It’s been exciting to deep dive into the world of Web3 and understand the real-world use cases that it is powering. After Ethereum which is the largest decentralized blockchain utilizing smart contracts, Solana is the one that everyone is most excited about given its high transaction speeds of 50,000TPS and improved scalability. With over 400 projects running on the platform, Solana is in a good position to give competition to Ethereum. To learn more about Solana you can check out the links here.

After one understands the terms blockchain and crypto briefly, the immediate next concept that you get introduced to is DeFi (Decentralized Finance). This is because decentralized finance applications are the most widely used real word apps on crypto today.

In this article, I will explore Solend which is a DeFi app for lending and borrowing built on the Solana Blockchain. In case you have not yet familiarized yourself with DeFi, check out the first half of this article which explains the core concepts really well.

What makes Solend interesting is that it was prototyped as part of the June 2021 Solana Season Hackathon where they were winners of the DeFi track! Since then, they have come a long way and today are the leading lending platform on Solana. Check out this tweet from Solanians comparing top TVL market leaders on the Solana platform from early Nov

Now before we dive into Solend, let’s understand lending a little more -

How does lending work in the world today?

One can borrow money against a specific collateral from an institution like a bank after going through some kind of verification

The money which is lent is essentially money deposited by someone who is earning some interest and the bank as a middleman is taking a cut

The interest rate is centrally controlled and based on several factors including your credit history, nature of the loan, government regulations etc.

If you default on your loan, the bank puts in checks and processes to ensure you repay the loan

What is Lending like in the world of DeFi?

There is no central institution, the platform can connect anyone who wants to lend and borrow on the blockchain opening up access to all

All transactions are captured on the blockchain through smart contracts, so there is no need for a middleman. All transactions are transparent and permissionless with reduced fees

Interest rates may be fixed or variable but are typically generated through an algorithm as part of the smart contract

You use digital assets as collateral to get crypto currency loans.

Lending in DeFi essentially enables accessible, faster, cheaper avenues of lending & borrowing.

PRODUCT OVERVIEW

What is Solend?

Going by the definition on their website,

“Solend is the autonomous interest rate machine for lending on Solana”

Let’s simplify that - Solend is a lending platform built on top of the Solana blockchain where interest rates are generated algorithmically. Currently, Solend supports the following – Earn Interest (lending), Borrow, Leverage Long & Short

Lending

One can deposit or “supply” any supported asset (currently 11 of them) on the platform. The lender earns interest basis the calculated Supply APY (annual percentage yield – similar to annual percentage rates in traditional lending) and additional Supply Rewards in the form of SLND tokens (native tokens of Solend).

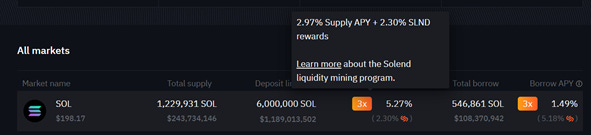

Let’s look at the following example from the Solend dashboard -

As per the current market rate, I can supply the SOL token and earn a total interest of 5.27% which will be split as:

2.97% Supply APY which one will get in the original asset supplied (in this case SOL) and

2.30% in SLND rewards.

Earning these additional rewards in the form of token of the platform is called liquidity mining. These additional SLND rewards help incentivize users to participate in the platform and improve the overall liquidity of the SLND token. We will talk more about this later.

Borrowing

Users can borrow any one of the 11 assets from the platform. Let’s understand a few more terms before we deep dive into borrower economics.

We know that any kind of loan is usually secured by collateral. In this case the collateral is the supplied set of tokens. How much collateral do I need to put up?

This is governed by the Loan-to-value ratio (LTV) of the specific token you are borrowing. LTV ratio defines the maximum amount that can be borrowed with a specific collateral. The LTV will be fixed and mentioned on the platform for each asset. For example, SOL token has an LTV of 75%. So, in simple words that implies that for 1 SOL supplied, I can borrow maximum of 0.75 SOL worth of any token listed.

Now you may be wondering, if I already have 1 SOL then why do I have a need to borrow at all? Well, there could be many reasons to do that –

You can use the token supplied to borrow a stable token like USDC and continue to own the supplied token which may appreciate

You also may want to avoid selling your tokens to avoid tax and hence borrow USDC instead,

You could further use the borrowed tokens to supply more tokens and earn rewards etc. More on this later.

The next concept we need to understand is liquidation threshold. Liquidation threshold is the point at which the loan is now under-collaterized. If the value of the loan goes above this number, your collateral will be liquidated to help ensure you are able to pay back the loan. This threshold is fixed for each token asset and the values are available in the platform documentation.

Liquidity threshold is generally higher than LTV (in the case of SOL, liquidation threshold is 5% higher than LTV). This buffer acts as a safety cushion for the borrowers in case of changes and volatility in the supplied token.

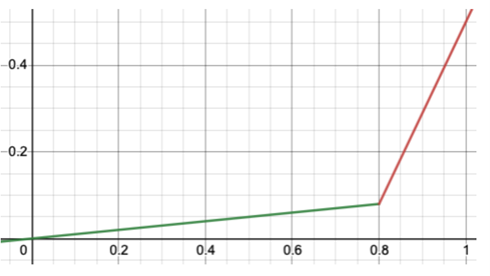

Lastly, let’s understand a little more about the borrowing interest rate charged. This interest rate called the Borrow APY is variable and controlled by an algorithm which produces the following graph:

The x-axis is the utilization rate (total borrowed /total supplied quantity) of an asset and the y-axis is the interest rate.

The borrowing rates increases significantly after a certain utilization threshold limit (80% currently). This is required to ensure that there is enough liquidity in the token pools.

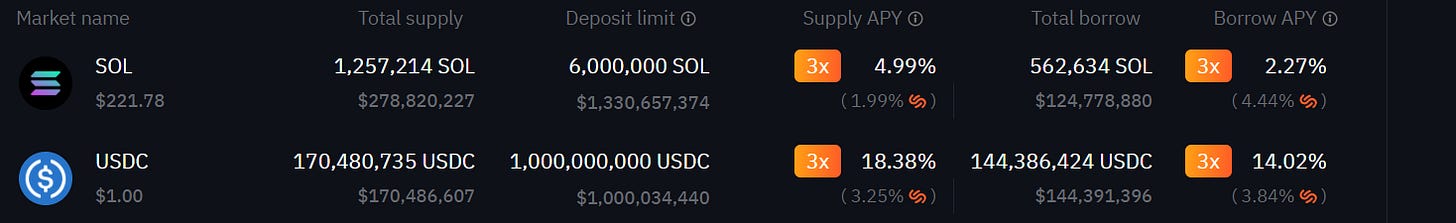

For example in the following screenshot taken from the Solend dashboard, the borrow APY for USDC is much higher than the borrow APY for SOL. This is because the utilization rate for USDC is ~84% (above utilization threshold limit of 80%) while the utilization for SOL is ~45%.

In simple terms, if any token has a high utilization rate (ie. good demand), it will have a higher borrow APY (simple supply-demand economics!).

Borrowing Economics

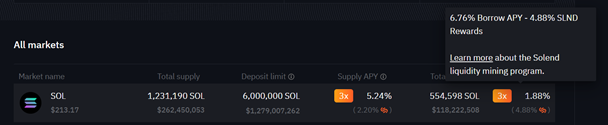

Now that we understand some of these concepts, let’s look at the borrower economics.

As per the screenshot above, you can borrow SOL at a total interest rate of 1.88%. You may be wondering why this rate is much lower than the lending interest rate as this goes against logic (in traditional finance, borrowing rates are always more than lending rates). The reason this mismatch in rates exists is because of the additional SLND rewards which are given to even borrowers as a way to incentivize participation (more on liquidity mining later in the document).

The final interest rate for borrowing is calculated by subtracting interest earned as SLND rewards of 4.88% from the borrow APY of 6.76%.

Borrowing Strategies

Some key borrowing strategies to increase your returns that can be employed in Solend are-

Borrowing for Long Leverage

If you are bullish about an asset, you can borrow funds to buy more of that particular asset, thus increasing your potential returns. This is known as leveraging. In the crypto world the same can be achieved by borrowing.

For example, you hold $1000 SOL and feel that prices are going to go up. You can deposit your SOL in Solend as collateral and borrow say $500 USDC. This $500 USDC can now be traded for another $500 SOL. In this manner, you have increased your exposure to SOL to $1500. This is equivalent to a 1.5x leverage compared to the initial capital of $1000.

Borrowing for Shorting

In traditional finance, you short sell an asset when you feel the price is going down. In the crypto world, you can essentially short an asset by borrowing.

Say you are bearish on SOL and feel the prices will go down. You can now deposit stable coins such as USDC and borrow SOL on Solend. If the SOL price drops, you can buy it back at the cheaper price from the market and repay your debt, essentially profiting from the drop in prices.

Borrowing to avoid Short Term Tax on Selling

Say you own $10,000 ETH which you had bought six months ago for $5000 and you now want to get a piece of the SOL action. Normally, you would want to sell off your ETH to buy SOL. However crypto-to-crypto trades are taxable according to the IRS. This means you will need to pay short term capital gains (as you’ve held the asset for less than a year).

To avoid this, all you need to do is lend your ETH on Solend, and borrow SOL against it. This lending loophole can be used to increase exposure in various assets without paying short term taxes.

TOKENOMICS, GOVERNANCE & IDO

Post its launch in August 2021, Solend also had their IDO in early November. Solend protocol has created a crypto token ($SLND) which is the governance token on the protocol. This is the token that is distributed as rewards to users to encourage deposits and participation in the ecosystem.

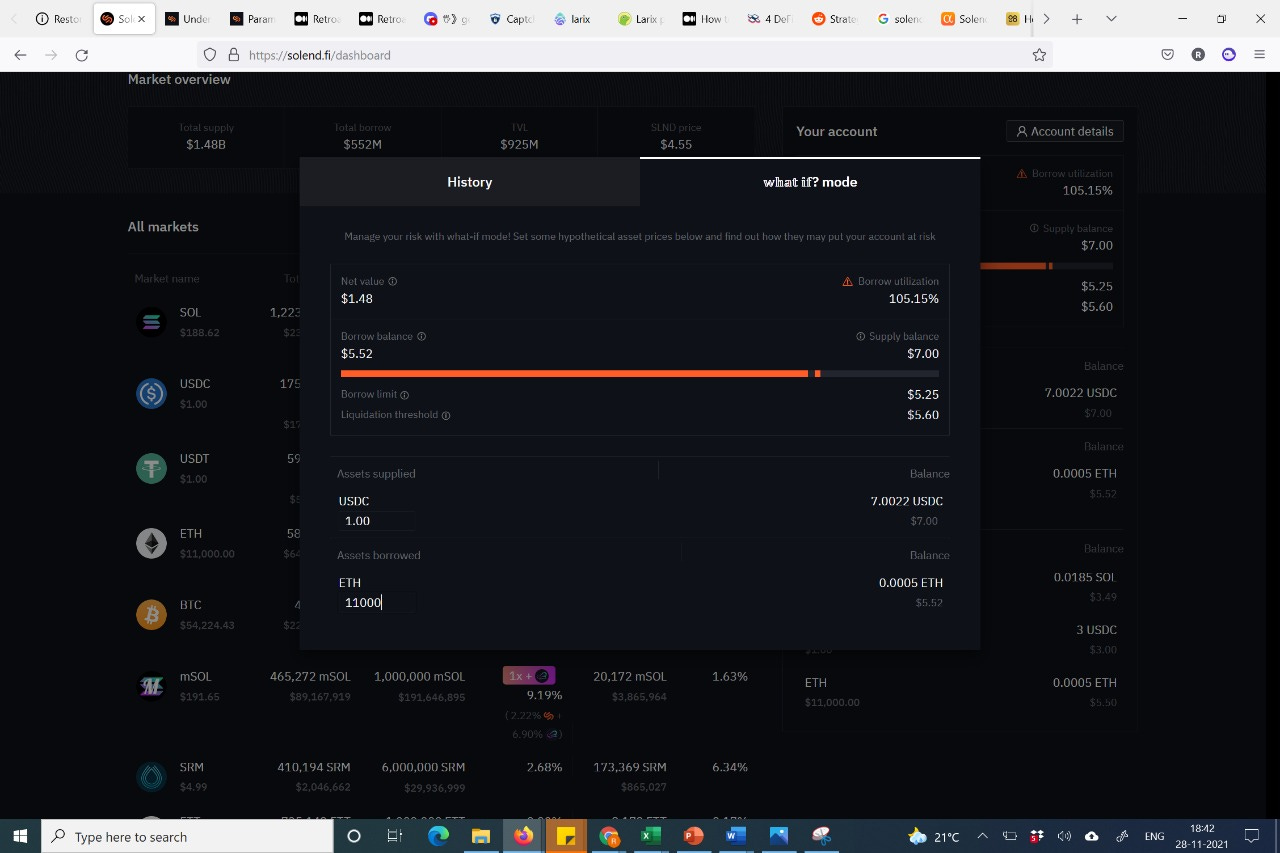

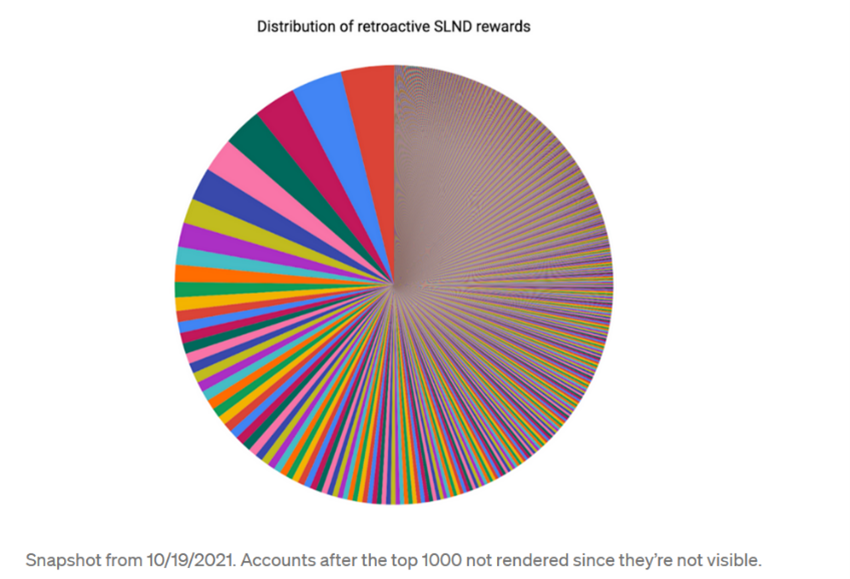

There will be a total of 100M SLND tokens and from a recent Medium article here is a snapshot of the distribution.

60% of 100M is for the community, half of which is allocated for the liquidity mining program (more on that later) and the other half is for the Solend treasury which is owned and will be governed by the Solend DAO. The treasury funds would be used for insurance, grants, user acquisition and anything else that the DAO decides on.

Out of the remaining 40%, 25% of SLND is allocated to the core team, 15% to investors of which only 10% was distributed in seed round and 5% set aside for potential future raise in case it’s needed.

There is a lock up model for the investors & the core team. For the investors, there is a 3-year vesting schedule with the first third vesting on October 1st 2022 and the rest vesting monthly after. The team also has a 3-year vesting schedule with the first third vesting June 1st 2022 or later. They recently posted out their projected circulating supply during the most recent Reddit AMA - Projected Circulating Supply (Estimated) - Google Sheets.

Their IDO had two 24hrs phases and ended on 3rd Nov. 5% of the tokens for the community were distributed as part of this IDO where they were able to raise a total of $26M.

SLND token is currently listed on multiple exchanges includes FTX, Raydium, Orca, Hoo, Aldrin to name a few. The entire list is available here.

Lastly, governance is something they will look to add in early 2022. Governance will allow SLND token holders to participate & vote in platform governance related discussions & plans.

SECURITY & RISK MANAGEMENT

Insurance Fund

The fact that anyone can lend or borrow a diverse set of tokens at any time implies that there are multiple moving parts to the platform. This implies there are multiple points of failure.

One failure or mishap with a rogue or hacked token could have a huge impact on the entire platform and its users given the interest rates are algorithmically calculated basis utilization and deposit rates. This is also the reason why Solend has been careful while listing assets on the platform to ensure they are controlling the risk involved.

No matter how many systems are put in place to manage such risks, it is difficult to mitigate it completely and hence Solend has set aside an insurance fund.

Every time someone borrows on their platform, apart from the interest they must pay a protocol generation fee which has two parts – program fees (50%) and host fees (50%). The program fee contributes to the insurance fund and the host fee which is to incentivize decentralized clients on the blockchain also goes to the insurance fund in case the host is Solend. Since its launch in August, Solend has collected about $2M in protocol fees. More details here - Fees - Solend.

The treasury governed by the DAO will also contribute to the insurance fund. The value of this fund as per a recent update in the Reddit AMA was stated as $26M which is expected to grow with the liquidity mining 2.0 program.

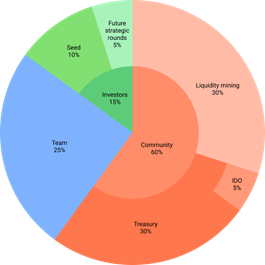

Bug Bounty Program

When you store your money in a bank account or do transactions with any financial institution, you expect them to keep your money safe & execute your transactions securely. Banks typical hire researchers & consultants to help them ensure their systems are hacker proof, secure and run bug free to prevent theft and fraud.

On similar lines, Solend’s Bug bounty program is aimed at allowing community developers to help keep the platform secure and bug free. The Solend smart contract platform is completely open-source and they encourage the community to participate by rewarding developers through their Bug Bounty Program. As the name suggests, it is essentially a program where developers can share any identified vulnerabilities on the platform to earn rewards in returns. The program focuses on identifying bugs for preventing thefts and freezing of funds (UI Bugs are not counted). Rewards are distributed as per the following classifications:

Actual rewards are determined by several factors such as severity, value at risk and likelihood of being exploited. They have also given very detailed description on what categories of vulnerabilities are in scope for the program, keeping the focus on things that could cause potential theft or freezing of funds leading to most disruption for a user of the platform. More details can be found here - Bug Bounty Program - Solend

Audit

Solend was audited by the security firm Kudelski and the report was published end of September. The report can be found here. There were a few identified issues ( 2 high, 2 medium and 1 low severity) that have been resolved or accepted for resolution as per the findings. The report also suggests that the code in production is of very high standards and extremely well documented. There is another audit underway as part of the upcoming roadmap to support more assets & other capabilities.

TOTAL MARKET VALUE

As of Nov 2021, when this article was written, TVL (total value locked) of SLND token is ~620m. This is the highest among all lending platforms on SOLANA (despite a big drop in the price of the token in the last few days).

LIQUIDITY MINING PROGRAM

Now that we have an overview of Solend, let’s double click into Liquidity Mining.

Liquidity mining is the act of rewarding borrowers or lenders with platform tokens to incentivize participation and improve liquidity. Think of it as a network participation strategy to improve overall liquidity. Solend provides SLND tokens as rewards when users borrow or supply on the platform.

Solend currently has a robust liquidity mining program and is planning on further improving it by reducing shortcomings of the existing programs with Liquidity Mining 2.0.

Program Details

Out of the 100Mn SLND tokens, 30% are reserved for mining over 3 years. Currently, mining rewards are split over 5 tokens [SOL, ETH, USDC, USDT & BTC] with weights being assigned to each token. The SOL rewards pool is split on the basis of the weightage. You can read more about the distribution on Solend’s blog on liquidity mining here.

What makes their program exciting -

Liquidity Mining 2.0 which is coming up soon. This has been covered extensively in the future roadmap section below.

One of the highest reward rates available especially when borrowing. For example, borrowing SOL on Solend has a 5-6% SLND rewards vs Larix which has a 0.5-1% LARIX rewards. Obviously, the rate is dynamic and keeps changing, however, the difference in rewards is clearly visible.

Well distributed liquidity mining rewards as a result of user deposit limits and global deposit limits. This ensures that in the spirit of decentralization, no one player corners all the rewards for themselves.

Some considerations -

Rewards are available only for 5 tokens currently. This limits the borrowing & lending volumes for other tokens where competitors provide rewards.

Rewards are claimable only on a monthly basis. This limits liquidity for the users to a certain extent.

Lastly, this new 2.0 program could be more confusing for beginners and potentially new Defi users on the platform.

All in all, Solend has a strong Liquidity Mining Program with a clear future plan mapped out.

SOLEND x MARINADE

One of the great things about Defi apps on blockchain is the integration and partnerships that can be set up quickly to bring value to the users and the network. One such example is what Solend did recently with their SOLEND x MARINADE rewards program.

Marinade Finance is a platform where you can stake your SOL and in exchange receive “Staked SOL” tokens called mSOL. What’s staking? Staking is where you contribute your SOL tokens into a pool in exchange for rewards. The staked pools are used by validators on the network to grow the blockchain (as part of Proof of Stake process)

By staking your SOL tokens, you help secure the Solana blockchain network and earn rewards while doing so. Learning more about staking here.

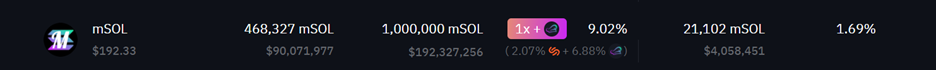

Coming back to the rewards announced as part of the two weeks SOLEND x MARINADE incentive program - Users can supply mSOL on the platform and get additional rewards in the form of $MNDE (Marinade platform tokens) along with the SLND tokens. Once again this is done to improve participation on both platforms and incentive users. You can see the rewards in the app. In the below screenshot we can see that the mSOL supply APY has an additional reward of 6.88% of MNDE along with SLND rewards.

Solend plans to continue doing more such collabs and provide double reward programs to its users.

FUTURE PRODUCT ROADMAP

The SOLEND team posted a detailed roadmap update on Discord on 22nd Nov talking about their three main areas that they are working on. Let’s double click into these -

Liquidity Mining 2.0

Current liquidity mining programs incentivize users to sell off their rewards as soon as they are earned. This results in dumping of tokens which leads to over-supply, falling prices and liquidity issues.

Solend plans to change this by introducing Liquidity Mining 2.0. This program so far is unique to Solend only. In this new program, instead of instant mining rewards, Solend will reward users with SLND call options.

For example, if SLND price is currently $8, instead of getting SLND tokens, users will get a call option for SLND with a strike price of $10, which would expire within a certain time frame, say 3 years. The user can now only make money by exercising the call option when the price of the SLND token is above the strike price ($10 in this example).

Call options help align the user’s incentives with Solend’s objectives. Users now would want to hold SLND call options as long as possible till they get a chance to profit. Users would also now care about Solend’s future prospects (the better Solend performs, the more SLND prices shoot up, the more money they make!)

Moreover, in the previous example, Solend was giving these rewards (i.e SLND tokens) for free. In the new system, users will have to pay the call option value to actually exercise the call option thus helping increase the Solana Treasury Fund (Insurance Fund)

One of the downsides to the new program is that users will have to wait for a much longer time before getting their hands on the SLND reward tokens. In the crypto world, where trading decisions are made in minutes rather than days, instant gratification available on competitor’s platforms may hamper the success of this program.

Upgrade to list more assets

The team is working on an oracle upgrade which is expected to finish soon with audit is underway, scheduled for early Dec (by Kudelski Security Firm). This upgrade will not only let them list more assets for users to lend and borrow.

Isolated Lending Pools

Support for isolated lending pools is also something that the team is actively working on. Currently, it supports only cross-chain pools where users can deposit one asset and borrow another. An isolated lending pool allows for users to lend and borrow a single asset. This essentially will allow Solend to list long-tail assets like SAMO in a secure manner without risking the larger pools by listing these long-tail tokens.

Ambassador Programs and More coming in December

Like any DeFi app, the success of protocol will depend on the kind of participation and network effects it is able to drive while continuing to deliver value to its users. In alignment with this, Solend is going to be launching ambassador and referral programs to improve user acquisition and also list more assets like UST & wETH. (More on wrapped ETH here).

PRODUCT WALKTHROUGH

Now that we understand what one can do on Solend and the concepts, let’s try out how it works on the app – Just open https://solend.fi/dashboard on your browser.

To use Solend you will need a SOL wallet (like phantom etc.) with some tokens to try out the product. SOL tokens are a must as that is used as fees while executing transactions.

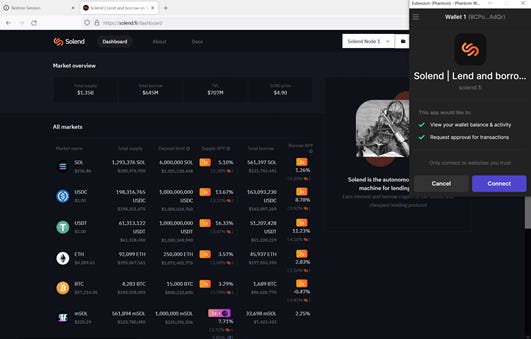

The first step is connecting your wallet, in this case, I used my phantom wallet. Simply connect, authorize the wallet & get started.

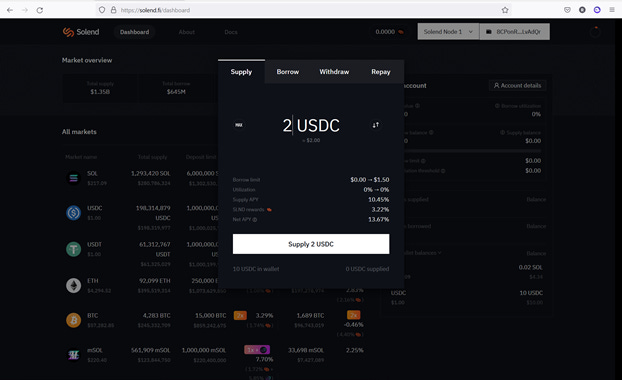

Next, we can start by supplying some tokens. You can do this to start earning interest and supply collateral in case you want to borrow more tokens. Just click on the token you want to deposit from the list, I selected USDC in this case. The UI is simple and intuitive. There are four tabs associated with each token to supply, borrow, withdraw, or repay.

As I enter the amount I want to supply, I can easily view my borrow limit, Supply APY and my SLND rewards as shown below.

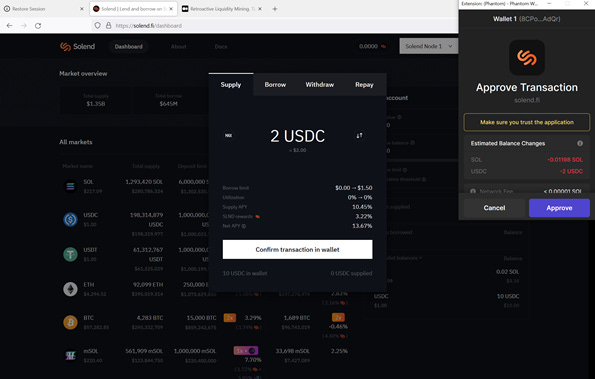

Notice on the top right that along with 2 USDC being deducted from the wallet, an additional ~0.012 SOL is also being deducted. This is a sum of the loan rent fee (one time only fee when you start on Solend of ~0.01 SOL), protocol origination fee which is charged as 0.1% of loan value in case of USDC and the transaction fee which is usually very cheap (currently 0.000005 SOL). More details on fees here.

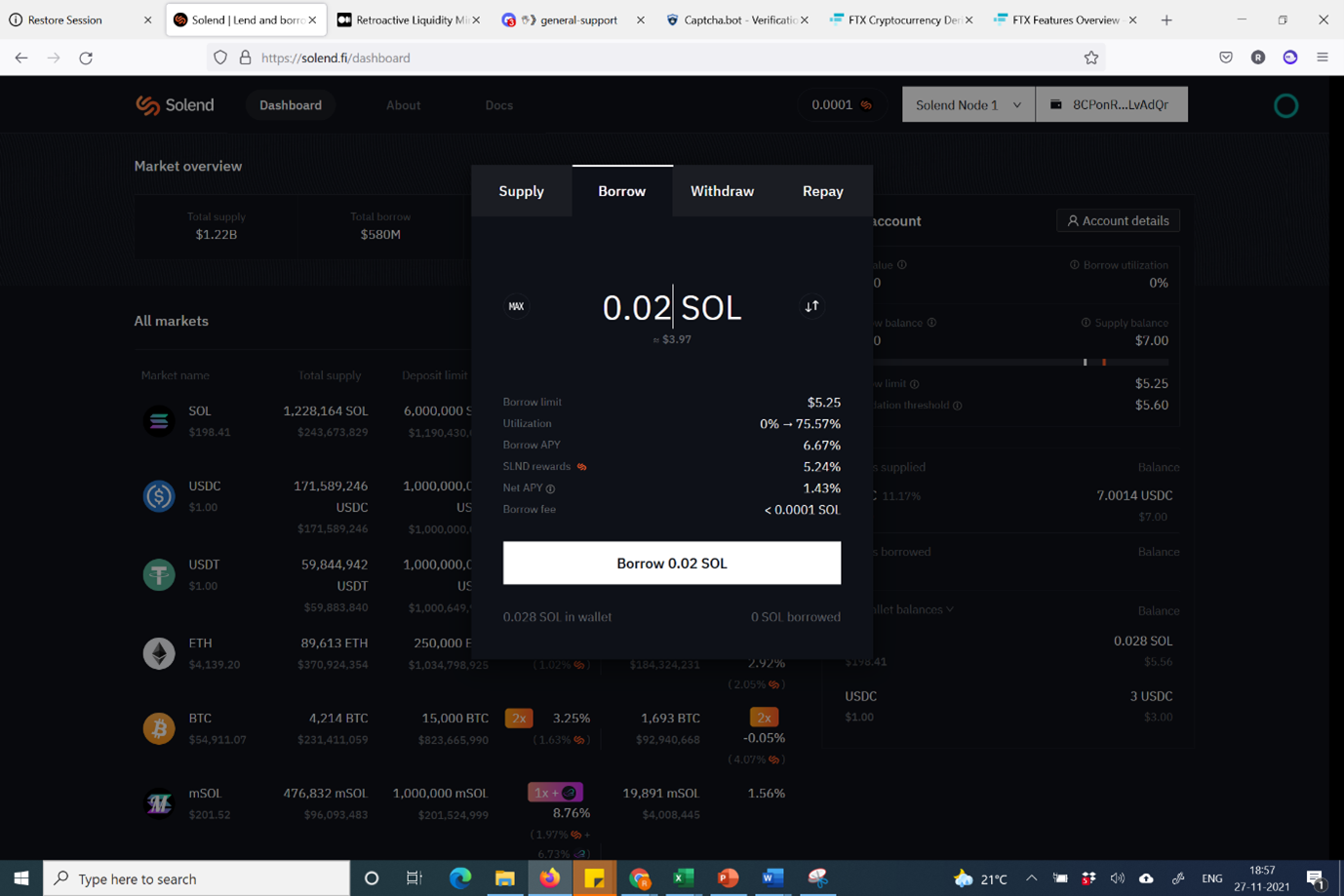

Now let’s try to borrow some SOL for example. Click on the borrow tab and enter the value. Once again, the borrowing limit, borrow APY and fee are clearly called out which make it easy to figure out how much you can borrow, and the interest associated. Everything is also converted to USD value for easy reference.

One call out, while I was trying this out, I did not realize I had to maintain a minimum of 0.02 SOL balance to carry out the transaction. In case you don’t have 0.02 SOL, you will not be able to proceed with the transaction and see an error like below –

After quickly verifying with their community team on Discord, got to know that this is not charged every time but is a minimum SOL balance required to be held in account to execute on a transaction. Would be good to have them document this somewhere as initially I thought every transaction would cost 0.02 SOL which did not make sense.

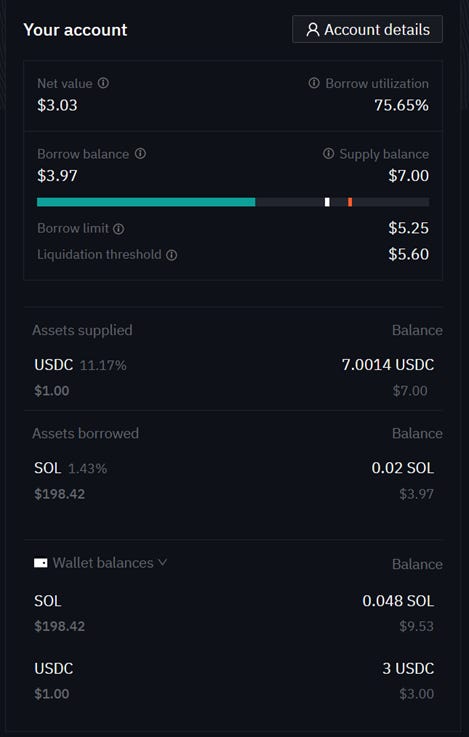

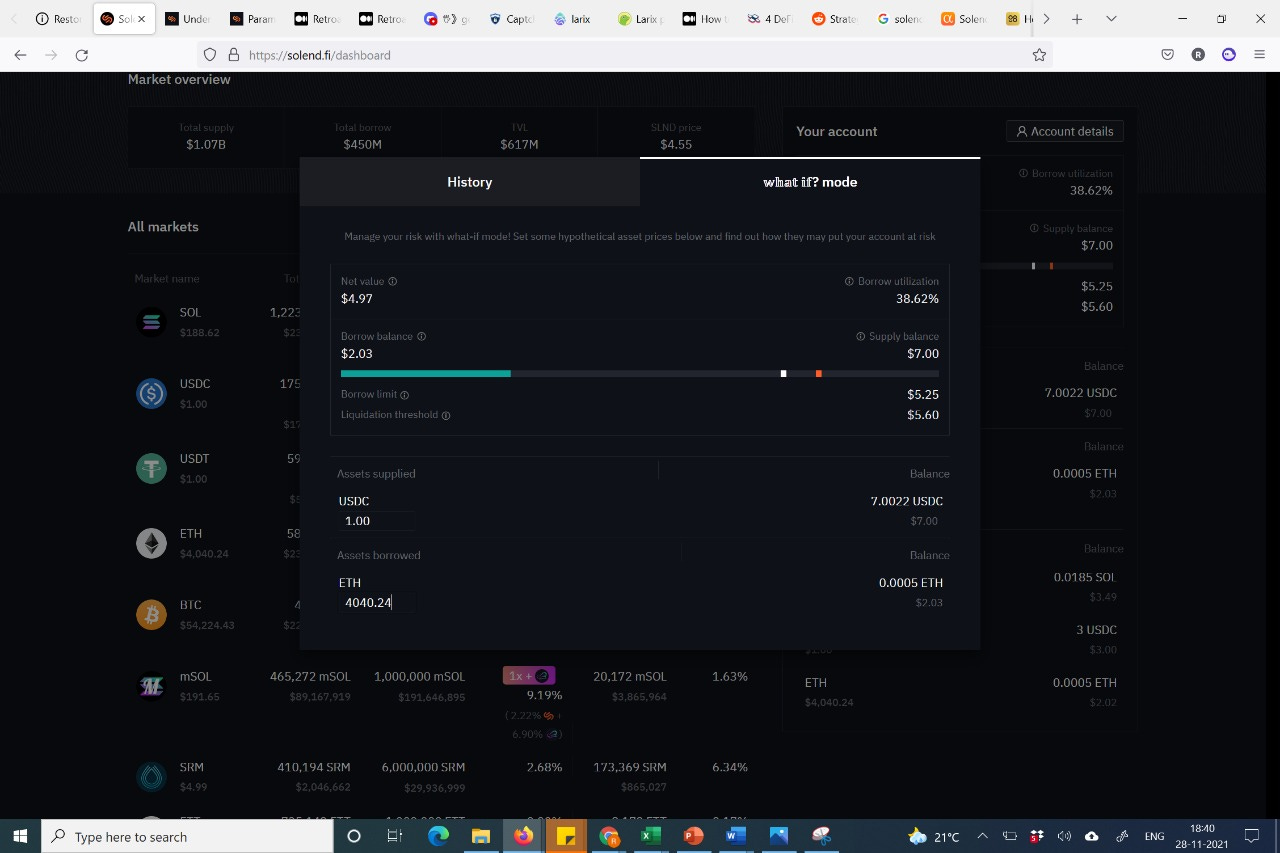

Let’s now look at the account section on the dashboard. For somebody just getting started, this view is intuitive to understand and the information can be used to avoid unexpected liquidations. I did do a few more transactions and here is what the account balance looks like –

So let’s go from top to bottom. We first have the Summary Section. Here my net value is the difference between my supplies & borrows. The borrow utilization is essentially what % of my borrow limit is currently used. When this number hits 100% it implies that I cannot borrow anymore and that my collaterals may get liquidated.

Next, I can see the Supply Balance which is the total value of my deposits so far. The full bar underneath essentially represents this total. The Borrow Balance is the total value borrowed. The green bar represents this. This bar turns red when you go past the Borrow Limit which is the maximum value of the assets you can borrow. This is represented by the white mark on the bar. Like we had discussed earlier, this borrowing limit is calculated based on the deposit and their LTVs. In this case, I have a supply total of ~7 USDC and the LTV of USDC is 75%. Hence my borrow limit is 5.25$ (75% of 7 USDC).

The liquidating threshold which is 5% more than the LTV is represented on the bar with a red mark. This is the point at which your assets will start getting liquidated, so it is important to keep your borrow balance lower than this as much as possible. My liquidating threshold is $5.6 (80% of 7 USDC Supplied).

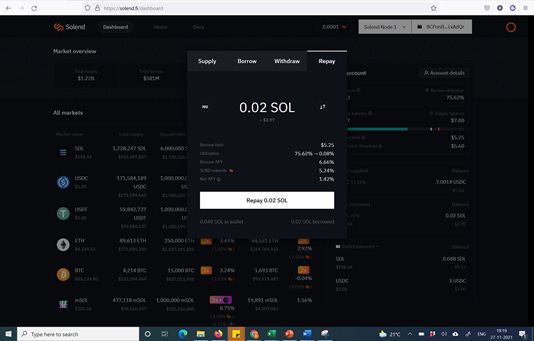

Lastly, let’s look at the repay and rewards claiming experience. Repaying is also simple, you click on the token and hit the repay tab.

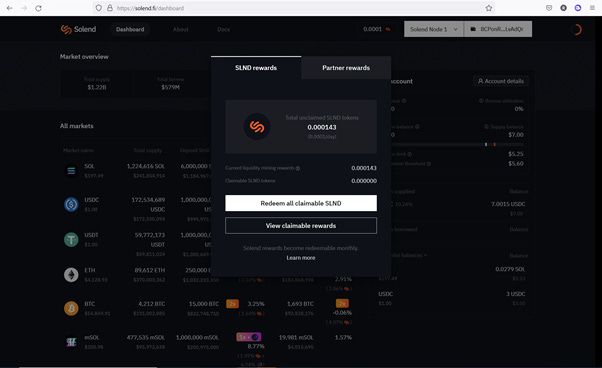

On the top right corner, you see the unclaimed rewards that you have earned so far and when you click on it you can redeem these tokens. As mentioned earlier, Solend allows for monthly redeeming only of the rewards keeping in mind its Liquidity mining 2.0 vision.

What if Mode - Don’t miss out on this cool feature!

What if mode allows users to enter hypothetical asset prices to find out the kind of risk associated with their account balance. To view the ‘What If mode’ click on Account Details tab on the top right. It will open a pop up like the one below where you can now set prices to your supplied or borrowed assets to see its effect on the borrow limits.

In the screenshot below, I changed the ETH asset price from 4040 to 11000 which shows that at this value I have crossed my liquidation threshold.

Last thing to note that Solend currently only supports up to 6 positions per user. Each asset you borrow or supply is essentially counted as one position. They do plan to expand this in the future.

Overall the entire experience of using the app was very smooth. Simple – Connect wallet, have some minimum SOL to support your transactions and get started! As you transact, keep an eye out on the account section to make sure you are not in the range of getting liquidated.

COMMUNITY & BACKERS

Solend community is growing strong with over 11k members on their Discord server. The community managers are very responsive and helpful. They recently also hosted an AMA on reddit which gave a great insight into their future plans and strategy for the platform.

Once you start using Solend, you can use their discord channel to ask any queries or raise support tickets if needed and get assistance.

Solend is also backed by several prominent investors and venture funds in the crypto space. This not only includes the likes of Solana Foundation and Coinbase Venture but also the Co-Founder of AAVE (Leading lending protocol on ETH) who has invested in the platform. The list of backers is just too good to ignore. Details here.

CONCLUSION

One thing that evidently stands out about Solend is their focus on security and risk management. They have been extra cautious with listing new assets on platform and have an extensive bug bounty program along with their insurance fund. The core team is active on all communities and their priorities are thought through with security being #1 along with ease of use.

With its impressive list of backers, Solend has come a long way since June and is now leading the pack of lending protocols on Solana. The upcoming liquidity mining program with call options and overall strategy of limited token supply will also be interesting to see. Exciting times are ahead for Solend as they look to create differentiated long term value for users of the platform. Will definitely be watching and participating closely!