Turbocharging CBDC adoption with public blockchains

CBDC adoption seems to have stalled. Public blockchains can be the solution.

Till about a year ago, CBDCs and Stablecoins were locked in a Batman vs Superman style battle for the title of “Future of Money”. However today, things are a bit different. The markets seem to have anointed a winner, with Stablecoins doing billions in volume, while CBDCs seem destined for limited pilots with restricted usage and much lower value transactions.

However, in spite of the current gloom and doom, the fact remains that:

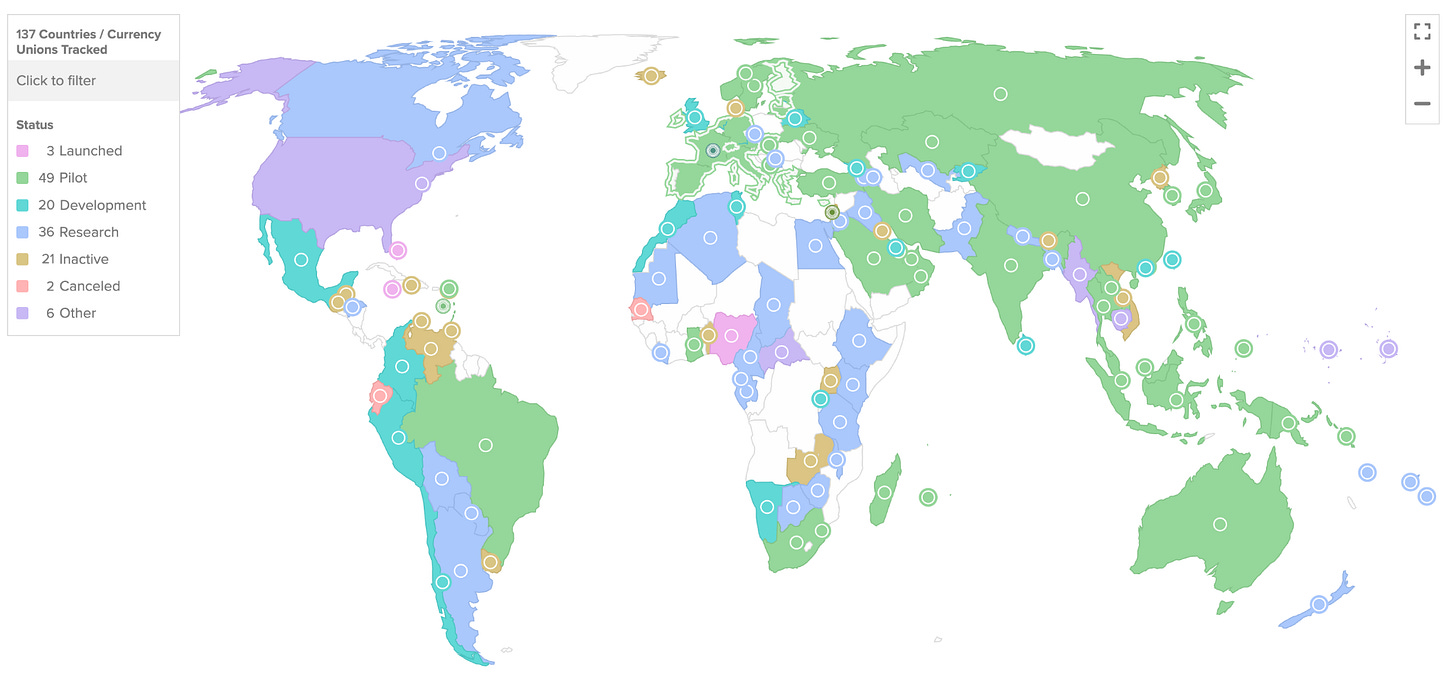

100+ countries accounting for over 90% of global GDP are trialing CBDCs.

BIS, the Central Bank to the Central Banks, is putting its weight behind CBDCs.

Non-US governments are becoming increasingly wary of ‘stealthy dollarisation’ via stablecoins and want to offer their citizens regulated alternatives that provide the same technological benefits.

The stablecoin ecosystem, after doing almost everything right, seems to be falling prey to the fragmentation with the launch of new L1s with limited value.

So it would be unwise to write off CBDCs just yet. In this post we argue that to bring CBDCs back in the game, Central Banks need to make ONE fundamental change and that is to change the distribution model — from current closed loop ecosystems built on proprietary platforms to open-source ecosystems like Solana and Ethereum.

Having worked on CBDC projects with various governments across the world for 7+ years and now having explored the world of public blockchains, I think the answer lies in bringing together the best of both worlds.

Before we dive in, let’s recap the basics of CBDCs. If you are familiar with them, feel free to skip to the next section.

CBDCs are sovereign money

Central Bank Digital Currencies are effectively cryptocurrencies that are issued by Central Banks, mostly on private ledgers, with their backing. They are more similar to cash than bank deposits as they represent a claim on the Central Bank (similar to banknotes in your wallet) as opposed to deposits which represent a claim on your bank (remember kids, if your bank goes kaput, barring a bailout, the max money you can get is the amount ‘insured’ as per your country banking laws - in short, very less).

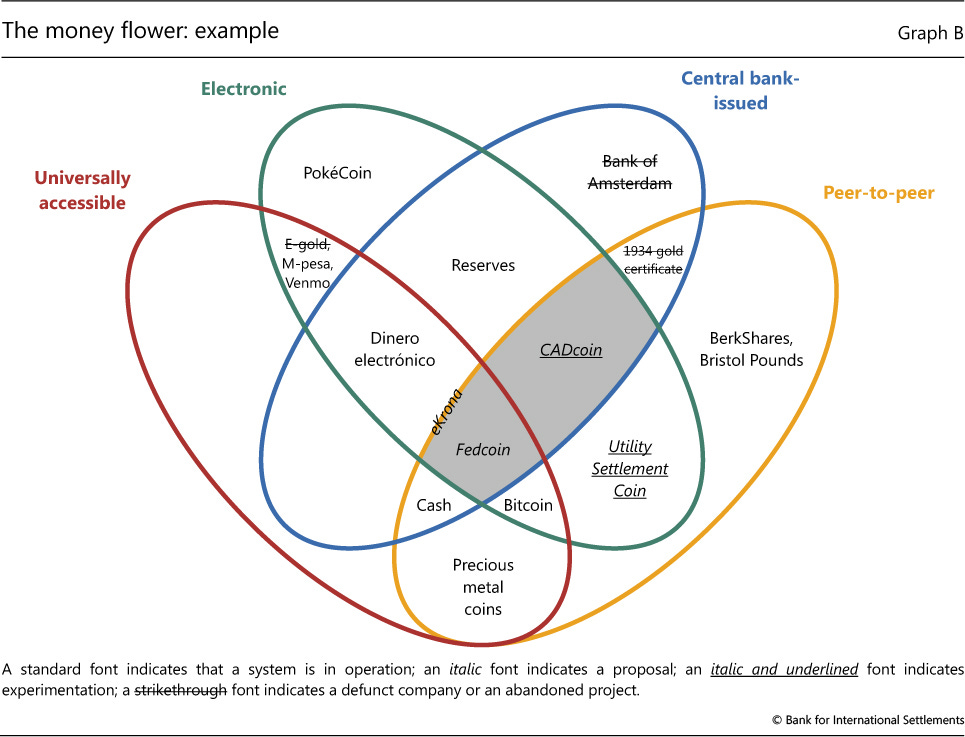

Whereas regulated stablecoins today are privately issued and restricted to being payment instruments backed by short term securities or cash equivalents. Therefore CBDCs can have more far ranging use cases and less risk compared to privately issued stablecoins.

If you want to dive into this rabbit hole further, look at BIS’ wonderfully named “money flower” and read the accompanying paper.

So how do Central Banks get CBDCs into the hands of consumers and businesses? There are two major ways of doing so:

Direct Distribution: in this model, the CBDC is distributed directly by the Central Bank to the consumer’s wallet. Due to the obvious complexity and operational overhead of this model (the Central Bank will need to have a list of all the wallets), it is rarely used.

Hybrid Distribution: Central Bank distributes the tokens to the banks who then send it to consumer’s wallets. Think of this as similar to the ATM model where the Central Bank issues cash to the banks, who load up the ATMs from where we get our money. This is the model preferred by Central Banks. Unfortunately, this model has also failed to provide the necessary boost to CBDCs with the three largest CBDCs in the world, Digital Yuan, eRupee and eNaira stuck at low single digit percentages of total money flows.

However, there is a third approach that can alleviate this problem.

CBDCs are trapped on private ledgers

Today, most CBDCs are issued using the hybrid model and on private blockchains (incl. private forks of public chains like Ethereum). This decision has its roots in Central Banks’ fear of public blockchain and crypto from the 2018-2020 era. They feared that building and issuing CBDCs on public networks will lead to loss of control on issuance and thereby on Monetary Policy and also facilitate the entry of bad actors into the system. There was also an assumption that open crypto networks and protocols were a fad that would eventually die out.

However, history played out differently. Public blockchain networks have gone mainstream with over $1.5Tn in value locked (excl. bitcoin) and many of these public chains transact more than Visa and Mastercard on a daily basis. They have built up a truly decentralised network of validators/ stakers which make the network robust, avoid single points of failure and prevent control by a single actor.

Money, at the end of the day, is a game of network effects. The more places your money is accepted the more it is likely to be adopted - a principle that public chains have understood very well.

In retrospect, this single decision to distribute CBDCs on private networks has played a major role in limiting the uptake and adoption of CBDCs. A new private network, harms adoption in many ways:

It requires all parties (banks, merchants etc) to put up new blockchain infra

It requires consumers, already burdened with multiple payment methods like credit cards, debit cards, faster payments, bank transfers, crypto etc., to set up another app/ wallet. Especially for older and less tech savvy users, this is a significant roadblock to adoption.

An even more complicated problem exists for cross border transactions, arguably one of the strongest use cases for CBDC. We dive into this in a separate section.

The cross border transaction problem

Cross border transactions are one of the strongest use cases of CBDC, especially for emerging economies that are in the long tail remittance corridors. CBDCs have the potential to:

Lower costs by bypassing correspondent banks and SWIFT networks.

Lowering settlement times through instant value transfer and atomic settlement.

With each country building their CBDC on their own platform, there will be hundreds of incompatible networks that will require Bridges and interoperability protocols to transact with each other. Two countries operating on incompatible networks require one custom bridge. For 195 countries that’s 18,915 bespoke integrations (NC2). Each integration/ bridge can take months to operationalize due to the technical complexities and the bureaucracy involved. This will not only add costs and delay roll outs, but also create a far more fragile, error prone and hack prone system.

Instead of trying to set a new standard, relying exclusively on consortiums or private blockchains, CBDCs would be better off on public networks.

With Public Networks, these interoperability concerns are immaterial as the largest public networks have global reach and the global developer community has already taken care of the interoperability concerns. CBDC living on public chains therefore can move across borders seamlessly, only limited by the programmable logic embedded in the tokens.

However, Central Banks are right to argue that the issuance of CBDCs needs to be controlled carefully by them to prevent monetary policy and financial stability risks and they must also be distributed in a compliant manner. Fortunately with the technology and tools available with public chains today, it is possible to create a product that balances the need for control at the issuance layer with wider distribution. In the following section we design a product that balances these two requirements to create a winning CBDC product.

Issuing CBDCs on Private Networks but distribute on Public Chains

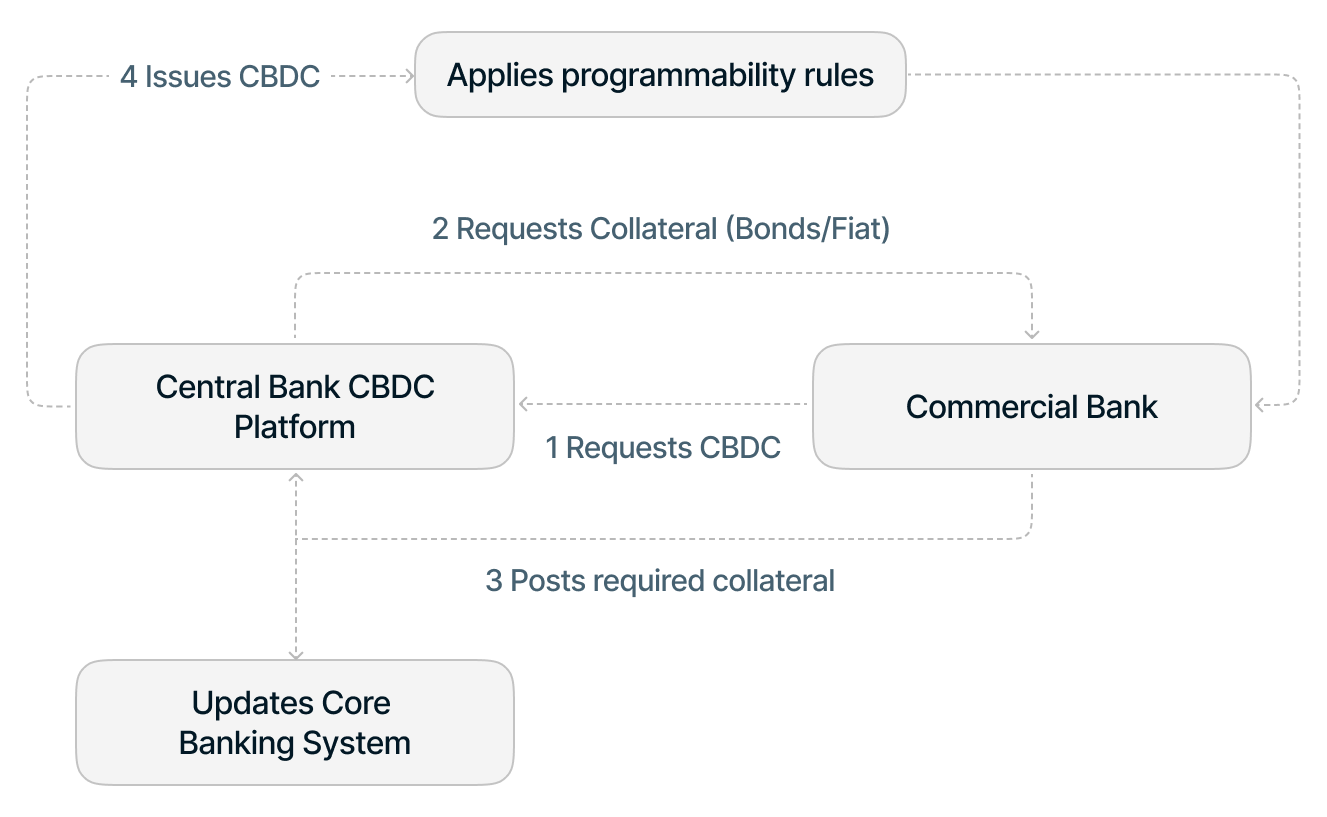

To understand how this works, we need to take a deeper dive into the mechanics of CBDC issuance and distribution. Let’s break it up into steps:

Step 1: CBDC Issuance and redemption in a closed network

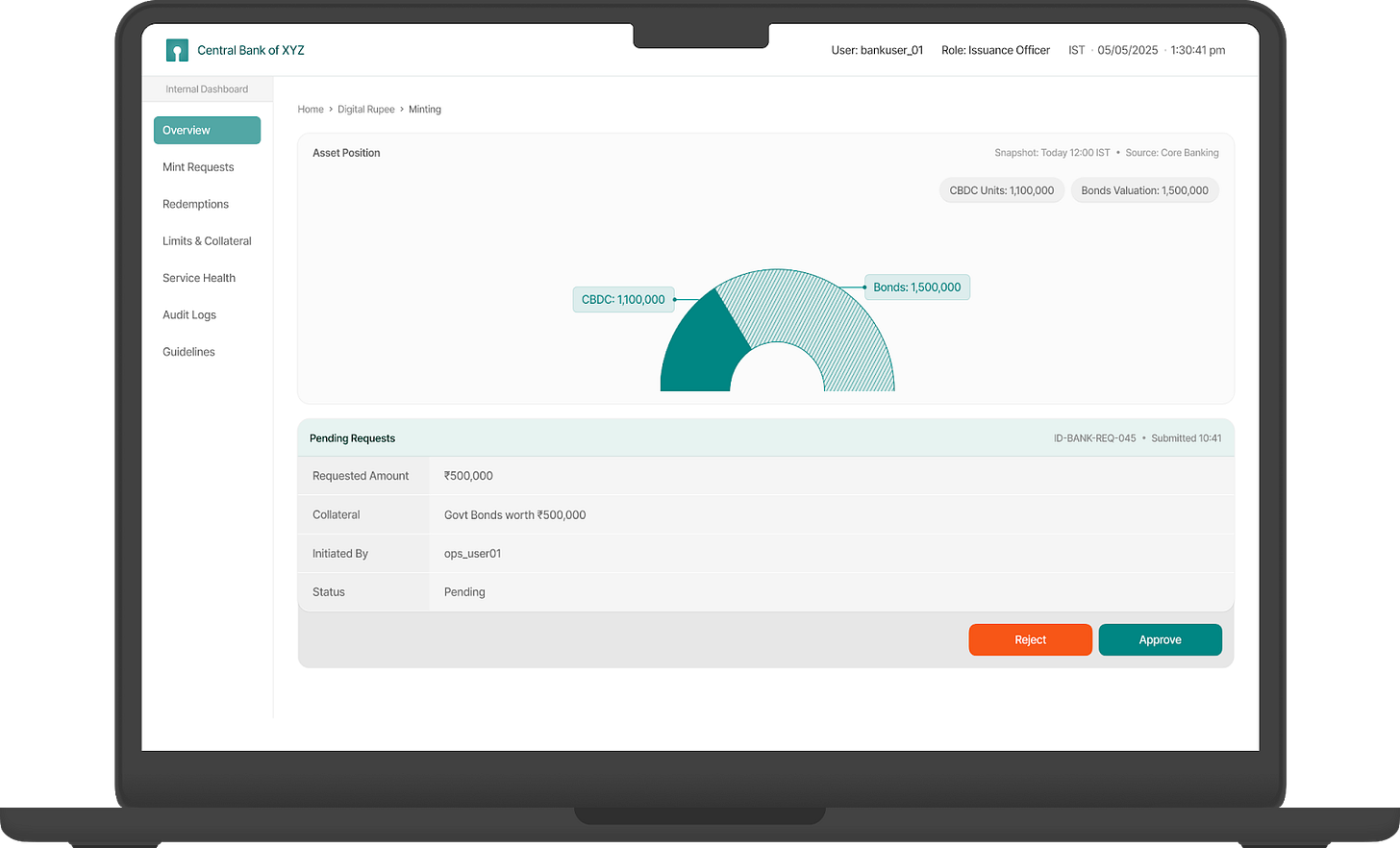

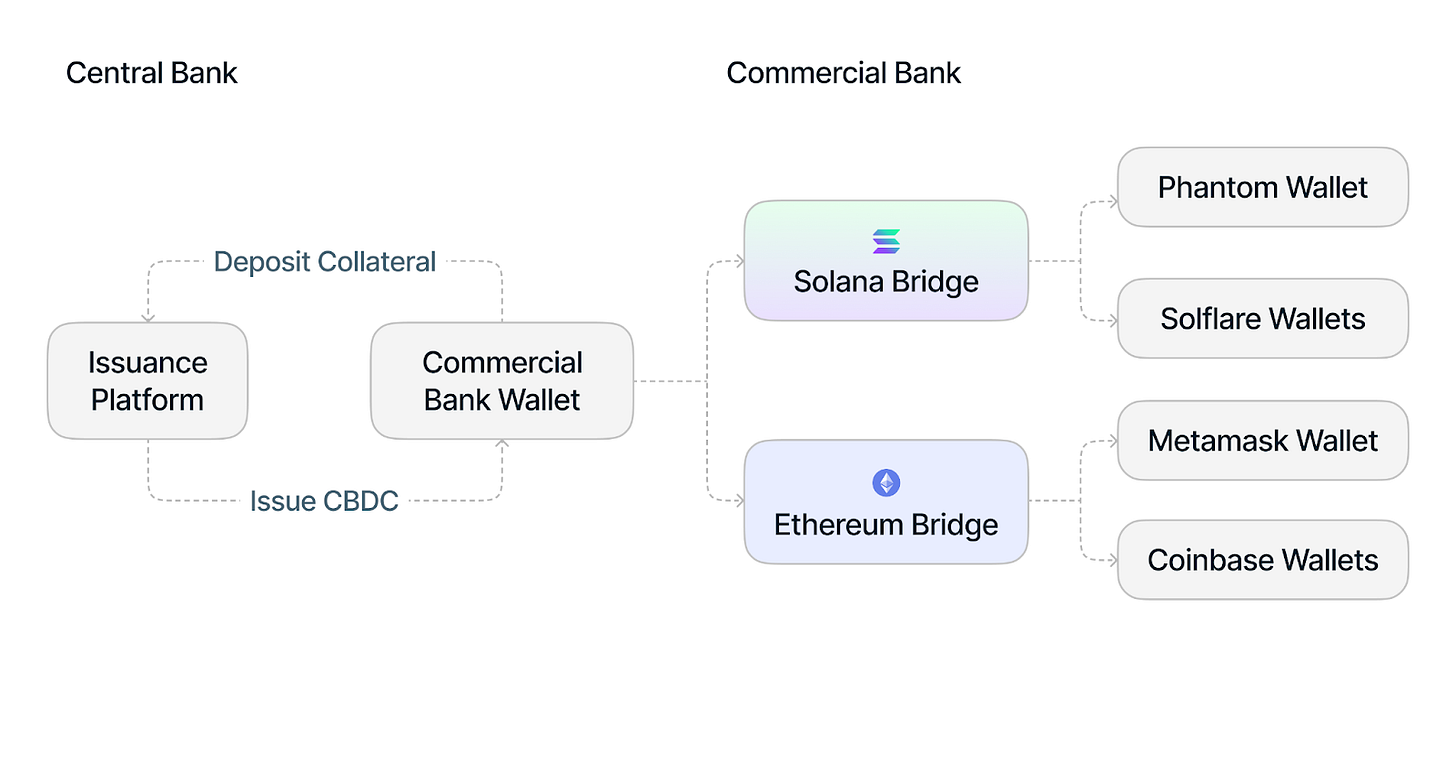

CBDCs are issued by the Central Banks ‘on demand’ when commercial banks deposit bonds with the Central Bank and place a request for CBDC. The Central Bank then mints the tokens and transfers them to the wallet owned by the Bank, to be further distributed to consumers. At the minting stage, various rules may be applied to the token that may influence its behavior (ex: max number of transfers, burn rules etc). This process looks something like this:

The minting happens on the CBDC platform and is recorded on the Core Banking system of the Central Bank which is something traditional like an Oracle Flexcube or Quantum Central Banking System.

While it is tempting to suggest that this process be conducted on a public chain, it is not advisable to modify this system for various reasons:

Issuance is the sole prerogative of the Central Bank and best handled on a single ledger integrated well with their IT systems.

The primary distribution of CBDCs should be limited to a select few regulated financial entities banks who have been vetted by the Central Bank and can deposit the collateral that is required.

Similarly, in the redemption leg of the CBDC lifecycle, where a Commercial Bank asks the Central bank to redeem CBDC for the original collateral (fiat or bond) - it is advisable to do this in a closed network so that the transaction does not have any impact on the monetary policy.

From a security perspective, it creates a ‘airgap’ between the core infrastructure of the Central Bank and distribution infrastructure that is exposed to public networks and may be subject to attacks.

Lastly, Central Banks may wish to ‘burn’ CBDCs for their monetary policy/ financial stability objectives. This should be a controlled activity within this network to avoid adverse impacts on the market.

Step 2: CBDC Distribution via open public network

Currently most Banks distribute CBDCs to their own wallets, which are specialized for CBDCs and have limited reach. Activating each wallet requires multiple steps, from downloading the application to setting up the wallet, managing keys and undertaking KYC/ AML once again. It also puts additional strain on commercial banks' resources, which have to ensure that the new infrastructure is production ready and secure.

There is little incentive & too much of an overhead for banks to distribute CBDCs compared to their vast suite of existing products. On the other hand, public networks have demand for a stable settlement asset and already have:

Wallets that are available with millions of users,

Hundreds of apps serving real customers and generating revenue

Users who have already completed KYC, that can be extended to CBDCs

Battle tested security features

It follows that to ensure that CBDCs reach their true potential, Banks should build bridges or implement interoperability protocols to open Web3 ecosystems and distribute the CBDCs to existing wallets, DeFi apps, payment companies, etc. The modified issuance and distribution process flow can be summarised as below:

Once transferred to this ecosystem, the tokens would look like any Web3 asset and move across that ecosystem seamlessly across the world with the same levels of security and control, which we explore in the next sections.

CBDCs on public networks can open up many new use cases

A CBDC issued by a Central Bank and launched on a public network can enable a large number of use cases:

CBDCs that were earlier locked into a limited ecosystem can now be used for all web3 native applications, driving up usage and demand. Ex: CBDCs can now be used across DePIN applications or DeFi lending protocols.

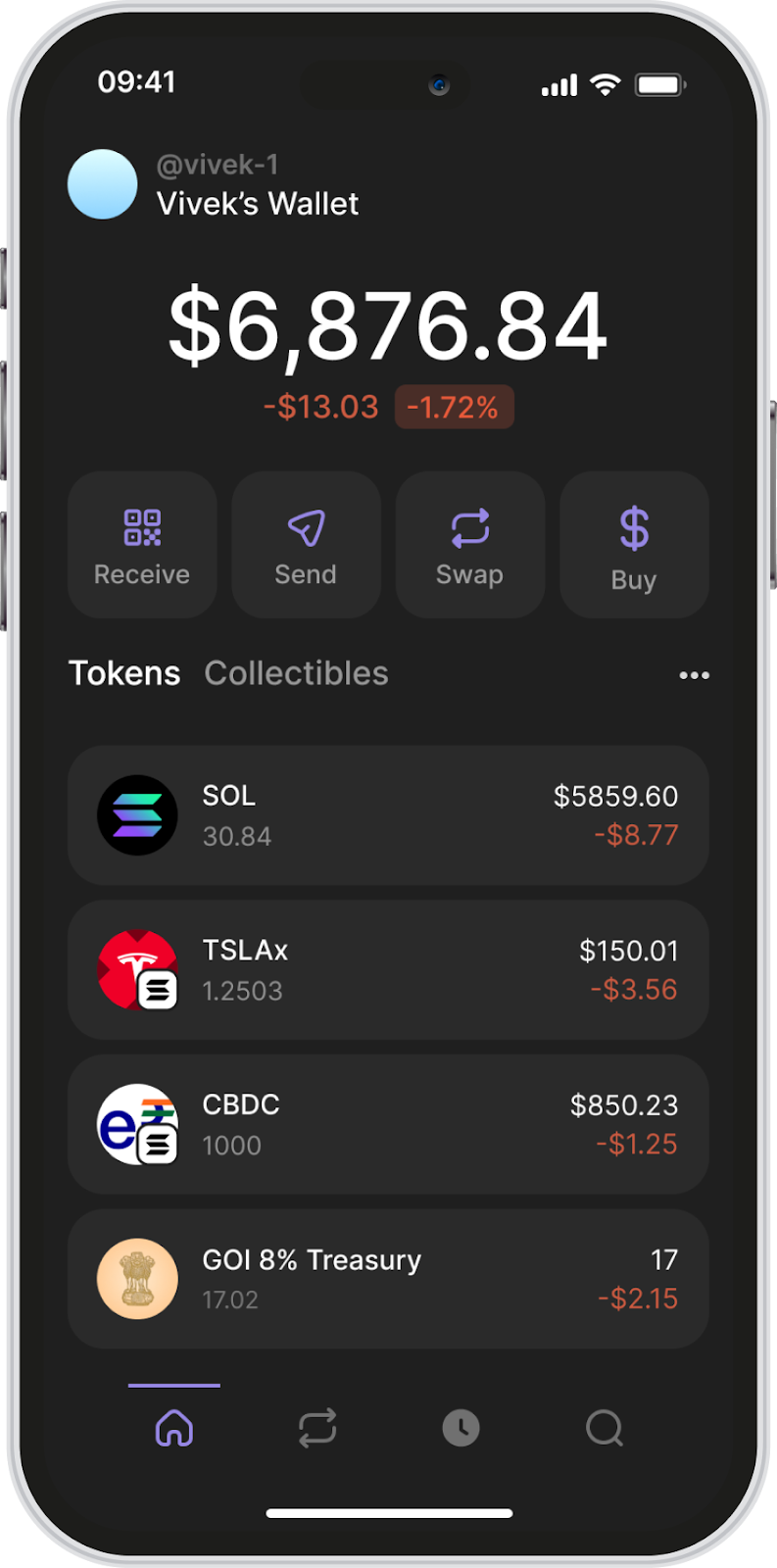

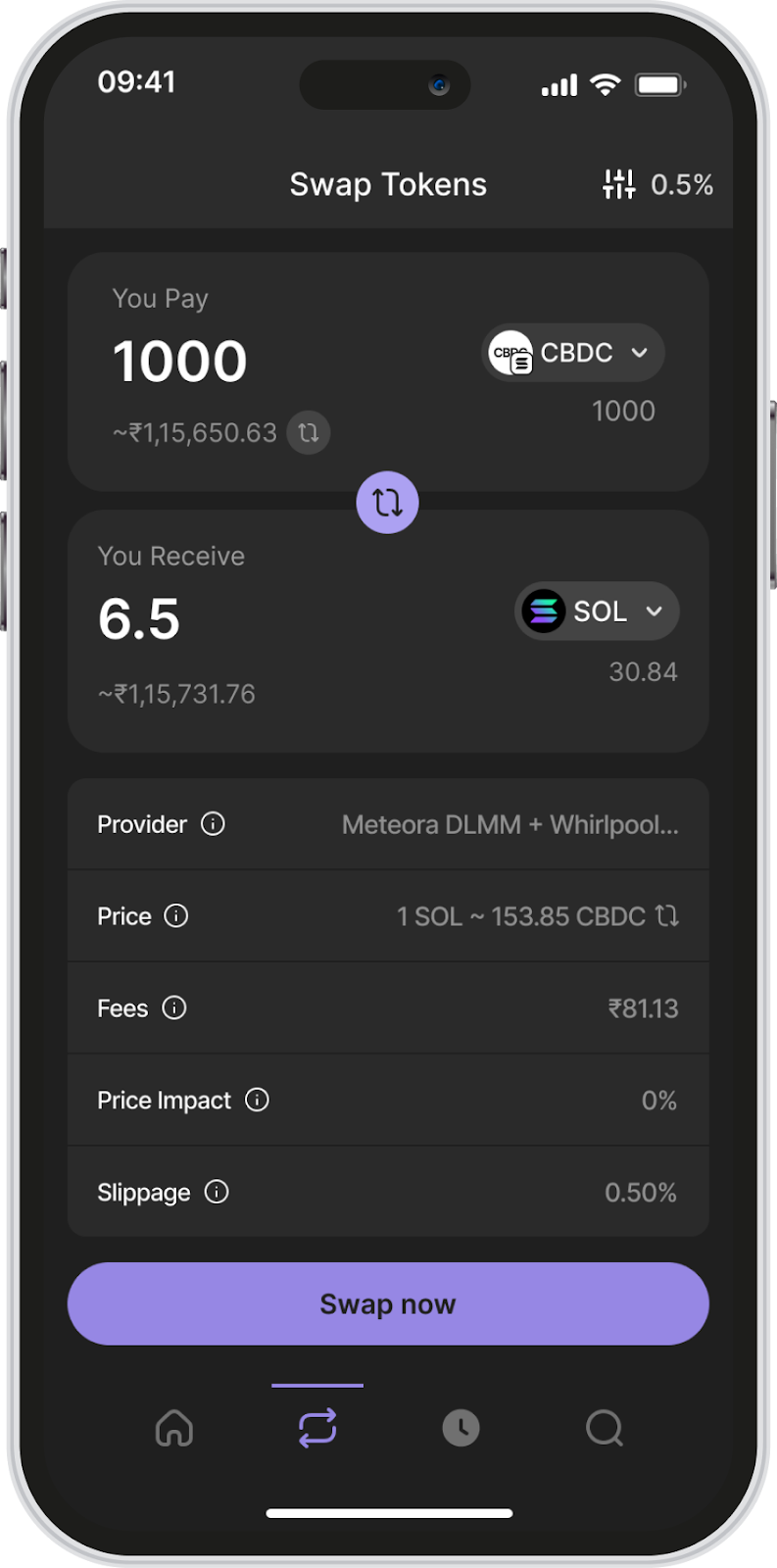

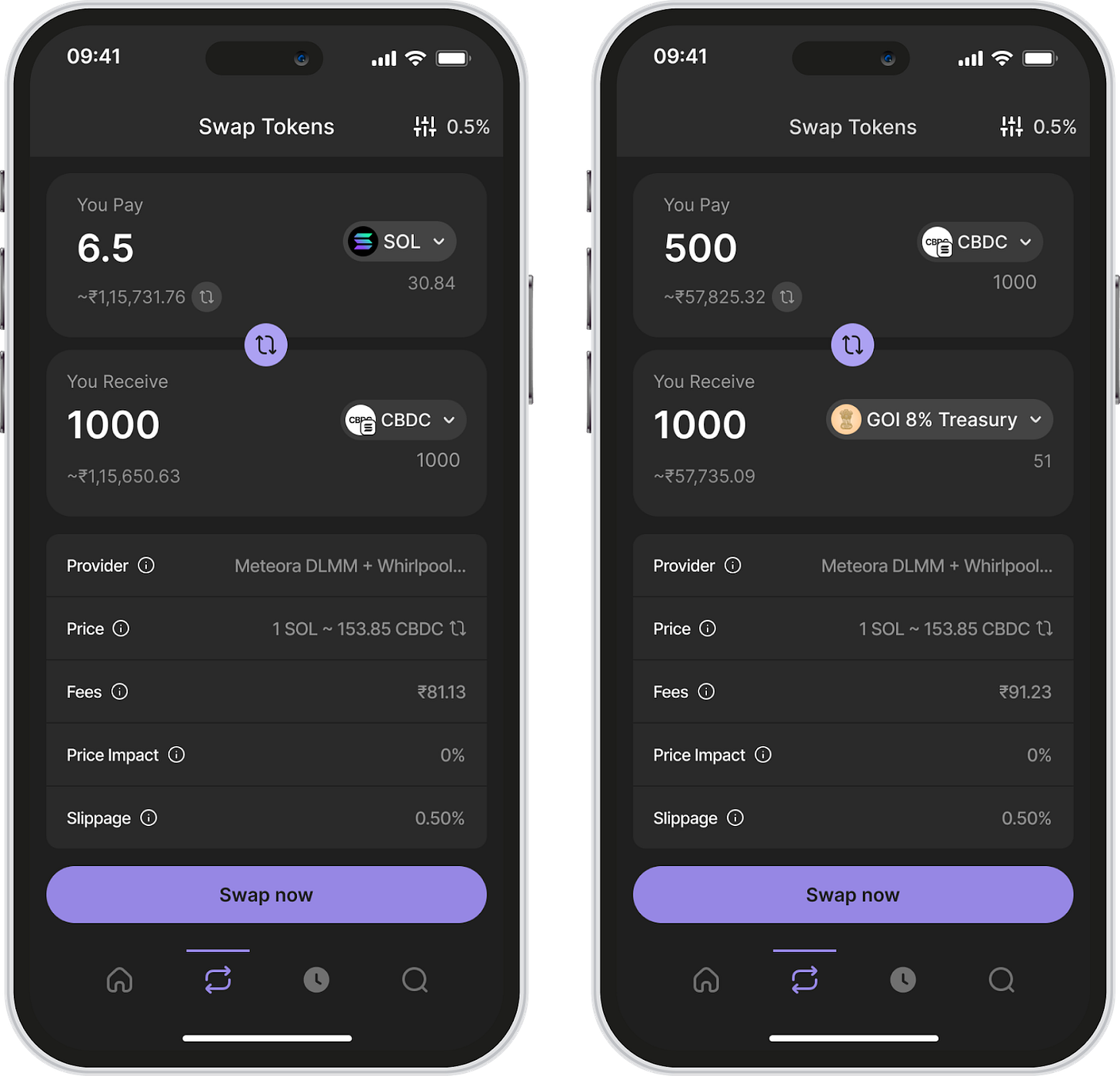

Existing Web3 capital can move seamlessly into CBDCs enhancing their demand and opening up new use cases in where regulated capital is required. Here we show a holder of a Web3 token like Solana moving into CBDC first and then into a government bond that is either issued natively on chain or as a ‘digital twin’.

Money can seamlessly move across borders due to the global nature of Web3 infrastructure. This will make cross border use cases truly seamless. CBDCs can now be transferred across all countries and on/ off ramped as per local regulations and requirements of the user.

Programmability, finality and all other properties can be inherited by CBDCs on public chains ensuring that purpose bound tokens, or limits can be easily implemented.

Lastly, we come to the issue of control, rules and compliance that are important and central to most regulators and the major reasons holding back the launch of CBDCs on public chains. As we show in the next section, most of these concerns are addressed with most modern chains.

Permissioned assets on Public blockchains can be 100% compliant

Technology for all the major public chains have evolved to such an extent that most of the common objections from regulators can be easily handled. Below I highlight some of the key considerations for regulators along with examples of how Solana solves those problems.

KYC

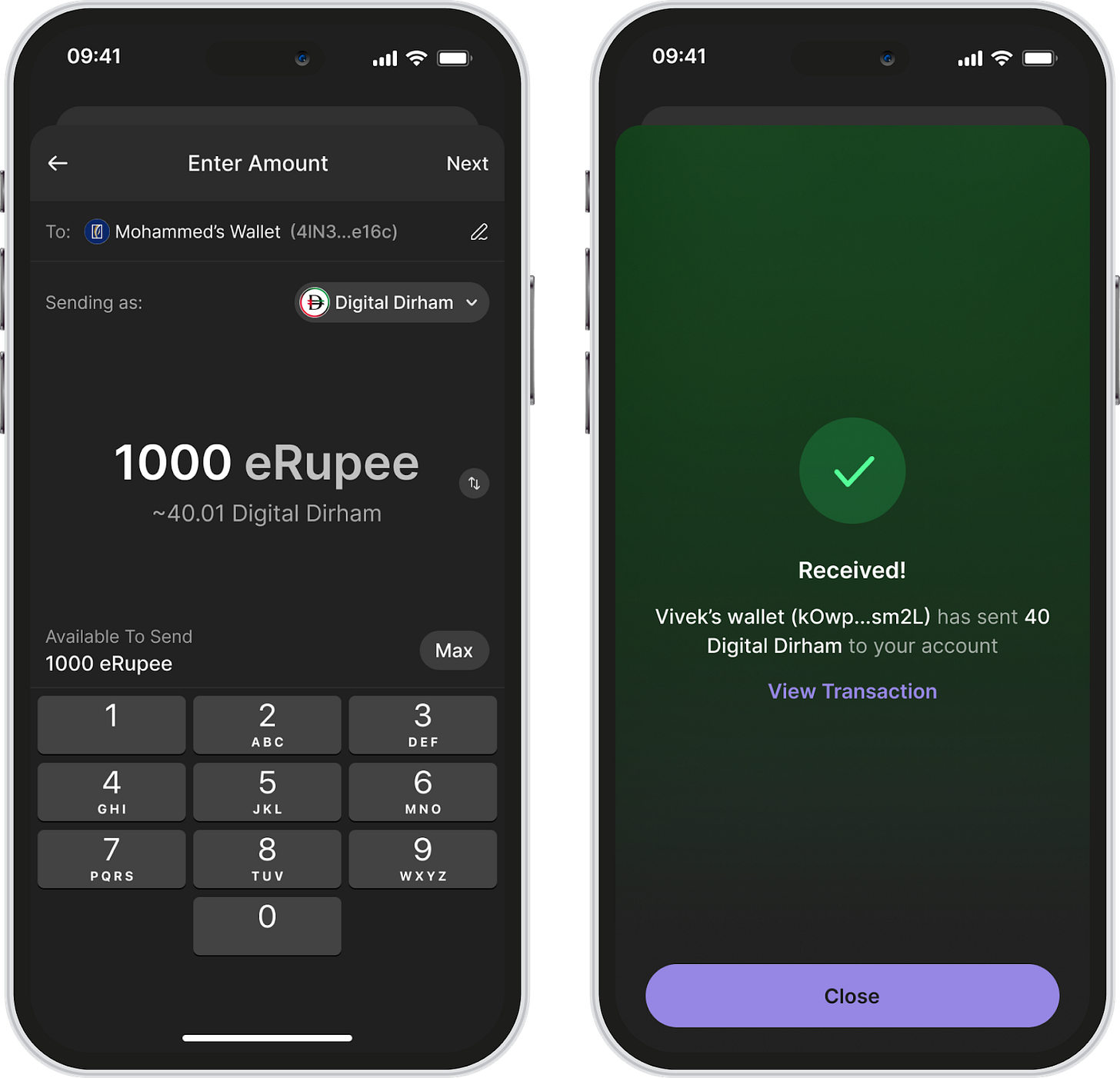

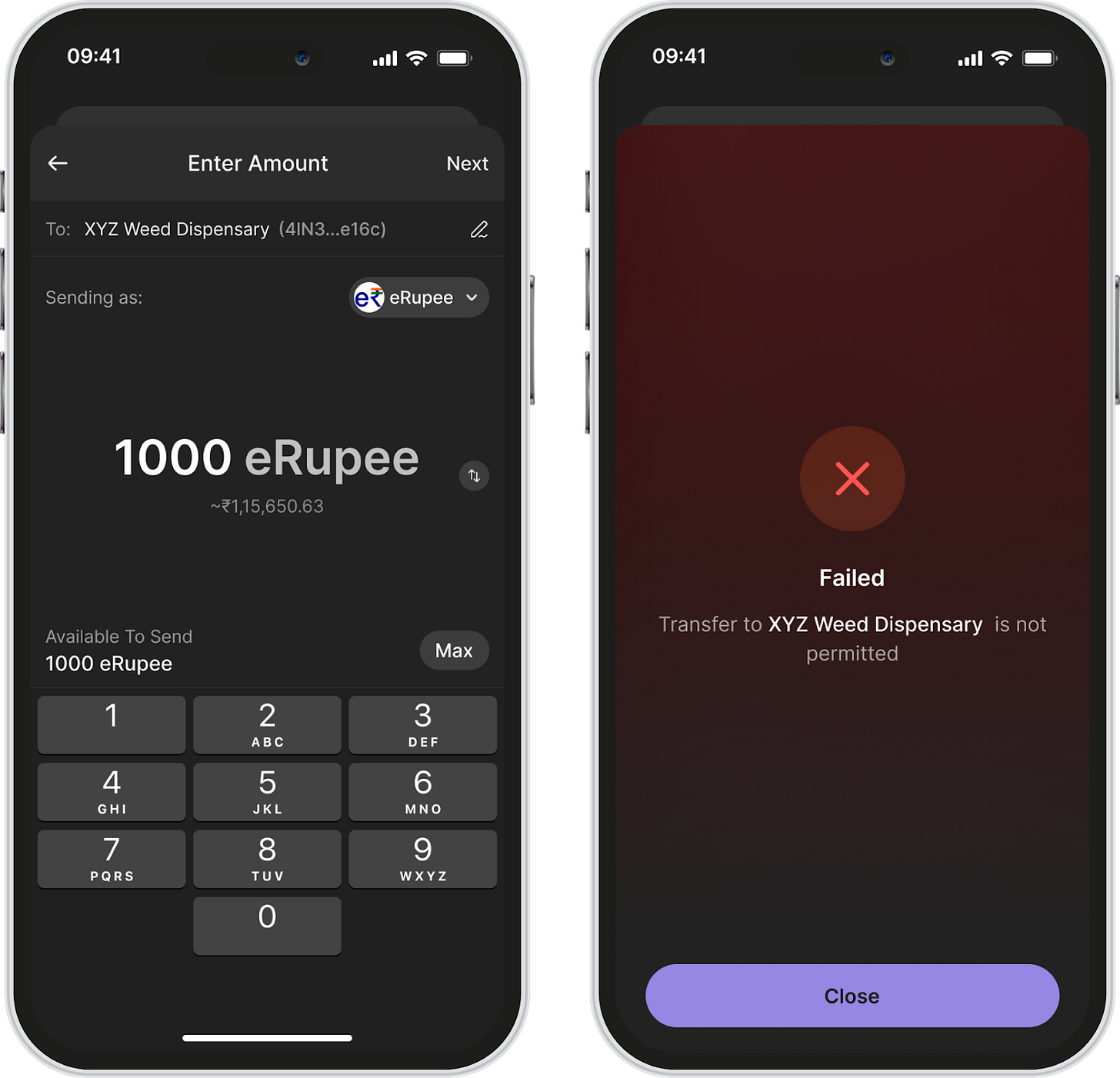

Token Extensions provide transfer hooks which give the token issuer (in this case the Bank) control over which wallets can interact with their token and how tokens/ users interact. Additionally default account state configures and enforces token account permissions. This means that the Bank’s distribution system can be programmed such that the CBDC is only transferred to those wallets that meet the minimum KYC threshold. The real unlock is that this applies even to secondary transfers. Since the rules are built in at the asset level into the protocol itself and not the app layer, even a third party app cannot violate them later.

Throughput

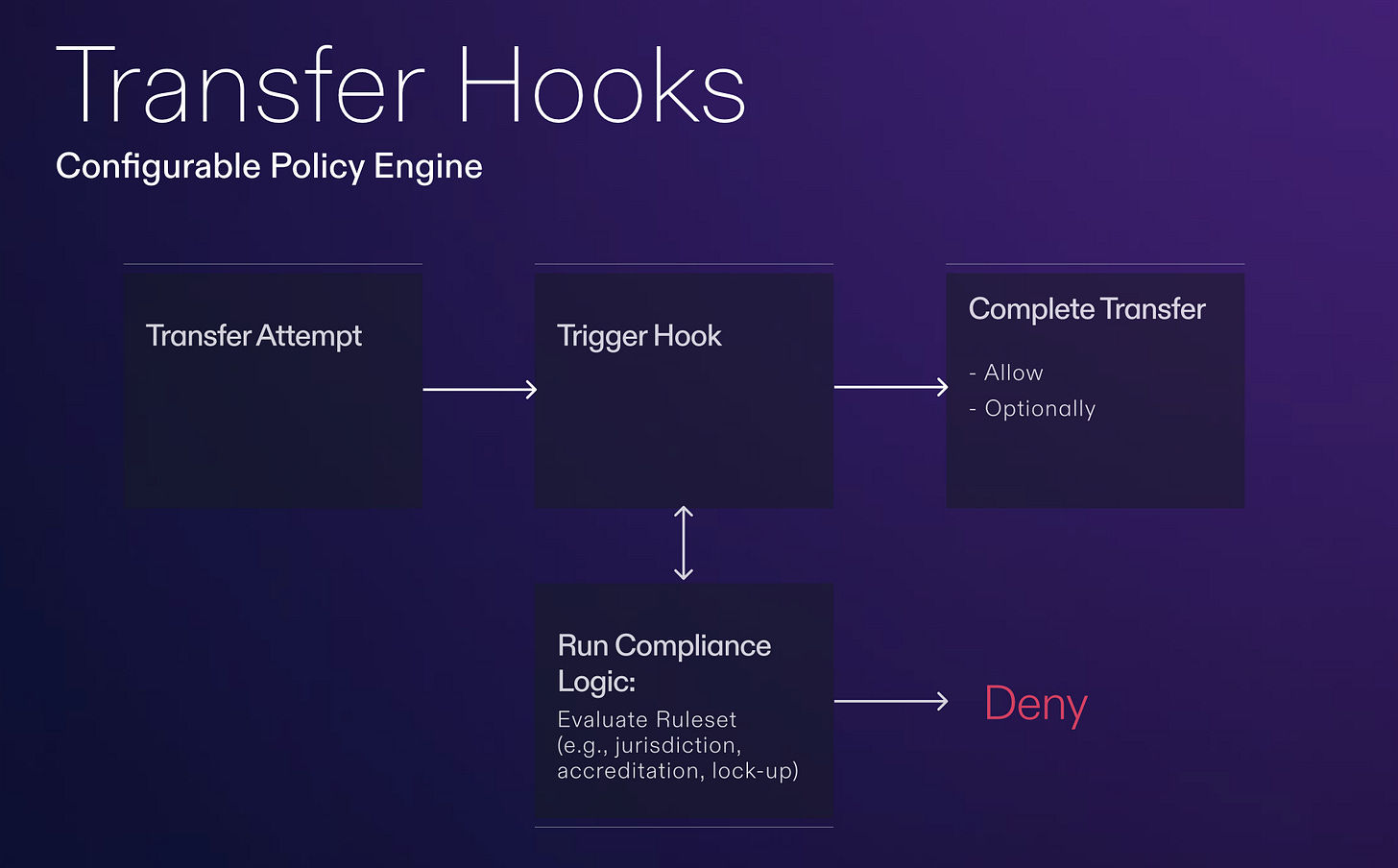

A major concern for Central Banks and governments is the ability for public networks to handle the transaction volumes required by nation scale payment systems. For example Visa and Mastercard have the capability to process up to 22,000 TPS at peak loads, while India’s UPI currently handles 10,000 TPS with an eventual goal of handling 100,000 TPS at peak. Solana already does upwards of 3K TPS in production with 1000+ globally distributed validators, constrained only by demand. It can already do 65K TPS and has a clear path to 1M TPS and beyond that includes a new consensus mechanism (Alpenglow), multiple validator clients (Firedancer, Mithril) and a new fibre network (DoubleZero) along with tons of software level improvements like local fee markets, priority fees, SWQoS, BAM, ACE, etc.

On and off ramps

The infra for these already exist through Liquidity Pools and Market Makers. Additionally, new regulated public infra can be created by the banks (via swaps between the Central Banks) for such transactions, in case they need to happen in the regulated space for any particular reason. I envisage that over the course of time, liquidity and issuance will migrate to chains that have deep and low cost infrastructure built for such conversions.

Capital Controls for emerging markets

Capital controls are similar to transfer limits for tokens. An intelligent system design combining token transfer limits with Token Extensions and Default Account States, can ensure that specific wallets are limited in the amount of CBDC that can remit abroad.

Privacy

Blockchains like Solana allow for private transfers at a token level which protects the confidentiality of users balances within a transfer, as well as hides the transaction amounts. This can ensure that critical transactions remain confidential which is important for enterprise adoption.

Liquidity fragmentation across chains

Over the past few years, liquidity has concentrated across a few chains, however there are still 20+ chains with viable liquidity. A major concern of the Central Banks is the liquidity fragmentation that may happen across these chains. These issues, while relevant are not major concerns:

Protocols like Wormhole facilitate seamless interoperability between chains, allowing users the flexibility of moving their assets as per their requirements.

Over time liquidity will aggregate into a few networks and Central Banks will only have to support those

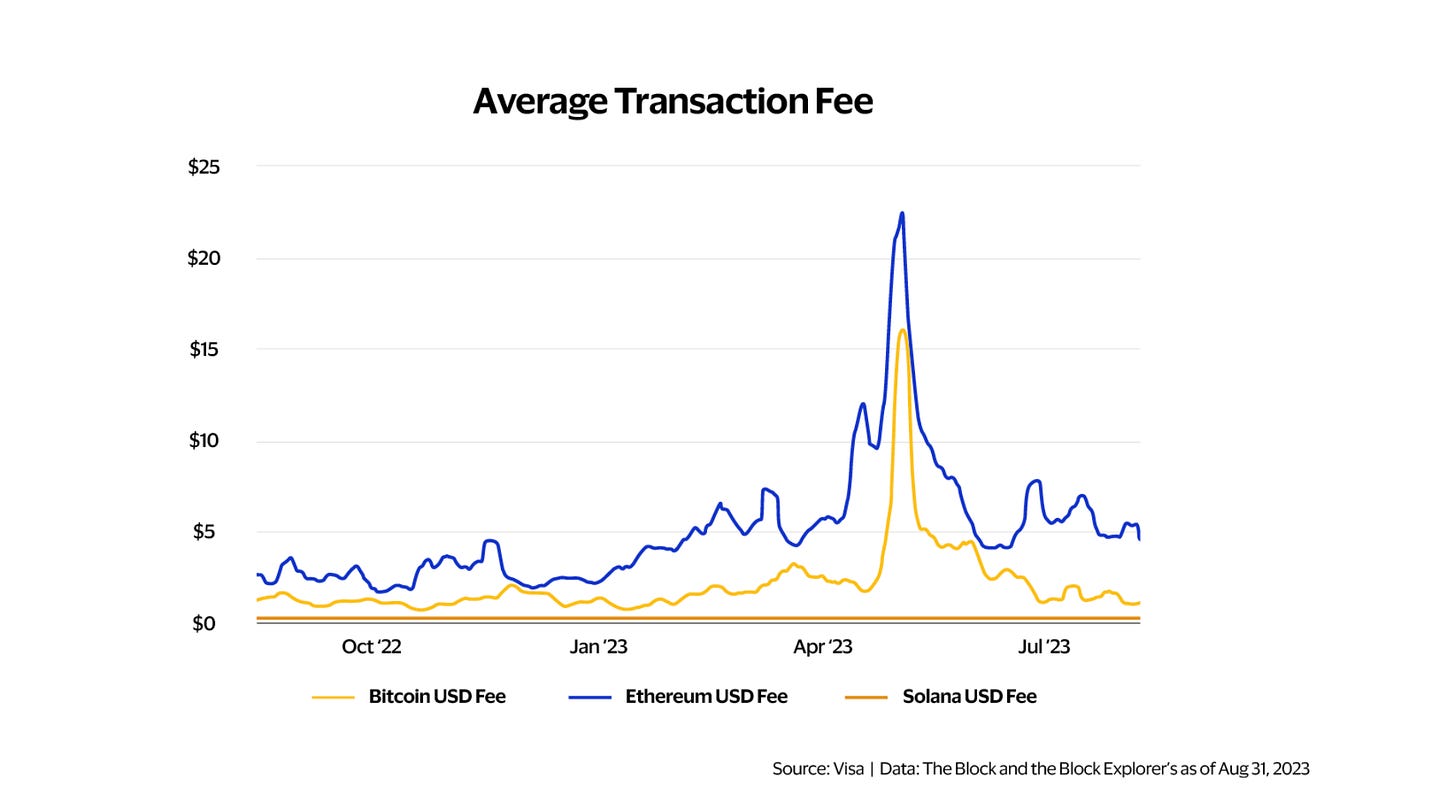

Transaction cost & their predictability

One of the major concerns is the fluctuating gas fees for transfers in public networks that can make it prohibitive to transfer assets. A solution to this problem can work in many ways:

Gasless transactions, where the banks and financial institutions pay for the transaction fees to drive adoption.

Alternatively, the transaction volumes will gravitate to the lowest cost chains like Solana due to sheer market forces.

Local fee markets on Solana ensure predictably low fees so that spikes on certain parts of the network don’t impact the rest of the network. Visa highlighted this in their paper as a major reason why they prefer Solana over other public networks.

The Road Ahead for CBDCs lies with public blockchains

CBDCs haven't lost the race for the ‘Future of Money’, they are just stuck in the wrong lane. As we show above, by moving from walled-off private networks to open public blockchains, Central Banks can give CBDCs the same reach and network effects that made stablecoins explode, while addressing all of the concerns that have held them back . Done right, this shift could make CBDCs useful in everyday life, power cross-border payments, and plug straight into the growing Web3 economy.