Deep Dive of the State of Mobile Apps on Solana

Network Trends, Recent Updates, Ecosystem Map, Future Apps and more.

You unlock your phone roughly 150 times a day. Now imagine if every third unlock could pay you. I'm not talking about pennies from ads. I mean real money for real things you're already doing, like walking to work, sharing a photo on Insta, commenting on a Twitter post, or playing a game during your commute to work.

Sounds impossible, right?

That was my first reaction too. But then I found out that 150,000 people have already preordered something called the Solana Seeker, a phone that turns this "impossible" scenario into a reality. It turns out, they're not just buying hardware, they're buying a citizenship in what Balaji Srinivasan calls a Network State.

We're witnessing the emergence of the first digital economy where human attention directly converts to money being flown into the ecosystem.

These early adopters aren't just users; they're the founding citizens of an economy that operates by entirely different rules than the one we grew up in.

And here's what really fascinates me: this isn't some distant future we're speculating about. It's happening right now, in real-time, with people making real money from interactions we used to think of as worthless digital noise.

Your likes on Twitter are way more valuable than you think.

What Makes the Solana Seeker Different?

Let's be honest: using crypto today is a nightmare.

Want to send someone $20 in USDC? Hope you enjoy copying wallet addresses, calculating gas fees, waiting for confirmations, and praying you didn't mess up a single character.

But here's what most people miss: the problem isn't just the software, it's that we've been trying to force desktop crypto patterns onto mobile devices.

The Seeker attacks this from a completely different angle. While previous "crypto phones" like the HTC Exodus or Samsung's blockchain features bolted crypto functionality onto existing experiences, Solana Mobile rebuilt the entire stack around a simple question: What if crypto felt as natural as texting?

Here's the thing: the Seeker isn't just running crypto apps. It's built on something called TEEPIN (Trusted Execution Environment Platform Infrastructure Network), which creates hardware-level security for your private keys. Think of it like having a hardware wallet permanently integrated into your phone, but one that apps can communicate with seamlessly.

The magic happens through the Mobile Wallet Adapter (MWA) and the Seed Vault. Instead of manually copying addresses and signing transactions, apps can securely request payments in the background. Your private keys never leave the hardware security module, but transactions feel as smooth as Apple Pay.

But here's where it gets interesting: the phone runs on SKR tokens, creating what they call an "SKR Flywheel."

=> Developers earn SKR for building quality apps.

=> Users earn SKR for engaging with those apps.

=> Hardware manufacturers get rewarded for expanding the ecosystem.

That way, everyone has skin in the game.

The result? You can walk into a coffee shop, scan a QR code, and pay with USDC as easily as you'd tap your credit card. You can earn tokens from a fitness app and immediately spend them in a game. You can tip a content creator and have the transaction settle instantly.

The Seeker ships in August 2025 with 100+ apps already live in the dApp Store. These aren't just crypto experiments, they're full applications that happen to have crypto superpowers.

The question isn't whether this will work. With 150,000 preorders, it's already working. The question is: what happens to digital behavior when financial transactions become as frictionless as scrolling through TikTok?

The Apps That Make It Possible

But the Seeker is just the hardware. The real magic happens in the apps that turn this vision into reality. When those 150,000 Seeker owners power on their phones in August 2025, they'll find an app ecosystem unlike anything that has existed before, one where every interaction has the potential to generate value.

These aren't the crypto apps you know from desktop. They're mobile-native experiences built from the ground up around the question: What if your phone could pay you for living your life?

Want to get fit? STEPN has already proven that >3 million people will walk for tokens. Want to discover art? DRiP has distributed over 10 million free NFTs to collectors who think they're just browsing cool content. Need phone service? Helium Mobile pays you for helping build network coverage.

The pattern is becoming clear: the most successful mobile Web3 apps don't feel like crypto apps at all. They feel like better versions of things you already want to do.

Mapping the Mobile Apps Ecosystem on Solana

This brings us to a fascinating question: what does this new app ecosystem actually look like? And more importantly, which approaches are winning?

Here's where things get more concrete. The current hackathon has almost 500 registrations with $1M+ in prizes. SendAI's AppKit has been downloaded 100,000+ times. These aren't vanity metrics; they represent real developer interest in building mobile-first Web3 experiences.

But developer interest and user adoption are different beasts entirely. The ecosystem currently has 100+ apps in the dApp Store, but how many of these represent genuine utility versus speculative experiments? The honest answer is: we don't know yet, and that's precisely what makes it interesting.

The Four Quadrants of Mobile Apps on Solana

Market Penetration (Top-Left): This quadrant houses the familiar faces, Phantom, Squads, and Magic Eden, serving existing crypto users with proven Web3 functionality. Growth here is steady but limited by the ceiling of crypto adoption itself.

Market Development (Top-Right): Here we see simplified versions of DeFi protocols like Jupiter Mobile (100K+ downloads, 4.6 star rating), Kamino lending, and SendAI's AppKit with pre-built modules for 18+ protocols. These apps successfully translate complex crypto operations into familiar mobile patterns, proving there's an appetite for accessible DeFi.

Product Development (Bottom-Left): The infrastructure layer powering everything else, Dialect's Web3 messaging, Helius's mobile-optimized RPC, and developer tools like those from the broader ecosystem. Essential but invisible to end users.

The Sweet Spot (Bottom-Right): This is where the magic happens. STEPN doesn't call itself a "blockchain fitness app". It's a fitness app that pays you. With 2-3 million monthly active users, it proves that people will use crypto when it solves real problems without crypto friction.

Star Atlas, Aurory, and Mad Lads represent the gaming frontier where virtual economies feel natural because gaming has always had virtual economies.

The Winning Pattern

Look at the apps that are winning: none of them lead with crypto.

Instead, they solve real problems first and use blockchain as invisible infrastructure. It's like the best magic trick ever; users get all the benefits without realizing what's powering the experience.

This tells us something important about where mobile Web3 is heading. The future isn't about "bringing crypto to mobile." It's about making mobile apps so good that they're impossible without crypto, while keeping the crypto completely invisible.

The Infrastructure Behind the Magic

But here's the question that matters: how did we get here so fast?

Just two years ago, mobile crypto was basically unusable. Gas fees killed microtransactions. Wallet connections were clunky. Most "blockchain games" felt like spreadsheets with graphics.

Today, we have fitness apps with millions of users, art platforms distributing millions of NFTs for free, and mobile carriers that actually pay you. That kind of leap doesn't happen by accident.

Something fundamental changed in the infrastructure layer that made all of this possible. The apps in our Sweet Spot aren't just good ideas; they're good ideas built on entirely new technical foundations that didn't exist before.

The breakthrough came down to one key innovation: the Mobile Wallet Adapter (MWA) protocol. This isn't just another technical standard; it's an attempt to solve the fundamental user experience problem that has plagued crypto since its inception.

Think about it: every crypto interaction requires managing private keys, understanding gas fees, and navigating complex interfaces. The average person finds this about as intuitive as performing brain surgery. Solana Mobile's approach is to hide this complexity behind familiar mobile patterns.

Technical Architecture: A Deeper Look

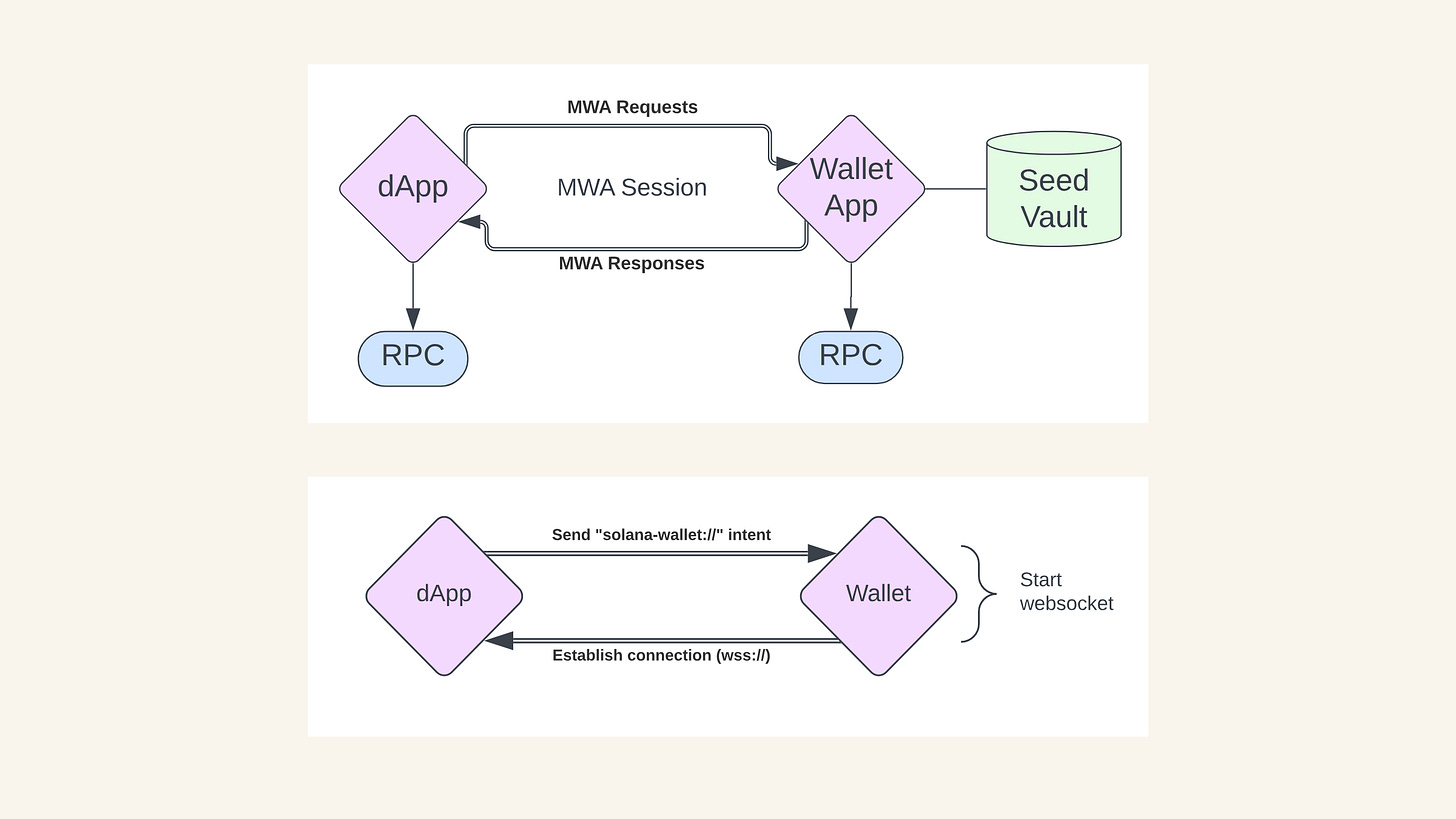

The MWA protocol represents a fundamental departure from traditional mobile app development patterns. Where conventional apps communicate with centralized servers, mobile dApps must establish secure connections with wallet applications while maintaining state across multiple applications.

This creates unique technical challenges:

State Management: Unlike web apps, where wallet connections persist in browser sessions, mobile apps must re-establish authorization with each interaction

Security Models: The Seed Vault leverages Android's hardware security module, creating a self-custody experience that feels familiar to users accustomed to biometric authentication

Cross-App Communication: The WebSocket-based protocol enables seamless value transfer between applications. Imagine paying for a ride-share with tokens earned in a fitness app.

The Technical Magic: How MWA Works

But here's where it gets really interesting from a technical standpoint. The Mobile Wallet Adapter isn't just a clever abstraction—it's solving fundamental problems that have plagued mobile crypto for years.

The WebSocket Revolution

Traditional mobile apps can't maintain persistent connections the way web browsers can. When you switch between apps on your phone, connections typically die. The MWA protocol solves this through a sophisticated WebSocket architecture that persists even when apps are backgrounded.

Here's how it actually works: When you tap "Connect Wallet" in a mobile dApp, your phone broadcasts an solana-wallet:// intent. Any compatible wallet app listening for this intent responds by opening a WebSocket connection. This creates a secure communication channel that survives app switching—something impossible with traditional HTTP requests.

The Three-Step Dance

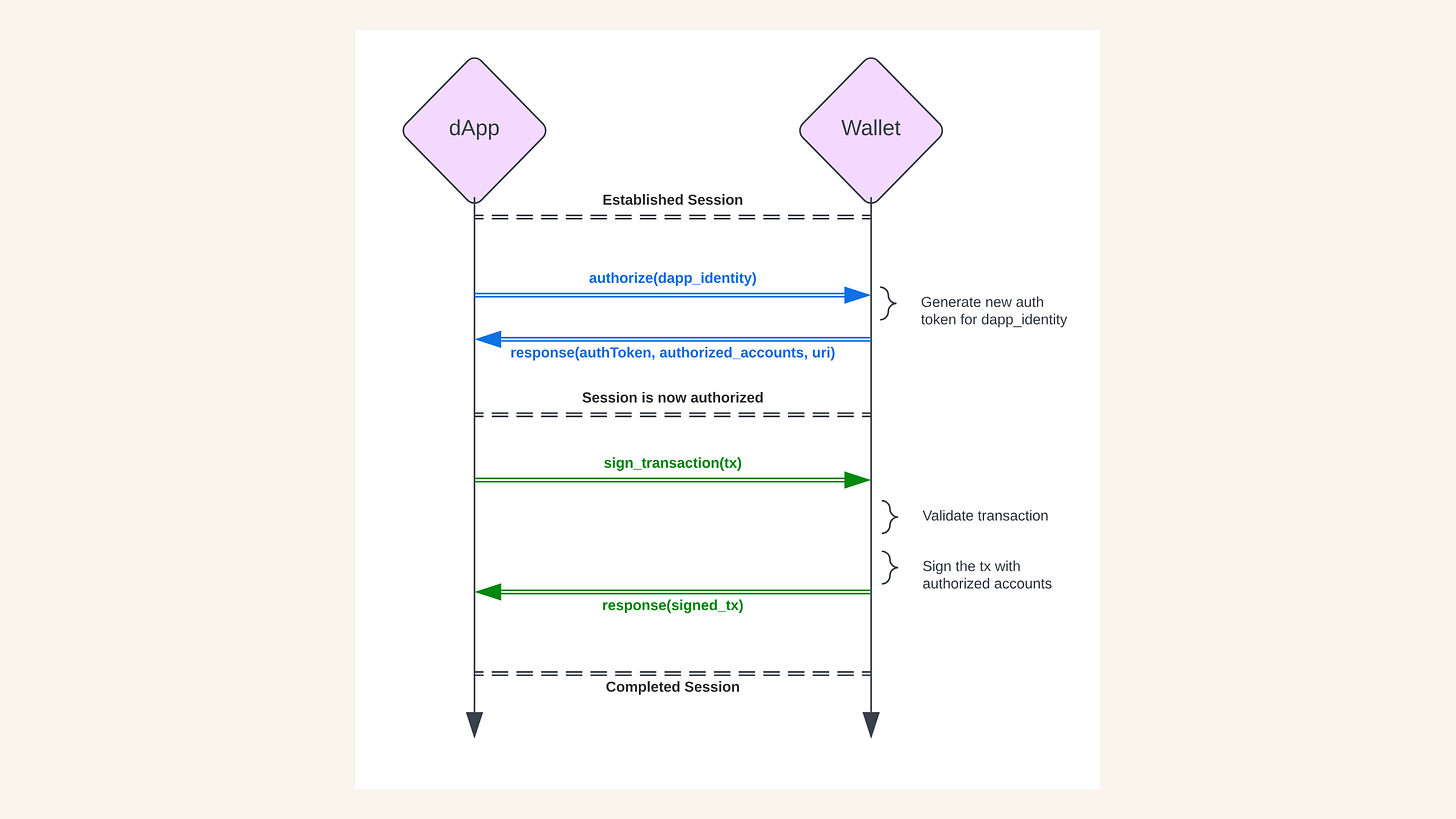

The technical flow is elegantly simple:

Authorization: The dApp sends an

authorize(dapp_identity)request through the WebSocketSession Management: The wallet responds with an

authTokenand authorized accountsTransaction Signing: All subsequent transactions use

sign_transaction(tx)calls within this established session

Hardware-Level Security

What makes the Seeker phone special isn't just software—it's the Seed Vault. This isn't another app storing your keys; it's a hardware security module that operates at the Android system level. Think of it like Apple's Secure Enclave, but specifically designed for crypto operations.

Your private keys never leave this hardware vault. When apps need signatures, they communicate with the Seed Vault through the MWA protocol, which validates requests and returns signed transactions without ever exposing the actual keys.

The Developer Experience

For developers, this complexity disappears behind simple React Native hooks:

javascript

const { authorizeSession } = useAuthorization();

await transact(async (wallet) => {

const authResult = await authorizeSession(wallet);

const signature = await wallet.signAndSendTransactions({

transactions: [transaction]

});

});The transact function handles all the WebSocket management, connection persistence, and error handling. What used to require dozens of lines of boilerplate now happens in a single async callback.

This technical foundation is what enables the seamless experiences you see in apps like Jupiter and Vector—transactions that feel as natural as tapping "like" on a social media post.

The iOS limitation reveals deeper architectural constraints. Apple's aggressive background process management breaks WebSocket connections, forcing developers to fall back to traditional wallet adapters. This technical reality means Android becomes the proving ground for truly native mobile web3 experiences.

The Seed Vault technology is particularly interesting from a systems perspective. By storing private keys in hardware-backed security, they're essentially trying to make self-custody feel as simple as unlocking your phone. Whether this actually achieves its goal is debatable, but the attempt reveals an important insight about technology adoption.

People don't want to understand the underlying technology; they want the technology to understand them. The challenge isn't building better crypto tools; it's building tools where the crypto becomes invisible.

Emerging Design Patterns in Mobile Web3

What if I told you the best crypto apps don't look like crypto apps at all? After studying the interfaces of Jupiter, Vector, Time.fun, and Kast, a fascinating pattern emerges: the winners are systematically hiding blockchain complexity behind familiar mental models.

Jupiter: The Venmo-ization of DeFi

Jupiter's onboarding reads "Welcome to Jupiter" with a simple promise: "Buy or receive SOL to get started." Notice what's missing? No mention of automated market makers, liquidity pools, or slippage tolerance. The "Instant Buy SOL" flow feels identical to buying Starbucks credits - $30 USD becomes 0.178 SOL through Google Pay, with a calculator interface users understand from banking apps. Jupiter took the most complex financial primitives ever built and made them feel like sending money to friends.

Vector: Memecoins as Entertainment

Vector's genius lies in framing speculation as social discovery. "Ape memes with frens" transforms degenerate trading into entertainment. Users scroll through token feeds like TikTok videos, seeing "$32.12 bought" with profit percentages instead of complex charts. The "demon mode" toggle gamifies intensity without explaining leverage or derivatives. By borrowing from social media rather than financial software, Vector makes trading feel like content consumption.

Time.fun: Commoditizing Access

"Time Is The New Currency" reframes creator monetization entirely. Instead of "purchase utility tokens for platform governance," users simply "Buy 30 mins" with verified creators. Toly's profile shows "$90/min +174%" like Uber surge pricing—familiar, understandable, valuable. The interface treats time as a purchasable commodity, making complex tokenomics invisible while enabling entirely new economic relationships.

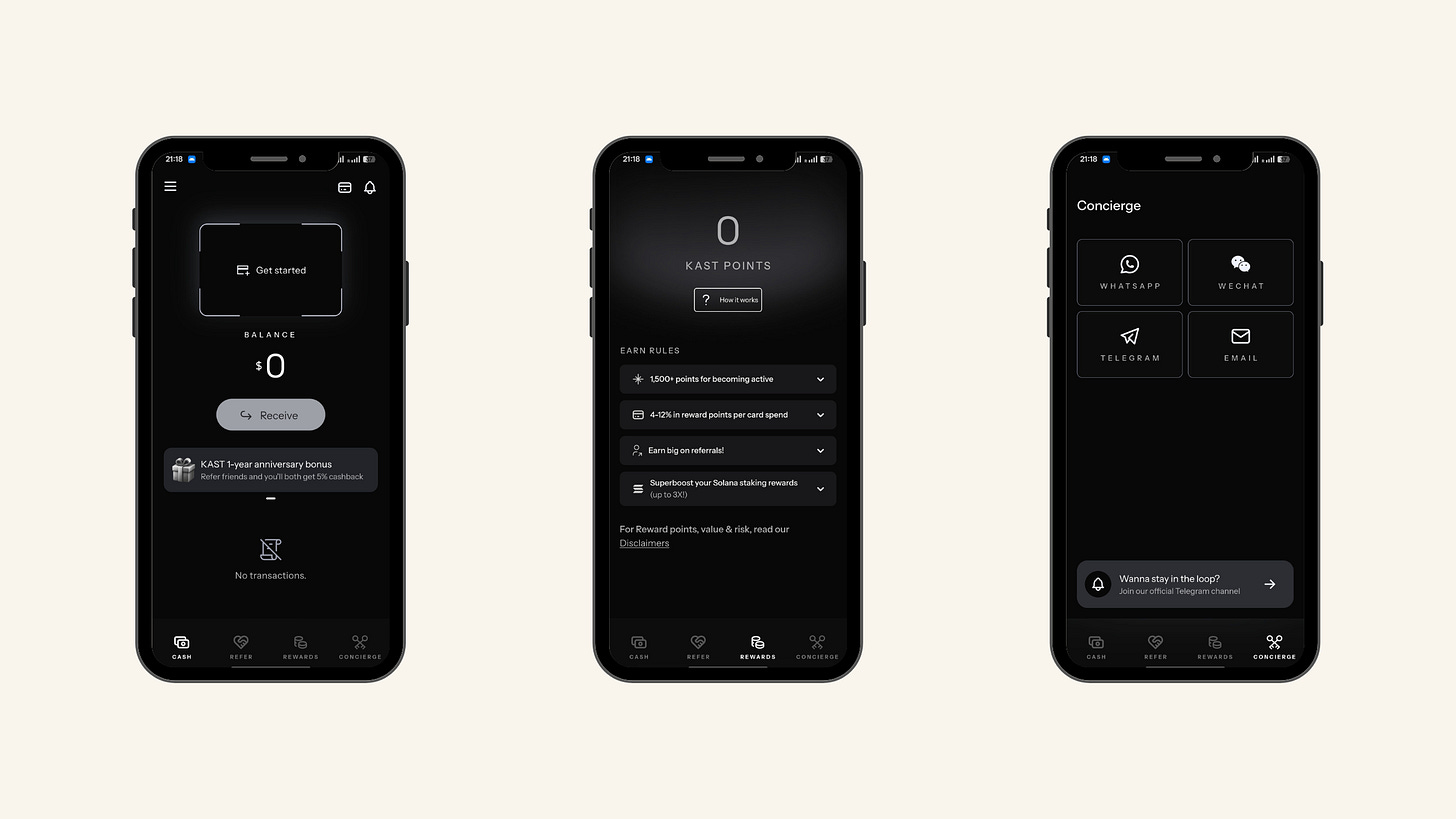

Kast: Premium Banking Psychology

Kast transforms crypto spending into status signaling. The sleek black interface promises "SPEND WITHOUT BORDERS" while hiding cross-chain infrastructure. Users see "KAST Points" and reward tiers (Standard, Premium, Luxe) borrowed from credit card marketing, not DeFi protocols. The "Claim Gift" button treats airdrops like loyalty rewards, making blockchain benefits feel earned rather than extracted.

The Unifying Principle

Each app succeeds by choosing the right metaphor. Jupiter = digital banking. Vector = social discovery. Time.fun = premium booking. Kast = luxury credit cards. They didn't try to educate users about blockchain; they made blockchain invisible by wrapping it in behaviors users already understood and desired.

The infrastructure works. The remaining challenge is psychology, not technology.

What to Watch: Key Inflection Points

The next 18 months will tell us everything we need to know about mobile Web3's future.

Q3 2025: Seeker shipments begin. Success metric: >50% of recipients actively use Web3 features within 30 days.

Q4 2025: Developer ecosystem maturity test. Success metric: 10+ applications with >100K monthly active users and sustainable revenue models.

2026: Mainstream integration indicators. Success metric: Partnership announcements with major consumer brands or integration into traditional mobile services.

Three simple tests. The infrastructure is ready. Now we find out if anyone outside crypto actually wants this.

Why This Experiment Matters

So here we are, watching 150,000 people bet real money that their phones should pay them for living their lives. The infrastructure is ready. The apps work. The user experience finally makes sense.

But stepping back, what we're witnessing isn't just a technological shift, it's a fundamental renegotiation of the relationship between human attention and economic value. For the first time in history, the tools exist to make every digital interaction potentially profitable for the person having it, not just the platform hosting it.

This raises uncomfortable questions we're only beginning to grapple with. What happens to human behavior when every swipe, every step, every social interaction has financial implications? Are we building tools that empower users, or sophisticated mechanisms for turning human existence into extractable data?

The Solana Mobile experiment will teach us something important regardless of whether it succeeds or fails. If it works, we'll learn how quickly people adapt to living in a fully financialized digital world. If it doesn't, we'll discover which aspects of human psychology resist commodification.

Either way, the lessons will matter far beyond mobile apps or blockchain technology. We're not just building better phones, we're running a real-time experiment on what happens when the boundary between living and earning disappears entirely.

Your next 150 phone unlocks are going to happen anyway. The question is whether you want them to pay you or not.