Are you a Crypto native and perform frequent transactions using Cryptocurrency? Or you are new to this world and see yourself making multiple crypto transactions in Web 3 in near future. What if these transactions could help you WIN a million-dollar reward!!!

Would you be interested in exploring a way to turn this thought of winning a BIG REWARD into reality? If YES, then don’t miss out on below.

In this article, we are going to deep dive into a Yield generating Protocol named “Fluidity”.

Before we understand the actual product I want readers of this article to understand all related terms. I consider myself fairly new to Crypto and I want to make this article one-stop-shop to understand Fluidity. I would consider this article good enough if its reader did not require any help from other articles or Google to understand the mentioned terms, concepts.

If you already know terms like Yield Farming, Liquidity providing, Staking from the Crypto domain and understand these concepts, then feel free to jump to the next section. Still, it won’t hurt to revise a few things or read the concepts again 😇

So let’s start 🚀

What is Yield?

It’s a financial term for the reward or return received for investing 💵

You must have come across a term called “Yield Farming” if you have started reading about Crypto, Web 3.

What is Yield farming?

Yield farming is a process of putting or investing your cryptocurrency in the most optimized spot so that it will earn you even more free crypto.

Why it’s important or beneficial for Crypto users/investors?

You might have invested in a project and believe it will do well in the future. So you will hold the relevant Crypto for the long term. So why keep it idle? Why not invest this Cryptocurrency in a suitable place where it will generate some yield i.e. some more cryptocurrency for you. This way you not just benefit from the price appreciation of your original Cryptocurrency, but also gain some extra rewards. As we know, the Crypto market is volatile. This helps you in dollar cost average your investments.

What are the few basic methods of Yield farming?

Below is a quick overview/explanation of a few methods of Yield farming.

Liquidity Providing = In this method, you provide your tokens to a decentralized exchange’s liquidity pool. Other users/traders can trade using these tokens from the pool. Fee is charged to traders for trading using these pools. Part of that fee is shared with you. This is your reward for providing liquidity. e.g. you can add your ETH and USDT in a liquidity pool to earn rewards.

Lending =Many borrowing and lending protocols will offer rewards/interest to users who lend their tokens to these protocols. e.g. you can lend your SOL on Solend and earn rewards.

Borrowing =Borrow stablecoins against your Cryptocurrency as collateral and deploy/invest it somewhere else to gain extra rewards. e.g. you can deposit your SOL as collateral on HUBBLE protocol and get USDH in return. Invest this USDH elsewhere to earn rewards.

Staking = In this you pledge your coins to a blockchain protocol such as Ethereum and earn some more free Ethereum.

There are many more methods and lots of other options to explore.

Does this Yield Farming help the Crypto ecosystem? Why would anyone give free Cryptocurrency?

There are numerous benefits from Yield farming to the entire Crypto ecosystem as well. It helps in improving the blockchains, increasing liquidity through lending, strengthening decentralized exchanges to perform currency swaps efficiently.

Overall “Yield Farming” is a WIN-WIN for Crypto users and the ecosystem.

Obviously, there are certain risks associated with different methods of Yield farming. Nothing in the Crypto world is risk-free. Please do your research before using it.

Now that we understand the basics of Yield Farming, the term “Yield Generating Protocol” might make some sense. So basically a product that helps you earn rewards using your Cryptocurrency.

One very unique example of “Yield Generating Protocol” is “Fluidity”

In the few examples of yield farming we covered earlier, you must have realized each method needs you to lock your Crypto. Respective yield generating protocols will pay your rewards for locking your assets with them and keeping them idle.

Fluidity is very different, they will pay you rewards for using your cryptocurrencies. Utilize them more and more for increasing your rewards.

For example, Solend is a popular Defi app that allows lending and borrowing of Crypto assets. It gives rewards to its lenders and keeps their cryptocurrency locked i.e. idle. Whereas Fluidity asks its users to spend and utilize their Cryptocurrency in order to earn rewards.

Let’s see how Fluidity rewards its users in layman’s terms.

Fluidity takes regular Cryptocurrency from its users and gives them an equivalent amount of Fluid tokens i.e. 1–to-1 ratio.

Users can use these fluid tokens for their regular transactions in the Crypto ecosystem. For e.g. buy NFT, buy another crypto, send it to someone.

Original cryptocurrency is stored in a different lending protocol that earns yield (interest for lending). This earned yield is then stored in a rewards bucket.

Randomly a Fluidity user will be chosen based on an algorithm and he will be rewarded a portion from the rewards bucket for his transactions done using fluid tokens.

Few key things to be noted over here.

The user still has total ownership of his original Cryptocurrency and Fluidity does not own them. Fluid tokens are essentially wrapped tokens whose value is tied to that of the underlying base cryptocurrency.

Users can anytime return the Fluid tokens and get back the original cryptocurrency. There is no risk of losing the base asset as Fluid tokens are a 1:1 pegged to their base asset counterparts and can be redeemed fully at any time.

More the number of transactions done using Fluid tokens, higher are the chances of a user winning rewards.

Rewards are distributed to both Sender and Receiver of fluid tokens in an 80–20 manner. The sending party receives 80% of the reward and the receiving party receives 20% of the reward.

You can use Fluid Assets in any supported Blockchain and Protocol. There are a variety of use-cases where Fluid Assets may be used, some of which include: Sending, receiving, and swapping tokens, Minting, trading, and selling NFTs, Blockchain-based gaming, Performing transactions in decentralized exchanges.

Now let’s try to imagine a real-life scenario and see how Fluidity can change someone’s life with its rewards.

Steve is a Web 3 Developer who earns his monthly salary in USDC. He performs his regular Crypto transactions like buying Cryptocurrency, sending payments to his colleagues, buying NFT, etc. using this USDC.

Scenario 1: He has received 1000 USDC tokens as Salary. He immediately lends it to a Defi protocol and starts earning 5% APY. He suddenly needs this 1000 USDC during this month for some Crypto transactions so he withdraws it. So basically he ended up having a loss because of GAS fees spent on locking and withdrawing. <LOSS>

Scenario 2: He has received 1000 USDC tokens as Salary. He immediately lends it to a Defi protocol and starts earning 5% APY. He keeps the entire 1000 USDC locked for a month, he earns merely $4 interest. But luckily this month he did not require this USDC for his Crypto transactions. <$4 PROFIT>

Scenario 3: He has received 1000 USDC tokens as Salary. He knows he might need it so does not lend it to any Defi protocol. Avoids the loss on GAS fees but does not earn anything. Performs his regular transactions in the Crypto ecosystem. <NO LOSS NO PROFIT>

Scenario 4: He has received 1000 USDC tokens as Salary. He goes to the Fluidity app and transforms his regular 1000 USDC into 1000 fluid USDC (fUSDC) i.e. mints fluid tokens. Starts performing his Crypto transactions using this fluid USDC. Uses it for multiple transactions and is rewarded with whooping 12000 USDC. It’s equivalent to his salary of an entire year. <$12000 PROFIT>

In the above case study, you will lose only $4 if you opt for fluidity instead of Defi lending option and don’t win any reward from Fluidity. AND considering Sam is already in the Crypto ecosystem, he is already taking bigger RISK than just $4 :)

So what we can conclude from the above case study is:

“If you have Cryptocurrency and plan to use it, then better spend it using Fluidity (Fluid Tokens) to give yourself a chance of winning a GREAT REWARD. Even if you don’t win a big reward, the loss of opportunity by not using other Defi protocols and keeping your Cryptocurrency idle is very small”

After reading till here, you have understood that the more the number of transactions using Fluid tokens, the higher are chances of earning rewards.

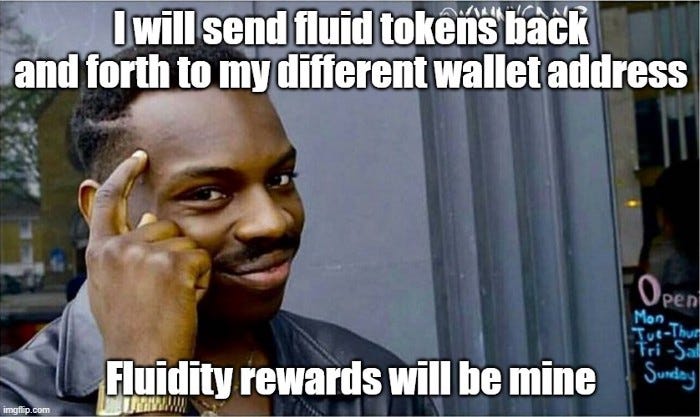

So you must have got a BRILLIANT IDEA!!!

Why not perform a large number of transactions back and forth and earn tasty REWARDS.

Don’t try it !!! Even if you win the REWARD you will end up losing money on GAS fees for those transactions 😂

This is because the fluidity team has already thought about this situation and came up with “Optimistic Solution” to prevent such spam attacks. It uses GAS fees as a protection mechanism, ensuring that attackers will always spend more in fees than they would receive in rewards.

Until now you have been reading much about REWARDS offered by Fluidity, but How often and how large are the rewards?

Transfer Reward Function (TRF)

Fluidity’s payout mechanism is determined by the Transfer Reward Function (TRF for short). In its base form, it includes the Optimistic Solution to prevent spam attacks and ensures that the protocol pays out all of the gathered yields from the underlying assets. The drawing mechanism for picking “winners” is similar to that of a ‘lottery”, with a pool of “balls” to draw from for a single transaction.

To be able to calculate how often and large the rewards are, it needs a few pieces of information. Including:

The Total Value Locked (TVL) = Value of Crypto assets transformed into Fluid Tokens

The yield earned on the TVL (APY) from different lending protocol

The annual number of transactions as moving average (ATX)

The gas fee or fee paid to do a transaction (g)

The number of reward tiers (m)

This information is required to be able to ensure that fluidity can protect the protocol from attackers and that the protocol is not overtime paying out more in rewards than it is able to generate in yield.

This information is loaded into TRF to generate the associated payouts. It recomputes the payouts every block to account for changes in TVL, APY, ATX, g. The size and frequency of payouts change every block based on how these variables change. Also, the parameters are considered in TRF in such a way that different protocols with different GAS fees will get a similar transaction probability reward metric.

Let’s check the below example with some sample numbers provided by Fluidity.

In the following example, the protocol has $1B in liquidity, earning 3.5% APY with 50,000 daily transactions, an average gas fee of $3, and five tiers of rewards.

As can be seen in the example above, every 3rd transaction receives over $1, one in every 320 transactions receives $120, and once every quarter someone will receive $1.6M.

So far we have seen Fluidity users are benefitted from its usage. But the next question arises, will other protocols in the Crypto ecosystem accept these Fluid tokens in their transactions? What’s the motive for protocols to enable fluid tokens on their platform?

Let’s check out the story and benefits from other side now.

Utility Mining

As of today, Liquidity mining is one of the methods used by protocols to attract new users to their protocol. What these protocols do is giveaway their governance token (Cryptocurrency) to users who provide liquidity. In order to get more liquidity, they have to shell out expensive fees in form of their governance tokens. This might not have long-term benefits and users will move away from the protocol as and when rewards of liquidity providing drop.

Fluidity proposes utilizing an adaptation to Liquidity Mining titled Utility Mining, to distribute a significant portion of the Governance Tokens. Although Liquidity Mining will still be utilized, a significant portion of the Fluidity governance tokens will be distributed through Utility Mining.

Basically in Utility mining, protocols can use Fluidity’s TRF, which means users will get rewarded with Protocol’s governance tokens if they transact on a protocol using Fluid tokens.

This will help protocol to gain new users who are actively transacting compared to passive liquidity providers. It also helps in increasing engagement between users and the protocol. Directly increasing the revenue for Protocol.

2. Fluidity wars

To understand the concept of Fluidity wars first let’s briefly understand what is Curve Wars in Defi. Then we can compare it for better understanding.

Curve Finance is a decentralized exchange but just focused on stablecoins like USDC, DAI, etc. They offer liquidity mining options so people who deposit their tokens to liquidity pools on curve finance are rewarded. And other traders can swap tokens from these pools.

Curve Finance has its governance token named “CRV”. Owning CRV has two benefits.

CRV owners get to vote on which liquidity pools on curve finance have how much rewards/yields

Also if you stake your CRV, you get boosted rewards for providing liquidity

So what happened is, not just regular people were accumulating CRV tokens, but even other protocols started accumulating CRV tokens in large numbers.

How does it help protocols? They can vote for their own token’s liquidity pools to have maximum rewards on CRV, plus they stake CRV so rewards are even boosted further. So they create attractive liquidity mining programs for their tokens increasing their revenue.

So this phenomenon of accumulating governance tokens of Curve Finance “CRV” became a trend amongst other protocols. It’s a modern-day war for CRV tokens hence termed as “Curve Wars”

Curve Wars focuses on where liquidity moves in the DeFi space, whereas Fluidity is about where users move in the space.

Users have a direct positive correlation with liquidity and its flow. So basically protocols can adapt Fluidity Utility Mining to provide a fairer mechanism for the distribution of their Governance Tokens to end-users, attract more users, directly attract their liquidity.

So what is Fluidity WARS? It’s another theoretical version of modern-day war where different Protocols will use the Fluidity Governance mechanism to provide the best-expected outcome for their users, indirectly gaining more users and increasing their revenue.

In Fluidity, governance tokens, yield and rewards are extracted through actions, this means that specific action can pay a higher yield than other actions, allowing protocols to consolidate user attention. For e.g. Using a Fluid token, performing a specific action in the protocol gives a higher yield.

Rational users will aim towards maximizing their expected outcome and yield from participating in the Fluidity ecosystem, this may cause protocols to lose or gain users, revenue. Liquidity and network effects as users migrate or react to the yield/ emission changes.

Contrary to Curve Wars, which affects liquidity on specific stable coins pairs, the outcome of Fluidity Wars can affect products ranging from Dexes, NFT Marketplaces, and even specific Stable Coins.

Lets try to understand real-life situations using two scenarios.

Number 1: Two different Protocols, one adapting Fluidity other does not.

Protocol XXXX enables Fluid tokens and Protocol ZZZZ is not allowing Fluid tokens. Users of Protocol XXXX will have higher expected outcomes and payouts so they will potentially choose XXXX over ZZZZ. (Crypto world never sleeps and Protocol ZZZZ was found sleeping on Fluidity hence named Zzzz…lol)

Number 2: Two different Protocols, both adapting Fluidity.

Even if both XXXX and ZZZZ adapt to Fluidity and enable fluid tokens on their platform, it will also matter how they engage with the Fluidity governance mechanism. For e.g. Protocol XXXX offers higher governance token emissions when users transact with their fluid token compared to what Protocol ZZZZ offers for using their fluid tokens.

This is where Fluidity WARS will begin!!!

3. Receivers Rewards

Lastly, protocols will be on receiving end for most of the transactions done using Fluid tokens. That means if any rewards are given by Fluidity to the user (sender), protocol (receiver) will also have a chance to win 20% of that reward amount. And let’s repeat. More the transactions, more the chances of winning. This gives extra motivation for protocols to support fluid tokens on their platform.

So to summarize, there are 3 benefits for Protocols to enable Fluid tokens on their platform and increase long-term user engagement. Utility Mining, Fluidity Wars, Receivers Rewards.

Currently, Fluidity has its TESTNET Live on Ethereum and DEVNET for Solana.

Using Fluidity when it will be LIVE is going to be super easy as it involves only one step “Covert your TOKEN to FLUID Token” and you are good to use it as your regular tokens.

Connect your wallet and Fluidify your money :)

Few good features to note when you will use Fluidity.

Dashboard: Fluidity is SUPER transparent on the REWARD POOL.

They not just showcase the current Reward pool value but also recent reward winners in the Reward Board.

2. Send and Track History: You can use the Fluidity portal itself to send Fluid Tokens and also track your transaction history. No need to visit Etherscan, Solscan, or any other block explorer and find your history.

3. Enable Notifications: No need to keep visiting Fluidity to check if any of your transaction was rewarded. Enable the notifications and you will be notified about your winnings.

4. Extensive Wallet Options: It supports multiple Wallet options.

TESTNET, DEVNET can be tricky to use if you are new to Crypto. So would recommend checking these detailed and easy-to-understand guides provided by the Fluidity team.

Guides= ETHEREUM TESTNET , SOLANA DEVNET

Thanks for staying this long. Let me draw a Conclusion and close this article.

Be it a Crypto native or Crypto newbie, you are either already transacting using Cryptocurrency or in the future will definitely have multiple transactions. So why not give Fluidity a try which takes just one extra step of converting your cryptocurrency into fluid tokens and giving yourself a shot of winning a life changing reward.

Remember “One who takes an extra step, will realize the power of it”

Sources used for writing this article: