Deep Dive: Symmetry Protocol

Symmetry is democratising asset management -- anyone can start a fund!

The recent SOL bull run has generated a lot of interest in projects being built on Solana. Symmetry.fi is a great first dApp to dip your toes into the Solana ecosystem.

The structure is as follows.

Overview of Symmetry.fi's functionalities

How to get started with Symmetry.fi

Analysis+thoughts

Feel free to skip around. Let’s get started!

Overview

Symmetry.fi is one of the coolest DeFi dApps in the Solana ecosystem.

Some terminology: Decentralized Finance, aka DeFi, is an umbrella term for dApps tackling finance-related use cases. Decentralized Apps, aka dApps, are applications where the backend is a blockchain instead of a traditional centralized server. Solana is a layer 1 blockchain (like Ethereum or Bitcoin) that promises to be faster and cheaper than the others. Symmetry.fi is built on Solana.

At its core Symmetry.fi is based on the Symmetry protocol- a decentralized crypto index protocol. It currently has four main products

Baskets aka crypto indices

Swap

Portfolio

Watch

PS: Future uses of the word "Symmetry" refer to the Symmetry.fi project, not the protocol.

Baskets

Say you want to go for a run while listening to music. You put on some earphones, lace up your running shoes, and open up your music streaming app. You want the song to match your run, which translates to you want songs of certain BPM and genre. There are few ways you can do this

You can choose each song individually during your run. Once the first song gets over, you scroll through your library to find the next song. This way you are always listening to a song that you want but you keep getting interrupted during your run.

You can shuffle your entire library. This requires no effort but chances are that will have to listen to some songs that you don't really want to listen to (or manually skip them, which takes effort and is an interruption).

You can listen to a playlist. You can either make a playlist from scratch (based on songs you enjoyed in previous runs), or listen to a playlist created by your friend who is also into running. Each song might not be exactly what you want, and it may require a little effort beforehand, but you will always have good songs in your run without having to do anything.

The effort:reward ratio makes option 3 pretty appealing. Playlists have changed the way we listen to music. Many people cite losing their custom playlists as the primary reason why they will not switch to a new music-streaming service. “Lofi hip hop radio - beats to relax/study to” is a worldwide sensation.

What are Baskets

Baskets are sort of like crypto playlists. You can create a weighted collection of tokens that you can then invest into with one click. You can also invest in a token collection curated by someone else. Often these collections will be centred around a common theme. Baskets convert your unique investment strategy into an instrument. ie. Baskets allow you to make one-step investments that remain consistent with your investment strategy.

Investing in Baskets have several advantages over investing in individual coins.

Baskets allow you to be bullish on a field while diversifying your risk.

You can invest in baskets created by people you trust.

Investing in baskets has lesser fees than making the same investments separately.

Parallels to the world of stocks

Index products are some of the most widely traded financial instruments in the world. Most passive investors rely on index products for stock market exposure. It is reasonable to assume that index-like products for crypto will boost crypto investments.

There are some tokens (like DEFI5) that function like crypto ETFs. These tokens are pegged to the top x assets in a field(by market cap). Baskets can be thought of as a variation to traditional mutual funds. In mutual funds, you give your money to a mutual fund manager and they are free to invest it however they want. There may be some restrictions (eg. large-cap MFs are regulated by the government to have a certain percentage of their portfolio in large-cap companies) but you generally have very little control and almost no visibility of your investment. You also can’t really create your own mutual fund and SIP into it.

On the other hand, Baskets give you full visibility of what tokens are present, how they are distributed, and what rebalancing strategy the basket has(more on this later). You are also free to create your own basket

There is an Indian startup called Smallcase that does something similar with stocks.

Features

Baskets in Symmetry.fi are based on the Symmetry protocol. The Symmetry protocol allows you to create custom baskets of tokens. When you invest in a basket your investment is split up across the tokens in the basket. You can also view and invest in baskets that others have created(you may have to pay a fee to the creator of the basket).

Volatile assets that shoot up in price may skew the balance of your basket. If that asset crashes, you will face large losses as your relative exposure to that asset was high. To avoid this the Symmetry protocol can automatically rebalance your portfolio. You can choose your rebalancing strategy while setting up your Basket.

Symmetry also comes with an Index simulator. This backtests your basket's performance with historical data. The Index simulator allows you to test out various weights and rebalancing strategies before you finalize your basket.

PS. Baskets is not yet live, the above info is based on information that the Symmetry team has put out

Swap

Swap is a token swap exchange by Symmetry.

Swap is an AMM. Automated Market Makers (AMMs) allow digital assets to be traded in a permissionless and automatic way by using liquidity pools rather than a traditional marketplace of buyers and sellers. Symmetry Swap has some key features that set it apart from others in this space

It has the lowest swap fees of any major exchange. It takes 0.22% as fees, which is lower than other Solana based exchanges (Raydium - 0.25%, Orca - 0.30%), and Ethereum based exchanges (SushiSwap and Uniswap take 0.30%).

It is powered by Serum, giving users direct access to $350M+ in liquidity. This lowers the slippage and spread needed for successful transactions.

Since it is built on Solana it is super fast.

Portfolio

Portfolio gives you everything you need to manage your crypto portfolio.

You can see what tokens you own, how they are performing, their historical value, and what your crypto net-worth is (in USD).

Watch

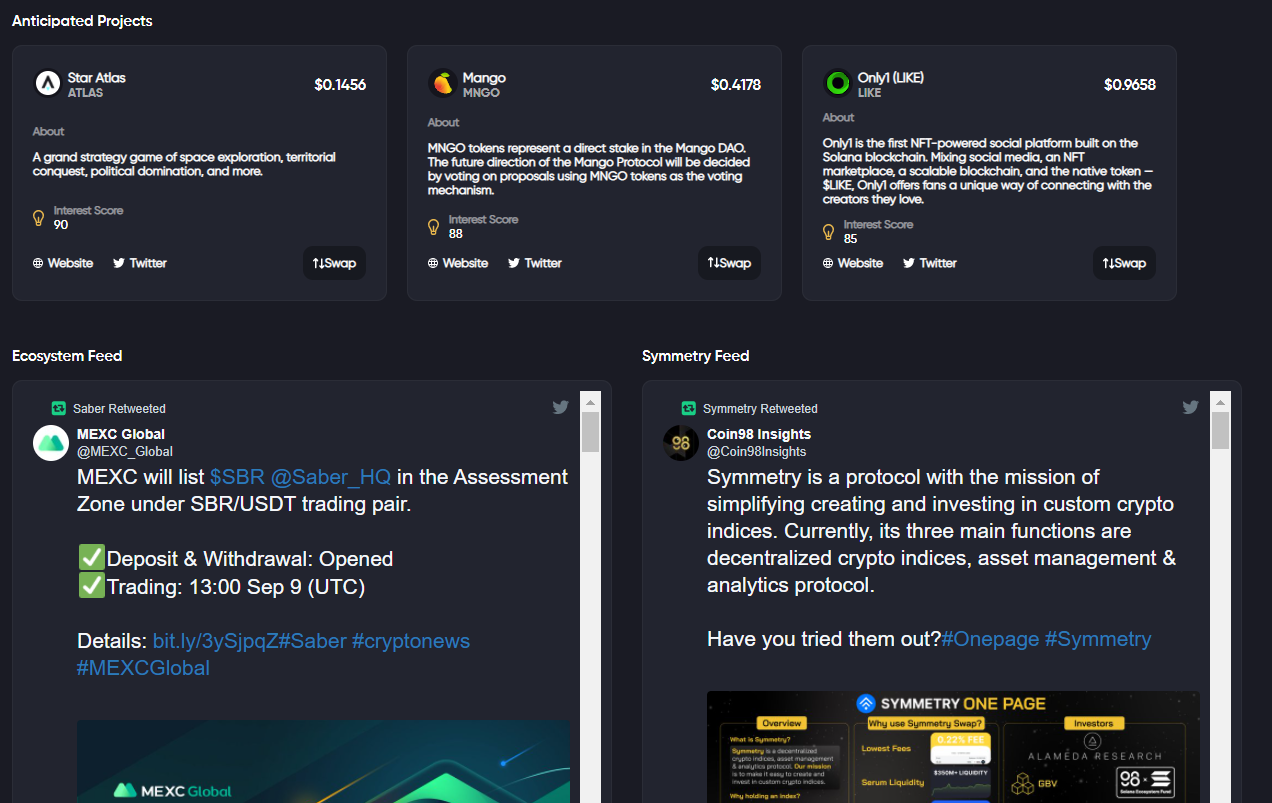

Watch gives you an overview of the entire Solana ecosystem.

Watch is the anti-FOMO product for Solana. As long as you check it regularly you can almost be assured that you will not miss out on the next big thing. It shows you what projects are hot, market cap/TVL(Total Value Locked) for each project, upcoming projects that are highly anticipated, and much more. It tracks what is happening across Serum, Solanium, Raydium and others. It even has a live feed of Solana Twitter.

How to get started with Symmetry.fi

Many dApps overwhelm users. Symmetry differentiates itself by being super easy to use, even for DeFi noobs. The below instructions are only for those completely new to the space, if you have used any other web 3 site it should be pretty easy to figure stuff out.

1. Set up your wallet

Wallets are your passport to web3. You need a wallet to perform transactions on most dApps. To use Symmetry.fi, you will need a wallet that supports Solana. Symmetry is integrated with Phantom and Sollet. I highly recommend Phantom- it has a lot of functionality, good community support, and great UX.

Download the Phantom browser extension from the official website and add it to your desktop browser (mobile is not currently supported but should be available soon). The setup is relatively straightforward, just click on the browser extension and follow the steps.

Some words of caution: make sure you note down your seed phrase and store it safely. Never share your seed phrase.

2. Buy some SOL

SOL is the underlying token for the Solana blockchain. The most straightforward way for beginners to buy SOL is through a CEX(Centralized exchange) like Coinbase, FTX, etc. If you live in India, SOL is available in most popular Indian exchanges including Coinswitch Kuber, Bitbns and CoinDCX(before buying SOL in a CEX check if they allow withdrawals. SOL is trade-only in some exchanges).

3. Fund your wallet

In order to use your SOL, you need to move it from the exchange's wallet to your wallet. You can find your Phantom wallet's public key near the top, it is the alphanumeric string in brackets. Just click on it and it will copy to your clipboard

Once you transfer your SOL you should see it in your wallet within a few seconds. If anything goes wrong you can look up the status of your transaction on Solana explorer- just enter your wallet pubkey or the transaction hash.

Solana transactions are very cheap. If you see that the CEX you are using has a high withdrawal fee I would suggest using FTX. The one-time KYC setup is quite fast and there is no withdrawal fee for Solana. If you have trouble getting fiat into FTX you can try doing this: buy a token with low transfer fees in the CEX that you use, transfer that to FTX, swap that to Solana and then withdraw it to your phantom wallet. Lots of unnecessary extra steps, but you might save some money :|

4. View your portfolio on Symmetry

Once your wallet is set up and you have loaded it with some SOL, you are finally ready to use Symmetry. Head over to portfolio.symmetry.fi. You should see a popup asking you to connect your wallet.

Click on the wallet you have(Phantom) and click on allow when your wallet pops up. You should now be able to see your portfolio dashboard. This shows you what tokens you have and what the value of your tokens are (in dollars). You can use this to track your portfolio over time.

PS: You might have to enter a beta access code before or after connecting your wallet. If so, you can get it by asking someone on the Symmetry.fi Discord or snooping around their Twitter. Try PORTFOLIO 🤫

5. Swap some SOL

Go to swap.symmetry.fi or click on Swap on your Portfolio page. If you are logged out, click on the connect wallet button.

Try exchanging some SOL for USDC. USDC is a stablecoin pegged to the US dollar, which means that 1USDC will always be equal to 1USD(backed by Circle and Coinbase). Choose SOL in the "From" field and USDC in the "To" field. You can see the exchange rate and other settings like slippage tolerance(how much variation in the exchange rate will you tolerate), transaction fee and Symmetry's fee. Please note that Symmetry Swap has a minimum amount that you can swap. If it is less than that, the "Minimum Received" field will be highlighted in red and the swap button will be disabled

If you head back to your portfolio you should be able to see your new token. You will also be able to see it in your Phantom wallet. Just like that, you have used a dApp :)

Analysis

Team

I could not find any information on the individual team members but this is how the team describes itself. This is from a blog post that Symmetry posted in May, so chances are some things have changed by now.

“We’re a growing team of 5+ people with Computer Science and Engineering backgrounds from leading universities, such as MIT. Our core team members have multiple medals at International Olympiad in Informatics (IOI). We’re a strong technical team, all of us contributing to the source code of the protocol, while some are also experienced at Business Development & Design as well. “

The team has raised funding from Rarestone capital, ROK capital, and others

Traction

August was a great month for Symmetry. Some highlights were:

Symmetry Swap surpassed $3 million in trading volume. This happened within a month of its launch. Uniswap took a year to hit this milestone.

Symmetry Swap partnered up with Serum and Solanium, two very prominent projects in the Solana ecosystem

Portfolio manager DAU hit 3 thousand

The team announced that Index protocol(Baskets) would be coming to testnet soon

Symmetry has a strong community for a product so early. They have around 11k followers on Twitter and around 700 Discord members. The general sentiment surrounding the Symmetry product experience seems to be overwhelmingly positive.

The token - $SMF

Another cool aspect of crypto projects is that early users who help perfect the product are often rewarded with tokens. These may start out as relatively worthless but tend to increase in value proportionally to the success of the project. Tokens also often come with governance privileges, which means token holders can actively shape the product roadmap. This creates a strong incentive for early users to do everything they can to improve the product and spread the word.

Baskets have some dynamics of two-sided marketplaces. This can lead to a Chicken or Egg problem - you need Baskets for new users to invest into(supply), but people will not create Baskets if there is no one to invest in them(demand). Symmetry can potentially reward Basket creators with a native token. Incentivizing Basket creators with a token that they believe will appreciate can help solve the supply problem.

The Symmetry team has said they will be launching a token called SMF, but they have not given any fixed dates or other details. A community airdrop is supposed to happen soon. Keep an eye on their Twitter and Discord. 👀

Bull and Bear case

The bull and the bear case for Symmetry.fi hinges on one main factor - Solana. Symmetry.fi is poised to grow(or fail) with Solana. So far so good- Solana is seeing a lot of developer activity and public perception is very positive, due to which Symmetry.fi has been receiving quite a lot of well deserved second-hand attention

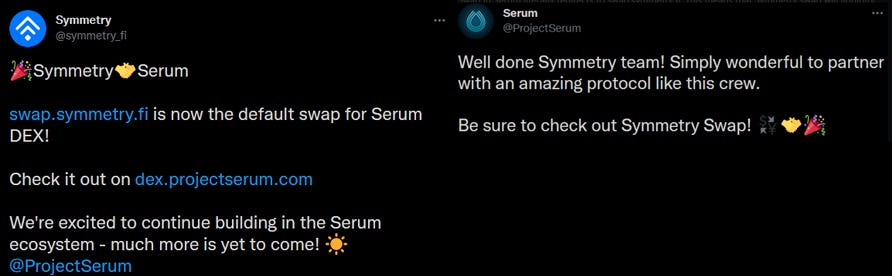

Swap

Symmetry swap is an official partner to Serum, a DEX built on Solana. Clicking on Swap in Serum literally redirects to swap.symmetry.fi. Symmetry's partnership with Serum means Swap has access to Serum's liquidity. It also means Symmetry has a very important vote of confidence - that of SBF.

Sam Bankman-Fried, popularly known as SBF, is the founder of FTX, Alameda Research, and Serum. He is a very prominent voice in the crypto space and is especially influential in the Solana ecosystem. When he talks people tends to listen. His publicly declared confidence in Symmetry will definitely be a valuable asset for the Symmetry team.

Symmetry swap has also partnered with Solanium, a launchpad for Solana projects. This means Symmetry swap will probably be the first place where projects that launch on Solanium will list their tokens.

Established token exchanges are often some of the biggest projects in the ecosystem they are a part of. If Symmetry swap can act as the Uniswap for Solana, there is a lot of value to be captured.

Swap is probably the Symmetry product with the most competitors. The Solana ecosystem page currently lists 34 DEXs. Many focus on a specific niche but there are definitely products built on Solana that function similarly to Symmetry Swap. What sets Symmetry apart is its network of partners. Having access to Serum’s liquidity will definitely be a competitive advantage. If Swap can maintain a high success rate of transactions with low slippage for a wide variety of tokens, they have the potential to emerge as one of the winners in this space

Portfolio

Portfolio is still in beta. It looks like there is a clear product-market fit(at least externally), people seem to find the product super useful and intuitive. The feature to hide your net worth and share your performance graph to social media definitely created some buzz (there were some pretty impressive graphs, wallets holding SOL have seen some spectacular growth). However, it is currently lacking in features. It is now on the Symmetry team to build this out to be the one-stop crypto portfolio management tool.

Some features that I think would be great additions are:

NFT portfolio management

Transaction history for each token

More comprehensive analytics

Baskets

Baskets really are the USP for Symmetry. It is not yet live so I could not try it out. Conceptually index products for the crypto market sound like a great idea.

The custom indices market, if there is one, is relatively uncrowded. Index Coop creates tokens that contain other tokens but you can invest only in indices created by their team. You can view the constituent tokens and their relative weightage but you can not change it.

Basket creators are a crucial part of the ecosystem. Better baskets mean better returns, which will drive more people to the product. I strongly believe that Symmetry should allow basket creators to capture a percentage of the value generated by their basket This will incentivize users to improve the quantity and quality of the baskets they create. Basket creators on Symmetry could be the DeFi version of hedge fund managers.

General

Symmetry is one of the better-designed dApps out there. Swap, Watch and Portfolio do a pretty good job of abstracting complexity. If Symmetry continues to focus on having a great UX throughout all their product offerings they can attract a lot of new users, especially those new to crypto.

The Symmetry products play very well with each other. Actions like finding an interesting basket → Investing in it → checking your portfolio, or finding an interesting project on Watch→ buying their token on Swap keep users within the Symmetry ecosystem. Symmetry can also acquire new customers through its partnerships. Someone using Serum will land up in Symmetry if they want to perform a swap, Symmetry just needs to hook them.

Symmetry is subject to all the challenges faced by DEXs and crypto in general. Regulation could stop the project in its tracks. Traditional finance is a highly regulated sector, no one is quite sure how governments will react to the emergence of DeFi. Non-crypto-natives will need to be convinced that DeFi is safe.

Symmetry definitely has the potential to become one of the defining dApps in the Solana ecosystem. It nails 2 factors required for a great DeFi product- UX and low fees. They have solid partnerships and the products that they have launched so far have been very well received. A lot hangs on if Baskets is worth the hype. A continued focus on UX, stability, support and education coupled with a long SOL bull run can result in Symmetry building out an awesome DeFi experience. I look forward to seeing how Symmetry evolves 🚀