Inside Solana Spaces & SpacesDAO

A novel retail experience & the world’s first on-chain retail cooperative

Our retail shopping experience has seen a dramatic transformation in the last century. Whether that is departmental stores like Macys, supermarkets like Walmart, cash and carry like Costco, e-commerce like Amazon or the vast range of specialised and boutique stores.

Franchising has played a pivotal role in accelerating this growth. It created what appears to be the perfect marriage - enterprising individuals get access to capital and expertise & companies get access to growth without much equity dilution, capex or operational overhead.

As per Statista, in the US alone, franchising contributes ~$827bn to the economy, employing 8.5 million people across 792,000 establishments. That is ~3% of GDP and 10.5% of all businesses being franchises.

In this essay we’ll first understand the pros and cons of the franchise model. Then take a quick trip down the history of growing retail networks through cooperatives. And finally, talk about the Solana Spaces retail experience and SpacesDAO as a model for retail growth.

Solana Spaces is a unique experiment on two levels, firstly it is pushing the frontier of the retail experience. There is no single definition of what a physical space for a digital community looks like. In fact, we’re yet to see digital native cross-category retail really take off. Most retail either started in physical locations first or more recently D2C retail which has single category retailers.

But secondly, through SpacesDAO they’ve taken the cooperative approach to scaling instead of an owned or franchised model. This invites & encourages independent minded store owners to operate these locations uniquely as opposed to following a prescribed template.

We’re really excited about the potential impact this can have in shaping both crypto and retail. Thanks to Vibhu, CEO of Solana Spaces for his inputs to this essay.

Let’s dive in.

The Franchise Model

The franchise model consists of two primary entities: the company or the brand that owns the IP (franchisor) and another person or company that wants to operate one or many outlets for them in particular locations (franchisee).

The story typically goes like this,

A small business achieves success running a physical store (fast food, repairs, apparel, etc) in a few locations.

They are ambitious and want to scale.

Instead of buying/leasing properties and hiring staff to run each location, they outsource it to entrepreneurial individuals and companies. These are called franchisees.

They (franchisor) provide them with a brand, training, marketing and charge a fee. In return they (franchisees) put down the money to buy/lease a place and bear the cost of operations.

This can be a win-win, because the brand gets low-cost growth and the local business gets a global brand and expertise to operate.

So, if you eat at a McDonalds in India you’re actually eating at an location managed under Hardcastle restaurants Pvt. Ltd or Connaught Plaza Restaurant Pvt Ltd. These are operating under the brand and SoP defined by the company , The McDonald's Corporation, headquartered in Chicago, Illinois, United States.

In this case, McDonald’s is the franchisor - they own the brand, define the operating procedures, are in-charge of marketing etc. In-return, they charge a royalty and service fee. And the two companies - Hardcastle & Connaught Plaza are distributing and managing the McDonald’s India franchisees. The franchisees are responsible for securing a location, running local promotions and operating the outlet. They benefit from the strong brand, IP and operational knowhow. It becomes easier to raise capital once you have a franchise of an established brand and chances of success dramatically increase as well. This justifies paying the fees.

Here’s a quick recap of on franchising.

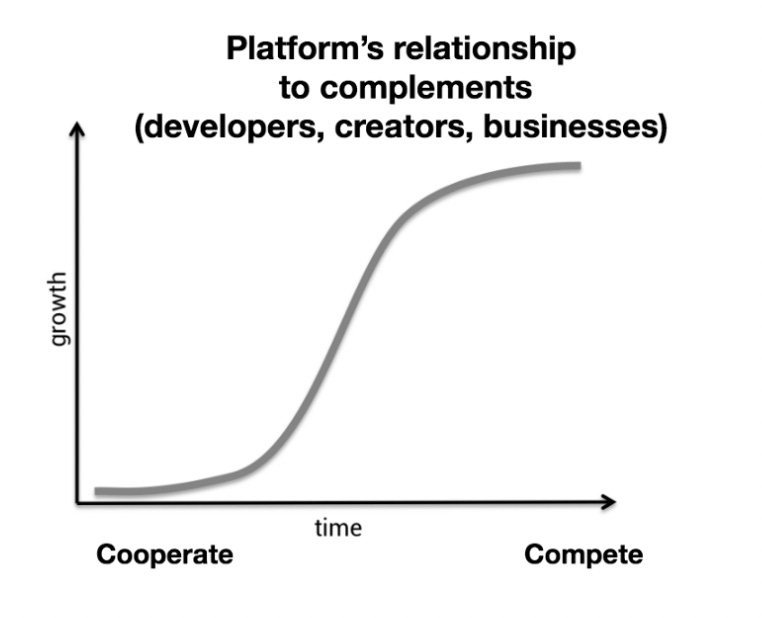

Now that we’ve seen the benefits, let's look at the challenges with the franchise model. It suffers from the same zero-sum dynamics that platforms do.

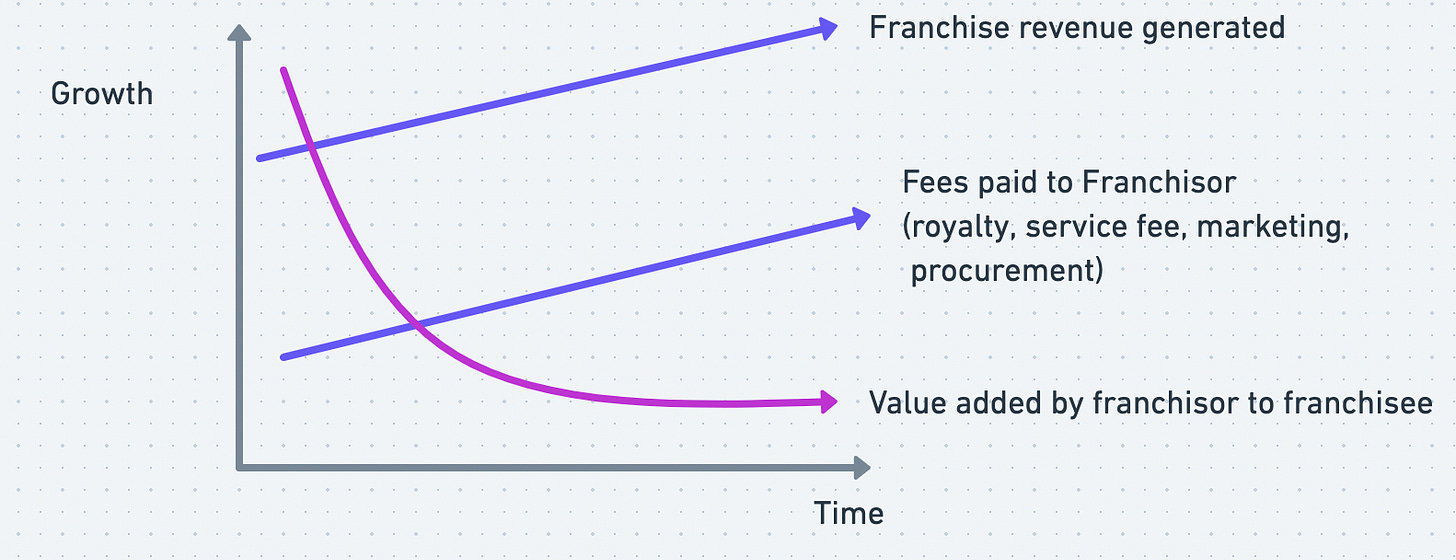

While revenue is growing, both the franchise and franchisor benefit from working to maximise the size of the pie. But, once the revenue growth inevitably stagnates to the potential of the micro market (i.e. the physical neighbourhood surrounding the store), it becomes a zero-sum game.

To exacerbate this problem, the value added by the franchisor also goes down over time. The franchisee has acquired sufficient operating knowledge within a year or so, along with possibly a better understanding of their local market. Brand value, if any, definitely carries through time but arguably the physical salience of the store might be sufficient to draw the crowds in.

Basically, the fees that seemed fair in the first year start seeming unjustified. The franchisee being locked-in to their lease/property has few exit options. Most franchise agreements include non-compete clauses and cool off periods upon termination which make it harder for people to go independent.

Until now, the market is telling us that these trade-offs are worth it. Franchisees are accepting these economics and risks from the variety of options available. Franchisors are happy with this model of growth. And consumers are getting access to a pretty awesome retail experience with stores on every corner, affordable prices and a great selection of products.

However, now that the barriers to commerce have reduced across the board - i.e. creating a brand and distributing products is easier than ever - newer models for retail are now possible. In the rest of this essay we’ll talk about how co-operatives could provide a viable alternative to franchising in many instances.

Retail Co-operatives

The idea of a retail co-operative isn’t new. In fact, in my opinion, it pre-dates the popular origins of franchising itself. The story goes back to Martha Matilda Harper who set up a network of hair salons in the 1890s.

The Harper Method : A cooperative franchise?

Born in Canada, Martha Harper didn’t receive a formal education & spent most of her life working as a domestic servant for a physician in Ontario. During her time there she developed an understanding & respect for the principles of science. Her employer also taught her much about hair health and passed on his hair-tonic formula to her when he died. She eventually immigrated to the United States where she continued working as a domestic servant before investing her life savings of $360 to start her own hair salon - The Harper Method.

Well, she first invested in legal fees to get “approval” for a woman to operate a business. But, within a few years of receiving a month-to-month lease & setting up in NY she had the most elite & exquisite clientele. And it was one such client, Bertha Palmer, who inspired Martha to expand and set up more salons.

The first 100 franchises were given exclusively to women, who like Martha had spent their lives as domestic servants. She trained them in the use of her products, delivery of services, setting up the right ambience etc. She also apparently invented the reclining Salon chair but sadly didn’t patent it. While Martha became really wealthy, her motivations were hardly just financial,

“She really felt that by developing her salon system she was helping women establish a financial life of their own beyond their husband’s, or allowed them to live without a husband.” - Source

She pioneered what is today the franchise business, it is unclear whether the Harper empire was a co-operative or a franchise business in reality. The first 100 choices were by no means “logical” ones - these women had no experience running a business. There was a sense of community among the employees and customers that not only helped grow the business but went well beyond work. They were truly like a family, graduating from “Harper Academy”, calling themselves “Harperites”, and in disbelief at the new economic freedom they’d found.

Maybe this is what makes co-operatives special. Instead of being motivated by the sole aim of maximising financial value accrued to the centre, they can maximise the socio-economic impact to their network. They don’t need to achieve domination or maximise market share, instead they seek to push boundaries and improve the lives of everyone who’s a member. Companies are designed to survive forever unless bankrupted, maybe cooperatives can disband once their mission is accomplished…?

But is this also why they’ve not had nearly the same footprint or impact as the profit-seeking enterprise in the last century? After Martha Harper stepped down, the Harper method quickly lost its touch, had multiple owners and eventually shut down. Today there is a tyre shop in place of the original store. But they did make a massive impact in creating two multi-billion dollar industries - Salons and Retail.

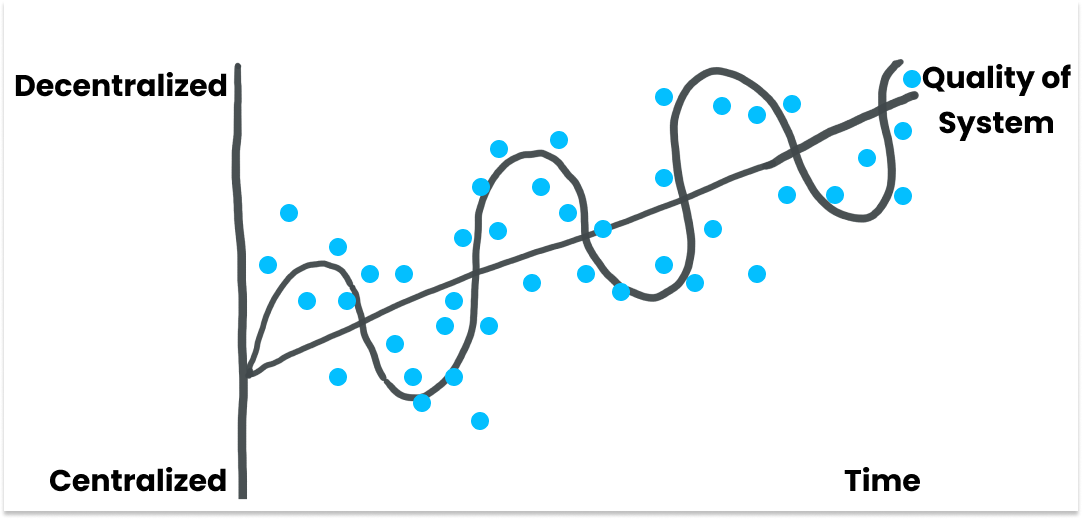

PackyM recently wrote an essay titled decentralisation, where he argues that society oscillates between centralisation and decentralisation over time but consistently improves the quality of civilisation. Given the last century was dominated by the company and franchise model, maybe cooperatives will make a comeback now?

I think this is likely because the innovations of the past century have empowered individuals like never before. Advances in hardware & software technology make it easy for individuals to set up & distribute products and services instantly, from anywhere and at very little upfront cost. This means people can take on more risk if they want more control and upside from their work.

The entrepreneurs running the Harper Method stores didn’t have access to the distribution and virality of social media, the payments infrastructure of Razorpay & Stripe, the e-commerce tools of Shopify, housing and communities through AirBnB, and they didn’t have a growing community of people entering the high-skilled gig economy, all in a world that is both increasingly connected and disconnected at the same time...

But the entrepreneurs of today do, and they might prefer to organise as co-operatives to retain their independence and upside.

Solana Spaces

As of writing this essay, there are two Solana Spaces live- the store in NYC & the embassy in Miami. It is worth pointing out that these aren’t operated by the Solana foundation, but by an independent company led by Vibhu.

Let’s take a brief detour to talk about Vibhu’s background and why that makes him a good fit for this type of operation. Prior to Solana Spaces he was running a company called b8ta - providing Shopify like services for retail. Their initial clients were in the electronics and robotics space but eventually expanded to toys and broader experiential retail.

As per this article, b8ta’s software solution includes checkout, inventory, point of sale, inventory management, staff scheduling services and more. And it cost brands half of what it would cost to do it themselves. While they eventually shut down operations in the midst of covid, the experience sets them up perfectly for building something like Solana Spaces.

Crypto applications in payments, loyalty and retail provide them with a much larger and unconstrained canvas compared to traditional retailers. There are three key experiences available at the Solana Spaces today,

#1 Learn & Earn.

Anyone building a product or service within the Solana ecosystem can partner with Spaces to educate and onboard customers. This is important because the most novel experiences aren’t obvious to customers at first. The most popular format is for brands to set up a tutorial and seamlessly airdrop 10 USDC to once you complete enough. This is probably the highest RoI customer acquisition spend you could make and it is possible to continuously track the effectiveness of it by observing if that wallet continues to interact with the product. There’ve been over 10,000 tutorials completed so far.

#2 Wallet Onboarding.

We’ve said before that wallets will eventually become a feature within apps, but for now they’re our gateway into the ecosystem. Setting up a self-custodial wallet isn’t easy for people who are new to crypto. You need to make sure you download the correct app, set up a seed phrase and then wait for that magical first transaction. Now, you don’t need to rely on overly-enthusiastic crypto friends to do this. You could just stroll into the store, get guided through all of that and potentially end up with some USDC in your wallet for doing it.

#3 Solana Pay, Loyalty & Rewards.

Spaces provide the infrastructure for teams building payments to build and test experiences IRL. It also enables people who earn and hold USDC to use it directly without off-ramping. But most importantly, this enables merchants to directly integrate discounts, loyalty and rewards with their payments. An experience live today is receiving discounts based on the NFTs in your wallet. The best part is you can run these without needing to close a deal with the NFT collection.

This is the paradigm of wallet-aware commerce we’d spoken about in our essay on loyalty programs or PackyM wrote about in token-gated commerce. It is hard to stress how big of an unlock this is. Until now the biggest aggregators of reward programs have been banks and credit cards. Individual merchants have been limited by them wrt the experiences they can provide. That changes once the entire wallet becomes accessible at the discretion of the customer.

Spaces DAO

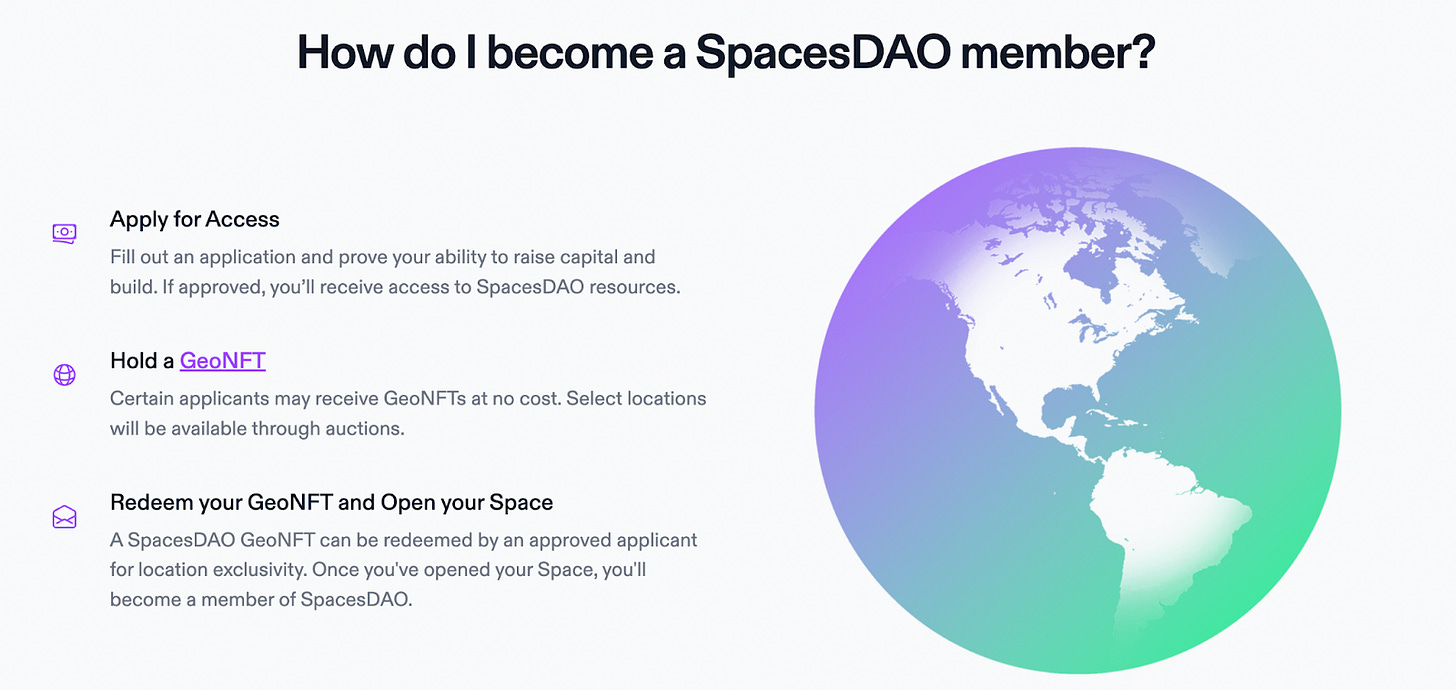

That brings us to the next question, how does Solana Spaces grow? How do they set up stores all over the world? Well, they don’t.

What I mean is, instead of doing it themselves which would be slow and expensive or driving it top-down via franchising which would be creatively limiting - they’ve chosen to set up as a cooperative. This is great because potential operators come in as equal partners and are encouraged to be creative in deciding the kind of Space they want to set up. It could be a co-working space, a coffee shop, a pizzeria, an NFT gallery, an adventure store, etc. This is really important because as we’ve said throughout this essay, there is currently no one definition of what constitutes a Solana Space. It would be damaging to either restrict its growth to the ideas of a small central team or grow via prescription.

The next benefit is that a cooperative structure aligns the incentives of all operators to the overall growth of Solana Spaces. If you’re running a franchise you only care about maximising your own revenue, you don’t really benefit from overall brand growth. But in a cooperative everyone is incentivised to work together and grow the pie, because they’re owners. Instead of the zero-sum incentives that franchisees have once growth stagnates, cooperatives like protocols are incentivised to be minimally extractive.

And finally, the reason why the cooperative is on-chain, is to make location rights tradable. By doing this they separate the rights to set up an abstraction between the rights and the business. They’re using Geo-NFTs to maintain transparent and immutable records of location rights.

These will by default be tradable just like the jpegs we’ve come to love. This is important because it converts growth into liquidity. Early believers who have capital but don’t have the time or capacity to operate a Space can support the DAO by purchasing certain rights upfront. If the Spaces brand grows and becomes valuable they’d be able to sell or lease them for a profit. There is the problem of domain squatters, but that should be easy to solve early on through a proper screening process. Currently most rights will be given only to people who are actually building and a few select locations will be auctioned.

Members of the SpacesDAO will get access to all the IP created by the core team so far. They'd have access to detailed information on how to set up and operate a retail space successfully and access to a team that has over a decade of experience at the cutting edge of retail. The GeoNFT grants provisional membership until the location goes live, after which it becomes full membership.

The team is aware that this is still very much an experiment and there will be challenges along the way. How do you ensure that members follow through and launch ? How do you ensure a certain brand standard is maintained? How do you resolve disputes over location rights especially for hot spots? The answers aren’t obvious in a cooperative model, especially one where you rely on the creativity of the operators to set up the right kind of space for their locality. We certainly hope that they’re able to overcome these and fulfil their ambition of putting a Solana store in every city in the next 10 years.

They’ve already received 100+ applications from individuals and teams looking to operate a Solana Space. Some of the applications are from ecosystem projects like the Cupcake team building in LA, NFT communities building out in Dubai and Salt lake city, DeCaf building in Mexico, etc. But there are also many traditional retailers who want to integrate crypto rails and culture into their stores, like Sourav who is opening up a Solana Spaces Pizzeria in Bangalore.

I’d strongly recommend watching their presentation on SpacesDAO from breakpoint this year.

Set up a Solana Space

If you’d like to set up a Solana space you can apply to join the DAO on their website.

For specific locations, SpacesDAO might invest up to $50k to help with your build out. And either way you’ll get to work with a team that is committed to help you succeed.

If you’re in India, Turkey, Vietnam or Germany - reach out to your nearest Superteam to find a swarm of people and projects who can be your partners, contributors, and customers.

Conclusion

Retail growth has been dominated by franchises over cooperatives because they did a better job of serving customers with the tools available at the time. Cooperatives were founded to protect workers from rapid industrialisation, they were a response to an emergent market trend. In most cases, the structure doesn’t directly add value to customers except for maybe creating happier and more enthusiastic operators.

In the past cooperatives protected workers, but now they can seed entrepreneurs. Those who don’t find the company structure appealing anymore. Those who want to build steady profitable businesses but are too big to bootstrap, too risky to bank loan and too timid to VC. They might choose to organise through co-operatives.

Disclaimer: This post is not financial or investment advice. It is meant for informational & educational purposes only. Please do your own research about risks and compliance before buying, investing/ or trading.