How Vietnam’s MoMo wallet can double its revenue using USDC

A product playbook showing how Fintechs can build stablecoin-led consumer finance products to become your primary bank account

This essay contains a full product mock-up which is best viewed on a desktop browser. Please click here or on the title to open this essay in a new tab.

This essay is structured into 4 parts,

First, we show that Vietnam’s MoMo wallet is struggling to move its large user base beyond low-margin payment services.

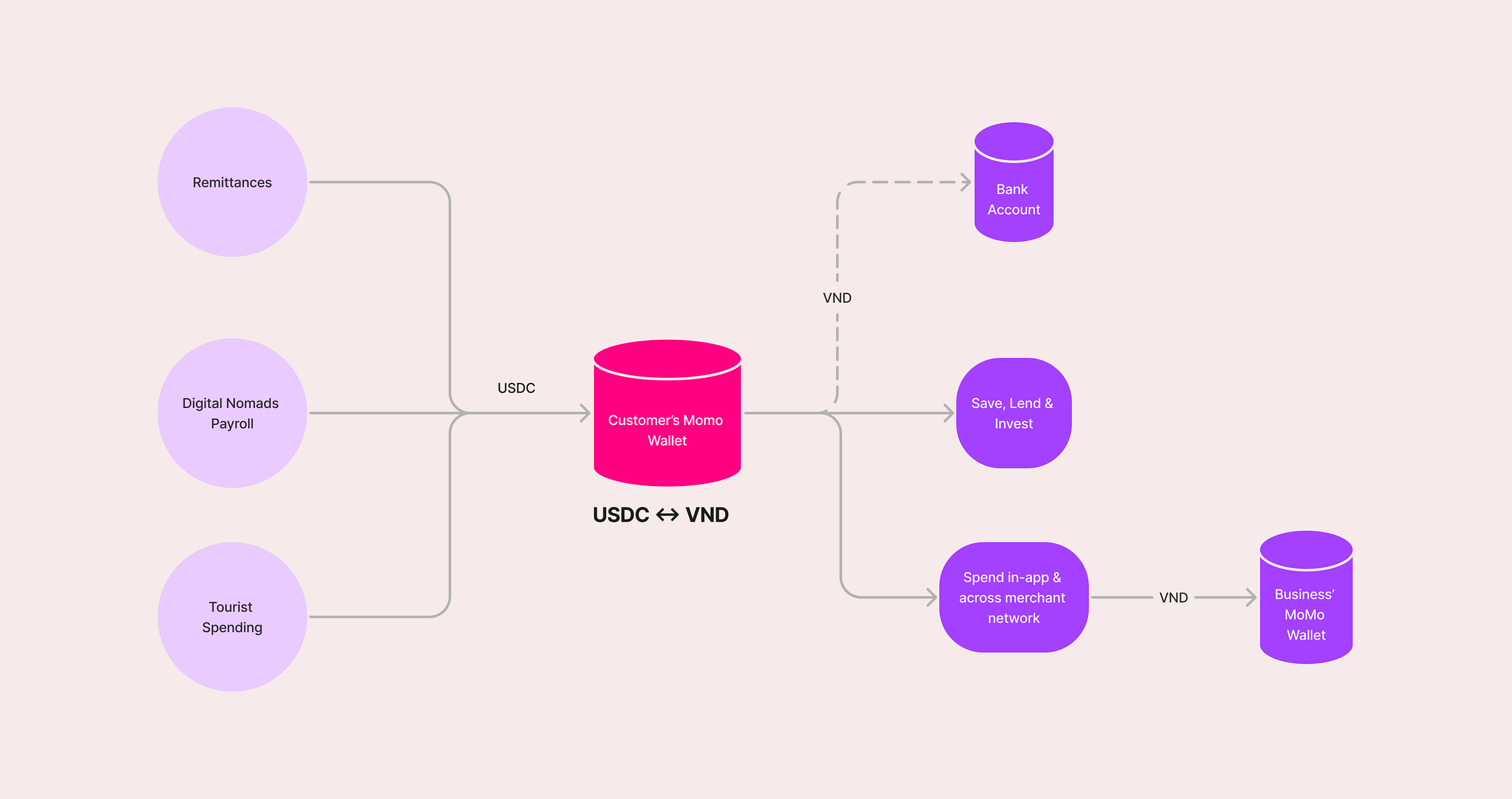

Then, we argue that they should become the primary bank account for stablecoin-led products like global payroll, remittances, and tourist spending.

And, we present product mock-ups to illustrate what these products and services would look like within the MoMo app.

Finally, we estimate the revenue that MoMo can generate from each of the proposed product lines.

Introduction

MoMo has quickly become a superapp offering a vast range of services including shopping, investing, remittances, lending, etc. However, over 75% of its users only use MoMo to make payments to friends or merchants and to pay their phone bills.

The behaviour is universal to all closed wallet systems, let’s call it the minimum necessary top-up. You only add as little as you need, when you need it. For high-value transactions, people use bank transfers or credit cards.

It isn’t because people don’t trust MoMo - in fact, a recent survey showed it is the most trusted fintech product even when compared with banks. The reason people don’t maintain a balance in their wallet is likely,

Power of defaults: your paycheck hits your bank account – and it stays there.

Product design: it is free & instant to add money to your wallet, but costs money and takes time to withdraw it.

Why is this a problem?

Well, because MoMo is stuck with a large user base, but one it can’t monetise effectively through value-added services. And there isn’t a lot of money to be made from just payments.

MoMo aspires to go public in 2025, and the last time a loss-making digital wallet went public it didn’t go so well.

Instead of just getting some trickle down from the legacy system, it should also use stablecoins to become the primary bank account for a new set of use cases and customers.

The Fintech Stablecoin Playbook

There are 3 key features that fintech apps need to provide to build a successful stablecoin consumer finance ecosystem.

Accept stablecoin deposits

Remittances: Vietnam receives ~$18bn in annual remittances and customers will be drawn by significantly lower fees creating natural demand for this product.

Payroll for Digital nomads: Vietnam ranks #5 as the preferred country for digital nomads, hosting ~700k annually. MoMo can be a superior alternative to short-term local banking options.

Forex card for tourists: Many local shops, cafes, etc don’t accept cards but they do accept MoMo. Tourists would be delighted to top-up some USDC into their MoMo wallet & spend it across the vast merchant network.

Spend in-app & across the existing merchant network

For people to want to keep USDC within your app, they need to be able to use it. MoMo can solve the cold-start problem by abstracting out off-ramping for customers and merchants, i.e. customer spends in USDC (stablecoin) but the merchant receives VND (local fiat)

Save & Invest

Allow saving and investing across a range of existing products (gold, ETFs, stocks, T-Bills, etc) and new products (DeFi)

Product Mock-Ups

Let’s see what this looks like on the MoMo superapp.

Accepting Stablecoin Deposits - Remittances

MoMo already allows you to receive a remittance through certain partner services. All they need to do is add USDC as one of the partners.

Vietnamese people from all over the world can use KYC’d services like Coinbase to send remittances at a fraction of the existing cost.

The default withdrawal option for remitted USDC is as VND into your MoMo wallet.

You could withdraw into your bank account but that would attract a fee and incur a delay. Most customers won’t do this.

Accepting Stablecoin Deposits - Digital Nomads Payroll

Digital nomads should be able to live and work anywhere they please without having to obtain local banking support in every country they go to.

Here’s the ideal digital nomad payroll product flow within MoMo

You sign up for a MoMo wallet & KYC with your passport

Connect your employer’s payroll system from within the MoMo wallet app.

Submit your details and wait for the employer's confirmation

Receive a weekly/fortnightly/monthly paycheck within the app.

Accepting Stablecoin Deposits - Forex Card for Tourists

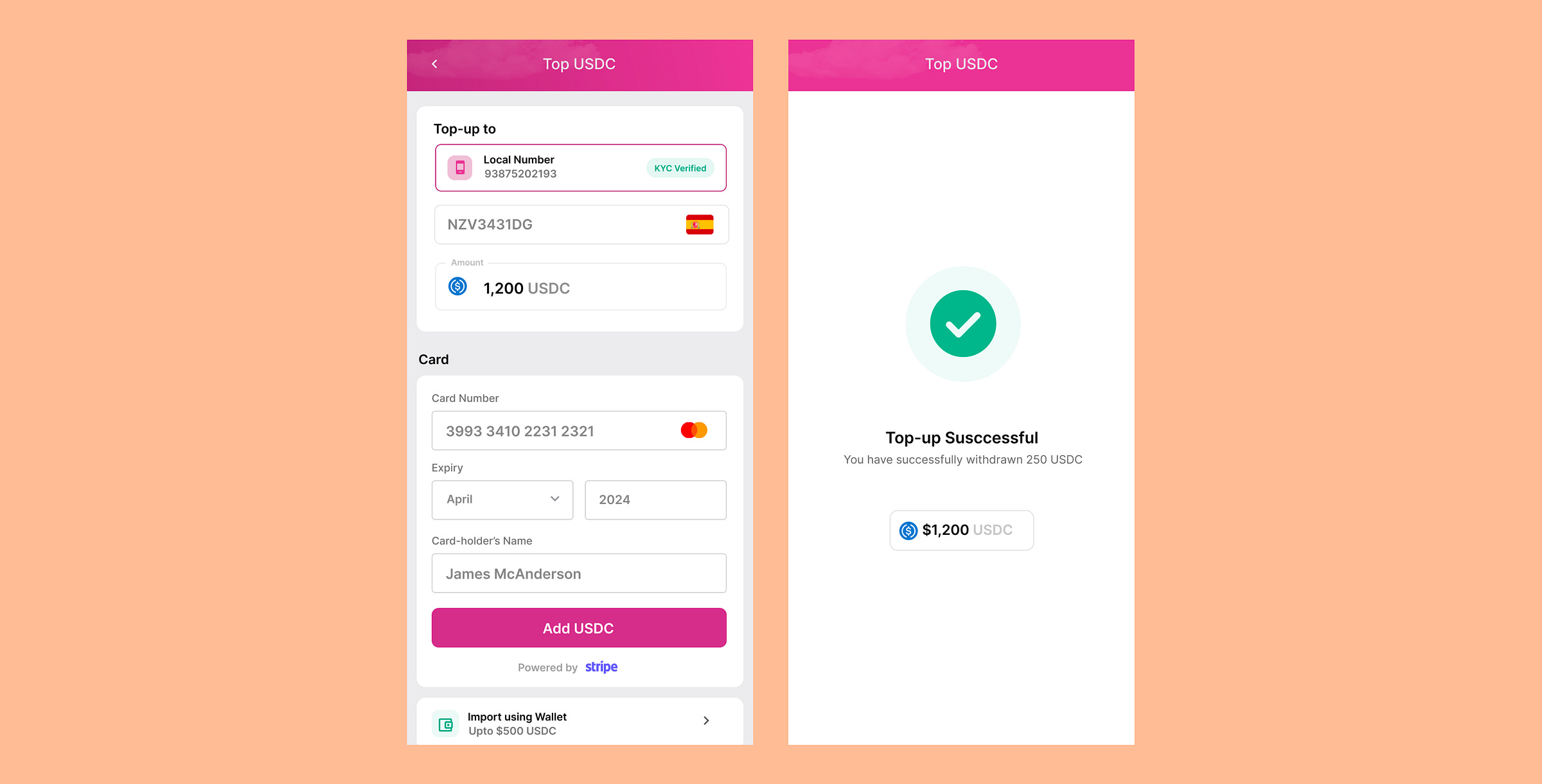

As a tourist, you register with a local number and KYC with your passport.

You can add USDC (up to reasonable limits) to your MoMo wallet by purchasing it with your debit/credit card or importing it from an existing crypto wallet.

Spending via Stablecoins

MoMo customers should be able to spend their USDC (directly or indirectly) either via the in-app marketplace or across the merchant network.

The key here is that this should, at least in the short term, be transparent to merchants. That is to say, MoMo should provide liquidity for the USDC-VND token pair which allows customers to pay in USDC but settles with Merchants in VND.

Saving & Investing Stablecoins

MoMo already offers a range of investment services, this includes buying gold, equities, debt, and lending. Allowing USDC deposits to seamlessly plugin is an obvious but important product feature.

Not only are these valuable services for customers but a highly profitable source of revenue for MoMo. Coinbase recently reported that 10% of their revenue was from the yield on T-Bills against the USDC they held. MoMo should easily be able to negotiate similar arrangements with Circle given their massive user base and scale.

Opportunity Sizing

TL;DR - We estimate that MoMo can generate an additional ~$170mn+ in high-margin revenue through stablecoin-led consumer finance products. Their current total revenue is ~$250mn — i.e. this is a significant opportunity.

Remittances

Vietnam receives around $18bn in remittances annually. To estimate the income MoMo wallet can generate by offering USDC remittances we make the following assumptions,

They achieve a 10% market share by offering the service at cost.

Half of the remittances received are saved via the MoMo app. This allows MoMo to generate a 4.4% interest spread - at par with banks.

On the balance, they can generate income from merchant and withdrawal fees using the existing pricing structures.

Based on this, we estimate that MoMo can generate an additional $50m in revenue.

Digital Nomad Payroll

Vietnam ranks #5 as the preferred country for digital nomads. To estimate the income MoMo wallet can generate by offering USDC payroll services to digital nomads we make the following assumptions,

On avg, 2% of the 35 million reported digital nomads are in Vietnam for the year. And they generate a median income of $40k.

MoMo can capture 10% of this market with their payroll service

50-20-30 split of savings, local spending, and outward remittances.

Based on this, we estimate an additional $55mn in revenue.

Tourist Spending

It is reported that ~1 million tourists visit Vietnam annually. To estimate the income MoMo wallet can generate by offering a USDC forex card to tourists we make the following assumptions,

Tourists would typically spend $100 over a 3-5 day holiday via the MoMo app.

MoMo will capture 50% of the market because of its popularity, convenience and distribution.

MoMo will continue to charge merchants a ~2% fee on payments.

Based on this we estimate an additional $1mn in revenue for MoMo.

While this doesn’t feel like a lot compared to remittances and payroll, we think it is an important product to give potential customers and merchants a taste of the USDC ecosystem.

Interest on Balances

MoMo needs to provide liquidity for the USDC-VND token pair. This is critical to provide a seamless experience to customers and merchants by abstracting out the off-ramping process.

We estimate MoMo can generate an additional 64 million dollars in interest income.

Total Estimated Revenue Growth

This brings us to an estimate of ~$170mn in revenue growth on a current base of $250mn.

Conclusion

Despite being the most popular and trusted apps, wallets in Vietnam account for $10bn in money transfers whereas the banking system does $250bn. This is holding fintechs back from providing new-age financial services and achieving profitability at scale.

Stablecoins unlock new use cases which are currently underserved by the existing financial system.

Yes, crypto is a regulatory grey area and while we can’t provide legal advice, we think regulators in general should be supportive of any products which increase the net inflow of dollars to a country.

Fintechs that are able to solve the cold start problem and seed a stablecoin-led ecosystem within their app stand the best shot to emerge as the consumer financial institutions of the future.

Many thanks to Anh Tran, Kelly Anh & Quang Nguyen from SuperteamVN for participating in research interviews which provided us with insights into the MoMo superapp.

Thanks to Akshay BD & Anna for their feedback on drafts of this essay.