NOTE: This article was written as a Superteam bounty submission and subsequently won the top prize as announced by Parcl here. I have made some edits to adjust for Substack viewership.

Parcl is a Web3 real estate investing platform that allows anyone to invest in real estate assets for as low as $1, by offering a platform for users to get exposure to entire real estate markets in US cities through REIT-like indexes.

In this article, I will attempt to explore the market context & viability of Parcl’s business model, the Parcl v2 product, and some of my own opinion & feedback.

Market Context

REITs

Real estate investment trusts (“REITs”) have been around for a long time. According to Investopedia, a REIT is a company that owns, operates, or finances income-generating real estate. Similar to mutual funds, REITs pool the capital of numerous investors, making it possible for individual investors to invest in real estate — without having to buy, manage, or finance any properties themselves.

REITs can be invested in through public or private channels, through equity and/or mortgage. However, for retail investors, public equity REITs would be the most common way to get exposure to the real estate sector.

Fractional Ownership

Zooming out further from REITs, retail investors can also get access to real estate asset via fractional real estate investing. This is when many different investors split the cost of property among them. Fractional ownership gives them a stake in the real estate and makes them part-owners.

Fractional real estate investing comes in different formats. Sometimes the investor receives a deed and equity in the property; other times one can buy shares in a property, which is then operated by a management firm. In some cases, the fractional ownership interest entitles its investor to stay in the property for vacation, for a portion of the year. In other cases, you can invest in the properties with no intent to actually stay in them, but to rent out via platforms like Airbnb.

On-chain Investing

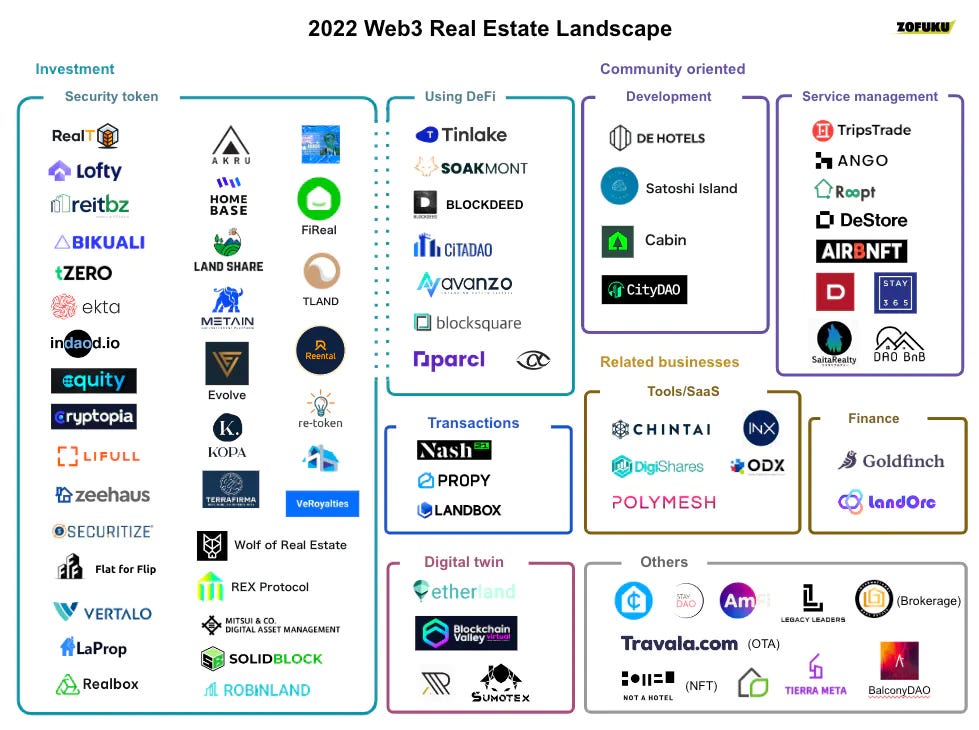

Expanding from the concepts of REITs and Fraction Ownership, a number of web3 firms have attempted to offer access to real-world assets (RWAs), particularly real estate, by leveraging blockchain technology.

Here’s a basic use case for blockchain in Real Estate investing:

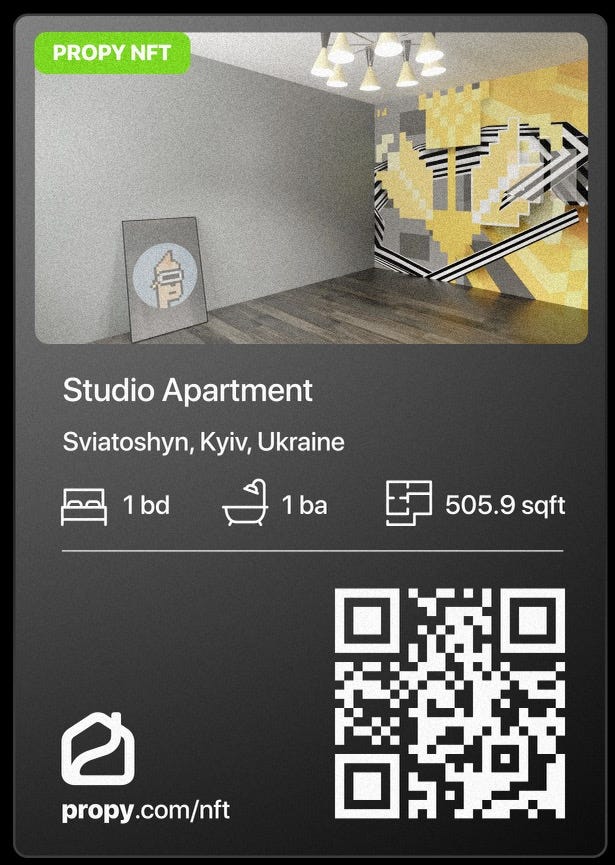

Propy is one of the earliest companies attempting to leverage blockchain for property auctioning. In 2021, Michael Arrington, the cofounder of TechCrunch and Arrington XRP Capital, tokenized his apartment near Kyiv, Ukraine, as an NFT and sold it on an auction for 36 ETH.

Fraction is an example, in which the company allows retail investors to buy partial ownership of a particular property for a price. The categories of offering RWAs can range from beachfront pool villas, penthouses, EV charging stations, to luxury yachts, which means it is not limited to real estate. Currently, the company only operates in Thailand and does not allow US citizens to access its products.

Then there is HomebaseDAO, a property deed tokenization platform on Solana that allows individuals to buy partial deed ownership as NFTs by tokenizing properties on Solana using a smart contract that was tied to an NFT. It has managed to tokenize its first NFT title deeds for a house in south Texas. The property was valued at $235,000, but Homebase was able to raise $246,800 (in USDC) for the property.

Above are some of the most recent and relevant examples of Web3 Real Estate companies and their practices. A more detailed mapping of the landscape can be found here:

Entering Parcl

About Parcl

Parcl is a Web3 real estate investing platform that leverages blockchain to address the current bottlenecks facing property investing, by bringing the world’s most desirable RWAs to the blockchain.

In May 2022, Parcl announced a $7.5 million funding round with participation from the likes of Archetype, Dragonfly Capital, Shima Capital, Solana Ventures, Not Boring Capital, and FJ Labs.

An Intro video about Parcl can be watched here:

Parcl’s Model

Parcl is quite different from other models. Most importantly, Parcl allows users to invest in neighborhoods and cities instead of specific buildings. Its indexes act as a REIT-like index system, representing a city’s residential real estate market.

The protocol developed by Parcl “allows users to invest in a digital square foot of real estate in neighborhoods worldwide. It does so by allowing for the creation of synthetic “Parcls” which are tied to a price feed that is representative of the average price per square foot/meter within a given neighborhood.” In layman’s terms, each Parcl index represents the median price per square foot/meter in a given geographical location and is freely tradable within the platform’s liquidity pools. The precision can be improved as Parcl collects 10+ million data points daily for precision pricing.

In theory, this concept works well for retail investors that seek out highly liquid assets and broad diversification in the same sector, or in this case, real estate & more broadly RWAs. It eliminates the particular risks of owning a real estate property within a distinctive region, which can be troublesome in market downturns like the post-COVID slum era. It also lowers the entry and exit timeline significantly and allows users to proactively manage their portfolios.

Parcl also suits investors seeking opportunities globally. It focuses on entire neighborhoods inside the world’s best-performing cities, including New York, Miami, and Los Angeles, with international markets like Paris, London, and Singapore, to be available in the near future. Retail investors can invest in multiple cities at once by forecasting market movement in a bullish (long) or bearish (short) direction.

Parcl Protocol v2

To understand how Parcl works, one must first understand the protocol driving it. The full Whitepaper for Parcl v2 can be found here. I’ll simply go through some of the key aspects of its foundation.

Definition

Parcl v2 is considered an automated market maker (”AMM”) for perpetual synthetic assets, by combining the best features of both traditional AMMs and synthetic asset protocols to produce an efficient and simple synthetic asset AMM.

“Automated market maker” is a type of decentralized exchange (DEX) that use algorithmic “money robots” to make it easy for individual traders to buy and sell crypto assets. Instead of trading directly with other people as with a traditional order book, users trade directly through the AMM exchange smart contract protocols that use mathematical functions for price discovery.

“Synthetic assets”, or tokenized derivatives, are records of the relationship between the underlying asset and the purchaser. In the traditional financial world, derivatives are representations of stocks or bonds that a trader does not own but wants to buy or sell. Synthetic assets, or tokenized derivatives, take this process one step further by adding the record for the derivative on the blockchain and essentially creating a cryptocurrency token for it. Synthetic asset protocols generate smart contracts that govern this record and token system.

Key Features

Isolated Pools

Solvency

Price Execution

Zero Credit Risk

Optional Liquidity Provision

Skew Management

Delayed Settlement

The details of these features can be found in the whitepaper and are applied to operate the Parcl app that we will dive in later.

Advantages

Some benefits of using Parcl v2 for synthetic asset trading include solvency, zero credit risk, capital efficiency, and price execution at oracle prices. Additionally, Parcl v2 ensures solvency and zero credit risk for users through its unique liquidity token accounting model. This model accounts for pool ownership and position PnL accounting, and all closed positions are paid out in liquidity tokens. This means that all traders become implicit LPs at position open and become explicit LPs at position close. This mechanism forces solvency because traders are not paid out dollar for dollar in collateral.

Parcl v2 protocol also minimizes governance as much as possible, mainly because there are fewer risk parameters than other competitors. Pool management can be configured to be permissionless and liquidity provision is always permissionless.

Limitations

Parcl v2 at the moment only supports price feeds for assets that cannot support liquid trading markets. Future development on slippage among other protocol features would allow the protocol to be used for any price feed.

For governance, there are some areas where non-permissionless configuration is involved. For instance, when pool creation is not set to permissionless, then only the protocol admin can create a new pool.

Diving into the platform

The Parcl DApp is built on Parcl v2 protocol and open to public access here. I will attempt to go through the features of Parcl DApp in this section.

Solana Wallets

One does not need to connect a Solana wallet to view around the DApp, in particular Explore & Trade views. Only when you want to start investing that you need to connect your Solana wallet to Parcl DApp.

Currently, Parcl DApp supports Backpack, Phantom, Solflare, and Ledger.

Explore

This is by default the landing page of the App.

At the time of writing, Parcl provides access to most of the top US real estate markets, including New York, Boston, Philadelphia, San Francisco, Los Angeles, Washington, Chicago, Atlanta, Seattle, Denver, Las Vegas, Miami Beach, and Phoenix.

Users can sort the indexes by Top Gainers/Losers, New Indexes, and geography (East Coast, West Coast, Midwest). “View All” allows users to see all the indexes, not just the top ones.

Each index has been provided with detailed statistics, including Open Interest price, Total Deposits, Market Sentiment (% of Long vs. Short), and Price. There is also a Trade button, which will redirect users to the trading page of that particular index.

Trade

Upon clicking on the “Trade” button for any index, user is navigated to the Trade page for that index. For instance, here’s my view for Atlanta:

I set the time period to 1 year, so the chart is showing Atlanta index movement for the last year. Other options are 7-day, 1-month, 3- month, and 6-month. The floating Trade widget on the right allows users to put their Buy/Long or Short order, which we will come back to later.

As we scroll down, we can view more data about this index:

Parcl DApp provides users with all the relevant data about this index, including key Trading Stats (just like when one buys a REIT stock on stock exchanges) plus Market Sentiment. This Market Sentiment feature is quite interesting because it allows users to read the arguments from both bullish and bearish directions.

Further down, there is a map of the Atlanta metropolitan area, showing all the housing units as well as basic Facts & Stats about this city.

There is a heat map for all the units, which users can filter by categories: Single Family, Townhome, Condos, or Show All. The heat map would change accordingly to the applied filter.

Facts & Stats appear to be standard for the entire city and not affected by the filter. Key stats include Total Population, Median Age, Median Household Income, Total Area, and even 90-day Temperature High/Low (this data item can be important if you’re looking at the livability factor of a city).

At the bottom section, users can also refer to other relevant markets:

This doesn’t appear relevant for geographical reasons, but rather due to the indexes being in the same Top Gainers category.

The “Explore More” button would take us back to the Explore page.

Going back to the floating Trade widget, as users attempt to make a trade, connecting wallet is required:

Other data like Leverage, Entry Funding Rate, Exchange Rate (USDC-USD) and Estimated Fee are also available for review. The Estimated Investment Value is calculated based on these data.

Upon submitting the order (in this case, I’m buying a Long order), users will be prompted to accept the transaction in their wallet and pay some gas fees in SOL (Solana’s native token). After that, the confirmation window looks like this:

Users can go to SolScan to view the on-chain transaction (mine is here), or just Dismiss this window.

The floating widget now looks like this:

Clicking on “Open Position” would allow users to trade again. On the other hand, clicking on the Position under “My Positions” would expand a panel allowing users to close that position:

Liquidity Pools

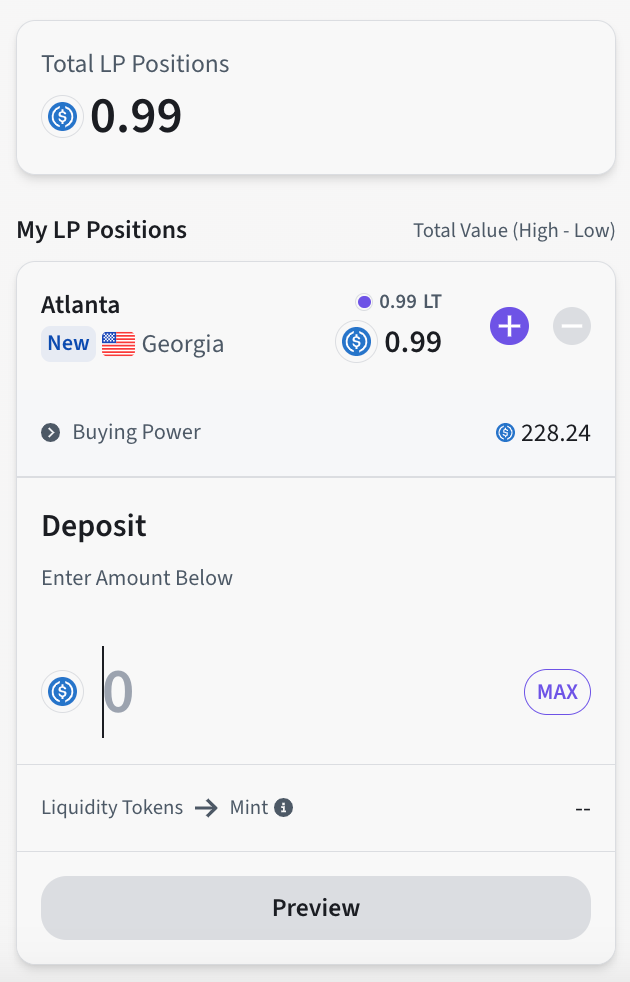

After successfully connecting a Wallet and opening a Position, users can navigate to Liquidity Pools tab in the navigation bar to access the Pool products. For this example, once again I select Atlanta:

After reviewing the order, clicking Submit, and approving the transaction in your Solana wallet, users can see this confirmation widget:

Similarly with the Trade feature above, after clicking Dismiss, users will see the updated view to add/remove Liquidity to/from Pools:

The +/- toggle buttons will allow users to alternate between Deposit/Withdraw their liquidity from Pools.

Portfolio

After opening a Position and adding some LP, let us go to check out the Portfolio page:

On the left side, users can check their total positions for both Long/Short trade and LP. Clicking on the “Total LP Positions” block would take users back to the Liquidity Pools page, whereas doing so on any index’s Long/Short Position block would take users back to the Trade page for that index.

On the right side, users can view their Buying Power, which means the amount of USDC in their connected wallet, as well as their SOL balance (for transactional gas fees).

Other Tools

Wallet Management

Aside from the Portfolio page, users can also access their balances by clicking the Wallet icon on the top right corner of any page:

Upon clicking on the Wallet button, this widget drops down:

Here you can see your Buying Power just as on the Portfolio page. There are also other features, including Transaction Settings (only for Advanced Features users), Copy Wallet Address, Change Wallet, and Disconnect Wallet. Change/Disconnect Wallet should only be used if you need to replace the currently connected wallet with a new wallet or log out of this wallet.

USDC On-ramp

If you want to add more USDC to your Buying Power, Parcl DApp allows you to buy USDC seamlessly from within the DApp, by clicking on the Balance on the right of the Wallet icon. Upon clicking, a window popup would appear:

This feature is powered by MoonPay, a Web3 payment gateway that supports dozens of currencies. Users will need to enter their email address and verify it with a one-time password sent to that email address, then enter personal details such as name, date of birth, residential address, and finally payment details (debit/credit card). After completion, they can buy USDC easily without having to re-enter this information.

Notifications

Should users wish to receive updates on their personal social accounts, they can also register for notifications. Clicking on the Bell icon on the right of the Wallet icon would open a dropdown window. Users would be asked to approve in their wallet before they can access this:

Users can opt to receive notifications to email/phone number/Telegram. Upon completion, users can always come back and manage notification settings. (For Telegram, an extra step of ID verification is required.)

Chat (Beta)

This beta feature is basically an AI assistant powered by ChatGPT, allowing users to query about Parcl products, features, and general market insights. It currently supports multiple languages such as English, Chinese, Indian, etc.

Trading Contests

Users also can access Contests to view and/or participate in trading campaigns in Parcl. One can compete with other Parcl users in order to win prizes, including cash (USDC) prizes, NFTs, badges, etc. One can also check the listed prizes, time period of the contest, rules, weekly stats, and leaderboards. “Maximize Your Potential” however is only available to Advanced users. At the time of writing this article, the Real Estate Royale Season 3 campaign is live:

(bonus) Advanced Features

This set of features applies only to advanced users, meaning that one must possess a sufficient understanding of how leverage trading works in order to opt in.

Users can join the Advanced Features program on Parcl DApp through the Wallet window as shown above. Upon confirming to join, users will be prompted to answer this form:

After clicking “Enable Features”, users can now access the Transaction Settings panel within Wallet window. Here, users can set their Default Leverage for trading. Close & Burn is On by default, meaning that the Long/Short positions will be automatically liquidated once down 75% and beyond.

After saving the changes and going back to the Trade page of any index, users can notice a new feature when opening a position. This leverage rate can be adjusted manually.

Furthermore, users can place simultaneous Long/Short positions, i.e. Long Atlanta, Short San Francisco.

Parcl’s Benefits

Having gone through the theoretical whitepaper of Parcl v2 and the actual Parcl DApp, I can see several benefits that Parcl can bring to both Web2 and Web3.

Benefiting Crypto/Web3 Users

Crypto users, in particular traders, probably are quite familiar with concepts of leverage, Long/Short trading, Liquidity Pools, etc, so the Advanced Features of Parcl would be quite easy for them to understand and use. With both the Basic and Advanced Features, traders can explore a whole new asset class with very minimal initial capital required, for as low as 1 USDC plus a few cents of gas fees in SOL. They can access all these real estate markets and their yields, as well as entire cities via indexes to minimize single-site risk.

Other Advanced Features like Leverage, Pair Trading as well as basic features like Liquidity Pools, Shorting, and Research Data would also allow traders to better prepare and hedge risks from market downturns, hence develop better strategies for changing market conditions to maximize returns on investment.

Benefiting the Mass a.k.a. Web2 Users

For the average retail user, Parcl opens the door to a new alternative when it comes to real estate and, in a broader sense, real-world asset investing. By accessing transparent datasets, RWA risk hedging, and improving liquidity through dynamic Liquidity Pools, retail users can easily tap into the on-chain RWA indexes and pools with very minimal initial costs and a seamlessly usable user interface.

Benefitting Web2⇒Web3 Onboarding

Assumingly, after using Parcl, these retail investors can get a taste of Web3 products and how easy it is to leverage blockchain technology in seemingly traditional investing practices, hence onboarding them into other Web3 RWAs and products. This opens a huge window of opportunity for other DApps to be built on Parcl Protocol with regard to other RWAs beyond just real estate indexes.

Final Thoughts

Having spent the last 24 hours reviewing Parcl Protocol v2 whitepaper and the Parcl DApp itself, I can confidently say that this has been one of the best Web3 consumer DApps I have ever interacted with, in terms of both functionality and user-friendliness. While I have to admit that I can’t fully comprehend the whitepaper, especially the mathematics behind the calculations of Impact Fees and Funding Rates, the DApp itself was straightforward, well-designed, and quite easy to navigate, even for Web2 users. There are certainly areas for improvements, but for a Consumer DApp not only on Solana but on any chain, this by far well exceeded my expectation for Web3 applications. I look forward to continuing to use Parcl for my investing needs and will be looking out for future features from the Parcl team.