In this post we’ll deep-dive into Chingari, a web3 social app with an internal economy powered by a Gari token & Panda NFTs.

This post is structured into the following sections

What are web3 social apps, how are they different/better?

Introduction to Chingari and their progress so far

The Panda NFT launch

The Bull & Bear Case

Before we start a gentle reminder that this post is not financial advice or an invitation to buy the Gari token or the NFT.

Disclosure : At the time of writing, I don’t hold any GARI but do have Panda NFT(s) I purchased with the intention of trying out the app. Additionally, please assume that I could be holding coins/tokens of any of the projects mentioned in this post. Always do your own research before investing.

With that, let’s dive right in…

Web3 Social Apps

Web3 apps in general are built with the following key principles:

Trustless: Deployed on blockchains they are not controlled by a single entity or person. As a generation that was onboarded to the internet through twitter, facebook, instagram this takes a minute to wrap your head around. Platforms are not the default of the internet. They were just a growth hack that played out over the last decade.

The next generation of internet applications aspire to be community owned while retaining the speed, innovation, value and distribution of their web2 predecessors.

This means that as a creator, contributor or consumer of these products your data, connections, content is secured independently of the application (E.g. if twitter wanted to they can seize your account and all the content you published on twitter - a web3 twitter won’t be able to do this because your tweets will be on-chain). The term “trustless” refers to the fact that you don’t need to trust anyone person/entity , you do need to trust the underlying chain - but once a few winning chains emerge, this will sound like “trusting the internet” - which is a much better option.

Community Owned: Internet Platforms have created and captured immense value, they’ve also distributed this value much better than the previous generation of companies did. These companies recognised the creativity and risk taken by early employees, founders, investors and have made life altering returns for these groups. However, there’s always room to do better. For e.g. You would’ve heard of employee #xx at billion $ company retiring off their early stock but never an early rider, delivery or creator partner. This group of people have not shared in the financial upside of the networks they helped create. Additionally you could argue (see tweet below) that even for employees who do get equity there’s room to do better

Web3 apps can leverage crypto tokens which are natively programmable into these applications to reward all contributors commensurate to value added irrespective of nationality, collar (white/blue) etc. They also have p2p transactions as default which means that the in-game economy for these digital assets can spawn a life of its own.

This is not easy, it needs the right intentions and careful tokenomics design, the good news is that a lot of these projects are open-source and community led where doing this well is possibly the best growth hack and not doing it will get called out. It is important for the community to not take this for granted and relentlessly demand this from projects

Censorship resistant: This plays out in two ways, these apps cannot ban specific creators/content unilaterally unlike their web2 peers & these apps cannot be shut down directly by governments/regulators. As long as these are built on a sufficiently decentralised blockchain, the underlying data is independent of the interface used to access it. The way this plays out is that either there will be many interfaces to access the same data-network or it’ll be easy to spin up one on-demand if needed. So even if the interface is censored, the network survives.

Source: Data Composability (The looking glass - Mirror)

This brings its own challenges because there are times when censorship is needed and these groups/communities need to be able to enact it. My bet/hope is that in the long term the ones that find the right balance will survive and thrive.

Introduction to Chingari

With this background we’ll now explore the Chingari product, background and future aspirations.

Chingari initially launched as a web2 video sharing app in 2018 and was one of the many short video apps trying to fill the void when TikTok was banned in India around June 2020. As you can see more the graph below, this was a real inflection point for existing and new entrants in the short video space

Source: Cumulative Downloads from App Annie

While Chingari was among the top 5 players to emerge to fill the Tik Tok void, they’ve seen a second inflection point after announcing that they are going all in on web3. You could argue, as people have, that this was a last ditch effort given Chingari was last in the pack, I personally find it pretty impressive that they took a 30m user base and went all in with a radically different strategy. Whether it pans out or not, only time will tell. Here’s one of the tweets from their founder on the issue:

Let’s take a step back and understand what it means for Chingari to “go web3”. So far, across social media platforms the way creators and their followers interact is guarded by the platform, here are two examples to illustrate this,

If Instagram , for example, turned off DMs tomorrow or introduced a new format (e.g. reels) - both creators and consumers have no recourse but to adapt to the new order. Leaving the platform isn’t a real option because all your connections, post, audience is locked within instagram. Influencing the decision isn’t a practical option either because the employees aren’t really accountable to the users or creators. Platforms have started investing in creator relations, forums, boards etc but imo this is pretty tokenistic right now. In the web3 world, you should have two recourses:

You can influence these decisions as part of DAO governance, voting, working groups etc.

You can exit the app with your network interact and use another interface

Gamified apps , like CRED for example, which have an in-game economy also exercise full control on what you can (or can’t) do with your CRED coins, the conversion rate for products etc. Two key differences in the web3 world,

Tokens are fully liquid, can be bought & sold in the public market based on demand and supply

Conversion rates are determined dynamically in the market place based on demand and supply.

Just to clarify, these are ideas. It is not clear whether these will be more effective than the traditional way of doing things. You could argue that everyone voting on which feature to build is a sure-fire way of not building anything. But these options offer the possibility of solving these real problems. If executed well, social media will not be the same.

Why does Chingari need a token?

Before we move any further, I want to address the question of why Chingari needs a token at all or why I can’t re-use an existing token. To put it simply, Chingari (and web3 apps in general) are betting on community controlled and generated value. A token is the most effective way to capture and measure that. At any point in time a token can be affected by speculation more than value or vice-a-versa (just like stocks) , but over time just like stock prices converge to earnings growth, token prices will represent the true market value of the product. So , for example, the first person to curate a list of “top creators to follow” should probably earn a lot more Gari than the millionth person to do it. This is how the community earns commensurate to the value it creates.

As to why it can’t use an existing token like SOL, Eth or BTC. I feel like you want to abstract out that complexity into the conversion rate. So, you’re project is still pegged to the market via a conversion rate of GARI-SOL etc but internally it is not affected by any changes to the token price of other tokens. This provides the best balance of accruing internal value relative to market & gives the project control in terms of supply, inflation and other token design considerations.

So, what is changing now that Chingari has decided to go web3? Drawing from their whitepaper there are four groups of users

Creators : They will earn GARI for creating content, they can also raise funds from their followers through staking pools & earn commission in GARI from product sales generated from their content.

Advertisers: They bring the money, only this time it they via GARI and presumably viewers earn a piece of it for their attention (similar to the BAT token in Brave).

Viewers: The consumers of content they can buy GARI to unlock the best of the app - exclusive content, merchandise, tipping their favourite creators etc. They can also earn GARI by watching ads or contributing to the platform in other ways.

Developers: Either fulltime employed by the GARI foundation or freelance contributors, they can GARI for building and maintaining the platform.

Worth noting that any of these groups can be part of platform governance and decision making by virtue of staking GARI on the platform

Here are some of the key features to look out for:

Source: Chingari whitepaper

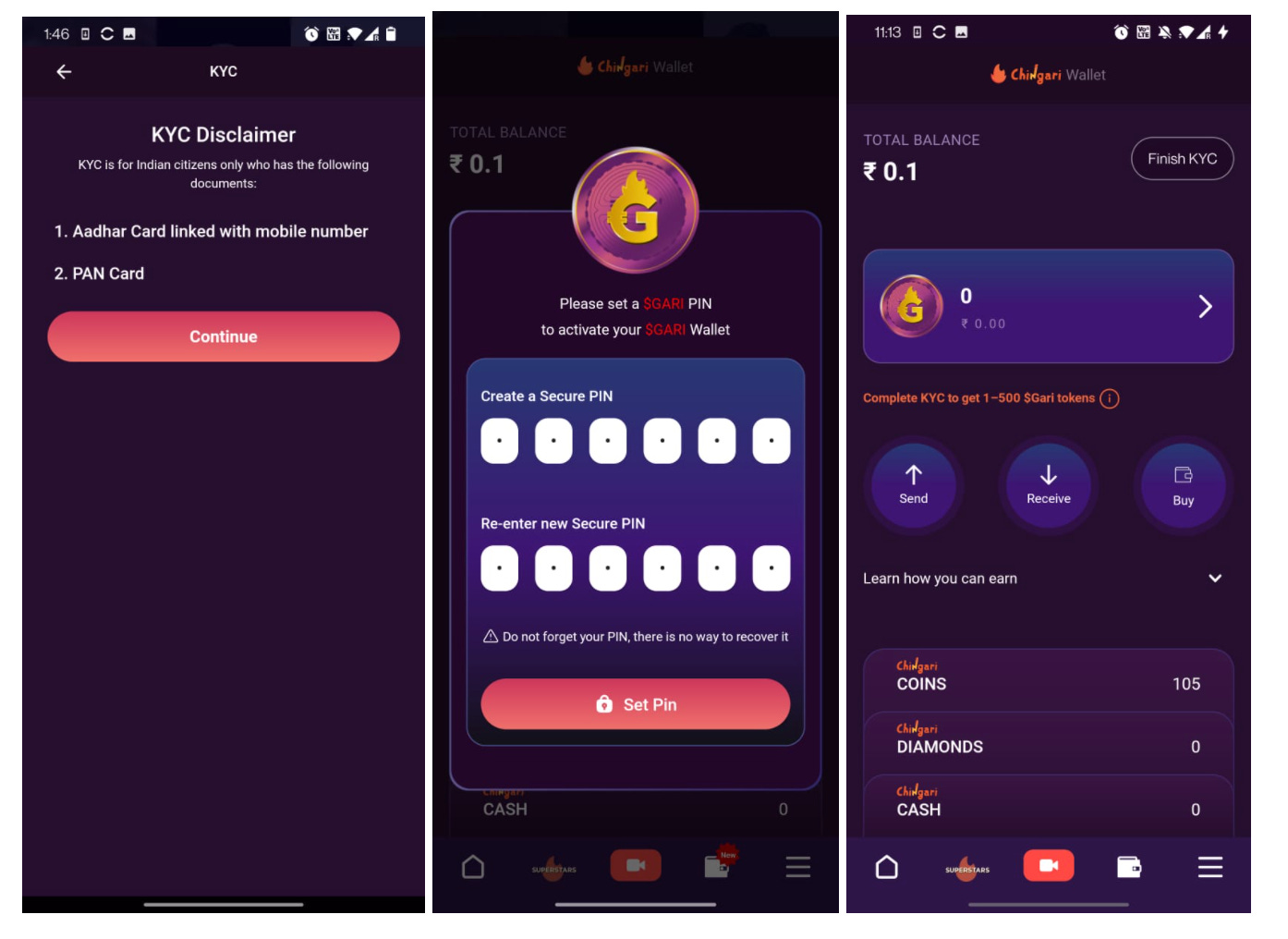

Non-Custodial Mobile Wallet

It is worth noting that Chingari has implemented an in-app wallet to abstract out the complexity of using a web wallet , writing down seed phrases etc. According to their whitepaper this is a non-custodial wallet, which means it is hosted on the Solana blockchain and thus fully controlled by you the user. I verified this for myself by pasting my Gari wallet address on Solscan, screenshot below. This also means that you can withdraw and deposit to your phantom (or any other wallet) from your GARI wallet - although this functionality is currently not available and will possibly present some KYC challenges on source of funds.

Complete your KYC , set a PIN and your wallet is activated

View your wallet address in the app and on-chain

The Panda NFT Launch

In case you’re new to NFTs, here is a great pre-read to get you started. Chingari recently announced that they’re launching a GARI PANDA NFT collection.

Similar to the GARI token, ownership of the PANDA NFT will provide access to various benefits, content and features across the Chingari platform. You can find the full list in their medium post, here are a few things that stood out to me:

Ads club: In the future, you will need to hold a PANDA NFT to be able to run adverts on the platform. This could be great because it creates a race in every new market or category. As a viewer/outsider you buy the NFT ahead of time, identify ways to increase the user base and viewership to attract advertisers and then sell/lease them your NFT.

Revenue share: Across a variety of possible streams like offline merchandise, music partnerships, creators, newsletters etc will be shared with NFT holders. Once these go live, they will generate a real return simply from holding the NFTs independent of price speculation. If this works, it will be a great differentiator as most current projects don’t have an independent revenue stream to back up their NFTs. A comparable example from the DeFi world is Lifinity where they bootstrapped liquidity pools from their NFT sales and will pay a % of fees to holders.

Exclusive access to creators : Through a variety of festivals, concerts and other events, holders will get access to popular creators, Bollywood A-listers etc

Investment opportunities: This one is exciting - users can invest in short film production and earn a share of the revenue generated from the content.

In-app swag: Identification and other swag in the app to make you feel special as a HODLER

Why launch both an NFT & a token ?

A question worth exploring is why does Chingari need to launch an NFT collection to achieve these things? Technically you could achieve all of this through the GARI token , privileges can be tiered based on the amount of tokens held, lock-ins over time etc. I’m not fully sure but here are a few reasons why

Community vibes: It creates a symbol that people can start to relate to and evangelise. Makes for a good PFP across platforms and helps build the brand both within and outside the community.

HODLing : You’re more likely to be attached to your NFT because it has a picture, some traits and a personality of sorts. At-least more than a token. This means you may get a set of people who hold more than your average token.

Art: NFTs carry more artistic value than numbers in a wallet (to most people anyway, no judgement)

All of these are arguments for launching an NFT collection, but one that could be airdropped to existing token holders for free. Using the NFT sale to raise funds is effectively the third ICO/IDO that Chingari has now issued. Nothing wrong with it per-say, but at some point you do wonder if it is too much too soon.

How to mint?

The public sale is now open, you can mint a PANDA from their mint site on SolRazr. Simply connect your wallet , fund it with some SOL and you’re good to go.

The Bull Case

In the best case scenario, Chingari is able to deliver on all the features in their roadmap , attract a large base of users and advertisers to get their internal economy going. This will be amazing because it unlocks:

Direct relationships between creators and their fans. Beyond likes and follows, fans can invest in creators early through staking and buying their merch. Not only can they support their favourite creators but also benefit financially if the creators make it big.

Better creator monetisation: Not only do creators earn from a global audience but also have the ability to raise funds from a global pool of early believers to upskill and accelerate their creator journey, similar to coinvise.

Community built platform: If their governance model works then we will see what a platform built by the people and for the people looks like. Open source algorithms, a choice of feeds, user led feature development, forking etc will be important parts of this.

Open source movie production: Bands of creators and viewers can come together (DAO style) to create and promote content they feel passionate about & benefit financially from its performance.

The Bear Case

There are a lot of things that can go wrong,

At the heart of social networks is user engagement. If you look at this graph of Avg session duration, you can see that while Chingari has seen a spike in user growth they’re still bottom of the pack when it comes to user engagement and significantly below their competition. They need the flywheel of great content getting users and in-turn getting more content to kick in.

Source: Avg Session Duration from App Annie

There is a lot of work to be done. Their roadmap is a laundry list of features every social platform (web2 or web3) would like to build. It is unclear to me from public information on how success of each feature will be measured, iterations needed and how these tradeoffs will be made. For example, Chingari had announced launching social commerce in Feb 2021 but i don’t see it live on the app yet. Failure to build these features or build them well enough to generate traction and monies is a big risk to getting this network going.

The economics need to work. Their founder said this himself that they plan to deploy funds from all the token sales to bootstrap the internal economy. After that it needs to generate enough return to keep itself going. This means you need the creator flywheel that gets users and advertisers to generate demand for the token.

Censorship resistant? From their whitepaper it is not clear to me whether the creator-fan relationships and creator videos are being stored on-chain or within their app. If the latter then all the benefits of being neutral and trustless we spoke about don’t apply. This will also become a barrier in onboarding more creators.

Conclusion

Chingari is attempting one of the boldest experiments in the history of social products. There are barely any consumer products in web3 with millions of users. If they execute well they will achieve their ambition of beating Tik Tok globally, empowering creators and fans in a way we’ve never seen before. But there is clear risk involved in building out the platform and attracting the users and creators needed to make this happen. I would think of them as an early stage startup that has raised a good amount of capital and now has the tall order of executing to the expectations of their investors. Here’s to wishing them all the best and rooting for their success.