Global DeFi Capital: India’s Opportunity to drive Foreign Investment in Capital Markets

Or, how the rise of DeFi markets presents an opportunity to drive inflows

Globally, blockchain-based finance has evolved from a cypherpunk experiment into a multi-billion-dollar market. Decentralized finance (DeFi) protocols now hold over $150B in value, and even traditionally risk-averse investors are entering the space via regulated vehicles. The global cryptocurrency market, at USD 3.5Tn, would rank as the sixth/ seventh largest economy in the world. Excluding bitcoin, the market is valued at ~USD 1.5Tn, a large component of which is in highly speculative assets such as memecoins and altcoins.

Over the past few months, a number of new products have been launched which bring traditional investment instruments to the global DeFi markets. These include xStocks (which make fractional stock investing in companies like Tesla, SpaceX etc possible), tokenized treasury products from players like Blackrock and Ondo and dual listing at venues like the Kazakhstan stock exchange. The uptake of these products has been phenomenal with xStocks reaching over $100Million in AUM a few weeks after launch. These assets, coupled with other instruments like Real Estate, Private Credit etc. are known as Real World Assets and their growth on-chain has been phenomenal. Tokenised RWA value on public blockchains had reached US$35 Billion by mid-2025.

The size and rise of these asset classes show a few clear emerging trends:

there is abundant liquidity in the hands of a new class of internet native investors that is chasing uncorrelated returns

a large amount of capital is available on-chain but much of it is forced to flow into volatile assets.

as with other investors, there is an inherent flight to quality that is currently limited by the availability of high quality assets on-chain

In light of the stellar growth in this market, in this post, we dive deep into a potential radical idea: leveraging global DeFi Pools to drive foreign investment in Indian capital markets.

The opportunity for India

For India, this convergence of factors – large pools of internet-native capital, proven blockchain infrastructure, and a clear trend toward tokenized finance – presents a strategic opportunity. By offering tokenized, regulated Indian investment instruments to global investors, India can channel the speculative capital currently tied up in risky internet capital markets into funding for the Indian economy’s growth.

There is an inherent attractiveness in Indian assets which would be attractive for these global on-chain investors:

Higher Yields: Indian government and corporate bonds traditionally offer higher interest rates than developed market bonds. For instance, a 10-year Indian G-sec might yield ~7-8.5% in INR; even hedged for currency or issued in USD terms, it could deliver 5-6%, beating most developed market yields. Infrastructure bonds or securitized loans might offer even higher returns. Global stablecoin holders and crypto funds would find these yields attractive, especially if accessible without friction, which is not possible currently.

Diversification and New Markets: Many crypto investors have little access to emerging market investments. Tokenized Indian equities or bonds provide diversification – a way to gain exposure to India’s growth story entirely through on-chain means. This is a new avenue to invest in India beyond ADRs and foreign institutional channels, potentially tapping a younger, tech-savvy, DIY investor class globally.

24/7 Markets and Instant Settlement: Even sophisticated investors (hedge funds, family offices) might be drawn to on-chain markets for the benefits of around-the-clock trading and T+0 settlement. If an Indian bond is tokenized, it can trade 24/7 on global liquidity pools – an investor in London or Singapore can rebalance holdings on a Sunday or during Indian holidays, which is impossible in traditional markets.

Memecoin to Mainstream: For the more speculative traders, having regulated assets available on-chain creates a path to “mature” their portfolios. A trader who made profits on a memecoin might rotate into a tokenized stock or bond to secure those gains in a safer form without leaving the crypto ecosystem. Currently, the jump from crypto to a traditional investment (like buying an Indian bond via a bank) is huge – involving off-ramps, paperwork, and unfamiliar processes. If instead that bond is just another token a click away, capital that cycles out of hype can plough into real investments.

The potential advantages of attracting such capital pools for the Indian issuers are manifold and include:

increased foreign investment in Indian enterprises and infrastructure,

lowering of government bond yields due to rising demand, an effect already being seen in the US treasury markets.

deeper liquidity for Indian markets, especially in areas like GSecs and green bonds, which have been a focus area for the government.

positioning India as a forward-looking financial hub.

Key Challenges

The design of such a system will pose some key challenges, many of which are specific to regulated capital markets while some of them are specific to India:

KYC and AML regulations: Investment in regulated assets will require thorough checks on investors and their backgrounds to comply with global as well as India specific norms. These will be especially relevant during on-ramp and off-ramp phases of the investment.

Investor Qualifications and Caps: Certain instruments may be accessible only to qualified investors or up to a certain investment cap. The system design should enforce such rules at a fundamental level to minimize chances of any breach/ workarounds.

Foreign Exchange controls: India’s capital account is only partially convertible and there are FEMA regulations linked to transfers and profit repatriation. The system design should be able to handle these rules.

Apart from the above, the system design should also be able to handle features like confidentiality (required by high value investors), corporate actions (interest, splits, bond calls) and real time monitoring.

Many of the large blockchains, like Solana and Ethereum have developed the ability to address most of these issues in a robust manner. However, their implementation models may vary dramatically (ex: token level at Solana vs smart contract level at Ethereum). It will be necessary to implement these regulations in a standardised manner to reduce complexity for investors and ensure security. Let’s see how this could work in practice.

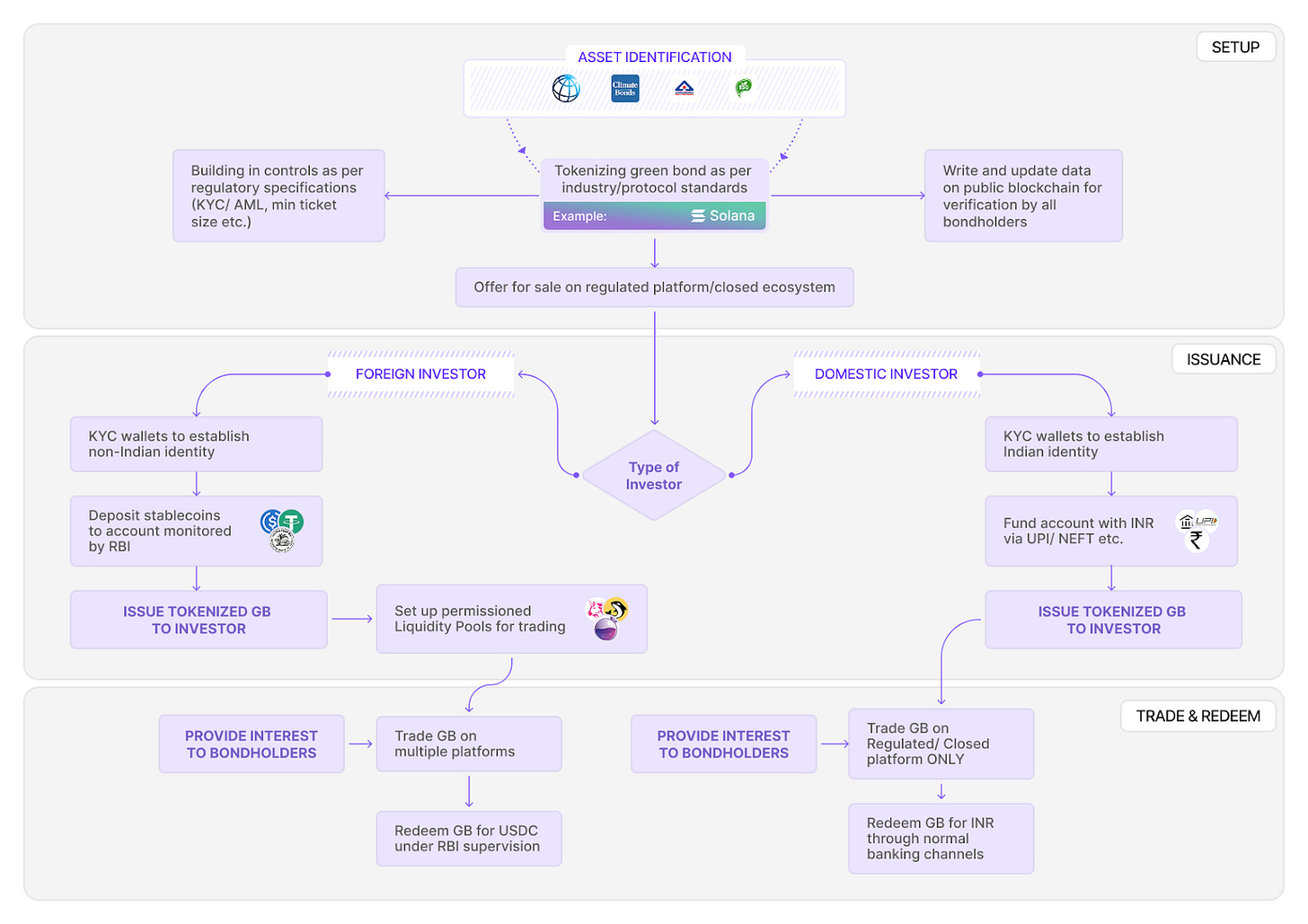

Workflow for a sample asset

We highlight the overall flow and design for this system using the example of sovereign Green Bonds issued by RBI . Green bonds represent an ideal asset for such this use case for India due to the following reasons:

It is an asset which the Government has to issue and place at regular intervals due to its Paris Climate Treaty commitments.

It is a high quality sovereign asset offering high levels of security and stable yields.

However, it has lower yields than vanilla bonds (‘greenium’) which makes it less appealing to traditional institutional investors. In fact, the last issue of Bonds had to be devolved to the underwriters due to lack of demand.

It requires transparency to prevent risks associated due to greenwashing.

We now deep dive into each of the elements in the workflow to highlight the design considerations and product requirements.

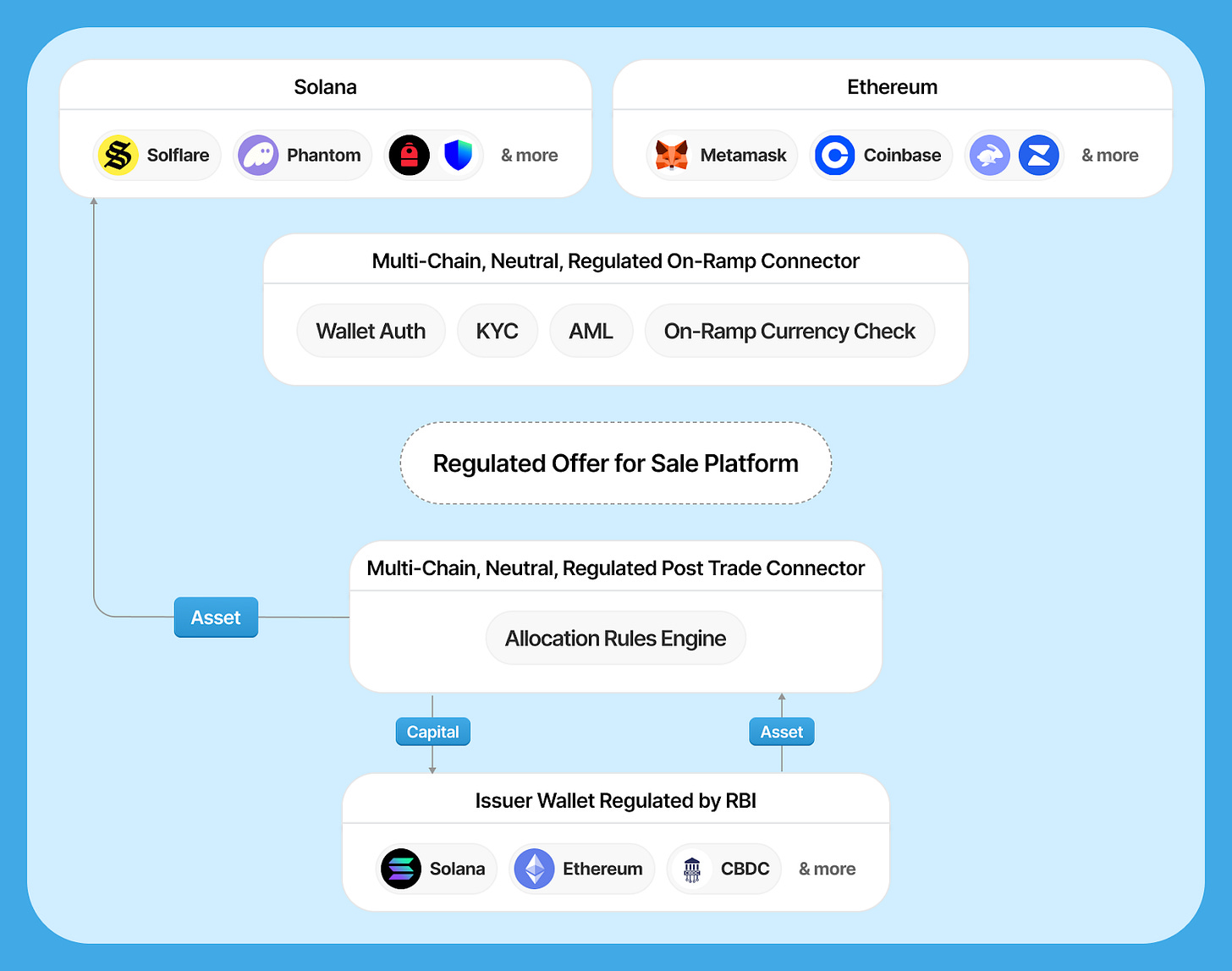

Pre-investment: Asset issuance, investor validation and distribution

The above diagram highlights the pre-investment workflows that would need to be performed for an Indian regulated asset to access DeFi capital:

Multiplicity of wallets and token standards: Due to its very nature of being open and permissionless, global DeFi capital is likely to be distributed across multiple chains, wallets and liquidity venues, each of whom will have their own standards for KYC and AML. A neutral connector could help standardise and enforce these rules across all the chains

Capital control rules and allocation guidelines: Regulators and issuers can work together to create a common standard for rules to be implemented across all the participating DeFi ecosystems to ensure compliance with capital controls and allocations.

Post-investment: Trading

To ensure accessibility to the largest possible DeFi capital pools, post allocation trading should be permitted in venues where liquidity already exists. With compliance built in at the token level, existing DEXs or CEXs can set up regulated liquidity pools or trading venues where wallets with the necessary approvals will be able to connect. These trades will happen within each chain’s ecosystem.

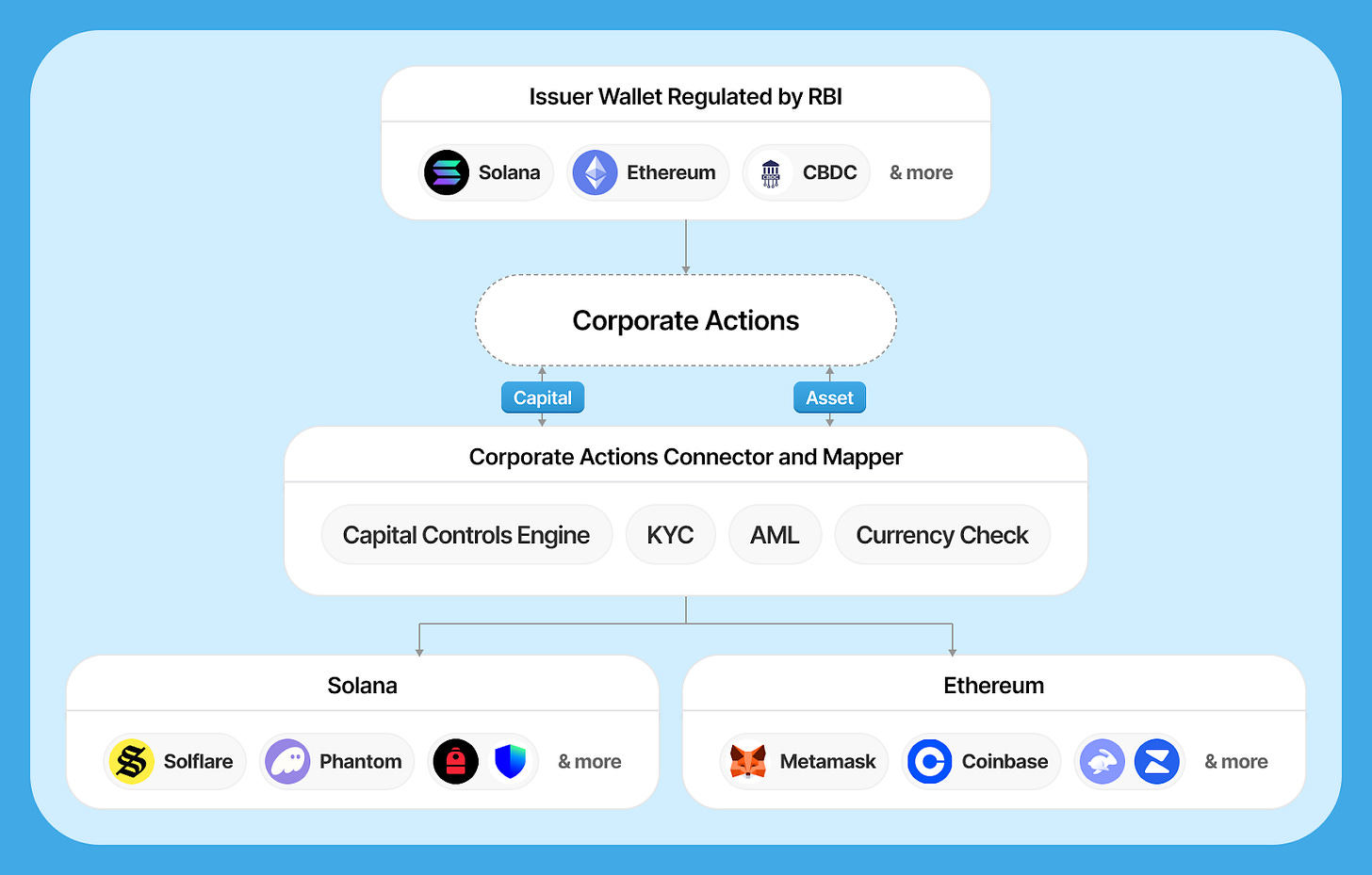

Post-investment: Corporate Actions

Corporate actions can include activities like interest payments, bond calls, stock splits and dividends. Post trading, it is possible that a number of new wallets with same permissions can hold the token. The connectors can act as a layer between the issuer and the asset holders by abstracting away the compliance and distribution complexities across chains while ensuring that issuers have a single protocol/ window that they can interact with.

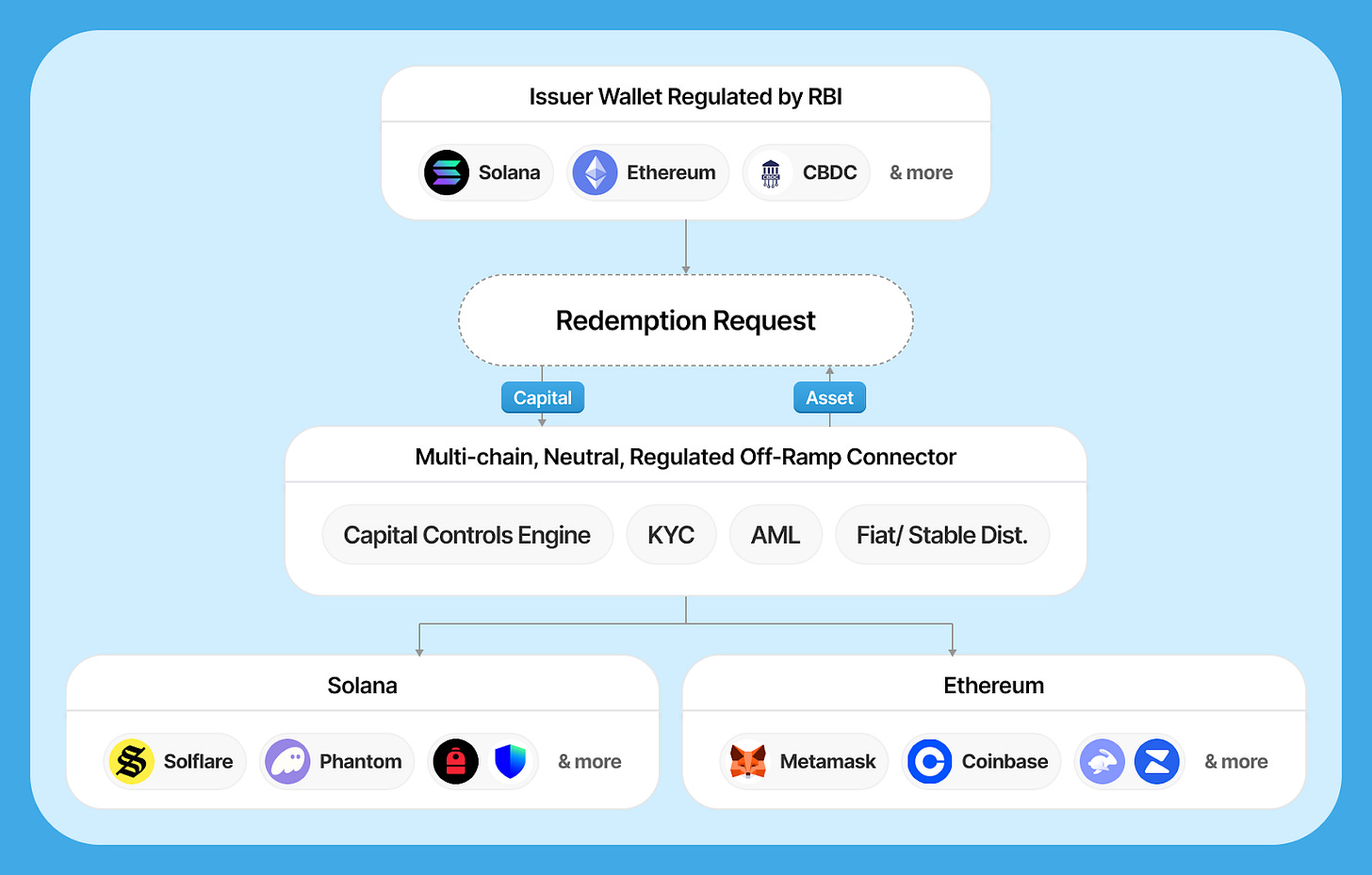

Post-investment: Redemptions

At the point of redemption, the asset issuer will have to provide acceptable stablecoins/ CBDC/ fiat in lieu of the asset which will be returned to the issuer and burnt. Similar to the pre-investment issuance phase, there is a large amount of coordination and and compliance checks across wallets and networks that will have to be performed by a suitable, neutral, intermediary protocol. At the time of redemption, the protocol will undertake pre-offramp checks for capital controls, KYC, AML, along with providing a compliant off-ramp methods for the issuer.

Designing this system on Solana

As the hub of Internet Capital Markets, Solana could be the natural home for this idea. As a Layer 1, it has almost all of the performance, robustness and compliance built in that would be required by regulators.

High throughput and low latency with instant finality. Solana already does upwards of 3K TPS in production with 900+ globally distributed validators, constrained only by demand. It can already do 65K TPS and has a clear path to 1M TPS and beyond that includes a new consensus mechanism (Alpenglow).

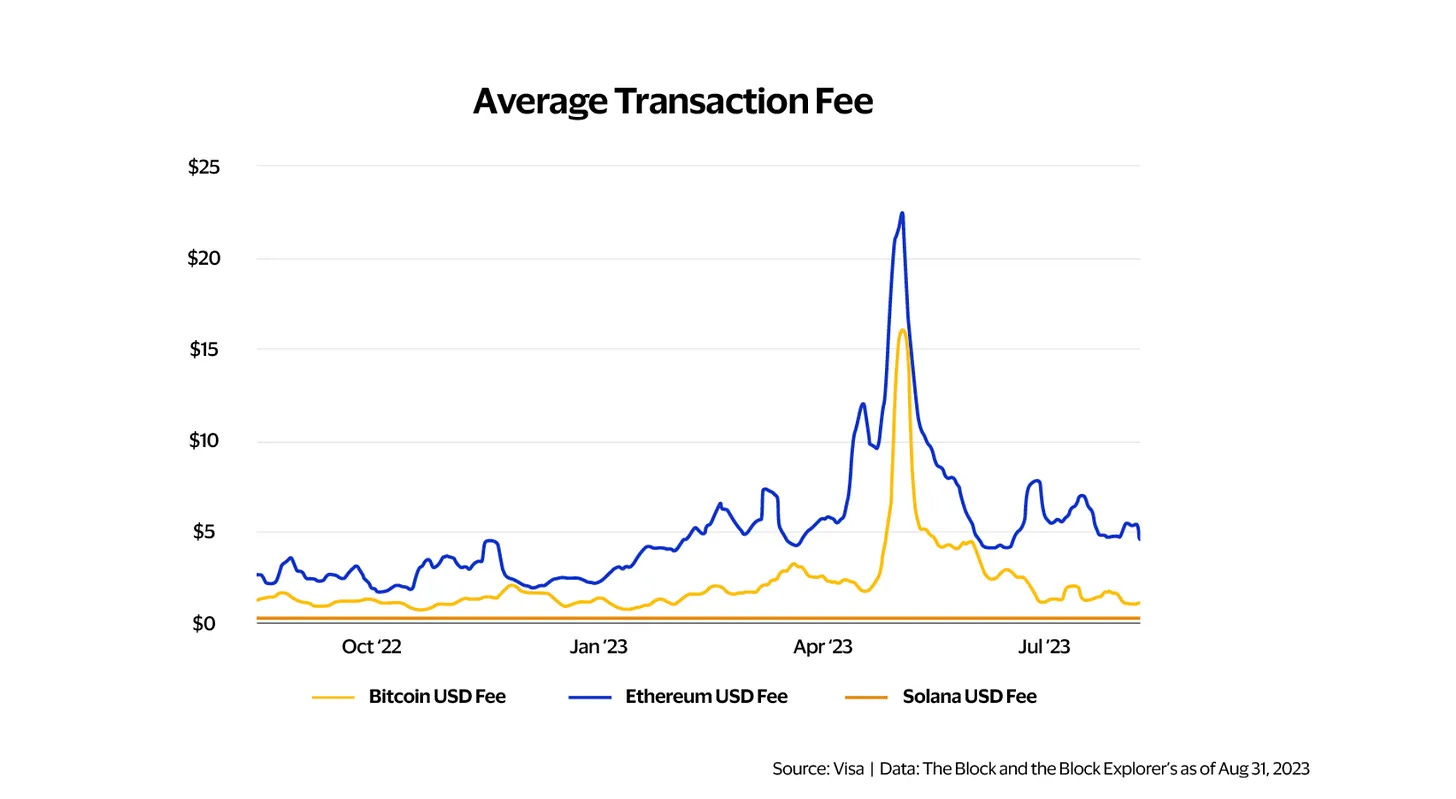

Transaction cost & their predictability. Chains like Solana have undertaken a significant amount of engineering and business model innovations to ensure that fees are stable and predictable. Local fee markets on Solana ensure predictably low fees so that spikes on certain parts of the network don’t impact the rest of the network. Visa highlighted this in their paper as a major reason why they prefer Solana over other public networks.

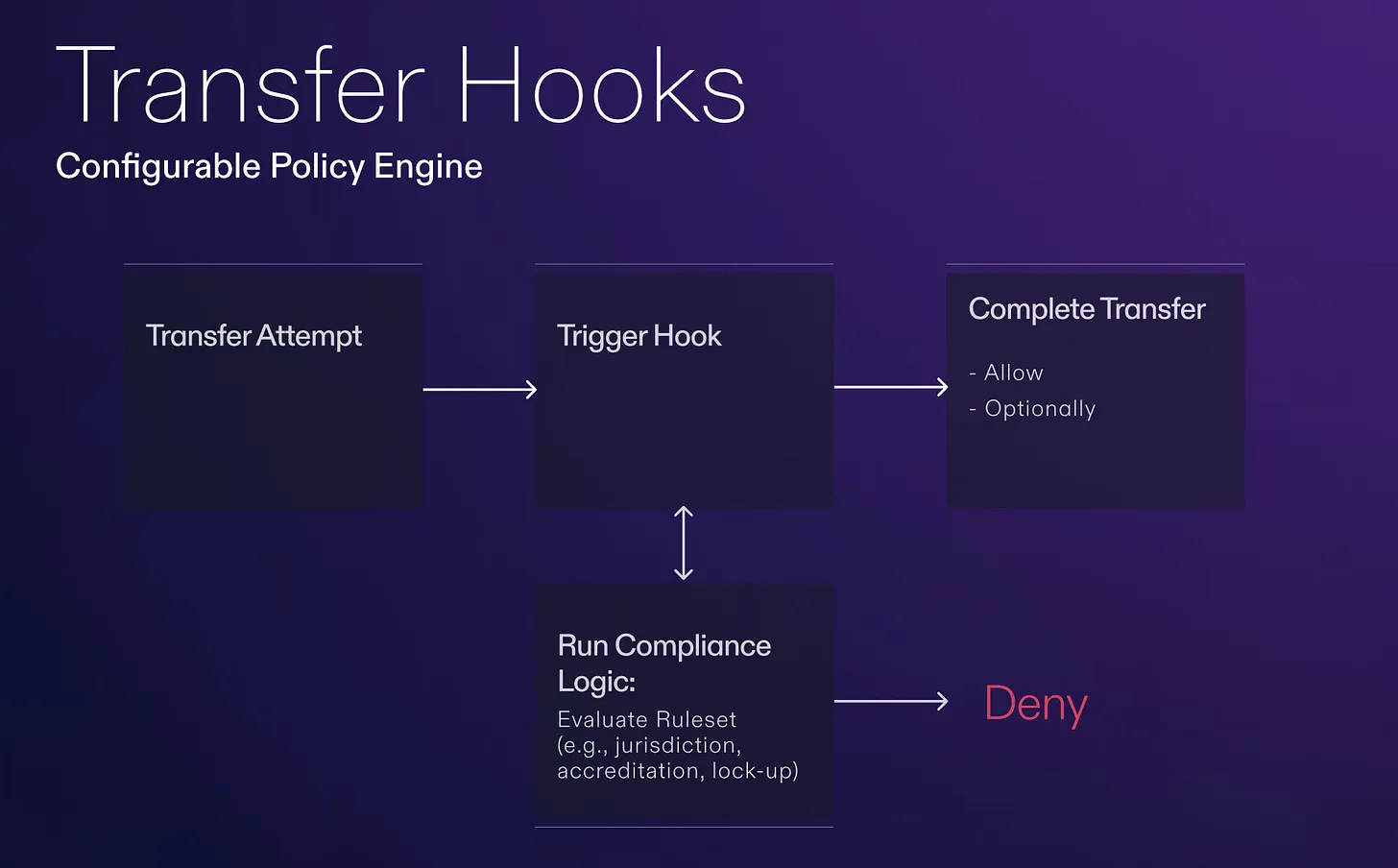

Compliance. Public chains like Solana provide features like Token Extensions which provide transfer hooks which give the token issuers control over which wallets can interact with their token and how tokens/ users interact. Additionally default account state configures and enforces token account permissions. This means that all capital controls, KYC and AML required by the regulators can be embedded at the token level.

Robustness. The decentralised nature of blockchain networks ensures that the network is able to function even when parts of it go down. During the recent AWS outage networks like Solana continued to function while many centralised Web2 services went down.

Conclusion

The advent of DeFi and large pools of internet native capital creates a unique opportunity for India to access new sources of capital while deepening its capital markets. The design of such an initiative will require careful consideration to ensure the widest possible access and ease of use. A standardised protocol can help connect the disparate capital pools and markets together through its protocols and standards thereby ensuring that regulated issuers can access DeFi capital in a safe and seamless manner.

Thanks to Farhat Kadiwala for the amazing graphics and the poignant cover image!