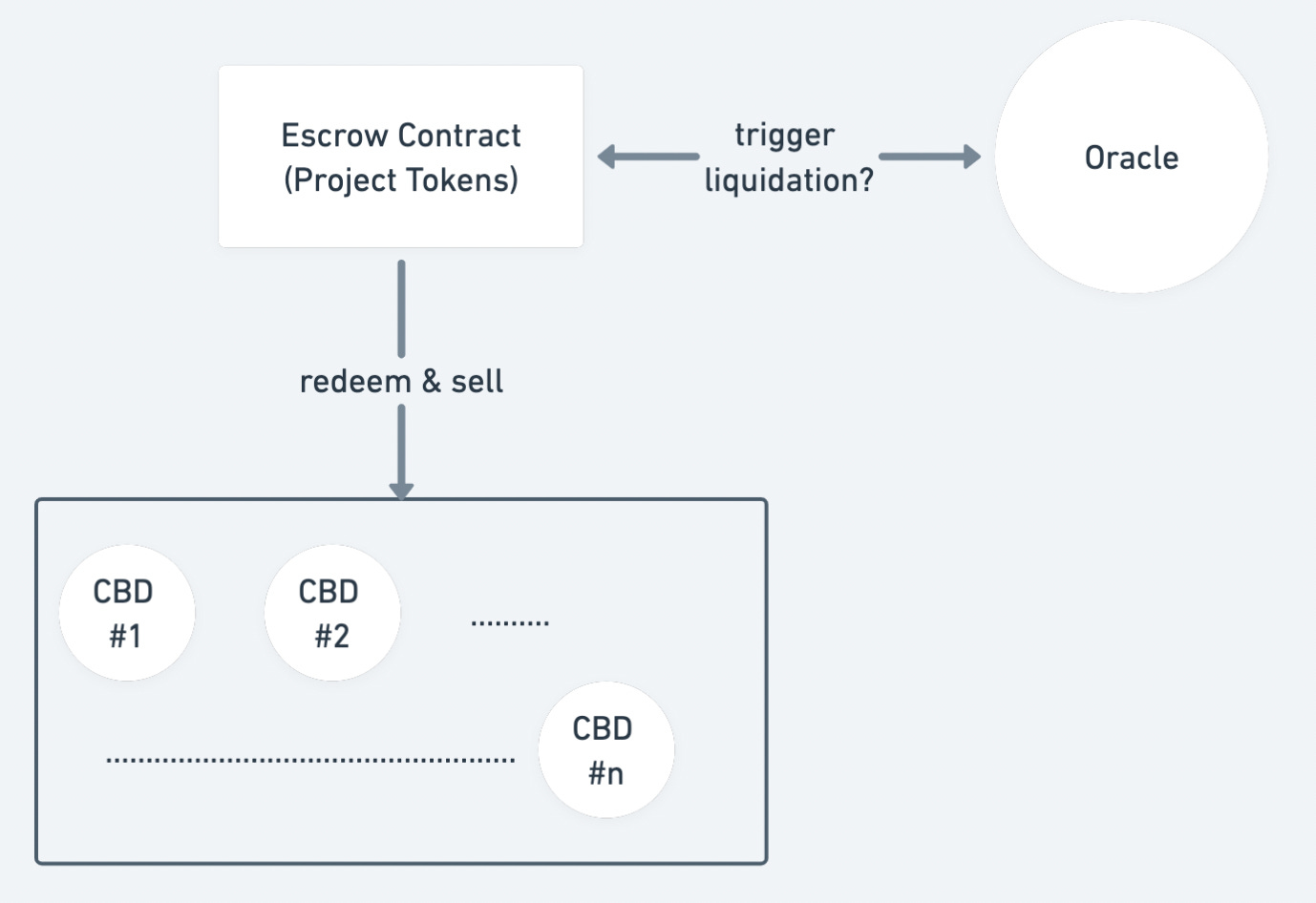

Funds in escrow: Initial funds raised from the sale of CBDs are deposited into an escrow contract. The project team can define the milestones for redemption & the community votes to verify whether these milestones were achieved or not.

Furthermore, when the project wants to lock up tokens and redeem the funds they need to deposit sufficient tokens to cover the returns. For example, if a project raised $1m and promised a 200% return, they will need to deposit tokens worth $3m dollars in the escrow contract. This secures the return value of the CBD.

Liquidation: If the escrow contract has project tokens deposited, there is a risk that the token price drops below what is required to provide the promised return. There is an oracle that will check for this condition and trigger the liquidation of the contract. This unlocks the CBDs & opens up the tokens to holders. These can then be sold in the open market. This isn’t a happy scenario because sell pressure on tokens will increase driving the price further down. But, it is some protection to community holders where there would be none otherwise (i.e. you can exit with some % of your capital). Keep in mind this protection is even more meaningful because the CBD escrow has not just the principle but the interest deposited as well (i.e. it is over collateralized).

Token Deposit: A crucial element here is ensuring the project deposits sufficient tokens into the escrow smart contract. This step is currently not enforceable but works on trust and a reputation-based system. The downside to the project is FUD & loss of trust from the early community. The Capx team is building tools to enable the project & its community reach a consensus in such scenarios by sending off-chain reminders to both the project as well as the community (project’s CBD holders) that the token lock-up is due once information around the token is public. They will work to make this enforceable on-chain as the ecosystem matures.

Project risk: CBDs provide fixed returns in project tokens. Ultimately if the project doesn’t succeed, your CBD will be worth nothing.

The Capx CBD Launch

The Capx team is going to be the very first customers of CBDs. They are launching a collection on Solana. You can learn more about it here. Given that Capx doesn’t have a token yet, this is the first opportunity for retail and community participation. (Not financial advice).

There are opportunities to earn CBDs by carrying out micro-tasks. You can find these in the Capx Discord. And there’s a bunch of them exclusively set aside for SuperteamDAO members.

Towards Open Capital Formation

The ability to have a share in the real fruits of your labor is fundamental to capitalism. It is what drives people & fuels growth. This system is not perfect. We’ve entered a new phase where ownership is more accessible than ever. There will be mistakes along the way. Building the infra for this journey is not easy. It requires an acute awareness of both short & long-term trends, a focus on building the right safeguards & relentless execution. Rooting for the Capx team to succeed as they take on this journey.

You can read this essay & follow me on-chain via wordcel.club

Thanks to Yash for designing the cover image for this essay.

Disclaimer: This post is not financial or investment advice. It is meant for informational & educational purposes only. Please do your own research about risks and compliance before buying, investing/ or trading.