Over the last few months, just like many others I’ve gone down the web3 rabbit hole. Having explored a few of the blockchains in Ethereum, Avalanche, Cardano, and others, I’m most excited by Solana. If you don’t know what Solana is, Packy’s deep-dive is the best in class. Give it a read.

The natural next thing for me was to look at applications. Decentralized Finance (DeFi) apps have been the most widely used real-world application category in crypto. As I started learning, decided to write-up my learnings about Project Larix, the lending gateway for Solana.

Let’s go!

Who is Larix?

From Larix’s website & white paper,

“Larix is the ultimate lending gateway on Solana, adopted a dynamic interest rate model and created more capital-efficient risk management pools, as such a broad selection of collateral types, crypto tokens, stablecoins, synthetic assets, NFTs, and other kind of assets can be fully utilized in a safe way.”

Ok, let’s break it down…

“…dynamic interest rate model”

This means, interest rates change based on utilization. If there are more borrowers, interest rates go up which in turn can attract more suppliers (lenders) or force borrowers to repay/borrow less. This has other benefits in terms of safety of the protocol. More on this below.

“capital-efficient risk management pools”

Collaterals/assets are clustered in isolated pools based on risk profiles, which enables people with different risk profiles to have many choices on the platform, thereby enabling Larix to utilize capital more efficiently.

DeFi Lending

Conventional banking business models originated from deposits and loans, rewarding excessive capital with interest. DeFi enables a similar business model without an intermediary, allowing both borrowers and lenders to earn cryptocurrencies. It is paramount to understand that all financial activities are encoded as smart contracts and no additional control is exerted by the platform that deploys the smart contracts. Trust is encoded in the system. This allows removal of intermediaries and users are able to interact in a true peer-peer fashion. If you are new to DeFi, highly encourage reading a short introduction here or watching a simple explanation here.

DeFi lending platforms are not new. Quite understandably the first wave of these lending protocols saw Ethereum as being the dominant platform where lending platforms were built. Low throughput and high transaction fees on Ethereum have opened up a new wave of alternate blockchains in the last couple of years. Solana seems to be the most promising one that can support 50,000 TPS at an extremely low transaction cost of ~$0.00025. Larix aims to be the gateway of DeFi lending on Solana, giving users the ability to utilize their favorite DeFi services on their favorite blockchain. The speed of Solana enables high throughput at scale and low gas fees reduce the barrier to entry for individuals to earn passive income on their assets, tokens, nfts, etc.,

How is Larix different?

Given the meteoric rise in Solana’s popularity in 2021, multiple lending platforms have sprung up and others will continue to spring up in the near future. A few notable ones are Port Finance, Parrot Fi (shoutout to Aditya at Superteam for these excellent write-ups) and tulip.garden. All of these platforms are competing in different ways to become the de facto lending platform on Solana.

Larix differentiates itself in a few ways:

NFT peer-peer lending NFT lending is not available as of this writing (Oct 2021), but expected to be available in the near future. As of now, Larix is the only platform to offer this.

Live Mining Borrowers and Suppliers are rewarded with $LARIX tokens to increase APY for capital, thereby incentivizing participation on the platform. Token holders will have vote on governance and features in the near future.

Broader selection of asset types Larix promises support of conventional financial assets on its platform, that include but are not limited to equities, mortgages, etc.,

Token Economy, Governance and Distribution

Larix protocol has created a crypto-token with the ticker symbol $LARIX. $LARIX will be used as a utility token on the protocol, providing economic incentives to encourage users to contribute and participate in the Larix ecosystem. To promote decentralized community governance, the token will allow holders to vote on governance proposals, feature requests and addition of new collateral types in the future. However, $LARIX should not be taken as a vote on the operation and management of the company.

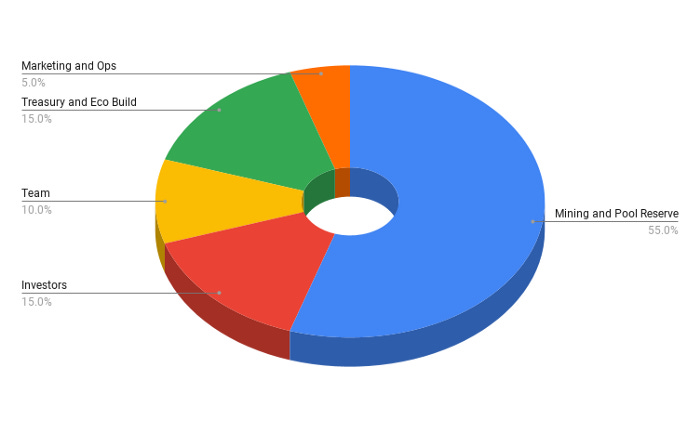

There will be a maximum supply of 10 billion tokens allocated to mining, treasury, investors, team and operations. The token distribution to the Mining and Pool Reserve which has the lion’s share allocated is split into 3 phases to last the 3 project phases over the next 5 years. Phase 1 will use 20% for mining to enhance APY, followed by 25% in Phase 2 and the remaining 10% in Phase 3. The tokens issued to the team and investors have a 12-month cliff, when 25% of tokens allotted to them are released. After the 12th month, 1/36 of total assigned tokens are released monthly.

Total Market Value

The total market value is a good indicator of the health of a DeFi service. In Larix’s case, as of this writing (Oct 2021), the total market value is around ~$500m. The total liquidity of $LARIX is ~$10m. Staking is being slowly introduced with the first few using SOL and mSOL as token accepted as stakes for accelerated mining of $LARIX.

Risk Management

Risk management has to be the top priority of any lending platform. It is great to see this be a cornerstone for Larix, not just in words but also how the product is structured.

Dynamic Interest Rates The dynamic interest rate model has the natural property of being able to manage liquidity via auto-correction when depositors need to withdraw their assets from the pool. The interest rate model has been carefully created to incentivize borrowers and lenders to continue to participate on the platform using $LARIX tokens as rewards.

Auto liquidation Borrowers are allowed to borrow only upto 70–80% of the collateralized value based on tokens deposited. When the debt value becomes higher than 100% of the collateralized value, automated bots liquidate assets to repay loans. Borrowers are therefore encouraged to keep the collateral factor less than 75%, and repay loans / deposit additional assets if it goes beyond 75%.

Selection of collaterals/assets Collaterals will be selected carefully. In the initial days, crypto assets with market cap > $10B will be the only ones offered on the platform. Over time, $LARIX holders will potentially have votes on collaterals/assets added to Larix.

Self governing DAO Introduction of DAO is in the plans (while not currently) through voting and governance tokens. $LARIX token holders may have limited voting rights in the early days, but the platform will transition to a self governing DAO.

Product Roadmap

Larix’s roadmap has been broken down into 3 phases. As of this writing (Oct 2021), the project has begun execution on phase 2 of its journey, with phase 1 completed.

Phase 1 is about supporting the essentials of DeFi lending with support for crypto tokens, stable coins and synthetic assets.

Phase 2 is currently estimated to launch by end of 2021 / early 2022, has the team partnering with pyth.network to fetch time-sensitive, real-time data from world’s largest exchanges and traders (equities for ex.) and provide a wider range of conventional financial assets like equities, mortgages, etc.,

Phase 3 is slated for mid 2022 and beyond. The team plans to enable peer-peer lending of NFTs.

Supplier / Depositor Economics

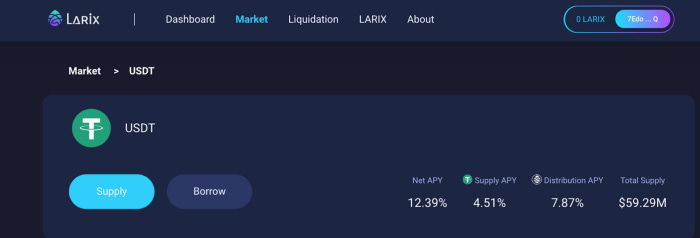

Suppliers get paid a portion of the interest (APY) in units of the original asset deposited (Supply APY) and a portion in mined $LARIX tokens (Distribution APY). In the picture below, a supplier will earn a net APY of 12.39%, which is comprised of 4.51% in $USDT and 7.87% in $LARIX

Borrower Economics

Borrowers get paid back a portion of the interest in $LARIX tokens (Distribution APY) as a reward for participating on the platform. In the picture below, a borrower pays 3.97% APR in $SOL and receives 2.74% APY in $LARIX. Hence, the net APY is -1.23%, ie., interest paid is 1.23%.

In some cases borrowers can make money from borrowing money, which might sound wild to a non-crypto person. It is important to be cautious here. In the example below, a borrower would end up earning 0.05% APY. Interest paid is 3.45% in BTC, and mined $LARIX is worth 3.49%, earning her a net APY of 0.05%.

Liquidation

Liquidation of assets happens automatically when the debt ratio reaches 100% ie., debt value exceeds the collateral value. To account for the volatility of crypto tokens, Larix allows a debt value of 75% of the collateralized value. Users can also participate in liquidation and are paid 8% of the liquidation amount as rewards. Having said that, liquidation is one area where the product needs more work as you will see below.

I tried liquidating the above loan, but the transaction failed as the debt ratio had not reached 100% yet. Why not disable the button? One more thing, when the debt ratio reaches 100%, liquidation bots kick-in to liquidate the position. Is there a time window for liquidators to manually liquidate before bots kick-in? Are manual liquidators competing with bots? I tried reaching out to folks on Discord. The community is responsive and generally helpful, but I couldn’t find answers to these questions. If someone finds out please leave a comment, so we can learn together.

Code Audit

Security and protecting against well-known hacks helps further solidify trust in the platfrom. Larix code has been audited by Slowmist, which is a blockchain security company, providing cybersecurity audits and protection for digital asset exchanges, crypto wallets, public chains, and smart contracts. They found 5 issues (4 critical and 1 medium) and all of them were fixed by Larix. Slowmist has done audits for 1K+ blockchain companies. The report can be found here.

Community

Larix has a fairly active community with 100K+ twitter followers and 50K+ on the Discord server. The team is fairly responsive and tried to answer all my questions in a timely manner.

Finally, Larix is not only backed by the Solana foundation, but a long list of credible investors and strategic partners in the crypto exchange gate.io labs, financial data oracle pyth.network, and other big name funds like epsilon fund, solar eco fund, and others.

Product Walkthrough

Larix is only available on the web currently. There are no iOS or android apps. Their website has a very clean and intuitive user interface / user experience, which is easy to follow. There are 4 self-explanatory tabs at the top. The product gives me an FTX feel.

When you land on https://projectlarix.com, you will be greeted with all Os. Not to worry, use the connect button to connect to a Solana wallet (about 10 different ones are supported). After you approve the wallet connection, it is fairly intuitive to deposit, supply / borrow assets, track your dashboard and participate as a liquidator.

After you have connected your wallet, the dashboard looks as follows:

As you can tell from here, I’ve supplied 5 USDT and borrowed 0.02 mSOL. My debt ratio is 70.84%, remember the max allowed borrow is 75% of the supply balance. The only confusing part of this dashboard for me is title for My Bill section. I don’t find it intuitive, and may have named it My Balances.

Conclusion

Larix is a pretty compelling option for DeFi lending on Solana blockchain, especially with plans to enable lending not only of crypto tokens and stablecoins, but also NFTs and conventional non-crypto financial assets. In some cases, the positive APY for borrowing may be enticing, but just like every other DeFi lending platform it is best to be cautiously optimistic.

These are early days not only for DeFi but Solana too, but with lots of promise to disrupt the financial infrastructure in the upcoming years. Stay tuned.