Streamflow: Enabling streaming payments on Solana — A Deep Dive

A deep dive into the coolest project on Solana — Streamflow, the problems in payments, how Streamflow is solving them, the product teardown, and many more!

Imagine, we can do monthly subscriptions like Netflix in Web3 or make automatic salary payments in crypto?

Well, the focus of this deep-dive, Streamflow does that exactly. In this piece, we will take a look at, What is Streamflow and why it’s one of the most interesting concepts in the Solana network which may completely change the way real-time finance works 💸

With that Let’s dive right into it!

We are in May 2022,

🚀 Raj pays Collin $100 every month.

🚀 A DAO distributes rewards to all its members periodically.

🚀 A DeFi protocol pays tokens as a salary to its employees.

🚀 Bob buys $250 of SOL every week.

All these operations described may seem obvious, but they still require many repetitive and expensive transactions to be processed on-chain.⛓

What if we could use smart contracts to ensure digital assets(tokens) move automatically on-chain without any need for periodic transactions?

What if you could pay monthly recurring subscriptions in crypto tokens?

It will be really cool. Isn’t it?

In this deep dive, we will discuss-

Non-real time payment problems with existing systems

Current issues while trying to solve it with Blockchains like Solana

A complete Product teardown (Background, Mission, and Features) + a brief guide

Some insights on its growth and monetization and some security concerns 💡

A competitor analysis ⚜️

Bull and Bear case for Streamflow as a platform 🚀

Let’s first understand the problems around payments and then look at the solutions streamflow is solving👇

Non-Real time Payment Problems 💵

When you provide a service, you always provide that service in real-time. Every second of your work goes to providing value to customers. However, singular, lump-sum payments (today’s default payment method) require that we disconnect the link between payment & value transfer 🔁.

The service requirement is successive, yet payment is detached.

Employees don’t receive payment in real-time when they are indeed providing this service, but they hop in and provide value during the hours that they’re on the job, they wait until the end of the pay period i.e end of the month to receive value in return for their work. This workflow has many cynical influences.

Not only employees. Small businesses often suffer from crapy payment terms.

In simple terms,

Paying at the end of the month always benefits the big businesses, while puts employees on the backfoot who provide services in real-time.

Payment Problems on Solana

While existing solutions on Ethereum like Superfluid are solving this problem well with streaming payments, but are inherently expensive and slow due to the nature of the network.

Solana offers one of the fastest and cheapest transactions, but advanced transactions on Solana are difficult. For example, if a company wants to give their investors a schedule to vest their tokens i.e sell the ownership and exit the project, there’s no standard currently on Solana to make it happen programmatically.

Similarly, automatically paying their employees every month, making bulk payments for bounties and airdrops and such complex payments are currently a pain in Solana.

There’s no crypto native distribution product on Solana and no event-based token locking product.

What’s the solution?🤔

Enter Streamflow — The future of money streaming on Solana

Streamflow is a token distribution platform that provides teams with the necessary tools to manage their treasury and distribute value (Streaming payments and on-chain salaries) with ease.

Money streaming lets us connect the service, requirements, and payment settlements.

Likewise, think of having an on-chain proof that you’re being paid. Streamflow lets receive money in real-time for your services in a way that is on-chain and fully programmable. If someone is delivering valuable work, why shouldn’t you be paid every second for that?

Now there is no concern about the risk of not getting paid, as you get the payment for every second of your work, and your employer has designed an on-chain stream of payment that you can check at any time and you have the proof. How cool is that!

Crypto businesses finally have a simple way to accept recurring payments, enabling subscription-based business models for software, communities, and content.

The Streamflow: Product Teardown 🧑💻

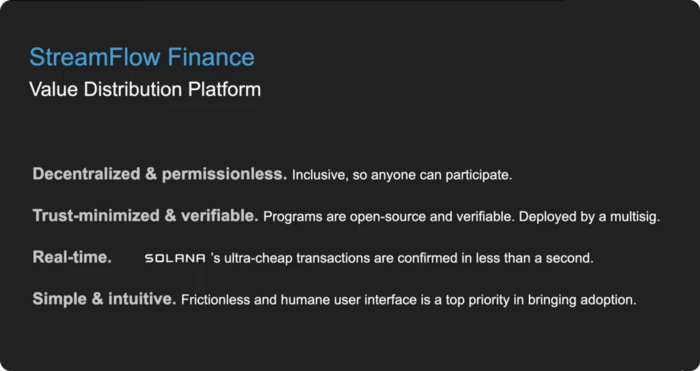

Streamflow finance is a platform for organizations to distribute value in a decentralized permissionless trust minimized efficient effective and pretty straightforward way.

It is made of composable and mutually compatible tools that way you can have a multi-signature treasury, bulk token distributor, token vesting, and A capital-efficient token streaming workflow.

Not only that you can have these as separate tools and also its real power comes when those are combined into a bigger platform. With the power of DeFi, the positive liquidity can be put to earn interest via lending protocol or deal farming protocol in the background.

TL;DR- Streamflow is building a suite of payment tools on Solana 😉

Now employers and project developers will be able to optimize their payouts to match the accessibility of traditional finance.

This is where Streamflow comes into play with its powerful primitive Streams functionality. Instead of a limited set of choices for token release frequencies and vesting options, Streamflow offers a highly customizable solution for both vesting contracts and payroll streams.

Some features include:

Payrolls: This especially becomes important if the trust between the parties is not yet established.

Vesting: Ideal use case, with minor alterations (cliff and time-step)

Services billed per time unit: Consulting, live events/concerts, audio/video content (pay only for the time spent consuming the content), bike renting, or even parking!

Fundraising & donations: Donors can create continuous streams and support the cause for as long as they wish.

Streaming digital assets create huge efficiencies and enable a new generation of apps to get built.

Now Let’s look at the already functional features of Streamflow,

Token vesting

Payroll Streams

1. Token vesting and why it’s important

Token vesting — which some call token lock-up — is the process of locking up a certain amount of the total tokens from circulation. These tokens are often released over an agreed period, which is usually over the years.

Core team members, partners, and advisors are always entitled to these vested tokens. The reasoning behind token vesting is to make sure the core stakeholders of the project do not receive their rewards at once, thereby keeping them around to ensure the growth of the project.

Hold on to this simple explanation of vesting:

it is the act of locking some tokens to be released gradually as the project grows.

Token vesting with Streamflow

Hold your chair back! as we are coming to the juicy part here.

Token vesting with Streamflow is simple yet highly customizable. For project developers, having access to this feature makes vesting tokens far more nutritive. Some of the features of the vesting tool are:

Vesting Duration — You can select a start and end date and time for the vesting schedule. Paired with Streamflow’s other features, payment senders also have customizability on token distributions.

Precise Release Frequency — This lets the vester choose a precise release schedule proportional to the vesting amount. This can be as often as a single second to a more spread-out time. This precision makes Streamflow a particularly efficient tool for allocating tokens through vesting.

Setting Cliffs — Users can set cliff times to adjust factors such as an immediate unlocking of a percentage of the vested tokens. The process is simple and only requires the user to select data and percentages.

Automatic Withdrawals — With this, tokens are automatically sent to the recipient’s wallet if toggled. This means the vesting recipients do not have to and the need to connect their wallet to the Streamflow app to accept their tokens, they will be sent automatically.

2. Payroll Streams with Streamflow

Payroll streams are identical to what token vesting is with certain differences.

The vesting contracts on Streamflow are used to vest SPL tokens to investors, teams, and communities. You can customize the vesting contracts as per your requirements using its unique features, such as cliff time release, release frequency, email notification, automatic withdrawal, contract duration, etc. A vesting contract is created for a fixed duration

On the other hand, payroll streams are used to stream payments to employees, freelancers, teams, contractors, and service providers. It is an efficient and secure way of making recurring payments.

You can stream payments as per the required release rate, and the sender of the payment stream can also top up the ongoing payroll stream with more funds.

What you can do with it

Customizable Schedule — Like the vesting contracts, payroll streams are highly customizable. Release frequency and amount can be customized, allowing for weekly lump sum payments or daily smaller chunks.

Topping Up Streams — Topping up streams allows employers/senders to increase the payment amount and duration. This can be done an unlimited amount of times in Streamflow as long as the payroll stream has not expired. This tool is handy for employers relying on contractors as some jobs can have delays that require more billed hours.

Automatic Withdrawals — Largely like vesting contracts, you can do automatic withdrawals using the payroll streams. This becomes useful for payments made in stablecoins and allows the recipient to access and receive their funds at any time.

Transferable Streams — Earlier set payroll streams can allow for the payments to be transferred to a new wallet address. The creator of the stream can choose who out of the sender or receiver can transfer the stream.

Canceling Streams — Streamflow payment streams allow the creator to cancel payroll streams, returning any locked tokens to the sender. Unlocked tokens will be sent to the recipient upon cancellation.

In case of employee turnover, this becomes handy.

Which tokens are supported by Streamflow?

Streamflow supports all SPL tokens for vesting contracts and payroll streams. As they say in their docs, All Solana network tokens are supported. To stream SOL, it should be converted into the wrapped SOL token.

One of their much-awaited features is -

A multisig wallet for teams to manage their payments and vesting with confidence including a clear summary of their open streams, signers, and more. So that Users will be able to use this feature in both the vesting contracts and payment streams.

How to Streamflow: A Step-by-Step Guide 📄

Creating Payroll Streams Using Streamflow

step 0: Visit app.streamflow.finance and connect your SOL wallet

Make sure to have some SOL balance in your wallet for transaction fees. We recommend having at least 0.02 SOL in the account. After connecting the wallet, switch to the ‘New Streams’ page for creating a payroll stream

Step 1: Stream amount and release rate

Specify the total amount that you want to lock into the payroll stream, you can also top up a live stream to add more funds later on.

You can choose any SPL token of your choice for the stream and enter the amount to be streamed in the given tab.

Let’s say an employee’s weekly salary is 700 USDC, either you can choose the old school way of releasing 700 USDC at the end of each week by setting the release frequency to one week and the release amount to 700 USDC, or you can proportionally breakdown the total salary amount into smaller amounts and release that in smaller time units like X number of seconds, minutes, hours, and days.

To stream the 700 USDC weekly salary in almost real-time, you will need to set the release rate to 0.0011574074 USDC and the release frequency to one second as shown in the screenshot.

Step 2: Title and recipient address

You can name the payroll stream by typing a subject or title in the given tab. The recipient’s Solana SPL wallet address can be entered in the recipient account tab.

It is strongly recommended to only use a non-custodial wallet address for the recipient. In case you want to stream salary to a centralized exchange SPL wallet address, make sure to turn on the automatic withdrawal.

Step 3: Start time/date and automatic withdrawal

You can choose the start time and date of the payroll stream from the respective tabs.

Automatic withdrawal lets you automate the transfer of unlocked tokens into the recipient’s wallet at the set frequency.If an automatic withdrawal is enabled, the recipient does not need to connect the wallet to Streamflow to withdraw the salary.

Step 4: Cancel & transfer authorization and referral address

You can choose who gets the authority to cancel or transfer the payroll stream from the sender and recipient.

You need to toggle on the advanced option to open up the authorization menu and referral tab. In case you were referred by someone,

you can paste the wallet address of the referrer and a small portion of the charged fees will be rewarded to the referrer.

Step 6: Create the payroll stream

You are now all set to go live with your stream. An overview tab will show you a summary of the parameters of your payroll stream.

Just click on the create button and confirm the transaction on a wallet pop-up.

Voila! now you are set to streaming those tokens. 👍

Note: The above guide is inspired by their docs, refer to it for more information about other features. We are leaving it for not making this deep-dive extra lengthy :)

Community and Backers💰

Streamflow raised $3.1 Million in its Seed Round led by one of the aggressive investors — Jump crypto which is also one of the biggest crypto liquidity providers and has backed Solana-projects like Phantom, Neon Labs, and Saber, helping them grow and scale pivotal crypto products.

Community is considered as a MOAT in web3, As more and more people are getting involved with Streamflow, the community is continuously growing and will continue to do so. Currently, on their Discord server, there are already more than 1.4k+ members, and on Twitter more than 4.2k+ followers.

The community is very responsive along with their team in answering any queries. They usually post product updates, take product feedback and host a bunch of community events echoing their vision of bringing streaming primitive and to unlock this value for the world.

Growth and Monetization play 📈

Growing quickly is a key factor for Streamflow’s success and one of the north star metrics for the team can be: Number of Projects on-boarded. Here are a few growth hacks by which the Streamflow team can grow i.e increase the number of projects, that use Streamflow.

Integration with Wallet providers: More the wallet integrations, more the network effects as potentially the wallet’s users can also use Streamflow, increasing its potential userbase.

Payroll solutions: Companies like Deel empower remote companies to hire talent from anywhere, by processing the payrolls of remote talent and have also added crypto as a payment option. Streamflow can potentially process these payrolls in real-time by streaming payments. It can also help them get exposure to the non-crypto market and expand its user base, thus potential market size!

On the Monetization front, there’s a mantra we follow:

“If money flows through your platform, you can always make money”.

Just think of any real-world examples like Amazon and you will understand it. The best part, Streamflow being a payments protocol has the money flow control. Here are a few ways, it can earn money (or potential revenue sources):

Lending locked funds: Earn interest income from lent money

Integration with swaps and onramps: Take small fees for enabling streaming payments

Service fees charged per Stream: It can also charge services fees per stream, just like stripe charges for each payment through them.

Security Concerns 🔐

What are modern heists?

Modern heists have moved into the networked world in the form of ransomware, phishing, and botnets. Most big heists these days involve spreading malware across networks and stealing information from private databases.

It exists in Web3, and it’s happening right now. Some of the most valuable, easily-stolen objects to ever exist (smart contracts with billions in user funds) are being fought over to shield the space from the blackhats trying to pull off some of the biggest heists ever seen in history.

Security is essential for payment operations. Streamflow has worked hard to ensure that its tools are safe for users and not prone to exploits and so Streamflow was audited by Opcodes.

Any issues detected by the audit have been resolved or determined to be irrelevant to the usability of the protocol. While not a guarantee of security, the audit proves that Streamflow is dedicated to building a secure service for its users.

Wen $STRM 👀 ?

Well, if you are building a protocol in web3 and you don’t get this question, you are probably living under a rock 🗿. Currently, Streamflow takes 0.25% of the payment that is streamed through, and with $STRM they might offer reduced or no fees for stream payments. ⏰

Competitor landscape: Tricky 🪄

While streamflow is one of the biggest solutions in Solana, the Ethereum ecosystem does have two major projects solving for streaming payments:

Superfluid: Superfluid is one of the biggest protocols in Ethereum, having raised $9 Million with good traction, covering a wide range of applications with a TVL of $30 million*.

Sablier Finance: Acquired by Mainframe in 2020, it was one of the earliest real-time finance protocols — it’s currently focussing more on payments streaming for payroll.

LlamaPay: LlamaPay is a multi-chain protocol( Ethereum, BSC, Avalanche, Optimism, and more) with real-time token streaming capabilities with a TVL of $300,000*.

Although, Solana — with cheap transactions and sub-second block time — is the perfect chain to make transactions: powerful, fast, and easy. With the Solana ecosystem growing day by day, it can potentially outgrow the Ethereum ecosystem. And the number of projects growing in the Solana ecosystem directly benefits the Streamflow, increasing the Total Addressable Market (TAM).

More the Solana Projects, More the Market Opportunity for Streamflow

Moreover, once Streamflow attains a strong Product-Market Fit on Solana, it can also become multi-chain and increase its TAM.

Bull Case: Endless Applications 🐂

With the streaming payments landscape being still nascent, even the Web3 world hasn’t seen many of the applications yet, but the possibilities are unlimited. Let’s look at some of the potential applications of Streamflow👇

1. DAO Payments Infrastructure:

With the rise of DAOs on Solana, the need for a robust payment structure is also increasing. With streamflow, DAOs can:

Pay contractors on a weekly or bi-weekly basis i.e authorize a single transaction to pay a contractor indefinitely, or until the end of a gig.

Enable DAO-to-DAO interactions by allowing one DAO to stream payments to another DAO.

2. DeFi:

While Solana DeFi exploding and presenting various types of exotic on-chain financial instruments along with lending protocols, the need for advanced payments are immense:

Streaming payment of Derivative premiums

Managing collateral with a counterparty as streaming payments as compared to settlements.

Dollar-cost averaging: Investing small amounts continuously over certain intervals, in a single on-chain transaction.

3. Subscriptions:

Just like subscriptions in the Web2 world, Streamflow can allow for subscription-based payments in Solana by allowing subscribers to push value over time to a service provider without requiring the further signing of transactions.

Bear Case: Technology & Adoption Challenges 🐻

As we have discussed, the technological delays on Solana can directly impact the protocol, this means that, if the network is behind, vesting contracts (streams) unlock with a delay until the network “catches up” with the real world. This can impact the performance of the app in the scheduled transfer system and can impose questions on the ownership of the funds too 🤯.

But when we see the larger vision of the streaming primitive and its value unlock for the world, then these issues can act as the bottleneck in driving user adoption and growth in this streaming primitive and make trust a scarce resource, for these types of workflows.

Along with on-chain technology challenges, another big challenge the protocol has to overcome is: Ensure Adoption. With streaming payments being a nascent technology and no Web2 counterpart, both awareness and adoption around streaming payments need to be executed well, otherwise, it will lead to low traction and ultimately lead to the spiral death of the protocol.

Future roadmap🛣

The initial suite of products includes the streaming payments and solutions for token vesting and payroll built on top of it. In addition, one-to-many payments and multisig vaults on Solana are also in the pipeline for launch.

A comprehensive UI/UX upgrade and adding batch payments are also on the roadmap.

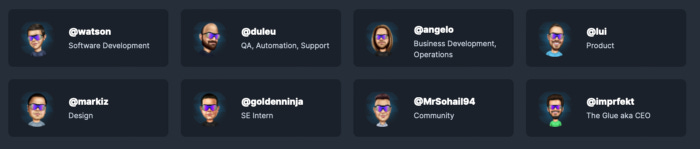

The dedicated team of glass eaters with a strong belief in the larger vision is to make these services widely adopted by being the payment “rails” and enabling seamless integration of the services within other applications.

Staring with the Solana ecosystem, then expanding cross-chain and onboarding traditional (web2) projects and now streamflow is dedicated to utilizing blockchain technology advancements to stay at the frontline of a financial shift taking place in the world.

Wrapping up: Can Streamflow make it?🚀

Let’s say in 2030, Web3 goes mainstream and used by billions of users, streamflow will have deep implications on cashflows on both individuals as well as business levels. In the Web2 world, individuals and companies process payments on weekly, bi-weekly, and monthly frequencies with frequent delays in payments. The lumpiness of these cash flows reduces the rate of turnover of capital with higher capital costs throughout the economy.

The current payment mechanism still rules us — due to the lack of technology and network effects. Web3 is increasing the capital efficiency of assets and payment streaming protocols like Streamflow has the potential to boost currency efficiency more than ever!

That’s all folks!

This was a deep dive on Streamflow and exploring money-streaming primitives on Solana.

And If you have any suggestions or want us to deep dive into your project, we would love to connect — Sitesh Sahoo and Yash Agarwal 🥂

Until then…

Further Reading:

DO YOUR OWN RESEARCH. We make no representation or warranty as to the accuracy or completeness of the information contained in this report, including third-party data sources. Some of the Images and information are taken from Streamflow’s official sources and third-party references. This post may contain forward-looking statements or projections based on our current beliefs and information believed to be reasonable at the time. However, such statements necessarily involve risk and uncertainty and should not be used as the basis for investment decisions. The views expressed are as of the publication date and are subject to change at any time. Read the full disclaimer here.