State of Solana DeFi 2024

Solana DeFi Deep Dive – Everything you need to know about Solana DeFi ft. 100+ projects and trends to watch

$3.8 billion+ TVL. $2.5 billion+ in Daily Volumes. Solana DeFi is back with a bang, fueled by memecoin mania and airdrop frenzy!

While 2023 may have seemed like an uneventful year for Solana DeFi, it was crucial. The year began with many people dancing on its grave, declaring Solana DeFi dead. However, it ended with Solana DEXs surpassing Ethereum DEXs in weekly trading volumes!

This was made possible by about 50 top-notch teams, led by blue-chip protocols like Marinade, Phoenix, Jito, MarginFi, Kamino, BlazeStake, Solend, Jupiter, Meteora, Orca, Raydium, Lifinity, and Drift, who were building during the bear market. Now, Solana DeFi boasts a family of over 100 quality projects.

Last year, at one of the lowest points (SOL was $20), we wrote an essay titled “State of Solana DeFi 2023.” Many of the theses we proposed in that essay did indeed come to fruition and were well appreciated by the community. Inspired by the previous piece, writing the same for 2024 — dividing this into two parts:

State of Solana DeFi

What to build for Solana DeFi?

In the part 1, we will briefly explore an overview of Solana DeFi, look at various DeFi categories, discuss various Solana projects in brief, and finally conclude with what lies ahead. By the end of this essay, you will have gained all the necessary insights about Solana DeFi.

If anyone asks what's happening in Solana or about the top Solana DeFi projects, just forward them this essay. All insights, no froth.

Solana DeFi Overview:

While the entire DeFi ecosystem suffered significantly due to the FTX collapse, Solana DeFi was particularly declared as 'dead' when its TVL plummeted to a mere $200 million at the beginning of 2023. It remained around $300 million until SOL prices began to rise again towards the end of October. In the last four months, it has surged to an impressive $3.3 billion TVL, primarily driven by SOL prices. A healthy stablecoin market cap of ~$2.5 billion is also a good indication of liquid capital available in the ecosystem.

The Most Capital-Efficient Chain:

Popularised last year, while TVL might be a vanity metric; DeFi velocity (Daily DEX trading volume/chain’s TVL) is a metric Solana DEXs have been truly ruling by a huge margin.

Is Solana DeFi truly OPOS?

In the bear market, the phrase 'Only Possible on Solana' (OPOS) became a widespread rallying cry within the community, but what truly makes Solana deserving of this title? The straightforward answer lies in its low fees and high throughput.

Low fees and high throughput make possible OPOS like:

On-chain Order Book: Two order books consistently handling over $150 million in volumes, a feat not feasible on Ethereum or even Layer 2s due to the high frequency of placing and canceling orders. Furthermore, perpetual order books like Zeta exemplify OPOS.

DEX Aggregators like Jupiter: A $100 order on Jupiter is split, routed through 4-5 DEXs, and then recombined. On a Layer 2 platform like Arbitrum, this process would incur over $20 in fees alone, rendering it impractical.

Anything high frequency like – rebalancing, faster liquidations, and more.

While Move chains like Aptos and Sui, also offer high throughput and low fees, these advantages may not remain exclusive as Layer 2 solutions become more affordable and parallelized EVMs like Monad emerge. However, Solana's vibrant community and its high-caliber builders truly set it apart.

The memecoin phenomenon perfectly illustrates the combination of Community/Culture with High Throughput/Low Fees. Consider this: would you be willing to pay $100 in fees for each swap if you were ape-ing $1000 in a cat coin? Solana enables users to ape with as little as $1, supported by fast transaction speeds, seamless bridging frontends like Jupiter, efficient DEXs, and ample liquidity.

Why are Solana airdrops so hyped? It's because Solana is home to a group of exceptionally talented builders, and who wouldn't want to seize the opportunity to farm their potentially high FDV tokens?

Solana DeFi Sectors:

Just like any DeFi ecosystem, Solana boasts a broad spectrum of sectors, with the majority of TVL contributions coming from LSTs, DEXs, Lending/Borrowing platforms, and Perps.

Let's dive into each DeFi category to analyze their strengths, limitations, and the opportunities that exist. We will try to proceed in chronological order, following the typical DeFi user journey – from beginner to advanced level; also giving some tips/alpha on the way.

Wallets and Bridges:

Starting with wallets, the wallet wars have now consolidated into the three most DeFi-friendly wallets, each equipped with all the necessary features for DeFi: Backpack, Phantom, and Solflare. Phantom's browser feature acts as an excellent discovery tool for DeFi apps and tokens.

In the interoperability space, Wormhole stands out as the dominant messaging layer, enabling the sending of messages between Solana and over 25 other chains. Wormhole supports several major bridges:

Portal bridge (by the Wormhole team) — one of the oldest bridges, boasting an all-time volume of over $40 billion, but with very poor UX.

Mayan Finance — one of the fastest-growing bridges, featuring a cross-chain swap protocol built on Solana that allows for native asset swapping between chains like Arbitrum, Polygon, Optimism, Avalanche, and BSC.

Allbridge — Another liquidity pool-based bridge, facilitating connections between Solana and Ethereum, Ethereum L2s, BNB Chain, and Tron.

LiFi, the bridge aggregator, has also made its way into Solana, powering Phantom’s cross-chain swapper while integrating Solana into its bridging aggregator frontend — Jumper. Currently, this is powered by Allbridge, with plans to incorporate more bridges.

deBridge stands out as one of the fastest bridges with an intent-based architecture, powered by its own messaging layer. Hashflow and Carrier are two other bridges, though they are less frequently used.

Circle’s CCTP is also set to launch by the end of March 2024, with some of the aforementioned bridges as launch partners. This will enable anyone to bridge USDC in any amount with a very low fixed fee, significantly improving bridging liquidity. The launch of LayerZero is also highly anticipated in Q2; which can be a game-changer for cross-chain Apps on Solana as LayerZero has a much bigger ecosystem and community than Wormhole.

Jupiter has also developed a bridge comparator to assist users in choosing the optimal bridge. However, it only facilitates transfers from Ethereum to Solana and does not include all bridges.

User tip — Bridging to/from Solana: For Ethereum, Sui, and Aptos, use the Portal bridge. For Ethereum L2s, compare between Jumper, deBridge, and Mayan.

Spot DEXs:

Solana's DEXs have been recording peaks of $2-3 billion in daily volumes, $12 billion in weekly volumes, and $28 billion in monthly volumes – flipping Ethereum on good days and weeks. Approximately 60% of total DEX volumes are facilitated by Jupiter, the leading DEX aggregator on Solana and the largest DeFi project on the platform. Using Jupiter as a proxy for insights into DEX activity for February:

The top 10 tokens by volume are predominantly:

~82% blue-chip tokens – SOL, USDC, and USDT.

~10% meme coins — WIF, MYRO, SILLY, and BONK.

~6% LSTs — JitoSOL, mSOL, and bSOL.

Unique Wallets: Over 840K | Total Transactions: More than 29 Million.

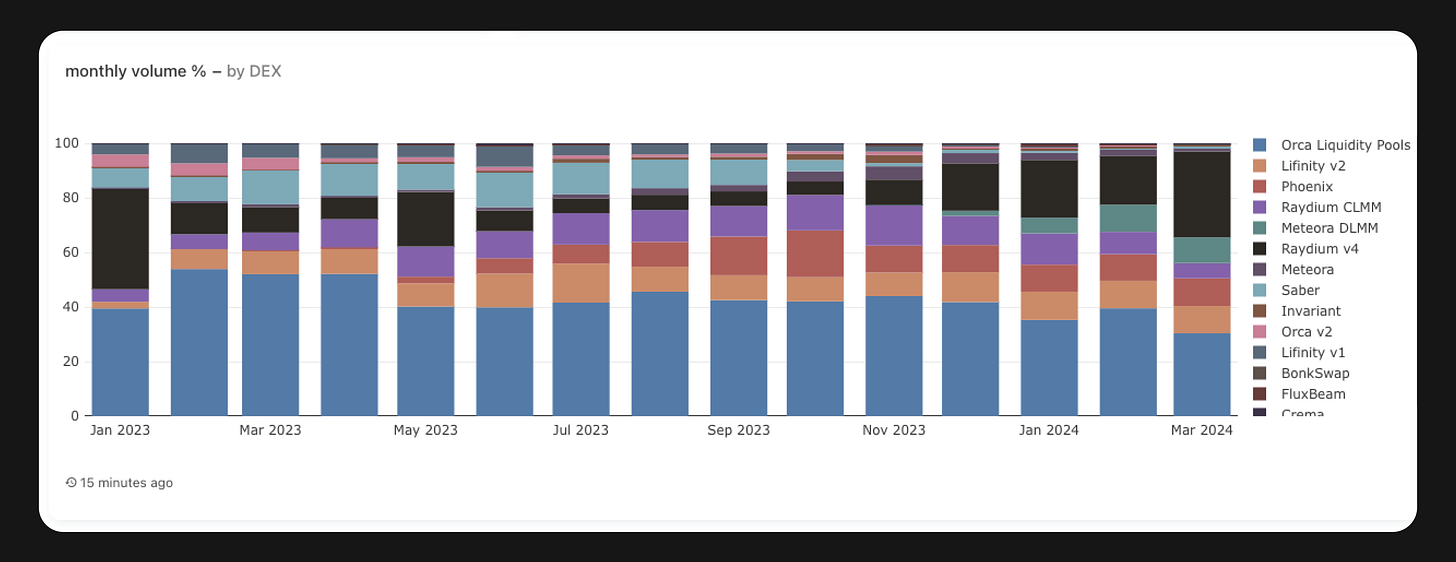

Unlike the EVM ecosystem, where Uniswap dominates, Solana's spot DEXs remain highly competitive, with top DEXs fiercely vying for market share. Orca, which held over 50% of the market at the beginning of the year, remains the leading DEX despite a slight decline in market share. Raydium and Openbook are achieving significant volumes, particularly during periods of meme coin popularity

DEX Aggregators:

Jupiter stands as the undisputed leader, not only within Solana but across the entire crypto sector, surpassing the volumes of EVM counterparts like 1inch and Matcha. Jupiter, the premier Solana aggregator, manages approximately 80% of the trade flow (after excluding bot activity). This contrasts sharply with the Ethereum mainnet, where a significant portion of trade still occurs through DEX frontends, and multiple aggregators share ~40-50% of the order flow.

Leveraging its sophisticated routing algorithm (Metis), Jupiter identifies the best prices across 30+ integrated DEXs, it also offers features like:

Limit Orders — enabling buying/selling at predetermined prices through the use of filler bots.

Dollar Cost Averaging — facilitating the periodic buying or selling of tokens over a set duration.

For developers, Jupiter provides a Payments API (allowing merchants to accept payments in any token while receiving the final amount in USDC) and a Terminal feature (enabling any dApp to incorporate swapping functionality within their interface). To date, Jupiter has facilitated over $100 billion in transaction volumes.

Prism, an OG protocol in the field, also features a DEX aggregator (doing insignificant volumes as compared to Jupiter) along with Prism Pro, a frontend for trading on Openbook. It plans to make its aggregator open-source.

Dflow, a potential contender to Jupiter, is being built by a solid team (which secured $5.5 million in funding last year, with possibly more since then). Dflow has developed a routing algorithm akin to Jupiter's, named Segmenter, with notable product distinctions:

A mobile-first approach and an integrated non-custodial wallet.

A mechanism for liquidity venues like AMMs to identify and apply higher fee rates to toxic order flows (such as bot activity and HFT firms).

Though not yet fully operational, Dflow has activated deposits and is running a points program, hinting at a possible token launch soon. Will be exciting to watch, if they manage to take any significant share away from Jupiter.

CLOBs (Central Limit Order Books):

CLOBs represent the first iteration of on-chain Order Positioning Systems (OPOS). Among the inaugural major DeFi ventures on Solana was Project Serum, initiated by FTX, which introduced the first fully on-chain order book, boasting unified liquidity across the ecosystem. Project Serum (and FTX too) played a pivotal role in sparking the initial momentum for Solana's DeFi sector, drawing numerous projects to the platform that are now considered blue chips within the Solana ecosystem. It's important to acknowledge and give credit where it's due.

Following the collapse of FTX, the DeFi community forked the Serum code, transforming it into a public asset and rebranding it as OpenBook. OpenBook might well be Solana's most underappreciated public resource, maintaining daily volumes of $50-100 million, imposing no trading fees, and allowing for the creation of markets without requiring permissions. For more on Openbook — read an essay I wrote previously.

Yet, the most prominent order book on Solana at present is Phoenix built by a strong team, with daily volumes ranging between $100-150 million. It currently operates markets with permissions (with plans to transition to a permissionless model) and derives the bulk of its volume from trading pairs such as SOL/USDC (~70%), SOL/USDT (~10%), and BONK/USDC (~10%).

In comparison to OpenBook, Phoenix offers:

Instant settlement (i.e., without the need for cranks).

More streamlined on-chain data, such as market events (e.g., placement and cancellation of limit orders, order fills) and more compact on-chain account sizes.

Root Exchange serves as another user interface built atop Phoenix, providing enhanced functionality for limit orders.

AMMs:

Despite the innovation of order books, the top four Solana AMMs continue to dominate the majority of trading volumes.

Orca — Drawing inspiration from Uni v3, Orca has emerged as a Concentrated Liquidity Automated Market Maker (CLAMM) and is now the most dominant DEX on Solana, focusing on developing the ecosystem's foundational liquidity. As of 2024 year-to-date, Orca has facilitated over $26 billion in trading volume, generating more than $40 million in LP fees. It is dedicated to being the most user-friendly liquidity integration platform with open-source and verified smart contract deployments.

Raydium — Diverging from other CLAMMs, Raydium also utilizes a CLOB (i.e., Openbook), adopting a hybrid model. Moreover, it supports permissionless farms, allowing anyone to create a pool and bootstrap liquidity for tokens. This feature has enabled the launch of thousands of meme coins on Solana, making Raydium the go-to DEX for meme coin launches.

Meteora — Modeled after Trader Joe's Liquidity Book, Meteora's DLMM (Dynamic Liquidity Market Maker) system arranges an asset pair's liquidity into distinct price bins. Each bin is defined by a specific price and liquidity amount, eliminating slippage for swaps occurring within that bin.

Meteora's DLMM can be viewed as a blend between an order book and an AMM, thus necessitating active liquidity provision and allowing for varied liquidity distributions based on strategies like Spot (uniform distribution), Curve (concentrated approach for low volatility), and bid-ask (inverse Curve distribution for high volatility). It’s particularly helpful for dynamic fee capture for LPs. i.e LPs earn more fees in periods of high volatility.

In addition to its DLMM, Meteora also offers AMM Pools (formerly known as Mercurial Pools), which include Dynamic Pools, Multitoken Pools, and FX and LST Pools.Lifinity — This platform operates as an oracle-based AMM. Unlike other DEXs that rely on arbitrageurs for price adjustments and use the pool's asset balance for pricing, Lifinity employs its own market maker. Furthermore, it does not depend on liquidity from LPs but instead utilizes protocol-owned liquidity (PoL), distributing generated revenue to its token holders. For example, in the last monthly cycle, it generated approximately $550K in revenue. Among all AMMs, Lifinity stands out as an OPOS and the most capital-efficient DEX, achieving $100-200 million in daily volumes with just about $800K in TVL (total TVL of approximately $7.5 million, including the Market Maker).

Fluxbeam is the sole AMM specializing in token extensions, poised to launch its launchpad soon. Other AMMs like Invariant and Saber (now SaberDAO) may not be as actively developed but still account for significant volumes.

Hybrid Exchanges:

Backpack Exchange — A centralized exchange developed by the team behind Backpack and Mad Lads. It is regulated under Dubai's VARA, with additional licenses forthcoming. The exchange currently offers spot trading and plans to introduce margin trading, derivatives, and cross-collateral options soon. It has successfully attracted over $70 million in deposits, spurred by anticipation of a potential snapshot.

Cube Exchange — Another centralized exchange, created by former members of the Solana Labs team. It boasts a latency of just 0.2 ms, which is lower than that of Binance (5 ms). The exchange maintains an off-chain order book, while settlements are executed on CubeNet, a meta-L2 blockchain that is reportedly a fork of SVM.

My Predictions:

Order books will continue to gain market share, especially for blue-chip asset pairs.

The specialization of DEXs will increase, with trading frontends becoming more social (e.g., Bonkbot, Fluxbot, or Dialect).

Given the token launch frenzy, the Solana ecosystem has two token launch tools:

Armada — This platform offers a suite of open-source protocols encompassing three key aspects of token launches: Token Launch (customizable auction and pool-based launches), Liquidity Provision (via CLMM vaults), and Tokenomics (automated protocol reward distribution and token staking). Projects like Flowmatic and Pepper are among the first to launch via Armada.

Jupiter’s LFG Launchpad — The top DeFi project on Solana has also established a launchpad, capitalizing on its existing ecosystem and community:

Features a customizable launch pool powered by the MeteoraAG DLMM.

Provides full trading functionalities, with a focus on the pre-ordering process and price discovery.

Includes a mechanism for voting on projects to be launched via the JUP DAO.

Projects like Zeus and Sharky are among the first to be launched via Jupiter.

Solana Assets:

Assets (or Tokens) on Solana can be broadly categorized into:

SOL and LSTs

Project tokens such as JUP and RNDR

Memecoins

Stablecoins and RWAs

Memecoins:

Memecoins are culture on financial steroids. They serve as the lifeblood of DEXs on Solana and have garnered significant attention. Many speculate that we might be experiencing a Memecoin Supercycle, with Solana leading the charge.

Solana has become synonymous with memecoins due to:

A fun community that embraces a unified meme culture, led by influencers like Ansem.

Low-cost and swift transactions foster inclusivity, removing the need to mentally factor in gas fees before trading.

A seamless user experience for memecoin trading through aggregators like Jupiter, supported by robust liquidity across DEXs.

Here’s the typical journey of a memecoin enthusiast:

Discover newly listed pools on Orca or Raydium, hear about a memecoin from friends or Twitter, or get insights from Ansem’s group.

Use DEXScreener and Birdeye to view charts and statistics on memecoins — the best part being that both platforms have integrated Jupiter into their interfaces, allowing users to directly invest in memecoins. One can also perform a quick check on a token's risk parameters using Rugcheck.

Continuously monitor your portfolio and share your findings with friends!

The adage "bet where the retail is" holds true — and the retail degens are on Solana.

My predictions:

Culture will become more fungible — I believe memecoins, as "Tokenized Culture," offer greater liquidity and inclusivity than NFTs, providing them with a significant advantage.

Vertical memecoin platforms will emerge; for example, a political platform featuring all politics-related memecoins like Tremp and Boden. Memecoins will lead us into the 'Metaverse' that was promised.

User Tips — Portfolio Trackers:

Solana supports three major portfolio trackers (or address stalkers): Step Finance, Sonar Watch, and Asset Dash. While Sonar Watch excels with DeFi integrations, Asset Dash and Step Finance are preferable for those seeking mobile-friendly options and better NFT support. For analyzing or monitoring any wallet, these portfolio trackers, along with Phantom's watch wallet feature, can be incredibly useful. From the two primary explorers, Solscan and SolanaFM, SolanaFM is much more advanced in terms of transaction analysis.

Stablecoins:

Solana now boasts a diverse array of fiat-backed stablecoins.

🇺🇸 USD – USDC, USDT, USDP, USDY, ZUSD

🇪🇺 EUR – EURC, EUROe, VEUR

🇯🇵 GYEN, 🇨🇦 QCAD, 🇨🇭 VCHF, 🇹🇷 TRYB, 🇮🇸 ISKT, 🇧🇷 BRZ, 🇲🇽 Etherfuse CETES, 🇳🇬 NGNC

Currently, Solana has approximately $2.5 billion in stablecoin market cap, with USDC (67.5%) and USDT (31.5%) commanding the majority of the market share, followed by a long tail of other stablecoins each with a market cap of less than $10 million. Despite the recent launch of many fiat-backed stablecoins, aside from USDT and USDC, most others face challenges with low liquidity and limited DeFi integrations. To address this, Meteora has introduced FX Pools (currently only for the EURC - USDC pool with a TVL of $20K), which is still in its nascent stages but represents a step in the right direction.

UXD (backed by overcollateralized lending positions, real-world assets, and delta-neutral positions) and USDH (CDP-backed) are the two decentralized stablecoins on Solana.

The Case for an On-chain Foreign Exchange (FX) Market

The FX market is huge, with over $6 trillion in daily volume. The availability of fiat-backed stablecoins with adequate liquidity could pave the way for on-chain spot FX markets through order books and AMMs. Envision a scenario where a merchant can accept payments in USDX and instantly convert them to YENX, with Jupiter routing the transaction through multiple liquidity venues. Someone will sooner or later build a spot Forex trading platform on Solana.

There are two LST-backed pseudo-stablecoins as well to be launched on Solana — MarginFi's YBX and Jupiter's SUSD. These are essentially CDP stablecoins but utilize LST as collateral (comparable to Ethereum's eUSD by Lybra and mkUSD by Prisma).

My Predictions:

Taking inspiration from Ethena, someone will develop UXD v2 (mirroring UXD’s previous model, akin to Ethena).

DeFi stablecoin mechanisms will become increasingly innovative in the quest to offer yields to holders and enhance the liquidity of lending positions.

User Tip — Not all stablecoins are created equal. Fiat-backed stablecoins are generally the safest, while other DeFi stablecoins, often termed “Synthetic Dollars,” carry inherent DeFi risks and are best suited for DeFi applications. Always verify liquidity and redeemability before holding any significant amount of stablecoins.

Bitcoin 🤝 Solana

In recent efforts to scale Bitcoin, several projects have embarked on creating Bitcoin <> Solana interoperability solutions to enable seamless Bitcoin usage via Solana:

Atomiq — A cross-chain DEX that facilitates the swapping of Solana assets (SOL and USDC) with Bitcoin (both on-chain and on the Lightning Network). Their payment demo, showcasing a Solana-to-Bitcoin transaction at a store accepting BTC, is notably innovative.

Zeus Network — An open communication layer bridging Solana and Bitcoin. It introduces zBTC (a wrapped version of BTC), allowing users to stake or lend it on Solana to earn yields. The project has ambitious plans, including deep integration of BTC into Solana's DeFi ecosystem with offerings like BTC-backed stablecoins, cross-chain lending between Solana and Bitcoin, Layer 2 integrations like Stacks, and more.

Sobit Bridge — SoBit functions as a token bridge where users can initiate the bridging process by depositing BRC20 tokens into a SoBit-specific address. The platform verifies these deposits and then mints equivalent tokens on Solana.

These initiatives are still in their infancy and have yet to fully launch. The Threshold Network's tBTC also provides a tokenized version of Bitcoin on Solana, facilitated by Wormhole Crypto.

For more insights and predictions, check out my thread on the Bitcoin x Solana thesis!

Real World Assets:

Tokenizing RWA (Real World Assets) brings off-chain financial assets on-chain. For example, real estate, private credit, T-bills, green bonds, gold, and other commodities.

Apart from stablecoin, Solana hosts a wide range of RWAs, ranging from:

Tokenised T-bills (Ondo and Maple Finance)

Real Estate (Homebase and Liquidprop)

Physical Goods (BAXUS and CollectorCrypt)

My Predictions:

DeFi Composability: For example, holders could earn higher yields on their U.S. Treasuries by tokenizing them, using them as collateral in a DeFi lending market, borrowing stablecoins, buying more Treasuries, and repeating the cycle. This scenario is just one illustration: integrating Real World Assets (RWAs) into the Solana DeFi ecosystem opens the door to creating valuable new products, some of which can only come to life through crypto-native mechanisms.

Expanding into more assets and markets will introduce more high-quality tokenized assets to DeFi.

I've composed a comprehensive essay on Real World Assets, which encapsulates all RWAs on Solana along with my thesis.

LSTs (Liquid Staking Tokens)

On Solana, ~400k wallets stake their SOL. As an asset class, liquid staking tokens (LSTs) contribute the most to the protocol's total value locked (TVL). Take any lending/borrowing protocol, and you will see LSTs dominate the TVL. However, Solana's LST adoption remains low at 4-5% of the total SOL supply, compared to Ethereum, where the staking rate is an impressive ~24%. While most LSTs offer similar yields, it is the higher secondary market liquidity and broader utility in DeFi that make them stand out. On DeFi integrations, Money markets dominate, with platforms like Solend, Kamino, and Marginfi becoming central hubs for LST activity, partly propelled by the anticipation of an airdrop.

On Solana, all LSTs generate yield, meaning their value increases as yields accrue. In contrast, popular Ethereum LSTs like Lido's stETH undergo daily rebasing (that means the number of stETH in your wallet keeps increasing, while the price remains roughly the same as ETH).

Marinade [mSOL]: Marinade, a pioneer among Solana's LST protocols, was established in 2021 from a merger of two teams at a Solana Hackathon. The project launched its MNDE token in November 2021 and transitioned to an on-chain DAO in April 2022. Its TVL is distributed between:

Native staking (35% at 3.5 SOL)

Liquid staking (75% at 6.72 SOL)

Marinade Native stands out by offering institutions the option to stake directly to a decentralized selection of top-performing validators without smart contract exposure, appealing to those hesitant about participating in DeFi.BlazeStake (bSOL): Initiated by an anonymous developer known as solblaze, BlazeStake quickly gained traction, amassing a TVL of 2.7 million SOL (approximately $400 million) in under a year, driven by token-incentivized rewards and extensive DeFi integrations. This approach has provided bSOL holders with additional yield opportunities.

Jito (JitoSOL): Although Marinade led initially, Jito emerged as a formidable competitor by late 2023, partly due to its effective use of points and airdrops for increased visibility. JitoSOL sets itself apart with a focus on MEV, delegating SOL to high-quality MEV-enabled validators. These validators, equipped with Jito Labs' software, earn additional MEV rewards by auctioning block space, which Jito redistributes as extra APY to its users.

Jito Boosted Yields = Standard Staking Yields + MEV Rewards

Jito's Stakenet: When we stake SOL using any LST solution, the staking program is operated by a hot wallet managed by an off-chain bot that decides to:

- add or remove validators- delegate or undelegate stake

This introduces centralization risks. Stakenet addresses this issue by moving all delegation logic on-chain, transforming a previously trusted and opaque system into a transparent one.

Recently, Jito Labs suspended its mempool services provided by the Jito Block Engine due to an increase in sandwich attacks. The decision has sparked mixed reactions within the community, with some appreciating Jito's proactive stance, while critics argue it could lead to private deals and potentially a new, private mempool being developed in response.While LSTs represent one use case, StakeNet can be particularly interesting for scenarios such as restaking networks, liquid restaking protocols, oracle networks, and more. In these instances, StakeNet can autonomously allocate assets across a decentralized network of Actively Validated Services (AVS) and high-performance node operators. It combines the best of both worlds: automation (by moving processes on-chain) and governance (allowing configuration parameters to be set via governance).

Numerous other LSTs exist, operated by solo validators, with a few attempting to differentiate themselves. For example, LaineSOL and CompassSOL have been offering higher staking rewards with the aid of MEV. For a comparison of APYs and active stakes, check out this list.

LSTs on Solana confront liquidity challenges, which is why there are only three major LSTs (JitoSOL, mSOL, and bSOL). Smaller LSTs struggle with the issue of fragmented liquidity – sanctum solves this.

Sanctum - Unified LST liquidity:

An interesting project by one of the OG teams helped Solana Labs build the SPL stake pool program and launched the first SPL stake pool, Socean.

To solve liquidity, Sanctum built two major products:

Sanctum Reserve – Pool of liquid SOL acting as a reserve. This enables instant unstake for all LSTs, no matter how big or small. Till now, 60k SOL has been taken from the Sanctum Reserve for instant unstakes or LST-SOL swaps!

Sanctum Route — Built along with Jupiter, it allows to convert from one LST to another even when there is normally no route between two LSTs. This unifies LST liquidity by allowing small LSTs to access the liquidity of much larger LSTs using the Sanctum Reserve Pool. It has facilitated more than $380 million in all-time traded volume.

But how does it swap any LST? It simply assumes that all LSTs can be redeemed for SOL in the next epoch and the price of LST is derived from the blockchain itself (based on yields it has accrued).

Sanctum has also launched two more products:

Sanctum LSTs — Validators can now launch their own LSTs, and in fact, six new validators have already been onboarded: bonkSOL, compassSOL, dSOL, jucySOL, pwrSOL, and superSOL.

Why would a validator choose LST over vanilla staking?With Sanctum, these LSTs have zero deposits, stake withdrawals, and management fees.

More DeFi integration, potentially boosting yields for stakers and the potential to launch a token and kickstart the entire ecosystem.

Benefits to the Solana Ecosystem:LSTs, when integrated into DeFi, can significantly increase TVL

This also reduces contagion risk in Solana, as no single LST would monopolize the market.

Sanctum Infinity — A multi-LST liquidity pool (Automated Market Maker or AMM) that allows swaps between all LSTs in the pool. It operates as follows:

Users deposit any (whitelisted) LST into Infinity.

They receive INF tokens (which represent LST itself), accruing both staking rewards and trading fees from the pool.

All LSTs can share the liquidity of INF-USDC and INF-SOL, or route via INF to access liquidity from any other LST pair.

For instance, JitoSOL can first be swapped to INF via the on-chain yield calculation and then swapped to USD or SOL. In this way, INF could become one of the most liquid LSTs on Solana. Think of INF as an LST, but with added trading fees accrued from the pool.

Think of Sanctum as Amazon for LSTs, just like:

1) You can buy/sell products on Amazon — you can buy/sell LSTs for SOL (Sanctum Reserve and Router)

2) Launch your own product on Amazon, while Amazon takes care of end-to-end delivery — you can launch your own LST while Sanctum takes care of liquidity (Sanctum LSTs)

3) Amazon’s own brand — Sanctum has launched it’s own LST (Sanctum Infinity)

My Predictions:

More LSTs: With the help of solutions like Sanctum or standalone, many LSTs will emerge in the coming months; with differentiations like the two-token model (like Frax) or better MEV/tips-sharing.

Deeper LST integration in DeFi: I am particularly keen on LST yield tokenization getting developed on Solana.

Will there be SOL Restaking?

Restaking is huge on Ethereum, primarily due to AVS (rollups/appchains/bridges) that require economic security and the same doesn’t translate to Solana — as it doesn’t have a modular thesis yet.

However, Solana can still have AVS (Actively Validated Services) as anything that requires distributed validation can use this:

Clockwork-type Keeper networks

Pythnet-style appchains

An early-stage team called Cambrian is also exploring this direction. Picaso is another solution exploring SOL LST restaking to secure Mantis, a cross-chain intent settlement protocol. Apart from that, Jito is another team, which is well-suited to build anything around Restaking via stakenet.

Lending and Borrowing:

Solana hosts three major Money Markets utilizing a Peer-to-pool model, adhering to floating (variable) rates and analogous interest rate mechanisms. They operate based on a utilization-based interest rate model, wherein the yields are contingent on the utilization ratio (the proportion of supplied capital that is lent out), with the formula: supply rate = borrow rate * utilization ratio * (1 – reserve factor). The 'reserve factor' represents a percentage of capital supplied by lenders on which they do not earn interest; instead, this interest benefits the protocol. The utilization rate largely hinges on the system's appetite for leverage.

All three markets feature an active points program, with MarginFi and Kamino planning to launch tokens soon:

Kamino Lend: Currently the largest Solana lending/borrowing platform, it has escalated from 0 to $700 million in just 5 months. Similar to Aave v3, Kamino also introduces E-Mode, enabling users to borrow highly correlated assets (like LSTs or Stablecoins) with a more capital-efficient LTV ratio. Additionally, it permits some LP tokens as collateral.

Kamino has developed products like Multiply and Long/Short, which are one-click vault products designed for leveraged yields through looping. Kamino features a comprehensive risk dashboard for examining all types of risks alongside various scenario analyses. Uniquely, Kamino has implemented Auto-deleveraging, where borrowers are deleveraged (i.e., partial unwinding of positions) in response to market conditions to prevent bad debt.MarginFi: One of the first DeFi protocols on Solana to initiate a points program, it has surged from $3 million to over $600 million in less than a year. Alongside its lending protocol, it is also launching its own LST-backed stablecoin — YBX.

Solend: The original protocol on Solana, Solend currently boasts a TVL of ~$200 million. In terms of SOL, it has fluctuated between 1-2 million SOL over the last 1.5 years (following the FTX crisis and the Solend whale liquidation incident). It is based on the spl-token-lending program (Solana Lab's reference implementation) and also offers a yield-bearing deposit receipt for every deposit, known as 'cTokens'.

While all protocols employ similar lending/borrowing mechanisms, they each adopt distinct approaches to risk management parameters, such as Price Oracles, liquidations, risk engines, and so forth. Given the high demand for leverage, the rates have surged significantly with USDC now yielding 30-40%!

On the trading front, there are two perps — Drift and Mango — with lending/borrowing features that can also serve as a margin for trading.

Yield Aggregators:

Yield aggregators generally aggregate two types of yields:

Lending/Borrowing, such as:

Automatic: Meteora offers Dynamic Vaults which automatically rebalance every minute between top lending protocols to optimize yields.

Manual: Flexlend, similar to Jupiter but for lending, aggregates the best rates for assets like USDC across five lending/borrowing platforms — Mango, Drift, Mango (listed twice, assuming to emphasize its importance or a typo that should be corrected), MarginFi, Solend, and Kamino. It automatically rebalances deposits to the protocol offering the highest APYs at any given time. Flexlend features a unique Homebase, where users can set a minimum desired rate, and if unmet, funds will revert to a wallet or a specified protocol.

JuicerFi acts as another yield maximizer by aggregating different lending/borrowing protocols along with strategies that maximize points.

LP in DEXs, like:

Kamino enables users to earn yield on their crypto by providing liquidity to CLMMs such as Meteora, Orca, and Raydium. It issues kTokens as receipt tokens, representing the value deposited in Kamino vaults, and allows users to create their own DIY automated strategy vaults.

Hawksight is a concentrated liquidity yield optimizer for active LPs on Solana, offering self-custodial & automated market-making strategies. It's akin to Kamino liquidity but has already launched its token, achieving a TVL of $10-12 million.

My Predictions:

Driven by the demand for leverage and high volumes, yields will go higher, attracting substantial capital.

There will be experimentation with yield derivatives, such as yield stripping, fixed-rate lending, interest-rate swaps, etc (more on this in part 2).

Note on Oracles:

Oracles not just bring off-chain data on-chain, but are very criticial for the DeFi infrastructure as all calculations rely on the orcale price feeds. Pyth (permissioned - only verified publishers can publish) is a dominant player being the first choice of integration for most players, while Switchboard (permissionless - can have custom price feeds) is another player which serves as an alternate or backup oracle for most DeFi players.

Perp DEXs:

Perps are the highest PMF derivative product in Crypto and like every chain, Solana has a wide range of perp protocols:

Peer-to-Pool Perp DEXs: Jupiter, Flash Trade, Parcl

Orderbook-based Perp DEXs: Drift, GooseFX, Zeta, HXRO, Pepper, Mango

Most perp DEXs on Solana have an active points program, which has led to a huge surge in volumes.

Peer-to-Peer Pool:

Drawing significant inspiration from GMX, Solana boasts two operational perpetual DEXs — Jupiter and Flash. Both are based on a novel LP-to-trader model, offering up to 100x leverage. They utilize LP pool liquidity (FLP for Flash and JLP for Jupiter) and oracles, ensuring zero price impact, zero slippage, and deep liquidity. Users can open and close positions in one simple step, eliminating the need for additional accounts or deposits. However, there are notable differences:

Jupiter supports only 3 assets, whereas Flash offers a broader range of assets, including commodities like gold and silver.

Flash introduces a unique NFT x DeFi play with built-in gamification.

Jupiter aggregates all fees (trading, swapping, and liquidity) into the LP pool, while Flash separates trading fees, distributing them to the staked FLP pool in USDC.

Nevertheless, network effects are powerful, as Jupiter perps are integrated into the Jupiter Frontend, the most visited DeFi site, giving Jupiter perps a significant advantage — the numbers speak for themselves. Jupiter achieving more volume than all other perps on Solana combined validates that crypto frontends can cross-sell anything (even products that may not be the best) — generating fees and, hence, accruing value!

Parcl – An intriguing perpetual DEX that enables one to go long or short on real estate indexes for cities like Las Vegas and Paris. The price feed oracle for this perpetual DEX is Parcl Labs, the company behind the Parcl platform. Despite attracting a significant amount of TVL, it does very little organic volume.

Orderbook Perp DEXs:

One of the other OPOS features, Solana is the only chain running completely on-chain perp order books, while most other chains have off-chain order books (as a sidechain/appchain/rollup).

Drift Protocol — Originally built upon the virtually automated market maker (vAMM) model, pioneered by Perp Protocol, Drift v2 now follows a unique mechanism “Liquidity Trifecta”, composed of 3 mechanisms:

Just-In-Time (JIT) Auction (5-sec Dutch auction for Market Makers to fill)

Order book (keeper bots keep track of open orders in an off-chain order book)

If market orders aren't filled, AMM Pool acts as a backstop liquidity provider.

Drift launching pre-token launch perps can be an interesting marketing play, however, the volumes would still be low as we have seen from Hyperliquid and Aevo pre-listing markets.

Fully-on chain orderbooks like:

Zeta Markets – Zeta v2 utilizes a fully on-chain orderbook and matching engine with similar operations to the Open Book DEX on Solana. Due to the upcoming token launch, it has managed to drive a recent surge in volumes.

Mango Markets – Once the biggest DeFi protocol on Solana, it’s struggling to even be in the top 5 perp DEXs, after the hack incident.

GooseFX – Another CLOB-based DEX with incentives around their native tokens.

HXRO — Hxro Network is a shared liquidity layer for derivatives which any perp DEX can tap into. It has two core protocols Dexterity (helps connect to and build CLOB-based derivatives) and SPANDEX (Risk Engine). Anyone can build their UI/UX and compose with the Hxro Network protocol – one such upcoming project is Pepper DEX building a sleek UI while leveraging Dexterity, a global order book for shared liquidity.

Solana Perp DEXs still lag their Ethereum counterparts by a significant margin, particularly the Hybrid DEXs (Off-chain order book matching with on-chain settlement) like Aevo, Hyperliquid, Vertex, and dYdX - which are consistently the top 4 perp DEXs. However, Jupiter has been recently doing high volumes, placing it in the top 5 perp DEXs in good days.

My Predictions:

Perps as Solana Appchains: In the EVM world, most perp DEXs, especially those based on order books like Aevo and Hyperliquid, are transitioning to their own appchain. In the future, Solana perp DEXs could also build their own chains, which could offer several benefits:

Freedom from any mainnet congestion.

An enhanced trading experience for users (trades could be gas-free for traders).

In fact, Zeta has already started moving in this direction.

Perp Aggregator: Just as we have aggregators for lending and spot DEXs, we might soon see perp aggregators as well, despite the challenges posed by varying design mechanisms. With the emergence of perp aggregators like Rage Trade and MUX, a similar trend could arise on Solana — particularly for designs akin to Flash and Jupiter.

Backpack and Cube begin to gain market share and overtake on-chain volumes, driven by off-chain order books and the excitement surrounding token launches.

Structured Products and Options:

Structured Products and on-chain derivatives (aside from Perps) were all the rage during the previous bull run, with many innovative products like DeFi Option Vaults ( Katana and Friktion) launching on Solana. We can expect a similar frenzy to return as we are on the cusp of the bull market.

Options:

On-chain options are challenging; however, they are making a strong comeback, with projects like Aevo experiencing a recent surge in premium volume of approximately $500K, while notional volume reaches $1-2 billion. This resurgence is followed by projects like Lyra, Typus, and Premia.

On Solana, there are two very strong teams building on-chain options:

SDX Market – Developed by the OG team — PsyFi, an Option AMM that enables fully collateralized, cash-settled European options, including calls, puts, and vertical spread strategies. It utilizes AMMs over order books, which most of the 2021 option platforms predominantly used, offering:

Passive LPs and better risk-adjusted yields as options are sold at a premium.

SDX provides quotes across various price levels and option tenors, offering a broader range of options.

The platform automatically adjusts bid-ask spreads to incentivize trades that maintain an optimal liquidity pool composition.

It's still in the early days but has powered over $8 million in all-time volume, with a peak daily volume of $450k, and assets available include SOL, ETH, BTC, and mSOL.

PsyFi also offers a vault product with standard strategies like the whETH-covered call, BTC-secured PUT, and SOL-covered call.

DeVol – Similar to SDX Market, it's also an AMM for fully collateralized European options. However, it is powered by a unique pricing methodology based on elementary units called "Standard Risk Blocks” (SRBs). SRBs are used to synthetically price and settle any derivative payoff, including that of traditional options.

Regarding structured vaults, Cega is another OG product, offering various types of vaults like Pure Options Strategy, Bond + Options Strategy, Leveraged Options Strategy, and Dual Currency Vaults. It supports deposits and withdrawals from Solana, has a TVL of ~$13 million, and has transacted more than $380 million.

Perp-based Vaults:

Circuit Trade — Vaults that deposit in market-making strategies on perp DEXs (currently only Drift). They help contribute to passive liquidity and take advantage of high-yield MM strategies. For instance, the Supercharger Vault is a fully on-chain delta-neutral market-making strategy.

Adrastea Finance — Allows you to earn leveraged yield or high fixed APY. Inspired by the GMX/GLP ecosystem, its initial strategy lets you either earn a leveraged yield on your JLP or secure steady APY on your USDC.

Yield Enhancers like Superstake SOL — assist in earning leveraged yield on LSTs through recursive borrowing/lending of SOL, powered by Drift.

Dual Finance – offers options infrastructure, but not for speculative use-cases; instead, it serves as incentive liquidity infrastructure for Web3 Communities. By using Staking Options, enables projects to offer lockup rewards in the form of options. Dual Finance allows projects to reward participation in their ecosystem (e.g., using their protocols or providing liquidity) by granting users options on their native tokens. For example, BONK has staking options (lockup rewards in the form of options) to incentivize long-term token holding and community engagement.

Amulet — is a yield/insurance protocol supporting Solana, featuring various products like AmuVaults, AmuShield, and AmuVerse. Symmetry is another platform for creating, automating, managing, and tracking on-chain funds.

My Predictions:

Structured Products and derivatives, especially those based on order books, will make a comeback on Solana.

Options will experience a resurgence — bull markets necessitate extra-speculative products for the degens. Options when used well can give leverage without the risk of liquidation.

User tip — Options are risky and should only be explored once you fully understand them. Nonetheless, since most projects are still in their early stages and tokenless, if you're an options trader, they're worth considering.

Closing Thoughts: Road to $10 Billion in TVL and Daily Volumes Each

Broadly, I expect the following DeFi trends to unfold:

The demand for leverage will significantly increase, leading to higher APYs and, in turn, a wide array of yield products.

Speculation and the velocity of money will reach unprecedented levels — we will witness a wave of speculative products like never before (for example, Power Perps and Everlasting Options).

Permissionless Real-World Assets (RWA), AI, and DePIN tokens will begin to occupy significant volumes in DeFi.

As both ends of the barbell of Solana DeFi have been developed, we will see more innovation happening in the middle! A massive unlock is about to happen, catering primarily to the utilization of yield-bearing assets and yield trading within the ecosystem.

The Solana DeFi ecosystem is rapidly growing; the blue chips have done a tremendous job in bringing Solana DeFi to its current state — it’s now time for new DeFi protocols to emerge. The biggest strength of Solana lies in its composability. While composability is a double-edged sword from a risk perspective, it offers early-stage DeFi protocols tremendous leverage to grow on the shoulders of giants.

Focus on innovations and design mechanisms that are ‘only possible on Solana’! The infrastructure is finally at a place where a high scale of activity can be sustained — so many DeFi primitives that previously failed due to being too early are now viable again.

This was just part 1 of the Solana DeFi series – stay tuned for Part 2, “What to Build on Solana DeFi,” which will delve deeper and focus on giving builders insights into trends to watch out for, along with in-depth ideas.

Subscribe if you don’t want to miss Part 2.

Feel free to contact me at Yash Agarwal (@yashhsm on Twitter) for any suggestions or if you have any opinions. If you find this even slightly insightful, please share it — justifies my weeks of effort and gets more eyeballs :)

Special thanks to Sitesh (Superteam), Kash (Superteam), Krish (Timeswap), Akshay (Superteam), Ata (PsyFi), and Mikey (Orca) who reviewed and provided insights at different stages of the draft.

Disclaimer:

Many figures like TVL are highly dependent on asset prices like SOL, which are bound to change regularly. All figures are as per the date of writing.

This essay is completely my perspective and thoughts on the Solana DeFi Ecosystem and in no way represents any organization. Given the comprehensive and informal nature of the essay, some amazing projects might have been missed or received lesser attention as compared to other projects. None of this is financial advice or any recommendation towards a particular project. As usual, everything discussed is Not Financial Advice, please Do Your Own Research.