Re: Metaplex Protocol Fees

A fixed fee model doesn't work in a world where most NFTs are distributed by apps

The team at Metaplex recently announced that they’re introducing fees for creating & updating NFTs using their protocol.

CT outraged that Metaplex is so well funded that it shouldn’t resort to an unfair tax on a supposed public good, especially without giving $MPLX holders a say. In response, Metaplex scaled back their fees, to be charged only on creation (not updates) & to be sensitive to price increases in $SOL.

We’re not here to talk about whether Metaplex is morally justified to charge fees - it’s a private company. Neither are we going to talk about their communication strategy or governance token.

We argue that fixed fees are not the right pricing model for an NFT minting protocol. This post is structured in three parts:

Most NFTs will be airdropped, claimed, earned, or unlocked within an app -- not minted

The largest NFT issuing apps will not pay a fixed fee

What are the alternatives?

Most NFTs will be airdropped, claimed, earned, or unlocked -- not minted

Any pricing model needs to be evaluated in the context of the market - who is the buyer, and what are their incentives, alternatives & trade-offs?

Metaplex assumes that a ~0.01 SOL fixed fee is acceptable because it is spread across many users who are often paying over 1 SOL per mint.

The reality is that most NFTs won’t be the 10K PFP collections we’ve gotten used to. They will be collectibles, profiles, gameplay assets, stickers, badges, etc. They won’t be just held in a wallet or listed on a marketplace, they will be part of a larger product experience.

This is happening faster than most people expect 👇

Dialect has minted over a million stickers as cNFTs. Apart from using them in chats, you can also hold and trade these inside the Dialect app via their embedded wallet.

DRiP switched over to compressed NFTs even though it makes their drops appear in fewer wallets & marketplaces. They prioritise scale and speed over floor price. They’ve minted 2m+ cNFTs since.

Solarplex is issuing upgradeable explorer badges as part of their scavenger hunts. Synap is airdropping Solana passports which represent your on-chain activity. Helium, as part of its Solana migration, has issued nearly a million NFTs to represent each physical hotspot. TipLink issued over a million NFTs just to show a PoC of their product.

The best apps use NFTs as one part of the product experience. They give it to their customers for free. They’ll unlock features or access within the issuing app first. Marketplace listing & wallet support will not be the primary consideration.

This is important because it breaks the core assumption that fixed pricing works because it is akin to a small gas fee distributed across each user who mints an NFT.

Instead, it is an upfront cost that apps distributing these NFTs will evaluate while choosing a protocol or deciding to build a custom solution in-house.

Apps will not pay a fixed fee

We believe that very soon all NFTs will be compressed and we may just “drop the c”. However, the protocol fees currently don’t apply to cNFTs. This means one of 2 things,

The fees (& this essay) are pointless because they’ll barely be incurred i.e. when 0 legacy NFTs are minted

Or, some version of the fixed fee model will be extended to cNFTs eventually

We think #2 is more likely, and this is Metaplex’s attempt to get feedback and set a precedent. Thus, this essay isn’t about the extent or application of fees - but about evaluating a fixed fee model.

Consumer apps are looking to build scale and onboard millions and billions of users. The entire machinery is geared to ensure that costs, including infra, don’t scale linearly with usage.

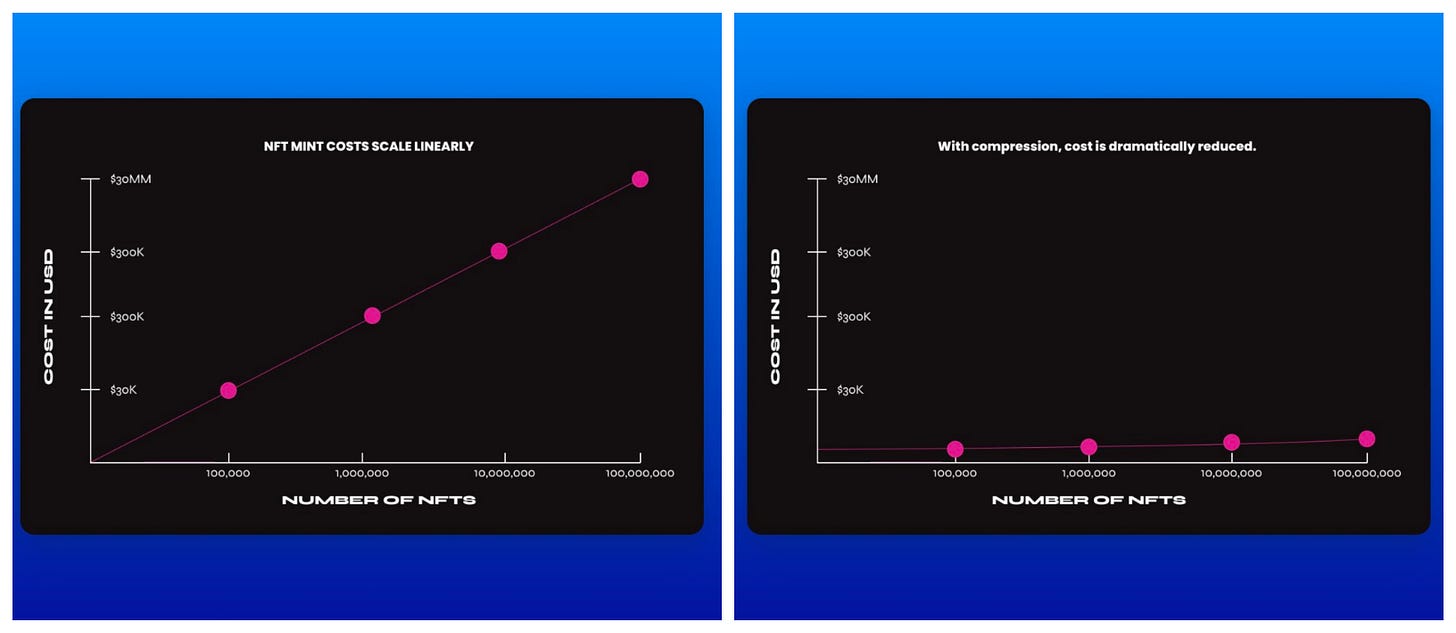

The graphs below show why cNFTs are such a powerful tool for apps. Any pricing model for an NFT protocol needs to look like the curve on the right.

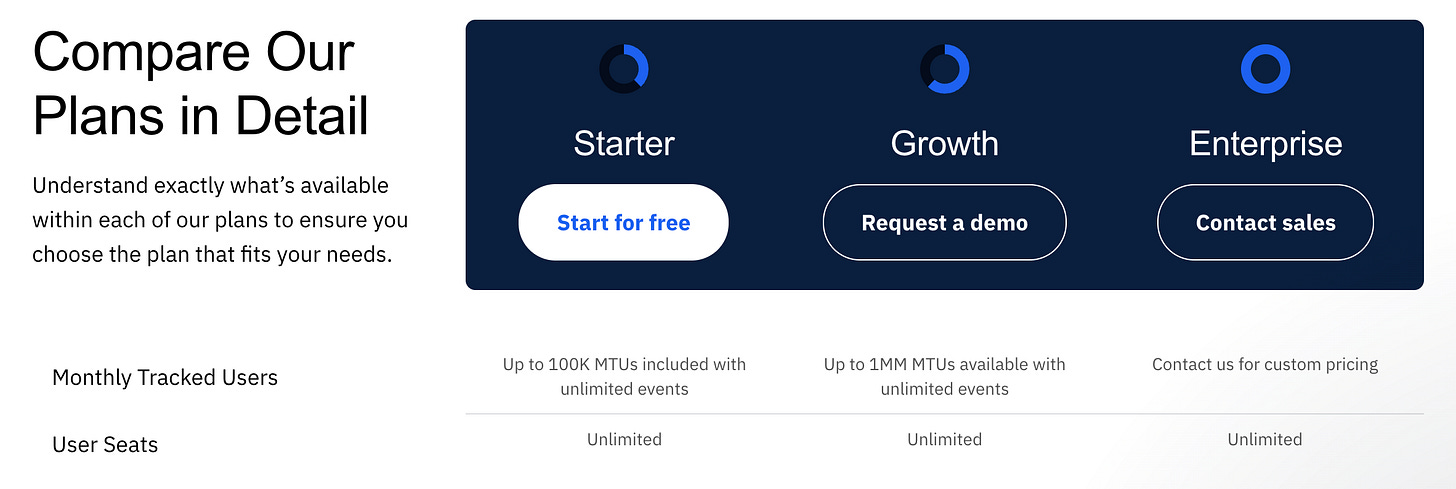

A useful analogy is to look at how analytics tools structure their pricing. It is different from most SaaS products in that it is driven by the volume of data processed and not the number of seats. And it isn’t a fixed fee model, otherwise larger companies would instantly need to build their own tools.

The pricing is designed to,

Onboard start-ups with the potential to grow via a free tier

Milk mid-sized companies that have a decent scale but not enough to build in-house tooling

Maintain large accounts so that the “customers” page looks pretty

The challenge with a credibly neutral fixed-fee model for an NFT minting protocol is that it both, under-serves some customers and leaves money on the table with others.

This creates a market for alternatives.

The announcement from the Solana Foundation says that for fixed fees to work they need to be credibly neutral - like the US postal service, where it costs the same to send a letter to your friend or a $1m check. But — maybe that’s precisely why the USPS is not only losing market share to private competitors like FedEx but is also stuck with negative unit economics, losing 15c for each dollar in incremental revenue.

What are the alternatives?

If you’re optimistic about crypto & Solana, you have to believe that 99% of NFTs are yet to be minted. So it isn’t too late for the market to change the underlying protocol and topple a perceived monopoly.

Apps that are onboarding millions of users, and there will be a few on Solana pretty soon, will find a fixed fee model prohibitive as they scale. They will build/fund and distribute alternatives. Recent stats from Metaplex show that a few breakout apps will drive most of the NFT volume.

It makes sense for new or existing marketplaces to inform their roadmaps and priorities with the Tweets like the one below because there are potentially 250k+ users waiting to trade on the first marketplace that responds.

Apps aren’t beholden to a wallet or marketplace support not only because they bring the users and the volume but also because the primary use case for their issued NFTs will be within their own product and not listing/swapping.

In fact, wallets and marketplaces will need to follow the users. For e.g., Tensor trade was the first to enable trading for cNFTs to capture volume from showcase & DP DRiPs.

If there’s going to be a single NFT standard on Solana, it needs to work for the biggest apps first. Because they have the largest incentive and the most capacity to exit.

We recognise that teams building public goods need to be competitively compensated for those goods to sustain. And because there’s no obvious answer on how to create sustainable funding for public goods, more experimentation is good.

Some alternatives that Metaplex should (and probably is) considering are,

Build & charge for products, like the Creator Studio, while giving the protocol away for free.

This is similar to UPI which enforces zero-payment fees on its protocol. Providers package UPI integration into a suite of payment & financial services products(refund management, checkout optimisation, pay-later services, no-code integrations, credit lines, etc) and charge a service fee.

This allows people to extract value by building useful products around digital payments and not tax the payment itself. The same should hold true for NFT minting.

This will position Metaplex in the onboarding & milking zone. This means that they will continue to be the protocol of choice for anyone new starting out and mid-scale products will continue to use their tooling and products. Large-scale products will use the protocol for free and likely have competing products (launchpads, etc) but their usage provides the continued credibility for Metaplex as the NFT minting protocol on Solana.

A volume-based pricing model, similar to the one we showed in the previous section.

The biggest challenge with this is implementing it after the program is made immutable. The current stance from Metaplex is that they don’t want to apply fees once immutability kicks in — but they’re open to community feedback. This could be a viable option executed with transparency & community involvement for the next 18-24 months before the proposed timeline to make the program immutable.

Vibhu’s suggestion of a temporarily fixed fee with a defined cap to recoup on a cost+ basis.

This makes apps more likely to comply because even though there’s a fixed fee for a short while, there are zero fees post-immutability. If Metaplex wants to position itself as an outfit building public infrastructure then this is probably the best approach.

There’s no doubt that Metaplex has built tooling that is critical to the growth of the Solana ecosystem and that the team deserves to be adequately compensated and share in the upside they’ve created.

But a pricing model needs to be driven by the market it serves, otherwise, the product itself will be rendered obsolete. The current market indicates it will pay for tools that make it cheaper and faster to distribute rich and personalised NFTs at scale.

Disclaimer: Everything mentioned here is for information & educational purposes only, none of this is financial advice to trade & speculate on any tokens or NFTs.