Fintechs & Stablecoins : The perfect (arranged) marriage

Build the future of banking for a fast growing, high value and underserved cohort of global remote workers

Fintech companies started out with the ambition to deliver new age financial services to the everyday consumer. A decade later they’ve made little progress at becoming the primary banking partner even for savvy customers. This is largely because they’ve been forced to build products held together by duct tape on top of legacy financial infrastructure.

In this essay we make the case for why Fintechs should cautiously experiment with stablecoin product offerings. There is a limited window of opportunity to build for an underserved, high value & global customer base. The time to act is now.

The Fintech Struggle: A bank without deposits

A 2020 report found that Neo Banks have added customers at a record pace but seen the avg deposit size plummet by as much as 25% from an already low starting point of ~£300. A McKinsey report suggested that digital banks need to go from burning €50 per customer, to a profit of ~€35 per customer to justify their valuations. It went on to say that they should find “alternate” paths to profitability by cutting expenses, becoming a vendor to big banks, exploring M&As with tradFi players.

Because of the inability to effectively own the customer deposit layer, fintechs have struggled to find a viable business model to justify their aggressive fundraising and valuations.

Payments is a ubiquitous but low-margin service. Across the world the dominant payment providers like Apple, Google, Grab, GoTo, etc. use it as a feature in their larger ecosystem. In India, companies like PayTm & PhonePe that achieved scale on the back of payments are scrambling to find ways to monetise through lending and other value added services.

When it comes to lending it is hard to beat banks at scale because of their deposit base, operating expertise and regulatory know-how. Fintechs likely end up lending to subprime customers and face higher default rates.

And finally, investment and advisory services businesses have struggled to monetise because they are highly correlated with market sentiment. In their recent earnings call Robinhood spoke about their focus on diversifying their income streams away from trading income.

The Opportunity: Stablecoins & Remote Work

There is an unmet customer need at the confluence of these two seemingly unrelated trends.

Remote work has been accelerated by covid lockdowns but the trend is here to stay. LinkedIn CEO shared that 15% of all job postings now offer remote work options & 50% of all job applications are towards these listings. AirBnB has seen such a dramatic increase in long stays that Brian Chesky is now living out of AirBnBs to better understand how their product should evolve to serve these global remote workers. Countries across the world are competing for this talent through initiatives like launching digital nomad visas, making it easy for tech workers to earn and spend in their country without being permanent residents. Entirely new startups like Deel have raced to unicorn status by promising to simplify global hiring processes. Companies are giving up their HQs in favour of satellite or cloud offices. And finally, Buffer’s State of Remote Work 2022 survey found that 97% of respondents wanted to continue working remotely at least partially and 72% of the companies they worked at were already provisioning for this (up from 46% in 2021).

Anyone who can look past media oversimplification of “offices open vs offices closed” can see that a fundamental shift in how we live and work is happening right now.

Stablecoins might have taken off as steady collateral in a volatile DeFi market but the underlying technology has quickly outgrown its initial use case. Stablecoins are a unique product that combines the borderless and instant confirmation of crypto with the stability of fiat currencies like the dollar and euro. At their core, fiat-backed stablecoins offer a faster, cheaper and secure way to move dollars around the world.

Just like social media facilitated the creation of global communities, it is our bet that stablecoins will usher in the era of global work by reducing the cost of paying employees and vendors across the world. This will enable anyone in the world to level up from forums and chats, pool resources to coordinate work and create value.

Stablecoins are going mainstream faster than any other crypto application; Visa has announced that they will be settling transactions in USDC, Stripe is supporting crypto payments, Moneygram is integrating USDC for remittances. I’m willing to bet that the next iteration for platforms like Shopify, Reddit, Meta, and Twitter will be to support stablecoin payments for digital collectibles on their platforms.

It is quite likely that most of the people who will become stablecoin users in the next 5 years won’t even be aware that they’re using a crypto or blockchain product.

Key Stakeholders

In this section we’ll review four key stakeholders, their motivations, and the problems which can be solved using stablecoins. Our hope is that you exit this section with a panoramic mental picture of the ecosystem.

Individuals who are working remotely. These are people who are being paid for their time, products, and services in stablecoins. They are likely to be temporary residents of multiple countries in a year. This means they won’t have a local bank account or payment instrument set up. They need a way to hold, save, invest, and spend their stablecoin earnings.

It is important to distinguish that these are not necessarily people working in crypto. Given where we are in the adoption cycle we think it is important to distinguish two customer segments within remote workers:

People who work in sectors unrelated to crypto and just happen to accept stablecoins as payment because they unlock higher earning opportunities for them by way of global clients, etc. These people are likely to be crypto agnostic or even sceptical. They need products that abstract out the blockchain, build trust and help them connect their crypto earnings to the existing financial infrastructure. Today these customers are likely using products like Deel, Wise, and their local fintech apps in conjunction with some traditional bank account and payment instruments.

People who work in crypto and accept stablecoins because they want to use them primarily in crypto-native products. These are people who are power users of NFTs, want to interact with DeFi protocols, invest in upcoming crypto projects and tokens, withdraw into self-custody wallets etc. They likely use fiat as-needed to pay rent, buy food, health and emergencies, and other life expenses. Today they’re likely using wallets like Phantom/Ledger, exchanges like Binance/Coinbase, and crypto start up products like Request, Parcel, Juno, Wagmi, etc.

Living without a local bank account is a tedious experience and often requires people to operate from an account in their home country or engage extractive shady services that capitalise on this regulatory arbitrage. The margin they anyway pay is an opportunity for a fintech business.

Companies & Projects operating remotely. The other side of the coin, these are projects that are tapping into a newly emergent global workforce. Again, we can segregate them into crypto native entities that hold a significant portion of their treasury in USDC and thus is a preferred method of payment. Or, traditional businesses that are chasing the best talent and relying on startups like Deel or platforms like Upwork, Braintrust to simplify their payments experience.

It is important to realise that new payroll solutions need to factor-in higher velocity, lower value payments to contractors, freelancers and contributors. Traditional payroll infrastructure is designed for full time employees with an average tenure of 2 years receiving a fixed monthly salary in a bank account; it does not scale to this new paradigm of work.

Products like Roma by Zamp are building unified banking solutions across crypto & fiat, but we’ll talk about that in another essay. For now, think of these companies as the primary depositors for remote workers and ensure that your stablecoin accounts are integrated with their payroll systems.

Merchants. It is reasonable to assume that most merchants will be focused on revenue growth and be agnostic to payment methods. As the circulation of stablecoins increases among projects and individuals, there will be a crop of merchants who will accept stablecoin payments as a way of tapping into this latent demand.

There is room to build financial services for stablecoin-native merchants as well. Lending and borrowing services, credit lines, wallet-based loyalty and retargeting, etc. We’ll talk about this more in subsequent essays.

For now, these merchants are prime candidates to include within your fintech app ecosystem, rewards program, card networks, etc. Today these merchants will be choosing from products like Rally, Decaf, CandyPay, Helio, Coinable, etc.

Stablecoin issuers. Boring is a characteristic of the best stablecoins. At this point the best strategy is to adopt fiat-backed stablecoins with audited reserves. Companies like Circle (USDC), Paxos (BUSD) and Tether (USDT) are leading stablecoin issuers to consider.

These companies are also investing in supporting projects and teams building products on top of their stablecoin platforms and attempting to build their own merchant ecosystem to drive adoption.

Product Strategy

The opportunity lies in building at the confluence of the needs of these four key players who are currently using a fragmented product stack.

Existing fintechs have an advantage that they are more trusted than crypto-native exchanges, startups and are more technology forward than legacy banks and institutions. The one thing fintechs have perfected is building intuitive consumer product front ends– they just need to plugin a stablecoin backend.

The ideal approach is to launch features iteratively which help teams build expertise in a new domain, get real customer feedback and build up their risk appetite.

Remittances

When instant global dollar payments become the norm, “remittances” as a category will become a relic of the past. Much like what happened with long distance calling and telegrams as Skype, Zoom, Hangouts & WhatsApp took off. But more importantly, when an interaction goes from being expensive & tedious to butter a vast new canvas of previously unimaginable use cases emerges.

Stablecoins are widely used for remittances in LatAm, Africa & parts of the middle east. Countries in Asia, like the Philippines, are encouraging their use as well. It would be a mistake to assume that this will remain restricted to sanctioned nations like Cuba, or nations with hyperinflation like Lebanon. This is why leading remittance players like Moneygram are integrating USDC into their services.

Most technologies started off as toys for the rich and then achieved mass adoption. Because our current financial system works well for the traditional rich, they don’t need a new one. Stablecoins may start off as a remittance lifeline for the vulnerable, but as more salaries become remittances they will find mainstream adoption.

Allow KYC’d customers to send and receive stablecoins globally within your fintech app. This single feature will allow you to fill a void for customers who don’t want to use self-custody wallets or crypto exchanges. Leverage your relationship with banks to build stablecoin off-ramps which are compliant with forex laws and tax reporting.

For example, Coinbase & Remitly are running an end to end pilot wherein coinbase US customers can send crypto to the email address of recipients in Mexico. These recipients can seamlessly withdraw cash against remitted crypto from one of 20,000 locations provided by Remitly.

The remittance market is currently estimated at $700b, and is expected to grow to $1T by 2030. This is likely underestimated because it doesn’t factor in the growth in cross-border payments led by remote work. The current avg. cost of sending remittances is 6-7%, this presents an opportunity to introduce efficiencies that people are willing to pay for. This can also create the impetus to start building a stablecoin deposit base.

US Treasury Yields

A benefit of a high interest rate regime is that all USD is eligible to earn US treasury yields. There is a market for simple and boring investment products, especially when most outfits offering higher yields are going insolvent.

Offer existing and new customers the option to convert or deposit their USDC, and integrate with a partner like Circle, to offer virtually risk free yields. This is ideal because it gives customers a yield on their holdings without having to convert them to fiat or rely on crypto outfits they don’t trust.

There is a regulatory restriction especially in the US & EU, for offering yields on crypto. This might not be the case in Asia, LatAm, Africa, etc.

Payments

Enabling merchants to accept USDC & customers to pay using USDC is easily one of the highest impact use cases.

There is value in issuing a stablecoin debit/credit card like Coinbase, Binance, Juno and many others since Visa and Mastercard both support stablecoin settlements. However, the real unlock lies in incentivising merchants to accept stablecoin payments or helping them off-ramp.

Luckily, most fintech apps have already built small e-commerce marketplaces or launched services of their own. This is the ideal insertion point for providing utility to the stablecoins your customers hold. Fintechs are in the unique position to abstract out the off-ramping process for their merchants or owned services. Customers who earn in stablecoins will be happy to pay a fee for this service.

Hydrogen offers a no-code solution that can help you launch a crypto card for your fintech app.

Consumer Banking

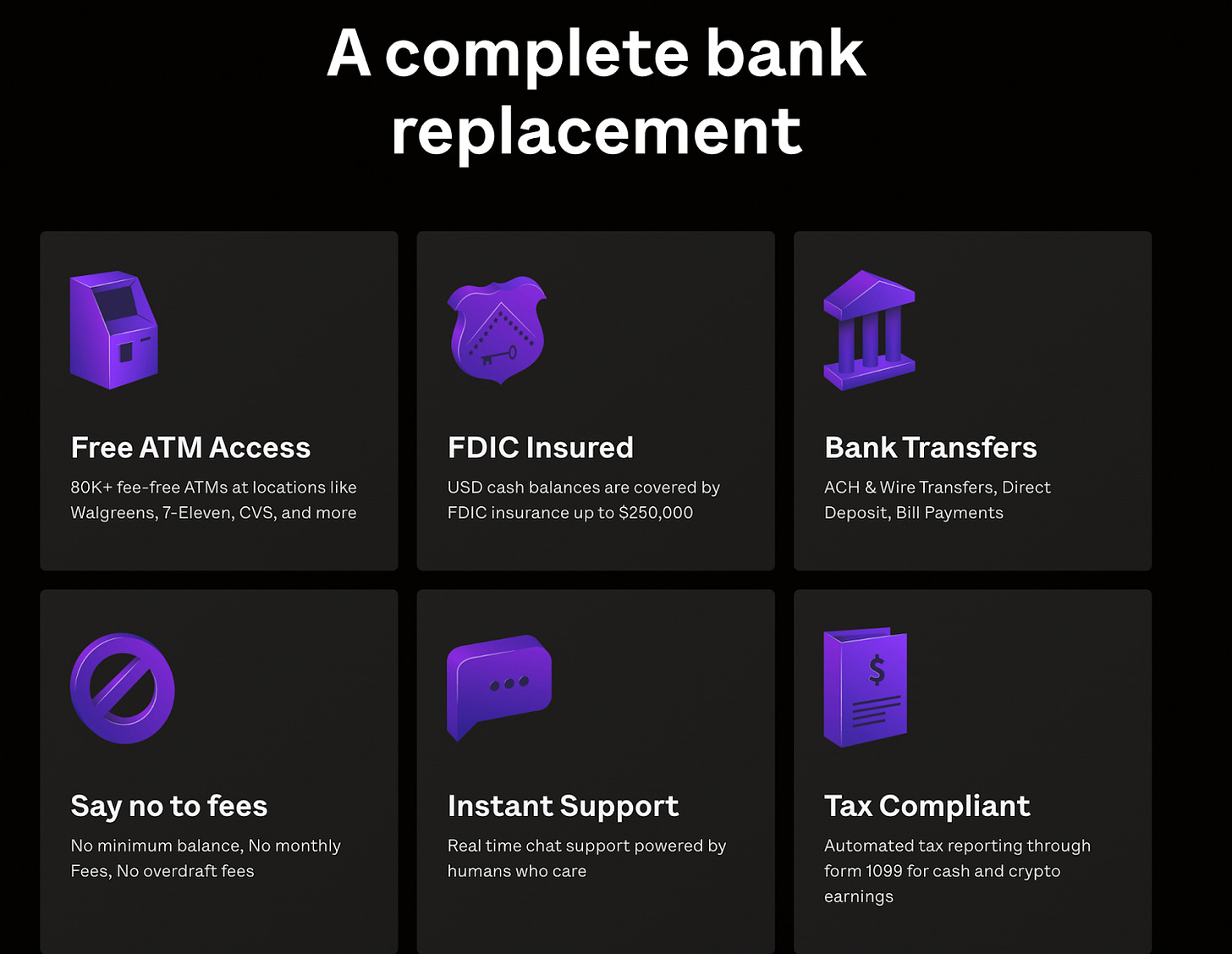

This is a full suite solution which allows KYC’d customers to receive a paycheck/deposits, earn interest, issue a widely accepted card and generate tax statements. Ideally this product would integrate with a customers traditional bank account.

This is an opportunity to rebuild the consumer banking stack from scratch, for a high value and quickly growing customer base. If this bet pans out the deposit base of the future will be built on top of digital currencies & global nomads. Building for them now can help fintechs demonstrate product expertise, earn customer trust, hedge regulatory risk across countries and be valuable to existing banks and regulators when they accept this new reality.

Conclusion

Most consumer fintechs today are default dead. There is an opportunity to build a new banking system on top of the technological innovation of stablecoins & a small but growing base of global remote workers.

In hindsight it will seem obvious that a new paradigm of financial services is ushered in not by legacy banks and regulators but by new technology which addresses the core inefficiencies of today. Fintechs have a limited window of opportunity to leverage their unique position of more trust than crypto & more tech than legacy institutions before the space gets too crowded.

Request for Proposal

Product Design playbook. Convert these high level ideas into actual product mockups that demonstrate how various fintech apps can incorporate stablecoin led financial services and consumer banking products.

Apply for a Solana foundation grant if you’re interested in shipping this public good.

Thanks to Anna, Yash A, Tanvi, Jitesh, Jayesh, Rahul, Kunal, Krish & Akshay for their feedback on drafts of this essay.

Cover image credits Yash B

Disclaimer: This post is not financial, legal or investment advice. It is meant for informational & educational purposes only. Please do your own research about risks and compliance before buying, investing/ or trading, etc.