Solana Index on Mudrex

On a journey to a billion users

gm.

In this post, we’ll deep-dive into our thought process for a Solana coinset submitted as part of the Mudrex bounty on the Superteam DAO.

Disclaimer: This is not financial advice or a suggestion to invest in anything. Please assume we are invested/biased towards the projects we talk about and do your own research.

Introduction to Solana

This post I’d written earlier is a great starting point to build an understanding.

Here’s the top-line:

Solana is an L1 blockchain, like Ethereum. You can store information and run applications (smart contracts) in a decentralised manner on it. Its main advantage is that it is significantly faster and cheaper than Ethereum. It achieves this by using proof of history to process transactions in parallel. This makes it ideal to onboard large scale consumer applications.

Source: Coinmonks medium post

One of the criticisms of Solana is that it is relatively more centralised, in that there are fewer validators because the node setup is more complex & there’s a Solana labs foundation that is focused on shaping & nurturing the ecosystem. Over time Solana will need to achieve and demonstrate credible neutrality and censorship resistance

In the meanwhile, the number of applications and developers on Solana is growing faster than ever.

Here are two stats from their recent hackathon that the team shared in the Solana breakpoint conference:

Projects submitted at an all-time high.

Source: Solana Breakpoint conf livestream

No. of developers at an all-time high

Source: Solana Breakpoint conf livestream

There are other metrics at all-time highs too - NFTs minted, self-custody wallet users, DeFi TVL & the token price (you can learn more about them by watching the first 20 mins of their recent breakpoint conference ), but in our view, the two mentioned above are the most exciting. Because we believe that real value generated for blockchains like Solana and Ethereum over a long term comes from the value of the output of the products and services built on them. Here’s a great twitter thread which captures this sentiment:

Coinset Overview

We are bullish that Solana will fulfil their ambition of onboarding a billion users to web3 apps. This Coinset aims to give you exposure to the upside created by some of the most promising apps on Solana and the increased adoption of the underlying network.

Filters & Constraints:

As this is a submission for a Coinset on Mudrex - we were required to only select tokens listed to one of FTX, Coinbase, OKex and BNB. We’ve selected FTX as the exchange of choice because it has the most number of projects listed.

We’ve filtered out any projects with lesser than a 10mn market cap as of publishing to ensure liquidity and broad selection.

Solana Universe Description

With this in mind, there are four categories of tokens we’re going to add to this coinset:

DeFi: This is the most popular category of them all, with the highest share of market cap. All apps which facilitate transactions, liquidity & generate yield fall into this bucket.

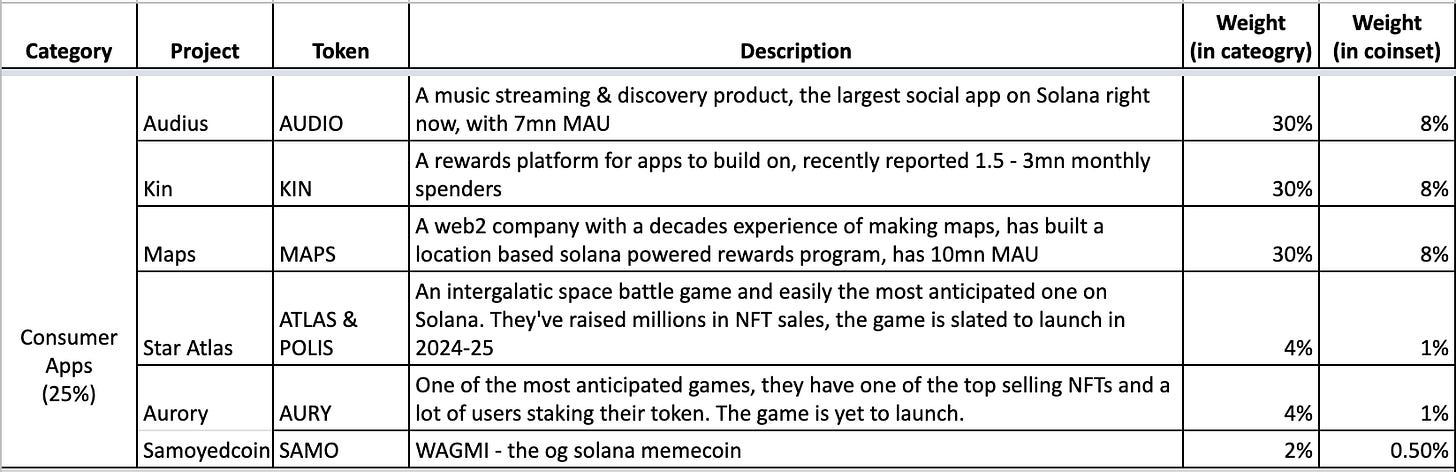

Consumer apps: We’ve grouped social, gaming, NFTs and other consumer facing products into this category. It is still early days but this is the fastest growing category and one we’re most excited about.

Web3 Infrastructure: These products and services are building solutions for common problems like payments, token launches, price feeds etc. Think of this as the SaaS part of the universe.

L1 Token: This is the Solana token. More on why we’ve included this in later sections.

Let’s go a bit deeper into each of these categories and better understand the projects we’re picking.

DeFi

Here’s an ecosystem snapshot as of 8th Nov:

The DeFi eco-system broadly comprises the following types of apps:

DEXs & Swaps: You can buy and sell tokens at market determined prices here. Raydium, Orca & Saber are the more popular DEXs. TVL is an important metric here because higher the liquidity lower the risk of slippage.

Lending & Borrowing: You can earn interest by depositing into liquidity pools and borrowing against the collateral you’ve deposited. Some of the popular projects for this are marinade, parrot, francium & an upcoming one is cropper finance.

Yield farming, Baskets, Derivates: Solrise & Symmetry are two products that are going to provide baskets - similar to index funds - which simplify thematic or focused investing. Tulip protocol enables leveraged yield farming.

Consumer Apps

The Solana labs leaders (Anatoly & Raj) have been pretty clear that they want a reach a billion crypto users (i.e. people using self-custody, not just exchange accounts) and they believe Solana is positioned to deliver that.

Well, we don’t think a billion users are going to join crypto to trade derivates and perps. Our bet is that consumer apps are the next frontier.

This space is growing really fast in two specific areas:

Gaming: The success of Axie inifinity has grabbed the world’s attention. It is increasingly obvious that the power of web3 in giving the community ownership, liquidity & control is going to revolutionise games. The Solana foundation has committed to a 100mn fund to accelerate the growth of games on Solana. While we’re bullish on this we also recognise that it is hard to make awesome games and teams with proven gaming track records are more likely to succeed. We’d also encourage you to have a healthy dose of skepticism for projects that raise millions with NFT sales and promise a 5 year game development roadmap. Some of them will no doubt come through but a LOT of them will likely fizzle out & most importantly - it is really difficult to evaluate these upfront.

Social: The last decade has undoubtedly been dominated by social products. These products have created new paradigms of content creation and distribution. They’ve also started drawing flak for the impact their algorithms have on both users’ minds and their creator’s incomes, and for censoring/de-platforming creators at will. The promise of web3 social apps is the portability of data, direct ownership for users and monetisation for creators through tokens & NFTs and community governance. The Solana foundation along with the co-founder of Reddit have committed to invest upto $100mn to grow social projects on Solana. In addition to this, the founder of Brave (a web3 browser) has committed to making Solana the default browser for all DApps on brave.

Web3 Infrastructure

These are products and services which enable the consumer apps & DeFi protocols etc to do what they do best. Just like companies like Stripe & Razorpay have atomised payments such that any small business can accept payments easily - these products and services will enable the next generation of DApps to onboard a billion users to crypto.

The key categories of web3 infra that are critical to the Solana ecosystem are:

Oracles: These are products that act as sources of truth for services to trigger smart contract execution or similar on-chain logic. (DeFi protocols get price feeds, betting markets get real-world outcomes)

Multi-chain tools: Enabling funds, data, NFTs etc to move across chains is inevitable. Protocols like wormhole, allbridge are enabling this already. There DeFi TVL on Ethereum is ~$100bn - this is 10x of the current TVL on Solana. That money is going to find it’s way onto a faster and cheaper blockchain. Neon Labs , one of the most anticipated projects, takes this one level further - by enabling EVM code to be executed on Solana (i.e. code for Ethereum and execute seamlessly on Solana as well). All the existing DApps are coming too.

DAO & Creator focused tooling: We’re very bullish that DAOs are going to transform the way people work & NFTs are going to change the relationship between creators and their fans. There is a suite of tools needed to enable this - launching tokens, minting NFTs, sending payments, managing treasuries etc. Here’s a useful post on DAO tooling I’d written earlier.

L1 Token

Like we said earlier we’re extremely bullish on the underlying growth of the Solana platform. Phantom - the most popular Solana web3 wallet just hit 1m, active users, that’s how early we are.

A billion users are coming & we’re convinced that allocating generously to the underlying token is essential to for four reasons:

It is really hard to pick winners when the ecosystem is so early

There are many projects that have a great product and traction but are not yet listed on any CEX or specifically on FTX. Holding SOL gives the coinset exposure to increased adoption these projects generate.

Along with acting like “cash on hand” , SOL is a capital asset that will keep appreciating if the ecosystem grows

50% of our SOL allocation are liquid synthetics which generate fixed yield at relatively low risk

Source: Breakpoint livestream

Constructing the Coinset

Okay, so let’s bring this together and talk about how we’re putting together the coinset. We want to build an index that captures the promise of a billion crypto users on Solana & one that you can set and forget.

Here are our guiding principles -

Market caps are not representative of future upside - ensure all categories are represented equally.

Prioritise product and growth over historical performance. This means we have different selection metrics within each category.

A lot of promising projects are yet to be formed or list on CEXs - allocate a generous % to SOL to capture underlying network growth & adoption upside.

Some specific comments on each category -

DeFi : While TVL is important for these products to function well, we’ll ensure we select projects across different key functions - swaps, lending, launchpads etc. We also recognise that DeFi has an inflated market cap compared to the rest because it has a head-start in adoption + leverage - our category caps will help here.

Consumer Apps: It is too early to pick winners, we’ll select projects that either already have a working product and/or a strong community.

Web3 Infra: A combination of Ethereum first tools which have extended support for Solana & native tools built on the Solana network. For the tools which are Ethereum native, they have significantly high market caps led by their adoption on Ethereum - we will be normalising these in our coinset

L1 Token (SOL): To capture network growth upside we’ll include a mix of SOL and synthetic (mSOL & stSOL)

Here’s what our total universe looks like:

Based on this universe, here’s our Solana Coinset, split by categories

You can view the entire coinset here.

Benchmarking Performance

In this case, we don’t think past performance is fully indicative of future potential. We believe the growth opportunities will come from increased user adoption:

Ecosystem growth initiatives like the gaming & social funds + the brave integration bring more developers and projects.

Institutional funds moving to web3

Inter-chain tools, like Neon labs, which bring Ethereum funds and users over to the network

Overall adoption of web3 and crypto technologies over time web2 companies bringing their distribution and clearer regulation.

This table from the mudrex bluechip coinset really captures the growth SOL has seen this year.

Rebalancing the Coinset

Given the pace of expected growth we think this coinset should be rebalanced each month with the following principles:

No category should comprise over 25% of the coinset

No single project should comprise over 10% of the coinset

Evaluate projects based on relevant first principles metrics (DeFi - TVL, AUM ; Social - users; Tools - use cases & apps they connect). Reduce allocation to projects with decreasing utility and increase to those with increasing utility. We believe this is a leading indicator of success.

A word of caution

This coinset will be fairly volatile and high risk,

Markets across asset classes seem to be breaching new all-time highs every day. We expect there to be a short term correction in the price of SOL and many underlying projects.

Today’s DeFi applications allow potentially dangerous amounts of leverage. This will fall like dominos, our category caps safeguard against this but funds are interconnected and we expect significant drawdowns when this happens.

Technology risk of new L1 chains beating Solana on performance or existing ones catching up (ETH + Scaling solutions)

It is very early days. Keep calm, DYOR, don’t bet the sheep & WAGMI. Either of the two outcomes shown below are possible… as you can tell we’re bullish on the first one (not financial advice)

Source: Twitter

Source: Twitter