Deep Dive: Taki - where tokenization meets social identities!

A complete deep dive into Taki, a revolutionary social protocol and it's impact on Web3.

Gm! We all use social media everyday and there’s no doubt about that. In fact it has become an important part in our lives. We spend a lot of time consuming content, support our favourite creators etc. So what do we get in return? Nothing! 😒

Source: Datareportal

The Problem 🦠

Since the start of the modern Internet era from the late 90s to the early 2000s with the dot-come bubble at it’s peak, the concept of social media took off. The evolution of social media is directly linked to the evolution of web and the internet itself, people didn’t care about how many connections or people you knew, there was no such thing as followers and likes, all they wanted was to communicate with other people in any part of the world instantly. This was initiated and forged by the early stage companies like Facebook, YouTube, Google etc and is being shaped by these handful of giants ever since.

It’s pretty obvious that they made the rules and people started adopting them and now they control majority of the internet. These companies would always want to profit off of their services and so they designed the rules that would fill up their pockets.

One of the major source of revenue of these companies is by selling user data and getting ad revenue! In fact we get exploited for our data! Whatever sites we visit our data gets tracked and we get targeted ads. Major fraction of the social media users are the people who just want to spend time consuming content and buying stuff online. There are no financial incentives of using social media just for entertainment, we basically get rekt of our personal data, money and time in a sweet way! This has to change and luckily we have Web3 and the concept of tokenization and ownership to save us from that.

The birth of the concept of identities. 👤

The internet as we see today didn’t have a native concept of identities built in. This was due to the fact that the early internet or what we call “Web1” was just used to pass on or display information, the web pages were static. Then came Web2 with the birth of social media platforms like MySpace, Facebook, Google etc. The websites became more interactive and “alive”. People started creating content and the era of memes started. Streaming content became cheap and accessible and the concept of influencers and creators started to sprout. These influencers and creators started recognizing their own identities and presence. They basically started to create a presence or a “brand” of themselves, which is nothing but their identities.

The domino effect begins…

Eventually the importance of these identities started taking off, people started monetizing and gating access to their content, incentivizing the time they spend to create content. This created several effects:

The platforms which host their content started bagging in profits through imposing high revenue charges on the creators’ hard earned money.

Targeted ads and selling user data (eg. cookies) to third party companies became a new source of revenue for these companies. As creators became popular, the platform started attaching ads to their content as an attack vector for their increasing engagement activity which led to more and more advertising….you get it…who hasn’t seen those annoying unskippable YouTube ads!

Users who generally like free stuff…now have to pay to watch their favourite content, which is okay to some extent until they started reducing the quality of content and focused more on paid partnerships and ads. The quality of content gets diluted.

Let me clue you in on how much fees some of the most popular companies charge to host content on their platform.

YouTube charges 45% of all ad revenue generated by a creator.

Twitch takes 50% of the revenue as fees

OnlyFans takes 20%.

The list is long and this is what happens in web2 currently.

The content creator may still earn some money at least but the audience spending their money and time to watch and interact with the content get nothing out of it, which seems unfair, plus there won’t be an organic and a strong relationship between the users and their favourite content creators.

Another thing that happens which is not so obvious normally is that creators who are less popular or they have a few followers they seem like they’re just wasting their time as they would get nothing off of their content.

The Solution 💡

Imagine if we could earn for spending our time on social media, what if we could earn tokens by commenting on a post or reaping profits by betting on your favourite content creator or a normal user with short term engagement? 💰

Let’s look through a creator’s perspective imagine if you’re a creator and people can invest in your digital identity or profile, like investing in a company by buying their shares! 🤑📈

This sounds very lucrative and yes this is possible, thanks to Taki! 🚀

Taki leverages one of the core features of Web3 - Tokenization. Since the genesis of Web3 and the concept of ownership, tokenization has played an important part as a value distribution instrument. With tokenization you can distribute any arbitrary value be it art, authentic certificates, equity, real estate and so many real life use cases with just a click! That wasn’t possible before. The possibility of transferring value across countries without any time delays and less transaction fees and in a permissionless way changes the way we see web and finance today.

One of the major perks of tokenization is that they’re able to make traditionally illiquid assets liquid by fractionalizing them. Taki is basically fractionalizing personal brands or identities ! So without further ado let’s dive deeper into the tokenomics.

The tokenomics 🏦

Taki is an engage-to-earn platform in which users can create posts (videos or images or just text) and/or engage with them to earn money! Well well about time we got something out of spending all the time scrolling on our phones 💸. So let’s breakdown the tokenomics and incentive mechanism of Taki app.

On Taki you can create your own creator coins with a fixed supply, which can be bought by other users depending on your reputation or strength of your profile, which you can build it over time by creating high quality content. Taki app has a native token $TAKI which is the main currency of it’s economy, users buy their favourite content creator’s tokens in exchange for Taki.

Users earn rewards in TAKI by engaging with content by liking, commenting etc. There’s also a provision of rewarding users with Gold TAKI by liking their posts. When a user likes a post, Gold Taki is paid to the creator of the post, the giver here basically pays 2 $TAKI. That $TAKI is then split amongst the person who posted the content as well as all users that hold the poster's User Coin. Specifically, the poster always gets 50% of the Gold Taki, and the remainder is distributed proportionally to everyone who owned the poster's User Coin at the beginning of the day.

The Bonding Curve. 📈

The tokenomics of Taki has incorporated a pricing mechanism which might seem a bit confusing to our readers at first but it’s very simple, trust me! The beauty of math is very subtle and yet so real!

Let’s first understand the concept of continuous tokens….

Continuous tokens are the kinds of tokens which do not have a capped or limited supply, can be purchased at any time and it’s prices are continuously calculated by an underlying algorithm usually bonding curves which I’ll explain in a bit…

Few properties of continuous tokens are:

Uncapped supply

Deterministic price calculation i.e. the prices increase and decrease with the supply of tokens increasing or decreasing respectively. This is unlikely to the usual supply-demand dynamic.

Continuous price i.e. the price of the token keeps increasing as each token is bought…the price of token n - 1 < n < n +1 where n is the token index.

Immediate liquidity, the user can buy or sell tokens at any time.

A bonding curve describes the relationship between the price and supply of an asset. It is a mathematical concept modelling the idea that the price of an asset (with a limited quantity) increases slightly for subsequent buyers with each purchase. - The Graph Academy article

Basically the bonding curve says that the price per token of an asset increases with increase in supply implying that the early investors get rewarded for betting on a token earlier than when the token gets mainstream adoption. The increase in price can be reasoned to the fact that the freely available supply is reduced with every token that is acquired.

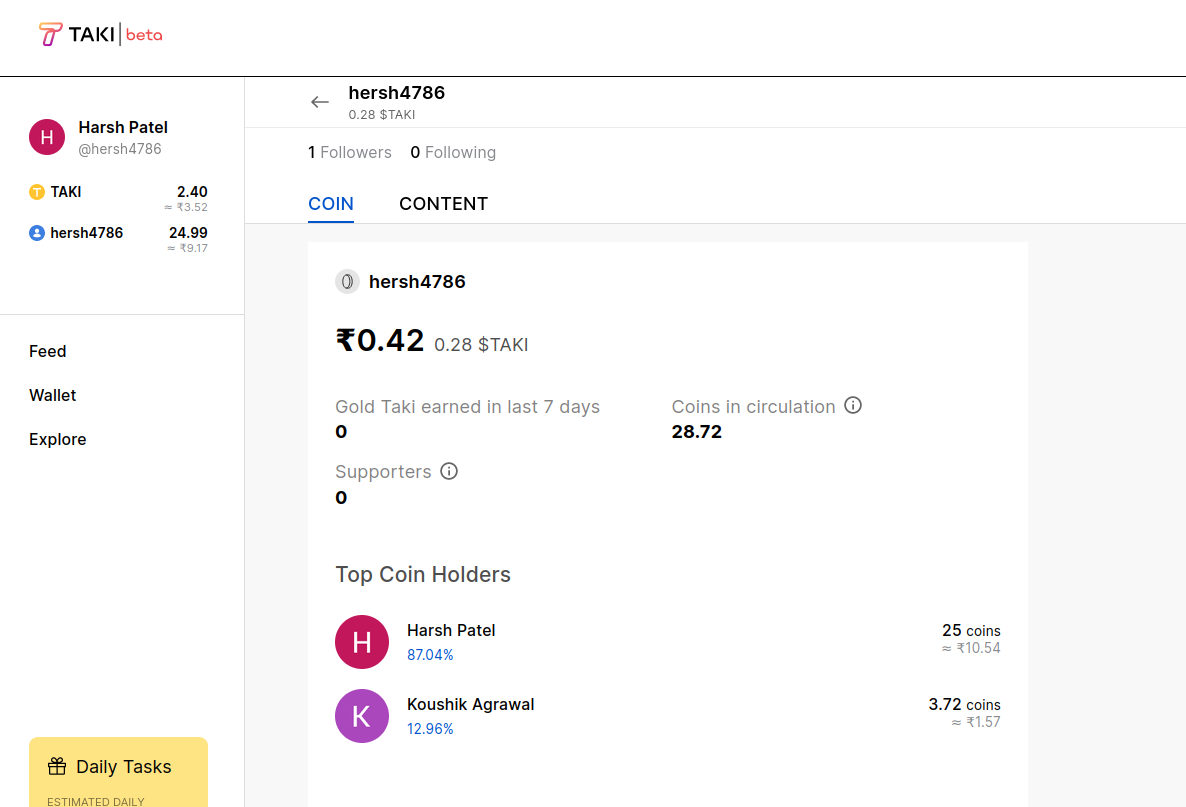

This is what Taki leverages for it’s user coins’ price discovery, User coins are on a bonding curve and each user has his/her separate bonding curve and as people buy a certain user’s coin, the per token price of that coin increases. The bonding curve is basically an Automated Market Maker for User coins. Note that people can buy or sell user coins inside of the app.

“Buying up” a bonding curve means that you mint new tokens, which increases the token supply. This subsequently leads to an increase in price. The same holds true when you “sell down” a bonding curve. When selling tokens, you are burning tokens, which reduces the token supply and decreases the price subsequently - The Graph Academy article

Reward system 💶

An inbuilt reward system is enforced where in the rewards a user may earn depends on their contribution levels, which is provided in the table below:

So how to earn more?

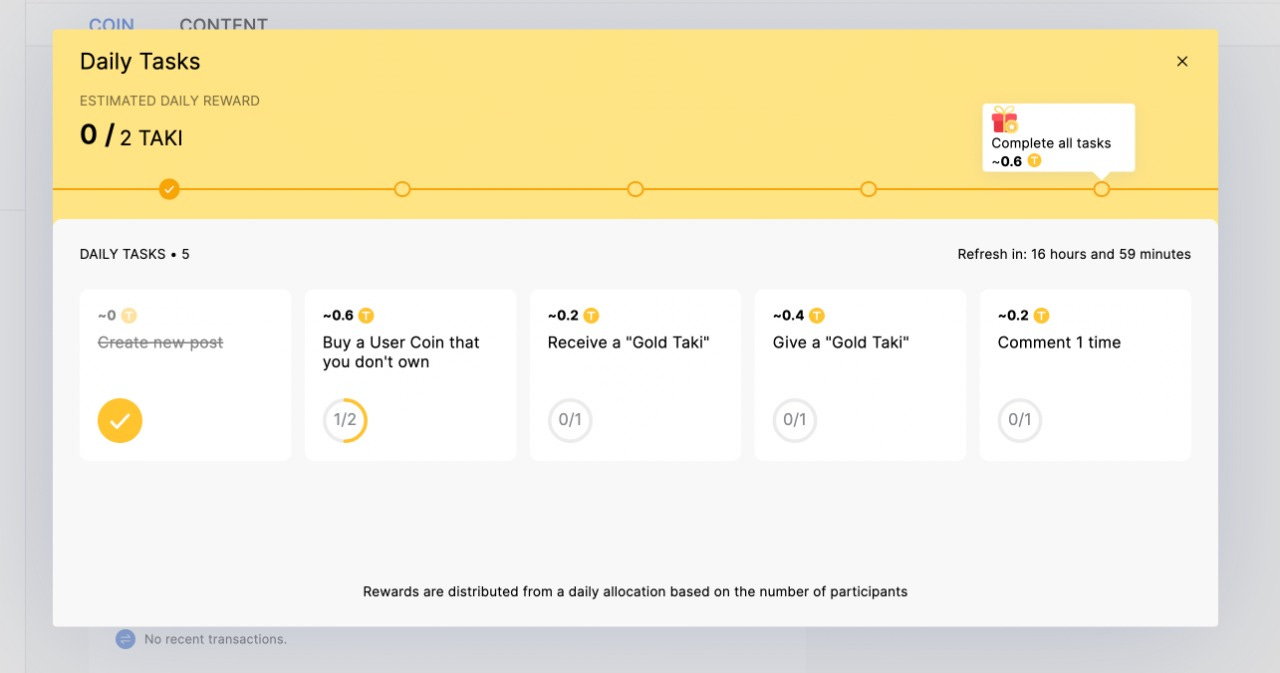

There are several daily activities that a user can do to start earning to their full potential. These activities are subject to change in the future but these currently (at the time of this writing) are:

Creating posts

Commenting

Buying user coins

Sending Gold taki

Receiving 3 gold taki

Positive contributions to the community

Sharing content from Taki

Another good way to earn is by inviting your friends, by using referral links. Taki rewards users who help in a wider adoption of platform! Currently they reward 1 TAKI for inviting 1 person to the platform, but this may be subject to change.

How does the protocol earn?

The protocol uses transaction fees as their main source of revenue to support it’s operation. There are three categories of fees taken by the protocol, each category has different levels.

The Product 💻

Onboarding: Currently Taki is invite only, you can ask your friends for an invite if they’re already on the platform.

Step-1: Sending an invite. I sent an invite to my friend through discord

Step-2: Registering through the invite and creating an account using your preferred email address.

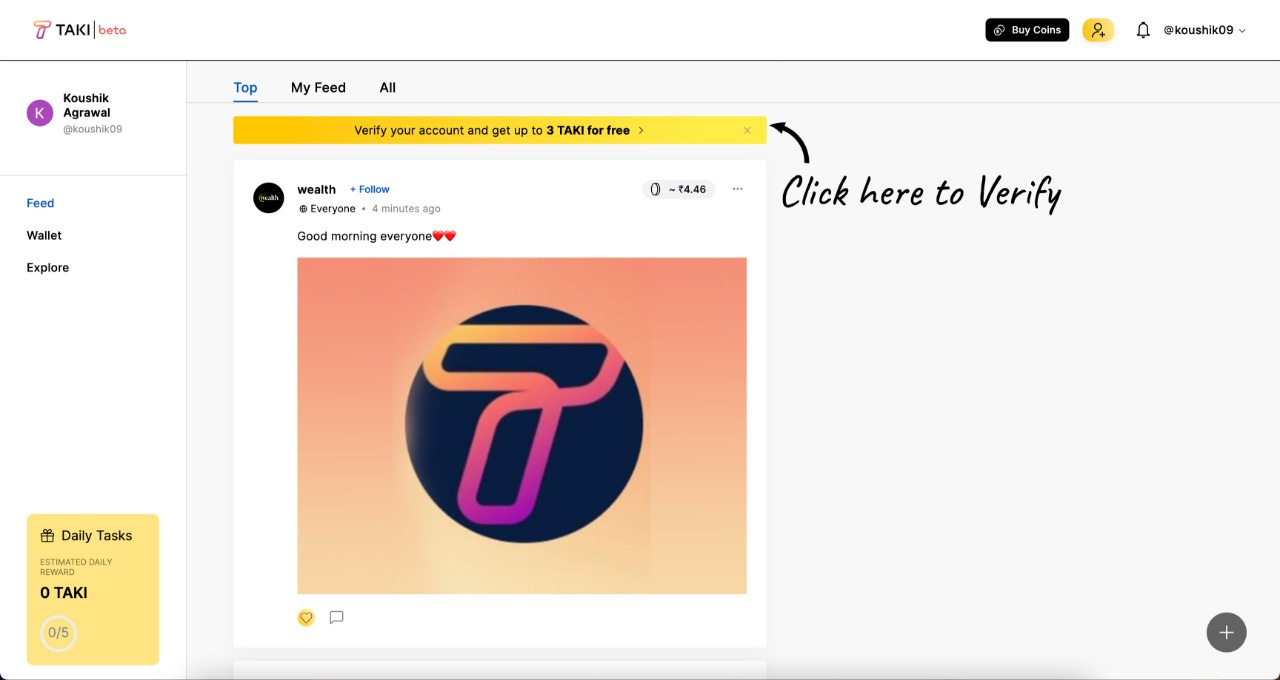

Dashboard view

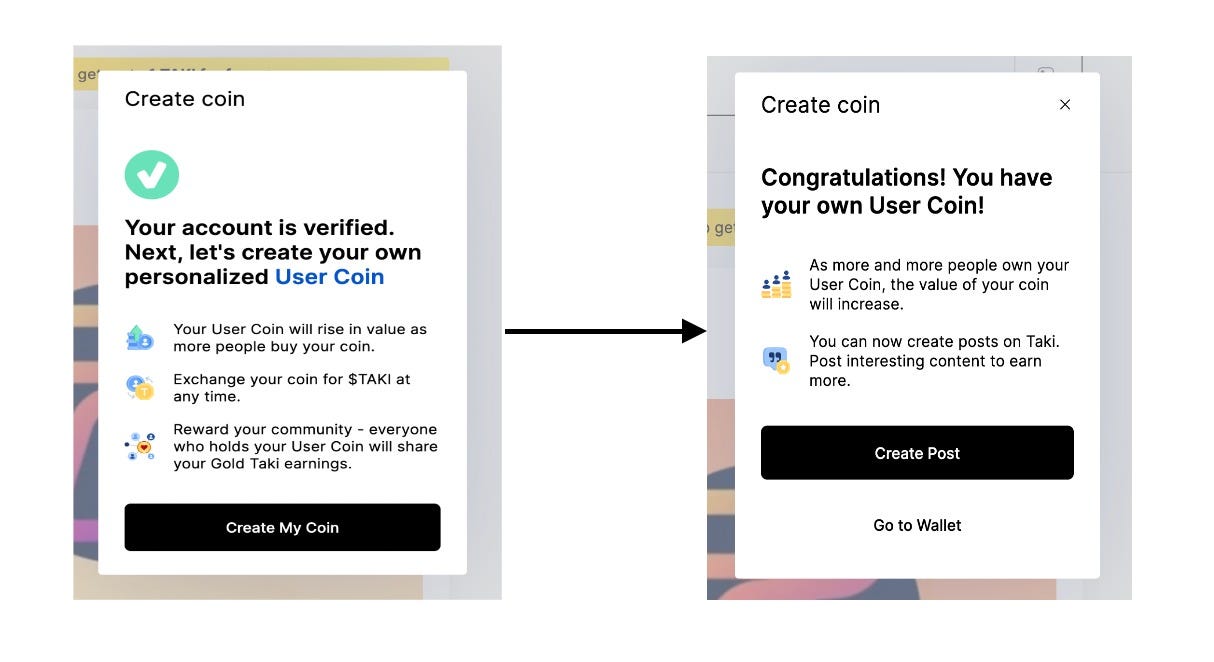

Step-3: Verification of your account, this is a mandatory step and it requires you to provide your contact number for OTP verification. After verification it looks like this.

Clicking on “Create My Coin” creates your coin almost immediately.

Key Features 🔑

Now you’re well set to use Taki, so let’s discuss some of the key features provided within the app.

User coins, as shown above the user coins are created right when we successfully verify and initiate the user coin creation. We can deposit TAKI from our Solana wallet to be used inside the platform.

While creating a post you have two options, to make it accessible for every Taki user or just making it available to your token holders.

Daily activities that can be done to earn TAKI.

Buying user coins: My friend Koushik bought my user coin which increased my total circulating supply from 25 hersh4786 coins to 28.72 coins.

Gold TAKI is nothing but a multiplier that evaluates to 2 TAKI which can be given to any good post that you genuinely like. See that little golden heart in the picture? They’re the Gold taki button, the red heart indicates that you’ve given a Gold TAKI to the creator of the post.

Explore trending coins is nothing but finding popular user coins that you could invest in. Basically like a Coinmarketcap of people!

The rest of the features are like any other social platform like feed, the posts that are being displayed on your screen from the users you follow or would like to follow.

Current status of Taki 🕐

Taki is currently in alpha stage, the UI/UX needs improvement but gotta appreciate how functional the alpha stage product is….with over 120K users and more than 660K people on waitlist. The users are invite-only as discussed earlier in the article.

Taki has crossed over $273 million in total transaction volume and has over $2.9 million TVL at the time of this writing….these are pretty big numbers if you ask us.

Currently if you want to deposit Taki from external sources you’ll have to buy taki on these exchanges and deposit to your solana wallet.

Why are we excited about Taki? 🥳

Engage-to-earn model is very innovative and promising in terms of the active participation of users to support their favourite content creators.

Creators get incentivized based on their content, and no matter how big or small their audience is they still earn which is in contrast with platforms like YouTube.

Incentivizing user engagement acts like a catalyst for new kinds of creator-audience relationship where audience can bet on their favourite content creators early on and get rewarded for taking that bet when their favourite content creator coins go up in prices.

Taki is going to take these User coins on-chain. This means that we can trade user coins on any Solana market and use them in Defi protocols to generate profits! Imagine a creator coin backed loan where the borrower’s identity is directly responsible for repaying the loans, this is really out-of-the-box!

In addition to the above context there could be an AMM dex for each UserCoin/TAKI pair and people could trade them in a decentralized way and easily participate in Defi. Imagine shorting a User coin of a user that you think will fail and being right for your decision, this is nuts!

Taki is bound to tokenize every possible aspect of social media eg. hashtags, posts, profiles etc. This would create a decentralized social graph, which is a path lot of popular protocols are following.

The concept of social tokens can be extended to DAOs where members have their own coins and their contribution to the DAO would basically represent their value and people can bet on that valuable member, buy their tokens and invest in the contributor.

Above point would fit in well with service DAOs like Superteam themselves, where members have their own tokens tied to their contributions. The more valuable a member is…the more other people can buy their tokens and benefit from their value.

Now let’s understand this, if I created my tokens outside of Taki, like just plain spl-tokens and tried to sell them… People would only buy them if I’m a big personality or have a big personal brand value like celebrities selling their NFT collections. With Taki users can bet on rising stars or users who have the potential of becoming a big personal brand or speculate on users who have a short term popularity trend.

Another benefit of going on-chain would be cross-chain value transfer, this although would take a lot of time before it’s sustainable. If we consider the bull case for Taki and the platform has an exponential growth in the coming years, cross-chain user coins would take social tokens to another level!

Conclusion 📩

In the modern internet era we have alot of social media apps at our fingertips, these were made by the most prominent companies in the space and hence they shaped the idea of social media. As time went by they started focusing on ads and filling their pockets through ad revenue, caring less about the users that spend their time on these platforms. The users are the main entities which give a platform their sole value! Not incentivizing them would lead to a gradual decline of the platform. Now with the rise of Web3 protocols and increasing adoption of idealogies like decentralization, ownership, identity through tokenization we can finally give back power to the users. Taki is one such app leading the charge through tokenizing social identities. This will change how we see social media in the coming years.

Web3 offers an opportunity to reinvent social media in the interests of users and creators rather than advertisers. Taki is specializing in the engage-to-earn model, where user engagement and quality content are directly rewarded. User coins deepen creator-audience relationships and create new engagement vectors. With the power of tokenization combined with the concept of identities, Taki will certainly initiate a new trend of social tokens and social micro-economies.

Shoutout to Vajresh ser for helping us clear our doubts and answering our questions!

References

https://thegraph.academy/curators/introduction-to-bonding-curves/

https://yos.io/2018/11/10/bonding-curves/

https://wiki.taki.app/key-concepts/taki-app

https://takiapp.medium.com/introducing-taki-c0441a737b46

https://datareportal.com/reports/digital-2022-global-overview-report