Return of the L1 wars: It’s all about AI Agents

... and the recent actions from Google, Coinbase and others prove it!

Just as the momentum and funding around the next L1/2/3 was winding down and we were seeing ecosystems like Solana, Hyperliquid, Base, etc breakaway, it feels like the pendulum has swung to corporations announcing plans to have their own chains. Stripe announced Tempo, a stablecoin focused chain in September; Google has been previewing a “credibly neutral” base layer under GCP’s Universal ledger; Circle unveiled Arc, its own L1; Tether is pushing Plasma.

The reaction within the Crypto community has been one of confusion with many theories being thrown around, but unfortunately most of the people have reached for familiar explanations centered around two key themes:

The Compliance Hypothesis: As crypto becomes more mainstream, the web2 giants have realised that further institutional adoption will be drive by offering more compliant rails that account for KYC, AML etc - essentially more safety and comfort for risk averse institutions.

The Value Capture Hypothesis: Regulatory clarity has the potential to increase the crypto TAM manifold with retail investors and Web2 giants with their refined B2C playbooks have clearly identified this as an opportunity for extracting maximum value (and making up for lost time) by creating new rails that can be ‘owned’.

However, if you look at the fine print and subsequent announcements, including Google’s AP2, it becomes quickly clear that those reasons matter, but only at the margins. The more compelling and simple explanation is: agentic payments, i.e. money movement initiated and orchestrated by AI Agents at machine speed, under conditions governed by code. If you are a Web2 firm at the bleeding edge of AI and payments, who believes that Agents will become a mainstream computing pattern, you operate on three core assumptions:

Agentic payments do not fit on today’s payment infrastructure

Which necessitates an agent-native settlement fabric

And that means starting at L1

Let’s dive a few levels deeper into the core hypothesis, the supporting assumptions, and see which of them hold true in this fast changing world of AI, blockchain and crypto.

Hypothesis: It’s all about Agents

… and that is very true

The argument around regulatory compliance and value capture stand on shaky grounds.

The ‘Compliance’ argument falls apart very quickly when you realize that the existing card network and bank rails already have heavy compliance baked in. On the crypto side, exchanges as well as public chains like Solana have compliance built in to such an extent that anyone who really wants to create a compliant app does not have to worry about the lack of features or primitives. We have reached a stage in the adoption curve where addition of more compliance will neither sway untapped retail users nor will it encourage crypto-averse geographies like China and India to come on board.

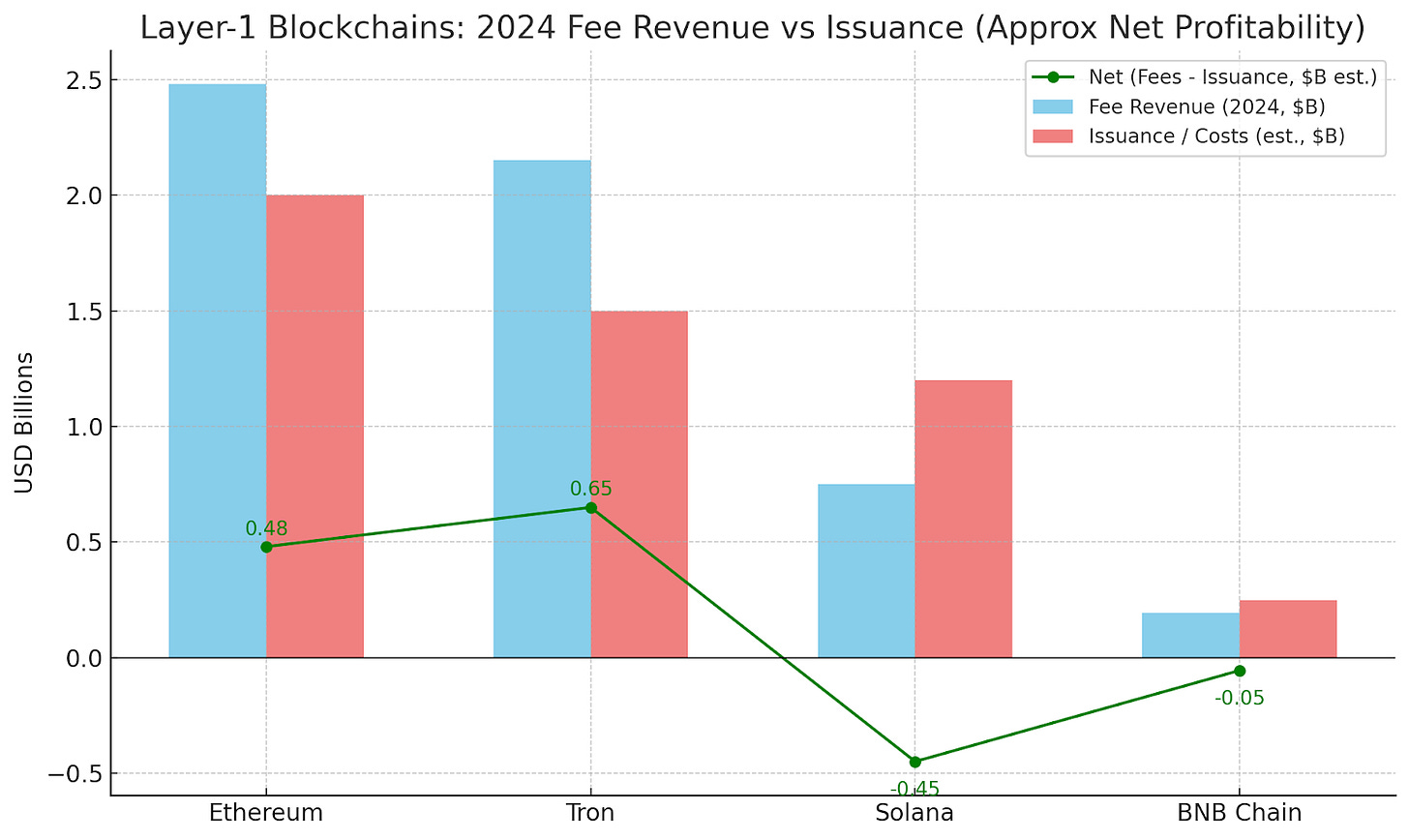

The ‘Value Capture’ hypothesis also fails basic economic smell tests. As many analysts have shown in the past, “owning the rails” by operating a Layer 1s is not a particularly lucrative economic activity, especially when accounting for the security and decentralization costs. This is one of the reasons why most Layer1s are treated as public utilities and structured as such via Foundations. It seems unlikely that these large Web2 corporations with highly profitable business models and strict accountability to public markets would be incentivised to launch potentially unprofitable L1s. The alternative would be to launch a token that gets valued very highly by crypto markets which is again something corporations won't or can't do due to multiple factors, including reputational risk.

So what is forcing the creation of these new base layers? All signs seem to point to the emergence of a new actor; autonomous software that must hold, reason about, sequence and settle payments in a programmable setting with next to negligible human intervention. The gap in the market is quite clear:

Legacy incumbents have designed their workflows for human interaction for various aspects like authentication and dispute resolution. Agents need a substrate that they can program based on model behavior, not simply access. Visa, for example, is trying to meet where they are. It has announced plans to connect ‘Agents’ to its network (the card, the auth, the chargeback model). Alternatively, infrastructure providers like Cloudflare are introducing models like ‘pay per crawl’ for AI Agents. While these initiatives should work in theory, it’s still oriented around human first rails and dispute workflows. Agents need a substrate that they can program, not simply access.

Modern incumbents like Stripe, that provide an API layer over legacy rails that cannot fundamentally change and thereby cannot solve the new Agentic requirements. Stripe’s own arc over the past 18 months is instructive: it reintroduced stablecoin acceptance, brought stablecoin accounts and treasury to its stack and finally decided to pilot Tempo as an L1 focused on machine-scale micro flows. The direction of travel is clearly towards programmable money transfer that can invoke agents directly.

Why is this happening now?

While the timing is curious, it is not unexpected for anyone observing the cambrian explosion in the AI and blockchain space over the past few years:

Agents are getting real (or real-enough). While there are debates about their success rates, nobody is questioning their utility anymore. Discussions are increasingly moving towards addressing edge cases and building better tools. Enterprises are building autonomous assistants that need payment rails and the vast economy of AI Agentic startups are realising that without native payments, many of their business models do not reach their full potential.

Stablecoins became normal and part of the legacy financial system. Circle, Stripe and others made on-chain money mainstream. Programmable, 24x7 money with instant finality and settlement that was abstracted from crypto volatility became common, allowing businesses to get the benefits without the volatility.

Governments got in the game and the rules got clearer with the US (Genius Act), Europe (MiCA), Hong Kong, Singapore, BIS and others leading the way. This paved the way for enterprising and visionary leaders within the legacy Web2 companies to think creatively about this technology and apply it to the emerging world of AI.

Whether all aspects of this innovation are required is a question that we will debate in the subsequent sections, but it is without a doubt that today’s payment rails break for agents and the time is right to propose a solution.

Today’s rails break for Agents

To understand the motivations clearly, it is important to understand why today’s legacy payment rails break for Agentic applications:

The first reason is latency and cadence. Legacy rails like ACH settle in batches whereas faster payment systems operate on ‘deemed approved’ models throttle volumes to retain network stability. Agents are expected to operate with high volume of microtransactions and millisecond feedback loops that have to sync with LLMs’ time to first token rates.

PINs, One Time Passwords or any 2FA authentication for legacy payment rails are designed for humans. Almost all banking and payment systems place a premium on the last stage being executed by a human. It is impractical to expect, for example, a deep research agent looking to micro-transact $1 for 50 academic papers across multiple websites each to request PIN entry from the user for each and every transaction.

Reversibility and dispute resolutions are still human-centric. Card networks and payment systems are built for long chargeback horizons that in many cases require human and legal intervention. While that may work for the current payment ticket sizes, high volume micro-transactions conducted by Agents will require programmatic resolutions.

Programmability is not a first class citizen of the legacy payment systems. It is usually bolted on, usually by another layer leading to limited features, reconciliation or security issues.

Micropayments are discouraged, and many times are tagged as fraudulent transactions. Try making multiple similar, small payments to a merchant. This makes probabilistic or streaming payments highly unreliable.

Identity, custody and payment decision delegation are mostly delegated to humans or human run processes. Identity is established by manually logging into systems. Custodial decision making requires humans in the loop and delegation is based on complex rules mapped to humans, monitored by IAM systems.

The backbone of the payments rail is mainly designed to cater to banks and their systems, using them as a hub for clearance of transactions, rather than as a decentralised system for machines interacting with them directly. This introduces bottlenecks in the system, limiting the true potential of agentic payments.

Agentic payment rails of the future need to be reimagined

It is clear that to overcome these issues, the Agentic payment stack needs to be reimagined with a focus on key principles:

Deterministic near instant finality with payments seamlessly integrated into the Agent’s or LLM’s workflow

Native programmability, that can accept both deterministic and probabilistic output from LLMs and act on them as per well defined business rules within the Agentic workflow.

24x7 access to the payment network with instant settlements and on demand access to payments.

Fully transparent audit trails that can be read easily by machines, alongside humans. This is required as the volume of Agentic micropayments is expected to be orders of magnitude larger than human payments.

Targeted and programmatic sharing of data between machines that comply with local regulations while maintaining necessary levels of privacy without human intervention.

Decentralised and peer to peer machine transactions to avoid bottlenecks and single points of failure.

Automated dispute resolution between machines, possibly enabled by LLM to LLM communication, without any human intervention. This will be especially relevant for micro and streaming payments where the cost and time involvement of humans will not justify the amount that is being disputed.

To people that understand blockchain technology, all the above points will seem strangely familiar. It is quite clear that many of the requirements of Agentic payment systems have been available with most of the leading blockchain networks for quite some time now.

We already see the beginnings of this with the launch of the x402 Foundation by Cloudflare and Coinbase on 24 Sep ‘25, specifically targeting AI Agents using Cloudflare’s Agents SDK or MCP Servers. While still rudimentary, the service is already being designed with deferred payments for dispute resolution and aggregated accounting. It is also instructive to note that Coinbase is the founding partner and the x402’s Sandbox is on the Base Testnet, indicating a native role for crypto in any future Agentic Payments network.

So all this begs the question, is it worthwhile to build a new Layer 1 to solve this, apparently solved, problem?

Is building new Layer 1 truly necessary?

… probably not.

The above analysis clearly identifies that legacy payment rails are not suitable for Agentic payments and that primitives like programmability and atomic settlements that are part of blockchain networks will be critical in the Agentic economy. But this still does not answer whether a new layer 1 is required. To answer that we must look at the existing networks.

Over the course of the past decade, public blockchain networks have invested significant amounts of time and engineering efforts to address some of the challenges identified above. Much of that has been necessitated by the fundamental nature of blockchains but many have been driven by the need to improve the experience for the community and unlock new use cases. We use Solana as an example below to highlight how some of the requirements of Agentic AI systems are addressed by existing public blockchains.

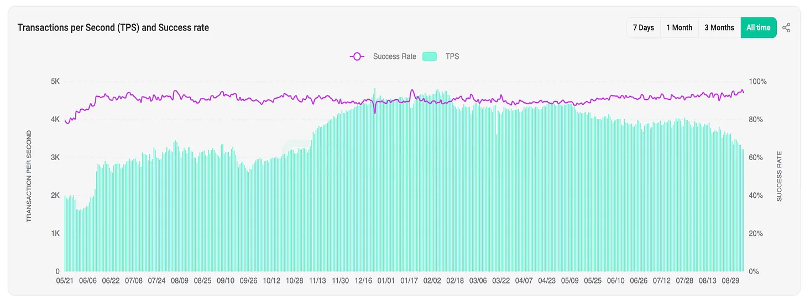

High throughput and low latency with instant finality.

Solana already does upwards of 3K TPS in production at near 100% success rate with 1000+ globally distributed validators, constrained only by demand. It can already do 65K TPS and has a clear path to 1M TPS and beyond that includes a new consensus mechanism (Alpenglow). Alpenglow will also reduce the Solana block finality time from 12.8s to 150ms. At 150ms, Solana’s block finality time will be less than Time to First Token of all major LLMs (between 200-300ms), ensuring a near seamless handover from Agentic tools to LLMs which will go a long way towards improving the user experience.

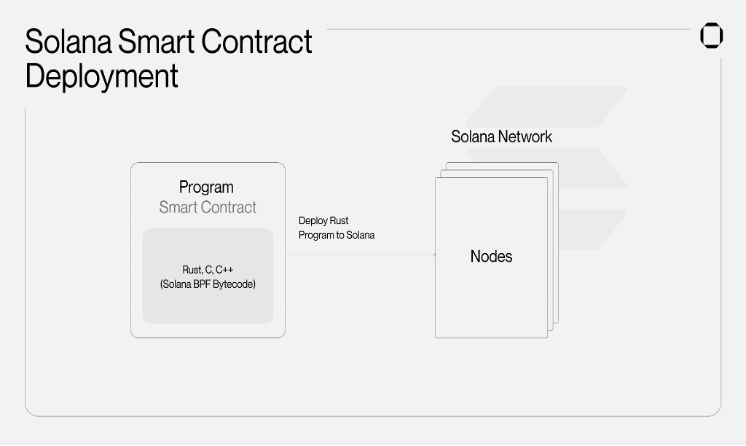

Programmability.

Blockchains like Solana are designed with smart contracts and programmability at their center making them ideal for Agentic workflows. Solana focuses on high performance by separating state and logic and using efficient instruction sets with Rust and C, which are widely adopted, safe and battle tested languages. The architecture provides fine-grained control and flexibility through its instruction-based approach, allowing for custom and specialized programs.

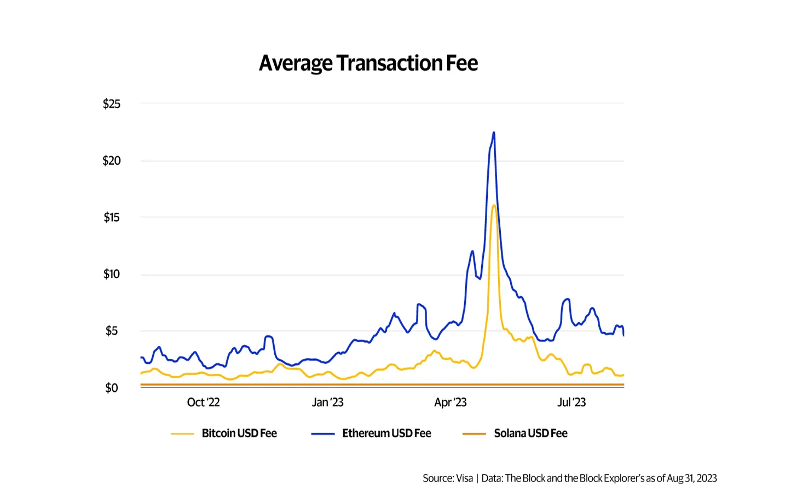

Transaction cost & their predictability.

Agentic payments need to reside on networks where fees are low, and predictable such that a large number of microtransactions or streaming transactions can happen. Chains like Solana have undertaken a significant amount of engineering and business model innovations to ensure that fees are stable and predictable. Local fee markets on Solana ensure predictably low fees so that spikes on certain parts of the network don’t impact the rest of the network. Visa highlighted this in their paper as a major reason why they prefer Solana over other public networks.

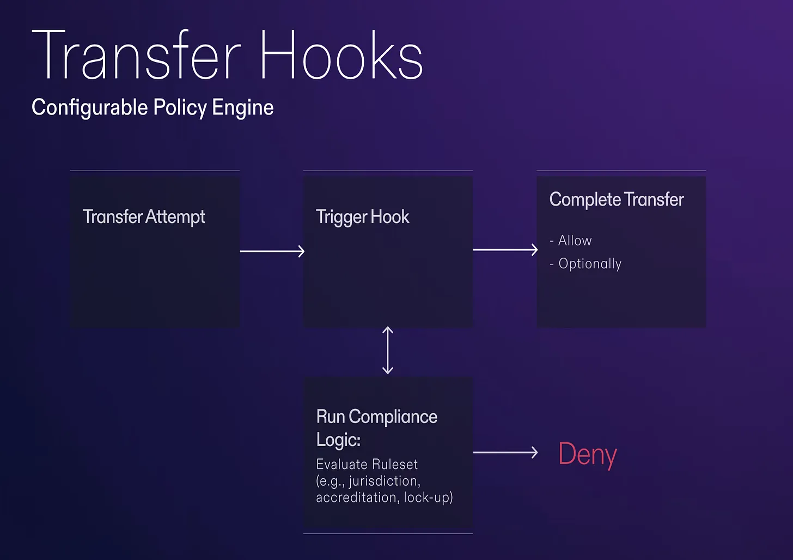

Compliance.

Public chains like Solana provide features like Token Extensions which provide transfer hooks which give the token issuers control over which wallets can interact with their token and how tokens/ users interact. Additionally default account state configures and enforces token account permissions. This means that the Agent can be programmed such that the money is transferred to only those service providers that meet the minimum KYC threshold, set by the Agentic program or LLM driven threshold. Since the rules are built in at the asset level into the protocol itself and not the app layer, even a rogue agent working on probabilistic data cannot violate them later.

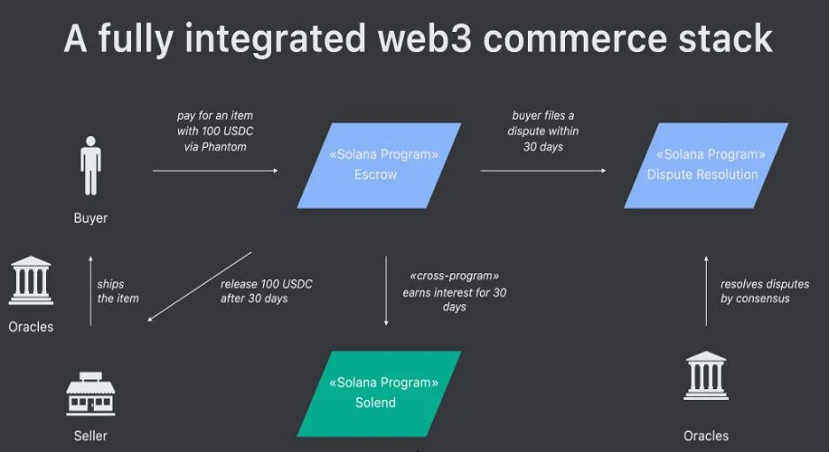

Dispute resolution and peer to peer payments.

Mature blockchain networks like Solana specific peer to peer payment protocols like Solana Pay, which not only bypass centralised intermediaries which can act as a bottleneck but also implement semi-automated dispute resolution mechanisms where smart contracts govern the process, with human in the loop oracles (called as judges) voting on the specific issue within agreed upon parameters. Many ecommerce vendors have successfully integrated such solutions and these protocols seem to have the fundamental building blocks required to modify these implementations for Agentic systems. Other Web3 providers like Circle have also built automated, custodial and non-custodial dispute resolution mechanisms for multiple blockchains.

Privacy.

Blockchains like Solana allow for private transfers at a token level which protects the confidentiality of users balances within a transfer, as well as hides the transaction amounts. This can ensure that critical transactions remain confidential which is important for Agentic business applications, where leakage of data by autonomous agents is a big concern.

These features seem to clearly indicate that the basic infrastructure required for Agentic payment already exists and creating a new Layer 1 would be an overkill. So what form would an Agentic payment system take?

AI Labs, not payment companies, will be leading the charge for Agentic payments

If legacy payment systems are unsuitable for Agentic payments and creating Layer 1s is an unnecessary overhead, who leads the charge to create the Agentic payments layer? To me, the answer seems to be the AI Labs themselves. The bigger AI labs, like OpenAI and Anthropic will soon figure out that the natural home for an Agentic payment system lies within their APIs and they will build a native Agent aware payment system, powered by one of the open public blockchains. This setup makes sense for the AI Labs due to multiple reasons:

Replicating the infrastructure, compute and security that public networks have built up over past years will not be easy and frankly unnecessary.

Second, big tech already has a centralisation and trust problem and building on top of open systems would be a great way to mitigate user adoption barriers.

Building on open public systems will provide AI Labs the freedom to price their offerings and capture value without being tied into the pricing model of payment players and the legacy payment rails.

Lastly, a large part of the payments business is dependent on securing regulatory approvals at multiple stages, which may not be core to the business of the AI Labs.

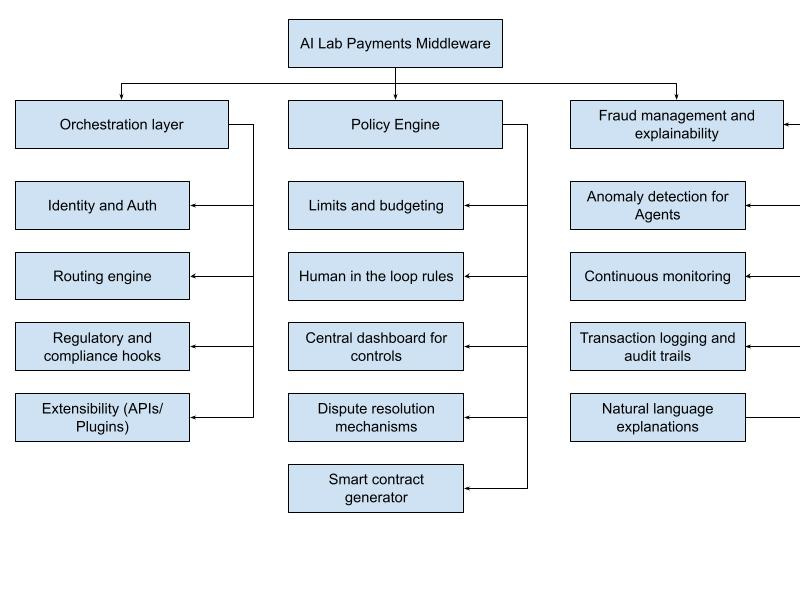

An AI Lab driven payment be a full stack redesign, but rather a middleware consisting of three main modules:

A Stripe like orchestration layer to handle inputs and outputs from the Agent to blockchain based payments network

A policy management engine defining automation, spending and human in the loop rules

Fraud detection and explainability layer

Each of these modules will have further submodules to handle specific granular functions.

This model strikes a fair balance between the regulatory burden that may dissuade AI Labs from getting into Agentic payments and the control, design and economic upside that a potential payments layer may provide.

Conclusion: The war will be about Agentic Payments, Layer 1s are a distraction

At the end of the day, the so-called “return of the Layer 1 wars” isn’t really about blockchains fighting for dominance. It’s about the fact that our payment systems were never built for autonomous software, and AI agents are forcing that truth into the open. The compliance story feels like a rerun, and the value-capture story doesn’t stand up to the economics.

What’s left is the simple reality: agents need payment rails they can actually use, with features like speed, programmability, transparency, and machine friendliness. And that doesn’t require reinventing the wheel with shiny new L1s. The primitives are already out there in mature public networks like Solana.

What’s missing is a layer that makes those primitives safe, explainable, and usable in the context of agent behavior. That’s why the action will shift to the AI labs. They’re the ones closest to the agents, the ones that understand the workflows, and the ones with the incentive to build middleware that handles orchestration, governance, and trust. So let the giants keep announcing new chains. The real battleground isn’t at the base layer. It’s at the interface between AI agents and money, and that’s where the next wave will be won.

Props to Farhat Kadiwala for designing the cover image.