SonarWatch: The Ultimate DeFi Dashboard on Solana — A Deep Dive

A Complete deep-dive into the DeFi Dashboards, SonarWatch’s amazing features, its competitive edge, community, and many more!

DeFi is growing rapidly with over $100 Billion in Total Value Locked, almost all of which comes from Ethereum. The Solana ecosystem is catching up rapidly, with everyday new Solana DeFi protocols getting launched. Tracking assets through multiple platforms is always a pain.

Today’s focus of the article, SonarWatch, a DeFi protocol that allows us to monitor the real-time performance and value of your various positions within Solana, from farms to staking and other yield strategies, manage and analyze our positions, view the floor price of our NFTs, stake SOL plus various other tools to make the DeFi investing life easier.

DeFi Dashboard: The Need of the Hour

There is a missing piece: Tracking!

Let’s understand this with a simple example. A user lends SOL to a platform, and holds USDC, he will be able to see USDC, when he logs into his wallet. Why? Because his SOL is locked into another platform. To check how his lent SOL is performing, he will need to log in to the platform he lent his SOL. Now, this is not a User Experience, a user would want in DeFi which is aimed to completely disrupt traditional finance.

Another problem DeFi users face is, they generally tend to forget assets after depositing into platforms. This is something DeFi Degens (someone who is an expert in DeFi) may also face as they usually put their assets into a huge number of platforms, whenever they spot any money-making opportunities. Now, tracking all these assets into different platforms is a big pain.

This makes DeFi Dashboard a very hot need in the market.

Types of DeFi Dashboards

Now you might be thinking, do DeFi Dashboards also track outside of a particular blockchain? Well, few DeFi dashboards do track assets on multiple blockchains. They are called Multi-chain Dashboards. For Eg. Ape Board,

The Dashboards which track only for a particular chain are called Single-chain Dashboard. For eg. Zerion for Ethereum, YieldWatch for Binance Smart Chain.

Both Single-chain and Multi-chain Dashboards have got their own utilities. For an analogy, think of how some Apps are only launched for iOS, some are only launched for Android, and most for both of them, so it completely depends on a target audience and use case.

If a DeFi user is completely focused on a particular chain, he will find a single-chain Dashboard much more useful, as a single-chain dashboard will focus more on integrating chain-specific protocols and customizing their features as per the need of that particular chain. Many single-chain Dashboards are also following the “Nail one chain and then expand to other chains” strategy i.e become Multi-chain after a certain point of time.

However, if someone is dabbling around multiple chains, Multi-chain Dashboards are a no-brainer for them as they can track easily across multiple chains.

Enter SonarWatch: The DeFi Swiss Knife on Solana

Sonar Watch brings a complete overview of a wallet or public address on the Solana Blockchain, which means they show the complete metrics of a user and how their portfolio is performing. It tracks a wide range of tokens from LPs, farms, staking pools into a single dashboard in a most intuitive way. Not just tokens, they also track NFTs! While personal asset tracking is a critical part of their product, they also enable their users to track the wallets of others as long as you know a wallet address!🤯

You might be wondering, how can you track other wallet addresses?

It’s simple — all transactions on the blockchain are public. Just go to Solscan, you can scan through any of the transactions in Solana. Well, SonarWatch leveraged that.

The Killer Features:

While Sonar Watch started with a small goal of tracking quickly as many protocols as possible, the platform has now evolved rapidly from just a tracking tool to a go-to-platform for anything DeFi in Solana by aggregating all necessary tools to bring a seamless user experience. Let’s look at some key features, which make up the whole experience for a user:

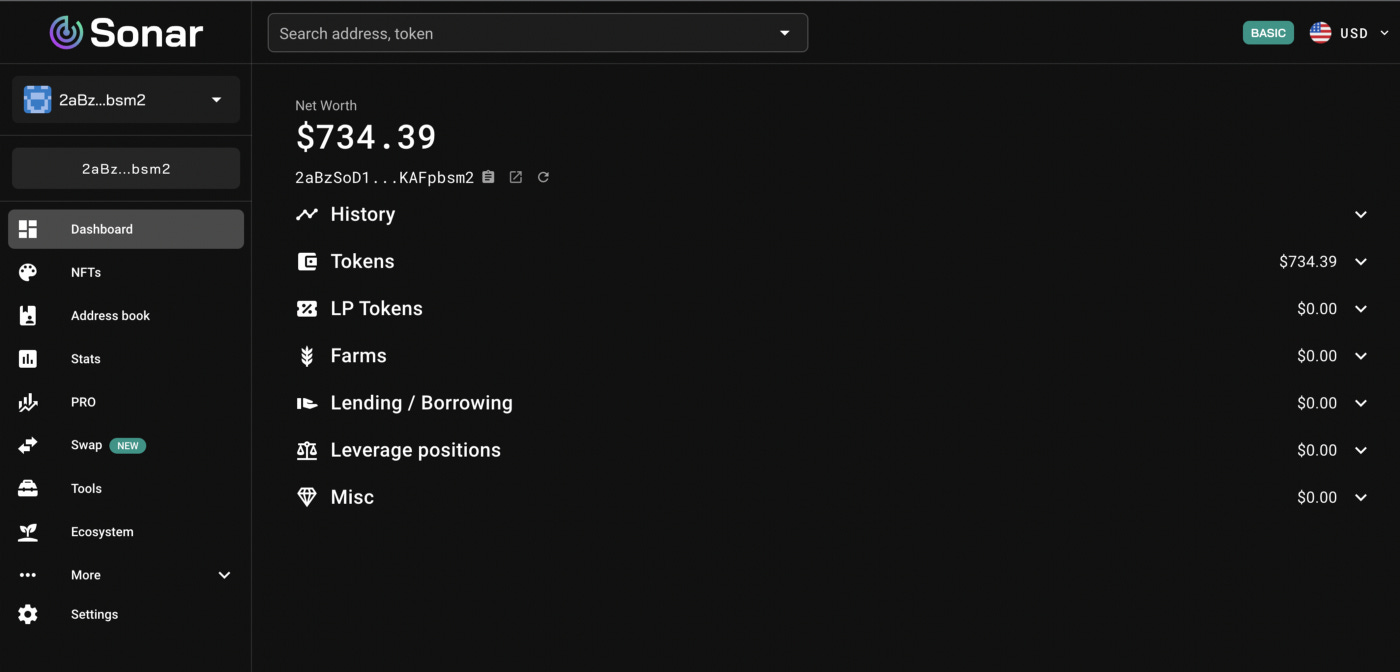

Dashboard — The Heart of Sonar Watch

This is the main feature as it provides a complete overview of one’s wallet. On the main screen, there is a history page that gives a complete trend of your wallets — it shows the performance of the portfolio in the form of a chart.

Stats:

The stats page on the Sonar Watch platform shows the biggest gainers, losers in the Solana ecosystem. It also provides the search tab, where users can search for tokens.

Once a user clicks on a token, a page opens up showing a detailed price chart of the token, along with other details like contract address, supply, and soon, one can also swap from this page itself!

NFTs:

Sonarwatch also tracks NFTs in a clean and intuitive way, but it currently displays just the NFTs in the portfolio and most of the NFT related data is provided by Hyperspace. If the NFTs are part of a supported collection, the price floor of the collection will be displayed. They are currently more focussed on enhancing the tracking of tokens, but NFTs are definitely part of their roadmap.

Swap — The latest addition to the suite

The journey of any DeFi user starts with a DEX i.e Decentralised Exchange where a user can exchange their tokens, but this experience hasn't been user-friendly. Currently, one needs to go to another website, place an order, maybe deposit their funds in one token, and then get another token. Moreover, switching between platforms is always a pain.

Sonar simply solved this by allowing users to swap tokens directly on their platform by integrating Jupiter’s API. Jupiter aggregates liquidity from various sources, which enables them to offer the widest range of tokens and discover the best route between any token pair.

This integration significantly increases the user experience as a user can swap their tokens from the same screen itself and it also opens up a new revenue potential for Sonar Watch.

Tools:

As Sonar’s aim is to simplify DeFi, it also provides a list of curated tools to enhance user experience as users can save on time and effort.

There are the following tools integrated with them:

Serum Dex manager: This allows users to recover SOL from each Serum pending asset i.e close any pending orders, DEX accounts, or settle the funds.

IL Calculator: This determines impermanent loss with simple inputs so that the Liquidity providers can calculate their performance.

Unwrap wSOL: Users can also unwrap wSOL to SOL directly on SonarWatch (wSOL is basically SOL wrapped on another blockchain)

Stake SOL: This is the most amazing tool — One can natively stake SOL via Marinade on SonarWatch.

Sonar Mobile View

A Dashboard is a product, which is used at a high frequency, and therefore, accessibility from mobile is an important aspect. The Sonar watch is not only available on the mobile view, but also very well optimized.

SonarWatch Pro

While the free version of SonarWatch is elegant and intuitive, the Pro version is like “SonarWatch on steroids”. It enables a user to access more features like:

More Wallets Tracking: The free version allows for tracking only up to 8 wallets, with a Pro version, one can manage up to 50 wallets.

Metrics: The Pro version allows for tracking additional metrics like:

a) Supply: An important metric to track the coins circulating in the market.

b) TVL (total value locked): The TVL reflects the true size of an LP token and farm and is an important metric just like Market Cap.

c) APR: SonarWatch also tracks APR for every farm, so that every user can have a clear view of the trends of the rewards generated by their investment.

Downloadable holdings report: This is one of the highlights of the PRO version, as the users can easily export the dashboard view as a CSV. SonarWatch also provides a spreadsheet template which makes the readability of data much smoother.

How to use SONAR?

Now, we have understood why Sonar is one of the killer dApps, let’s understand how to use it.

Connect your Wallet

To get started, you can either connect your wallet to 10+ most popular Solana wallet providers like phantom, Solfare, Sollet, Coin98 or simply, paste your public address.

First, Click on connect from the Sonarwatch homepage and then, Select the wallet of your choice and approve the pop-up of your wallet.

Connect with your public key or Track an address

For this, just click on “Track an Address” and a screen will open up, where you can add multiple addresses, by just pasting the public address — that’s all.

$SONAR Token:

Is anything even Web3 without a Token, so SONAR also has a Token! And no, it’s not just a random token, it has got real utilities and it’s simple — users with a sufficient amount of $SONAR get access to PRO features, such as multi wallets support, history charts, dashboard CSV export, and others.

$SONAR also acts as a loyalty tool, where a user holding $SONAR, depicts trust in the Sonar Watch platform, and for this loyalty, Sonar rewards its users by reducing their transaction costs.

Competitive Edge: User-Centric Product

Sonar Watch has been successful so far with its unique capability to quickly integrate new protocols on its platform — which has actually proved its competitive edge.

One of its primary competitors, which is also providing a DeFi Dashboard on Solana is — Step Finance!

While Step Finance is also elegant with a good UI/UX, Sonar Watch has got a lovely community at its back. Sonar Watch’s focus on accepting user feedback and feature requests publicly can go a long way in creating a more user-centric product. It will be interesting to watch how these players differentiate themselves, a year down the line.

Another DeFi Dashboard on the Solana Ecosystem is — Symmetry Finance, which is an asset management protocol on Solana. They also provide a sleek dashboard, however, they lack the sophisticated tools which are available on Sonar such as DEX manager, and IL calculator.

There are some other multi-chain DeFi Dashboards that count as its indirect competitors like Apeboard Finance and Zapper.

Partnerships & Community:🤝

The success of Sonar Watch is all about quick partnerships, and this has become the most challenging in recent months as Solana is exploding with new protocols.

They have partnered with 50+ top Solana protocols like Raydium, Orca, Serum, Saber, and Solend and the list keeps growing each week. This page also depicts the close-knitted Solana Ecosystem, which keeps supporting each other so that the ecosystem makes it together aka WAGMI in the true sense.

While the funding amount is undisclosed, they have raised from marquee investors like Serum, Solana Capital, Skyvision, Genblock, Huobi, and many more!

If someone had to describe Sonar’s community in one word, it would be simply “Amazing”. The community keeps driving them by keeping them updated on all the amazing new protocols with promising ideas. They are then able to quickly contact the protocol and integrate them as partners.

Their community is strong on discord with ~6K+ members lurking around and contributing to the product. They also actively share memes, and feature requests. In fact, they have completely open-sourced feedback, anyone can simply post any feedback publicly, and others can upvote it.👍 They have a dedicated tool for collecting feedback: Feedback.Sonar.Watch. The feedback page can be also be accessed from the bottom of their website — “Request feature”.

As said by the founder about the community, “They are the best to find small issues, give feedback with as much detail as possible or identify new pools, farms or protocols”.

2021 has, in fact, been extra-ordinary for them — let the numbers speak for themselves👇

Conclusion: Long SONAR and SOL Ecosystem🚀

2022 will be an interesting year for SONAR as they scale and will be marked by new interactions between the SonarWatch platform and protocols of the Solana ecosystem. They have set out with an audacious goal to create a smooth journey for every DeFi user out there and to stop the endless road of switching between platforms to interact with each protocol. In short, they want to make DeFi easier and more seamless. Their strategy is clear — they want to build the best tracking dashboard possible on Solana, then they will think of migrating to other blockchains.

Nonetheless, Sonar’s success is completely dependent on Solana. If the Solana ecosystem continues to boom like it’s doing currently, there’s certainly no going back for Sonar!🚀