Incento: The FinTech Layer around Crypto Payments — A Deep Dive

A deep dive into the Incento, building on one of the hottest themes of “Web3 x FinTech”, the on-ramp and off-ramp problems, and how incento is solving them, the product teardown, and many more!

Let’s start with a billion-dollar question: “How can we get billions of users for Web3?”🤔

Obviously, demand is one thing but a good Web3 onboarding experience is probably something everyone should care about. To understand the onboarding problem, remember when you used the Web3 wallets like MetaMask or phantom for the first time:

Navigating centralized exchanges (like Binance) → completing KYC → transferring USD or INR (fiat) from bank → buying volatile ETH or SOL → setting up a Metamask or Phantom wallet → write your seed on a piece of paper → transfer ETH or SOL from Binance to wallet → find Web3 DApps to sign up on and link your wallet and so on. Phew😪

Similarly, withdrawing your money into a bank account is an equally painful process. This is certainly not how we will onboard our users from Web2

Today, let’s have a look at how Incento, one of the hottest FinTechs trying the solve the biggest problem of off-ramps & on-ramps through a unique wallet-based solution!

This deep-dive essay is structured into

The emergence of Stablecoins in ascending markets

Earning in Crypto and On-ramp and off-ramp problems of today

DeFi mullet: Solving for adoption and User-experience

Product teardown of Incento (a Global Venmo or Paytm ) and the complete analysis of its features, fundamentals, and how it feels 🎯

The Business Model and Go-To-Market Strategy

The Bull and Bear case for Incento 🏄🏻♂️ (The juicy part :p)

Ready? Let’s dive right into it🚀

Let’s first understand the importance of stablecoins👇

Importance of Stablecoins: Earn & Transfer!

Seeing how the fundamental concept of Crypto got formed, we can clearly see changing the way the ‘international payment system work’ is the motto from the beginning. Bitcoin started with the same aim in 2009: to be the global digital currency. So as a result international transfers originating and terminating in developed countries (like US & Europe) have become more cost-effective and faster as these have more liquidity due to the size of the economy, while payments to and from emerging countries (like India & Brazil) have become more expensive due to low liquidity of their currency pairs.

In those places, it is still slow, expensive, and might take several days to finish, even in 2022, the question still remains: how do we push international transfers to the next level? This is where the adoption of web3 can help in sustaining financial inclusion and accelerate the benefits of financial system efficiencies in emerging markets.

Talking cross-border payments, aka International transfers or remittances are mainly seen through the lens of people living abroad in developed countries sending financial support to their friends and families in developing countries. In fact, in 2021, transaction volume reached $589 billion, according to the World Bank.

While the remittances originating from developing economies to developed economies are lower in volume, they are undoubtedly not insignificant as they are hundreds of billions of dollars. These kinds of international transfers are still in need of better solutions.

A user of an emerging country is at a disadvantage due to the financial system that includes severe challenges for international money transfers, starting with a huge exchange fee markup of about 10%, high transfer fees, and an extended settlement time of up to 5 days. In fact, as per World Bank, depending on the destination country and the type of service utilized, a $200 remittance can incur costs ranging from 5% to 9.3%^.

The answer lies in one specific type of cryptocurrency: “stablecoin” — the least volatile of them all. Stablecoins are built to not fluctuate in price while still giving users the benefits of crypto. Their value is tied to other assets such as government-issued currency, like the U.S. dollar, precious metals — gold, for instance, and algorithmic functions (though that didn’t age well for a token recently; UST crash⚡️).

Stablecoins like USD Coin (USDC) are getting integrated with global payment networks like Visa Inc. which allows transaction settlement using USD Coin. USDC has partnered not only with the largest crypto exchanges like Coinbase & FTX, but also, Marketplaces like NBA Top Shot, and even some traditional international payments services like Moneygram. Along with USDT, USDC also grew so rapidly that, it has now become a primary mode of payments in Web3 with more than $50 Billion in circulation in just 3 years!🚀

And now you might be thinking….

Why Stablecoin settlements over SWIFT?

As Venture beat, brilliantly wrote about stablecoins —

“Crypto worldwide usage jumped over 880% during 2021, with P2P platforms driving cryptocurrency adoption in emerging markets. Unsurprisingly, Vietnam and India are at the top of global markets in terms of cryptocurrency adoption by individual consumers.

As cryptocurrency adoption continues, facilitating international money transfers from many other emerging markets would become faster and cheaper than traditional payment rails. Specifically, with the enhanced role of stablecoins across global payment networks for settlement, these sets of cryptocurrencies will power the next generation of international money transfers.

A good use case for this stablecoin settlement process from the emerging markets could be the international education market. As more international students originate from emerging countries(as they say Ascending nations), a cost-effective and faster way of cross-border payments saving billions of dollars is undoubtedly the need of the hour”.

Earning in Crypto: Just the beginning

The emergence of Web3 has created new mechanisms on how we play, learn, organize, and socialize with ownership and income generation. The average person in the future will not only have a standard ‘9–5’. Instead, income will be earned in non-traditional ways by taking actions such as playing games, working in guilds(groups of people), learning new skills, creating art, or curating content. This kind of shift in how we earn is not unusual or unexpected.

However, the key challenge with the average user actively ‘earning’ in this future is that crypto financial services are spread across in complex systems and have limited connectivity to regional payment rails i.e the local country’s fiat currency. These local payment rails are more often than not well optimized for crypto financial services, and will not be able to serve the demands of the crypto earning population.

And this is where the problems kick in, the roadblocks, let’s understand what they are👇

The Classic On-Ramp & Off-Ramp Problems

In the world of DeFi & crypto, there are a lot of hard problems which people are trying to solve, and one such problem, that has notable overlap with traditional finance is — “on-ramping and off-ramping”, but what on earth do they mean?

On-Ramp: The process of using regular, fiat money (probably your cards or bank transfer) to buy some crypto. Essentially, it lets you leave the so-called traditional monetary system, and enter into the Decentralised Finance (DeFi)

Off-Ramp: Contrarily, the process of “cashing-out” of crypto, i.e. converting the coins or tokens back into fiat cash i.e withdrawing it into your bank account.

A good way off-ramping can be done is by simply buying goods or services straight with your crypto. This sounds direct, but it isn’t. While cryptocurrencies are starting to get accepted as legal tender by a few countries like El Salvador, and even corporations like Tesla, we’re still a long way from mass adoption.

So although you’ll have to chew some glass to find places (those are a phew!) that accept certain coins and tokens as payment, this is unlikely to be your principal off-ramp for now, until we see mass adoption of crypto by merchants.

So what remains? Yes, an EXCHANGE

Off-Ramp through an Exchange:

Centralized crypto exchanges like Binance, provide a way to convert your crypto back into Fiat money (USD or INR). So what you need here is to check if the exchange supports conversions into your chosen fiat currency. Then you will be able to ‘sell’ a given amount of your crypto and have the fiat equivalent paid onto your regular bank card — the transaction might have a small service fee, (which depends on the platform).

To understand the whole off-ramp process in India, you can take a look at this thread — which takes more than 7–8 steps to complete.👇

Real freedom comes from using your crypto with the same agility as fiat money — that means instant transactions, trustworthy payment options and not having to plan ahead just to buy some drinks with your Crypto, But with most retailers still not accepting direct crypto payments, and exchange off-ramps still prohibitively slow, so this off-ramping process for crypto can be a major roadblock to its utility and value.

Many ascending markets face substantial currency devaluation, it makes tenants buy cryptocurrency on P2P platforms in order to preserve their savings and avoid any further devaluation of their hard-earned money. Though some may be willing to buy cryptocurrencies with no foresight of being able to cashback out into traditional currency, this is not an everyday and common position, nor is it a feasible one for most people. This may not appear quite realistic for supporters of the crypto to expect people to infuse directly, without worrying about converting their crypto back into fiat cash, with the promises and FUD that maybe, someday, goods and services will be exchanged for cryptocurrency rather than traditional money.

Payments are one piece of the puzzle in Finance, but to go completely bankless, there needs to be a lot more!

The DeFi Mullet: FinTech in the front and DeFi in the back

Bankless came up with an excellent concept of DeFi Mullet, which simply implies the next generation will not even know they are using DeFi. Just like 20 years ago, the question was “Is it an internet company?” — Today, almost all are! 10 years ago, “is it a mobile company” was a common question but now the majority are. Similarly, 5 years down the line, people will stop asking “is it a crypto company” as most financial services companies will have a crypto component. Why?

Traditionally, FinTech is solving gaps in the user experience by abstracting a UI/UX layer on top of the existing bank infrastructure, but it never remade the core infrastructure. They have either built better products (in UX, price, audience, or execution) or optimized the finance value chain by APIfication (i.e use superior-tech), but they didn’t reinvent the financial wheel.

On the other hand, DeFi is promising to reinvent the financial wheel & has already crossed $200 Billion in Total Value Locked (TVL), but there are a few problems faced, halting the mass adoption:

Lots of Noise: Huge number of Ponzi projects, rug pulls, hacks, and scams going around make it very difficult for a newbie user to choose the safe & best protocol.

Awful UX: Long on-ramp and off-ramp processes, custodial wallets, and complex DeFi concepts make it look like a maze for the masses.

The hunch here is: just like FinTech solved the User Experience part by building a UX wrapper around traditional banks and financial services, FinTechs can also solve this for DeFi too! For instance, FinTechs offering APIs to buy NFTs using Credit Card are solving for on-ramps and off-ramps and FinTechs offering high DeFi yields are solving for a seamless high yield generation experience.

In nutshell, for DeFi to reach billions of users, a ‘DeFi x FinTech’ is vital. Essentially, allowing protocols to keep experimenting and innovating in the back, while FinTech becomes the consumer layer, solving for adoption and user experience.

Now, that we have understood why stablecoins are important, what are on-ramps/off-ramps and how can FinTech solve the user experience layer for DeFi at large. Let’s now focus on the spotlight project — Incento, and how it is solving some of the crucial problems, we have discussed earlier!

Ready? LFG🚀

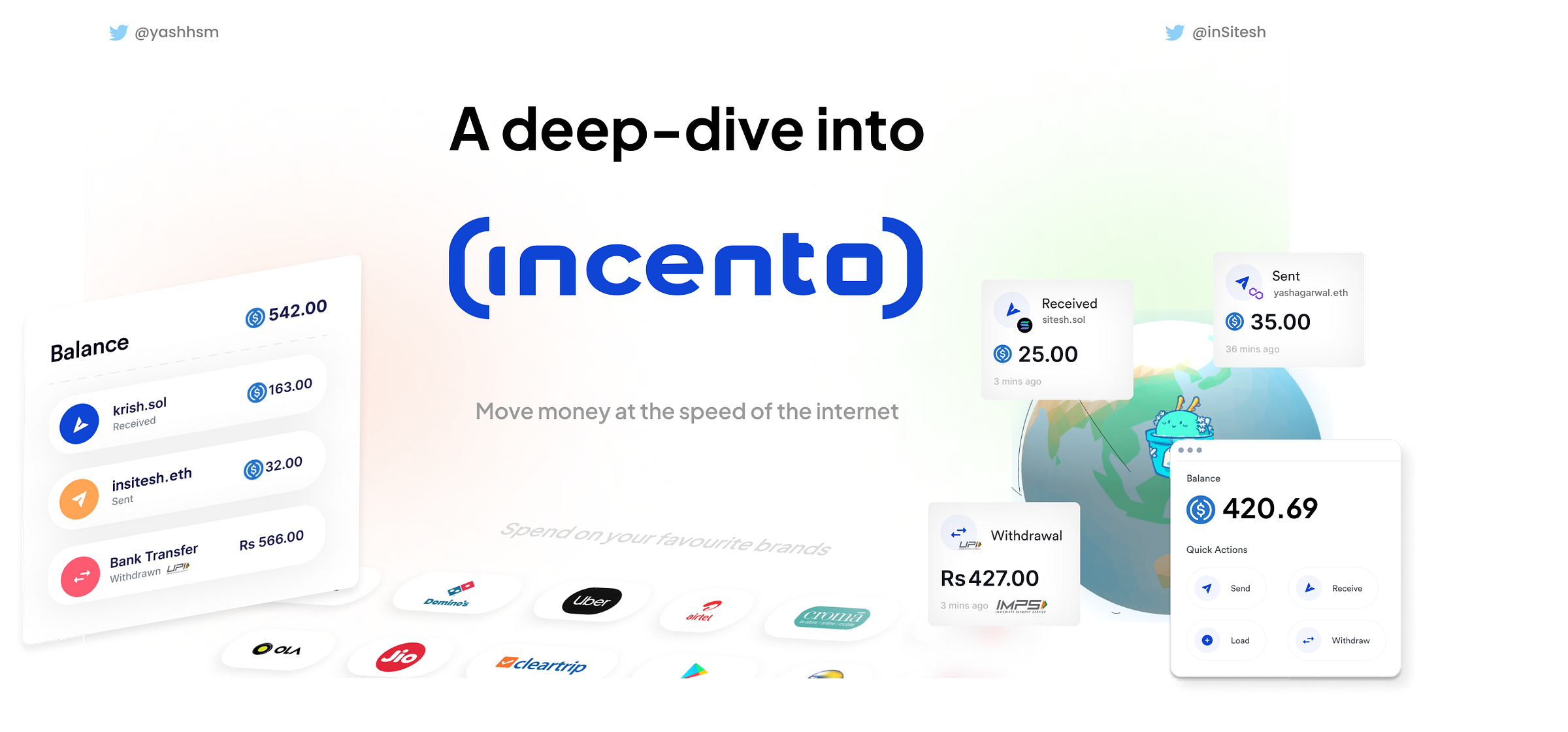

Enter Incento: The FinTech around Stablecoin

A single platform that resembles a traditional ‘fintech’ that combines the speed, connectivity, and efficiency of crypto-financial infrastructure while seamlessly plugging into regional payment rails (via on-ramps & off-ramps) and abstracting away all the blockchain complexity under the hood.

Think of Incento as a “Global Venmo or Paytm”. Just like any payment wallets app creates your own wallet, in which you can load money, transfer it to your friends and withdraw money — Incento does exactly that, but instead of a fiat currency (USD or INR), it involves USDC.

Now, why USDC?

Pegged to the world’s most dominant currency — US Dollars and to ensure stability, USDC is backed by $1 in reserves in the form of cash and short-term treasuries.

It already has more than $50 Billion in circulation and is run by Circle, which is backed by Coinbase, and BlackRock along with marquee partnerships like Visa, and FTX!

Multi-Chain: Launched in 8+ major blockchains like Ethereum, Avalanche, and Solana along with high liquidity across exchanges.

Currently, Incento supports USDC on two major networks: Polygon and Solana, both being the cheapest and fastest chains with rapidly growing ecosystems.

The Product Teardown 🧩

Let’s understand the various parts of products one by one:

On-boarding

Dashboard

Making transactions

On-boarding & Sign-up: Seamless 🌊

While making accounts in the existing Web3 non-custodial wallets like Metamask or Phantom, one has to note down their public keys and write down the seed phrase on a piece of paper or a secure note-taking app. One can always make custodial wallets in Coinbase or Binance, but they have custody of your funds, and you actually don’t own the tokens completely.

With Incento, you not only get the non-custodial wallet with complete control of your funds but also get seamless onboarding. Let’s have a look at, how can get onboarded:

Get Whitelisted: Incento is currently in private beta, and once you get your email ID whitelisted, you will get an email confirming your whitelist.

The Magic Link: For a seamless sign-up and login, Incento is using Magic’s developer SDK, which enables passwordless Web3 onboarding. The way it works is — a) Enter the Email Address while signing up or log-in b) A magic link is sent to your e-mail address, which upon clicking, logs you in

The Magic Link Pitch

So, there’s no need for a seed phrase noting down, and the login/sign-up becomes a cakewalk! Once, you are logged in, you are landed on the landing page. It automatically creates non-custodial wallets in three chains: Polygon, Solana, and Ronin! (How cool is that!)

3. KYC: Now, this might seem a bit anti-web3, but this is very essential as it’s dealing with Fiat currencies and need to obey the law of the land. To avoid any fraudulent activity, they need to follow proper KYC (Know Your Customer) and AML (Anti-Money Laundering).

Incento has made the KYC process quite seamless by just asking for necessary information:

Select from a list of the country (Currently, it’s only India, but definitely, it will expand to other countries)

Selfie: Upload your photo or click a selfie

PAN Card: It is mandatory in India as it acts as an identification number for income tax purposes.

Supporting Documents: A user can select from either Aadhar Card, Voter Card, or Passport.

Once, you upload the Selfie, PAN Card, and Supporting Documents, you will get a verification pending. It generally takes a few hours to get the KYC verified and once it’s verified — voila! We are now ready to do transactions!

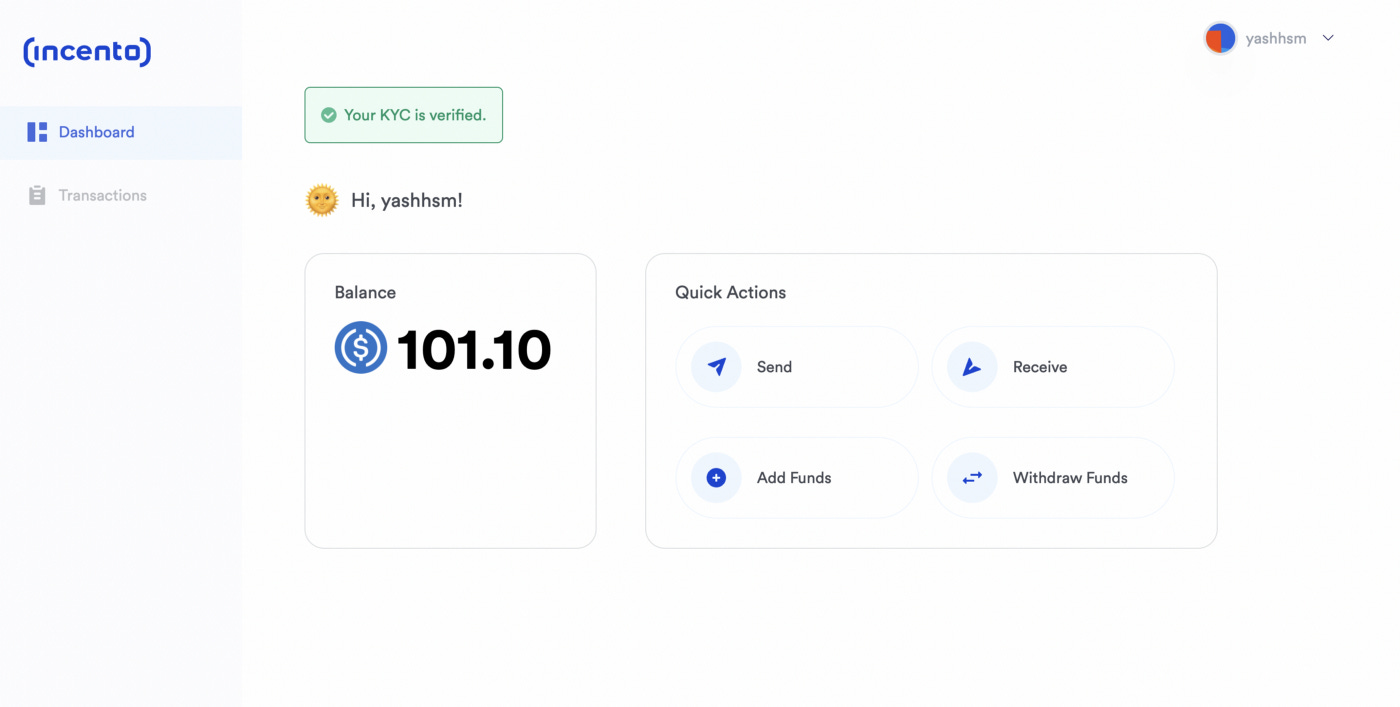

Dashboard: Elegant and Clean UI🍁

The Incento Dashboard is clean and easy to use, with a white & blue combination used elegantly to gain the trust of a first-time user. This also gives more of a FinTech feel, than a Web3 feel, which generally uses dark themes with all those shiny gradients — which is good for the fact, that it helps establishes trust 🤝

The big display of wallet balance along with the Call-to-Actions (CTAs) in the middle of the screen, enables users to perform all actions swiftly. The left navigation panel enables the user to switch to various sections of the applications (currently it’s just transactions, but as we go on, this keeps getting added).

Transactions: The transaction tab enables users to check all the transactions made through the incento app. The clean tabular format has minimal information which makes it easy for a first-time user to understand their transactions at a glance.

Making Transactions:

Incento provides for four types of transactions:

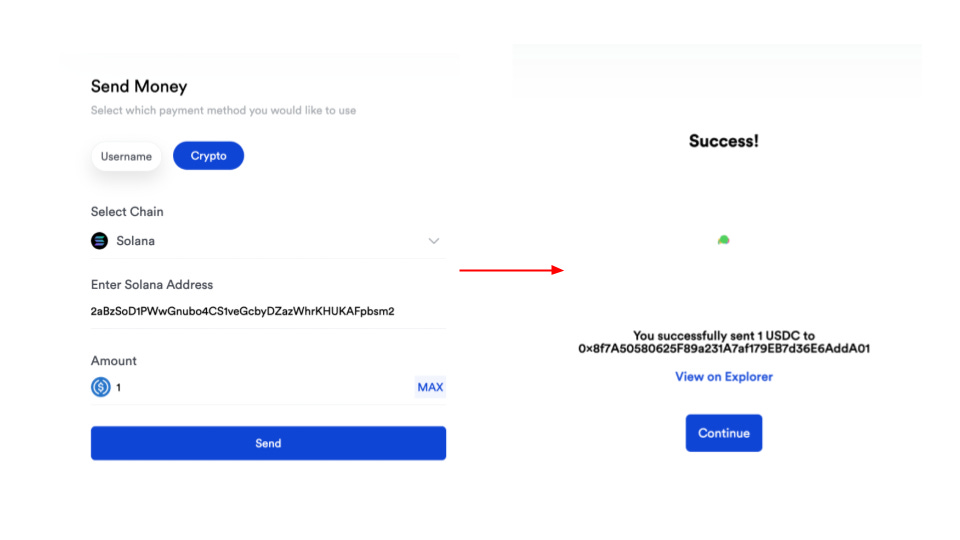

Send: Enables sending of USDC, via two options: —

Username: Just like in a payments wallet app, you can send money to your friends by using their unique ID or contact number, you can send USDC to your friends in Incento using their Incento username. This is a killer feature, as it substantially enhances the User Experience!

Crypto Address: Similar to any Web3 wallets like phantom or Metamask, you can send USDC to other crypto wallets, and it can be any address, be it a centralized (binance) or decentralized wallet (phantom, metamask).

The transactions are completely on-chain and once the transaction is complete, you can also check the transactions on polygonscan or solscan via “View on Explorer”

2. Receive: It allows receiving payments via two major options:

Address: Just select a network i.e Polygon or Solana, and you will get your wallet address, which you can send to your friends or clients, from which you can receive payments in USDC.

Payments Link: This is an absolutely amazing feature, just like a payment gateway like stripe, it creates a payment link, which you can share with your clients or friends to collect payments.

All you have to do is, enter the USDC amount, you wish to collect and a description (optional), and then upon clicking, “Create link” — a link is created🎉

This link can be either copied or shared via social media channels like WhatsApp, Telegram, SMS, or Mail

When your client or friend clicks on the link, the payment screen opens up. Upon clicking “continue”, they can select from either polygon or Solana, and the client can scan or copy the address to which they can send the required USDC.

3. Deposit: This functions similar to “Receive”, where you can just go to your existing wallet like phantom or metamask, and transfer your USDC to Incento’s wallet. In this, you can also deposit Ronin SLP (popularly, used for Axie Infinity).

The Team will be soon adding On-ramp i.e Deposit money from your local bank account to your Incento Wallet, and this can be a complete game-changer.

4. Withdraw: It simply makes the whole Off-Ramp process, just a few clicks! It also provides two options to withdraw:

Bank: This is simply amazing, as you can get your USDC to get converted into Fiat (INR). All you have to do is, enter your bank account details (Account Number and IFSC Code) and add the Bank account. Once it’s done, you can simply enter the USDC amount and a real-time exchange rate is shown. Based on the exchange rate, the total amount is shown and you can select the bank account in which you want to withdraw the amount.

Once you click on withdraw, the amount gets credited to your bank account in just a few seconds via IMPS which is super fast and instant!

How does the off-ramp work in the back?

As soon as the user selects the USDC, the exchange rate is fetched by the partner exchange and the rate is displayed on the screen.

The USDC is then sold to the exchange, and the partner exchange releases the INR.

The INR is processed via a payment agent, who transfers the equivalent amount from the exchange to the user’s bank account.

Crypto: In this, you can just enter your Solana or polygon wallet address, and the USDC gets transferred to your phantom or metamask or binance wallet.

Now, that we have understood the product, let’s also have a look at their potential business model👇

The Business Model 🍕

There’s a mantra: If money flows through your platform, you can always figure out monetization — applies to Incento as well. Here are a few potential revenue sources:

Payments: While on-chain payments don’t make any revenue, in fact, Incento might be sponsoring gas fees for on-chain transactions. But the on-ramp and off-ramp are the real goldmines, as they can simply take a spread from exchange rates without charging any explicit fees from the user. For example, if the prevalent exchange rate is 1 USDC = Rs. 82, they can simply give their user 1 USDC = Rs. 81.5 and earn Rs. 0.5 for each USDC withdrawn. However, they also need to cover up the costs like trading fees, payment gateway fees, etc.

USDC Deposits: As Incento is a wallet play, it can also generate yield on the deposits while ensuring enough liquidity. For instance, banks keep 5–10% of the deposits as cash and bonds and give out the rest of the money as loans i.e earn high-interest income from the loans. Similarly, Incento can simply earn 4.75% by depositing USDC in Circle Yield (Circle is the issuer of USDC). Although, they have to give up their non-custodial status while enabling this!

While these are just the potential revenue sources as per the current product, the possibilities are endless in the FinTech play. For instance:

Earn Merchant commissions by issuing USDC-powered cards

Earn yield margins from offering Investment products

Service fees from services like payroll processing

Backers and Traction:🎒

Incento being in private beta, is currently more focussed on product iterations and bug fixes. Despite being in private beta, they have already processed more than $35K+ and counting via their partnerships with gaming guilds like IndiGG and facilitating payouts for 2 skill games which are already doing more than $100K in weekly volumes. The market for gaming guilds off-ramps is huge as gamers in emerging markets like Indonesia, and Vietnam will be earning game native tokens, and they would need a seamless token to fiat (INR) conversion for their daily needs. Along with these, Incento is also being well received in DAOs like Superteam, which has tons of people earning through USDC and has cumulatively earned $450K+ till now!

The dynamic founding duo of Krish Tripathi & Chetan Badhe, who are experienced in Crypto and working in this domain for 2+ years, adds credibility to the project. The founders are also the graduates of consensys tachyon and won circles USDC money hacks hackathon which was judged by the CEO of the circle himself. Further, Incento is backed by Consensys, the company behind the most widely used Web3 wallet, Metamask, and Incento will be soon raising its seed round!

Roadmap:

Gift Card: Incento will be soon launching the gift cards feature, where you can directly spend crypto in your favorite brands and marketplaces like Amazon, Dominos, Uber, etc using gift cards. For instance, the USDC gets converted into Amazon gift cards, and then you can use that Amazon gift card on that particular platform.

2. On-Ramp: Incento will be soon adding on-ramps, where you can directly purchase USDC with your Fiat money i.e using Internet Banking or UPI (Unified Payments Interface) or Credit Cards.

3. Connect Exchange or Web3 Wallets: Incento will soon allow you to connect your crypto exchange account (Binance, FTX) or Web3 wallets (Metamask, Phantom) to your Incento account and move funds to your exchange without any fees whenever you need to.

Further, as per the founders, Incento also plans to scale globally building on top of FTX Exchange Whitelabel and Circle, the two giants with massive distribution in Crypto! The Go-To-Market strategy seems to be clear — partner with companies with distribution and spin-off the flywheel of adoption.

The Bull Case for Incento: Crypto-powered Banking Stack🐂

Incento can expand in breadth and offer a wide range of crypto banking services like:

Yield Products: Just like a bank savings account, Incento can offer an interest rate on the USDC kept idle in the Incento wallet.

Buying Crypto: Enable users to buy not just USDC, but also various cryptos like Solana, Ethereum, and Bitcoin!

Crypto-powered Card: By partnering with networks like Visa or Mastercard, users can spend the Incento USDC using Incento Card in all major merchants across the globe.

Payroll & Invoicing: Users can set up a direct deposit and companies can use incento for seamless Payroll Integration. Another good use case will be to build an invoicing suite of tools for freelancers.

Besides, building on-ramps and off-ramps for emerging markets like Southeast Asian countries, Africa, and Latin America which is largely untapped can be a very big market in itself. The Total Addressable Market (TAM) is simply endless with multiple revenue streams possible!

The Bear Case for Incento: Regulations & Competition🐻

While the on-ramp/off-ramp and the crypto-banking market are smokingly hot, the grass is not all green. Regulatory challenges in respective geographies can significantly hamper the prospects of Incento’s growth. These can include a Blanket ban of crypto, high taxation of crypto (like 30% in India), Banks being unfriendly to fiat payment rails, and so on!

Given the huge market, the market is also heating up with the fierce competition with heavily-funded billion-dollar on-ramp/off-ramp players like Moonpay, Transak, Ramp Network, and Wyre! Further, many players like OnJuno, and Kash are already well-established crypto-banking players.

Conclusion: A FinTech x Crypto play

Despite these regulatory challenges, ramps have a tremendously promising future. It will not be a winner-takes-all outcome but there will be a handful of dominant players with a long tail of smaller companies that service a particular niche or excel in a particular aspect of their product offering.

Incento can target specific geography or a niche and nail that perfectly and then expand to other product offerings.

With launches like Stripe crypto, this gives further push to the mass adoption of crypto, and players like Incento is well-suited for receiving payouts via Stripe.

Incento is looking solid in their first version of the product, and we can already see a huge number of Indian gamers and freelancers like us to be using their off-ramp services. Overall, we are extremely bullish on the “FinTech x Crypto” thesis and it will be interesting to see how Incento solves for the $100 Billion+ Market! 🥂

Ready to move money at the Speed of the Internet ⚡?

That’s all folks!

That was us diving deep into the emerging problems of this ascending world and decoding Incento for all. If you have any suggestions or want us to deep dive into your project, we would love to connect — Sitesh Sahoo and Yash Agarwal

Until then…

Sources:-

Remittance-flows-robust-73-percent-growth-in-2021 (World bank)

The-future-of-international-transfers-stablecoins-for-cross-border-payments

PS: Shout out to Krish (Founder of Incento) for sticking to the end and giving information about the product day in and out.

DO YOUR OWN RESEARCH. We make no representation or warranty as to the accuracy or completeness of the information contained in this report, including third-party data sources. This post may contain forward-looking statements or projections based on our current beliefs and information believed to be reasonable at the time. However, such statements necessarily involve risk and uncertainty and should not be used as the basis for investment decisions. The views expressed are as of the publication date and are subject to change at any time. Read the full disclaimer here.

Amazing deep dive 🙌🏻🙌🏻

The idea of mixing Fintech UX with DeFi is interesting. In addition to pulling masses into Web3, this, along with KYC, will also increase credibilty of crypto-companies among regulators.