The Saga is for Producers, Not Users

"Where there's a phone, there's a job" - exploring what that means for smartphone distribution & global gig marketplaces

This essay contains a full product mock-up which is best viewed on a desktop browser. Pls click here or on the title to open this essay in a new tab.

New technology often starts off as a toy for the rich before reaching the masses, but when the technology being advanced is money itself the opposite is likely.

Crypto enables dollars to move at the speed of the internet, and thus crypto products are likely to find product-market-fit first with those most capable & willing to earn dollars - globally.

If crypto is to achieve its promised potential, it must crack mobile distribution and experiences. And the way to do that is to distribute a crypto phone based on the potential income a producer can generate with it v. monetising a consumer’s spend.

Why Mobile?

Because it has the pole position as the consumer electronics device of choice. Most people experience the internet only through a smartphone.

1. There are more smartphones in use than all other devices combined

2. Those phones are way more likely to be connected to the internet

3. There are more developers building apps for smartphones

In this essay we will analyse the specific playbook that led to the current ubiquity of mobile apps today. And present a new version which we think will drive the adoption of crypto smartphones over the next 3-5 years.

Web2: Fat Application Thesis

So far, platforms have treated user attention as a leading metric to revenue.

As a result, every layer of the smartphone stack — hardware, connectivity and apps — was either subsidised or given away to maximise user attention captured within platforms.

This has fundamentally shaped the economics of the mobile business. Value is accrued & captured at the application layer, squeezing the margins out of every other player.

This is validated by a McKinsey report showing that telco share of mobile market cap reduced to 22% in 2019 from 54% in 2014. And this article which reported that Apple & Samsung sell roughly the same number of phones, but Apple generates twice as much in profit because of its higher margin software services.

And as you’d imagine, the empire will strike back. Or at least try to.

Emerging headwinds to the Fat Application layer:

Telco operators calling for VoIP communication apps, streaming apps , etc to chip in more towards building at the infra layer. Jio, the biggest & most ambitious, has set out with the explicit intention of dominating the application layer with their consumer products.

To compound this further, the active user lead approach isn’t scaling globally and is being challenged locally (in the US). Global ARPUs are not anywhere close to those in North America, making international expansion less lucrative.

An increased focus on privacy in the US is a threat to their ads business. Apple’s move to make cross-app tracking default opt-out & google’s plan to deprecate cookies are early indicators of this.

Direct User Monetisation

While Meta is betting on building the next hardware platform (Oculus, etc), Google is forced to increase monetisation of their existing customers through subscriptions.

This can be observed in the recent push on services like YouTube premium, charging for google drive storage, google play pass, etc. While these services are still new, they’re growing rapidly. YouTube premium has grown from 1.5 mn subscribers in 2015 to 80mn subscribers last year. Google One was the top grossing app on the play store with a billion dollars in revenue.

For the first time in a decade, these Google products have maximum revenue and users from within the US.

Was “Next Billion Users” a zero interest rate meme?

Do the Next billion dollars really matter? Will apps give up a focus on growth (DAUs) for revenue (ARPU)?

By turbocharging the Producer Internet, crypto presents an alternate paradigm for continuing the growth of smartphones and all the benefits they provide.

In the next section we’ll talk about why distributing crypto-enabled phones based on their income potential is a robust alternative to the limitations of the attention based model.

Crypto Networks: For Producers, Not Users

Blockchains like Solana enable money to move at the speed of the internet. The ability to receive $1 using only a phone & an internet connection unlocks a new paradigm for smartphone distribution: earning bundles.

We think crypto phones will be distributed based on the the earning potential of a producer, rather than the spending potential of the user.

You don’t need an H1B Visa anymore, because you now have the TCP/IP Visa

The ability to program money natively into software applications and transact just using a smartphone will unlock a new paradigm of global work that was previously non-existent.

There are two key unlocks of a crypto phone:

Your phone as a bank account

A native “app store” for work: The Gig Exchange

Your phone as a bank account

Stablecoins like USDC on crypto rails provide the best of both accessibility and features.

The USDC used by financial institutions in the US is exactly the same as that used by a taxi driver in Brazil. This means that if you earn even a little USDC, anywhere in the world, you benefit from rich ecosystem effects and get access to a full suite of saving, investing, spending and borrowing products. This is a powerful ecosystem effect.

The beauty of technology is that it levels the playing field. Just like Uber works equally well for a CEO or an intern, stablecoins and crypto networks will connect a wide range of market participants to the global financial systems.

“Ok, but what about Fintech?”

Today, sending money over a phone is a magic trick orchestrated by apps, banks and service providers. The actual balances are still maintained and settled on legacy banking systems. Today’s fintech solutions therefore best serve customers like you and me - who are already banked.

This paper on digital payments in LatAm presents evidence to validate our claim. The depth of financial services used is directly correlated with your current level of affluence.

India’s JAM accounts did speedrun banking coverage from 40% to 80% within a few years but continue to suffer from lack of usage and surrounding services. This is largely because the traditional banking system is not designed for low volume and high value transactions. Slapping a mobile front-end on top of it can only take us this far.

Mobile Money networks in Africa have emerged to fill in the vacuum of a missing banking system. This is a digital currency issued by telecom operators against talk-time minutes, tradable across a range of merchants and p2p.

They’ve made progress in both increasing coverage & volume. But it has been restricted to vanilla use cases like sending and receiving payments.

The image below is a hard-hitting summary of this problem. It is difficult to build inclusion or coverage for people without an income. Crypto phones flip the script by unlocking access to an income, which then makes these customers viable to service. This is likely to increase both the number of people who can access services, but also the quality of services they receive.

Mobile money is more accessible but less programmable than banking & fintech. The burden is on telecom operators to play the BD and product development role. To connect mobile money to traditional finance, merchant acceptance, etc. This approach hasn’t scaled over the last decade.

App Store to Gig Exchange

The second paradigm shift is a new type of software focused on the flow of value, not just information.

Today, every smartphone comes equipped with an app store or a play store,

Any developer can publish an app near instantly;

Browse and download from millions of apps, sorted by popularity & rating;

One-click experience to pay for using an app

However, if you want to receive money on a smartphone, you need to sign up with a platform on many systems outside the phone to connect your bank account, complete KYC, etc.

The impact of the friction is evident in the fact that your outflows are optimised via saved payment methods, recurring charges etc; and inflows are …. well, non-existent.

The ability to send & receive money natively using only your phone will usher in entirely new product design possibilities. We’ll explore the impact on consumer software in a subsequent essay, for now let’s look at the impact on gig work.

Gig platforms of today become the choke point for all value that flows through them. They are incentivised to keep gig workers off the marketplace by designing incentives that maximise the share of their work that they can capture. They can unilaterally block or remove participants from gigs and are the first recipients of all value created. The gig workers reputation is also captured within a single platform and not portable across a range of employers.

This friction has prevented an app-store like paradigm for gig work and micro-tasking that appeals across a vast income range.

Once the phone becomes your bank, we expect that gig work and micro-tasks will operate in a marketplace that resembles the app store,

Anyone can publish gigs and micro-tasks to a marketplace

One-click to receive payments on completing a gig

Two-way reputation and talent matching system

Let’s visualise what this could look like through a series of product mock-ups.

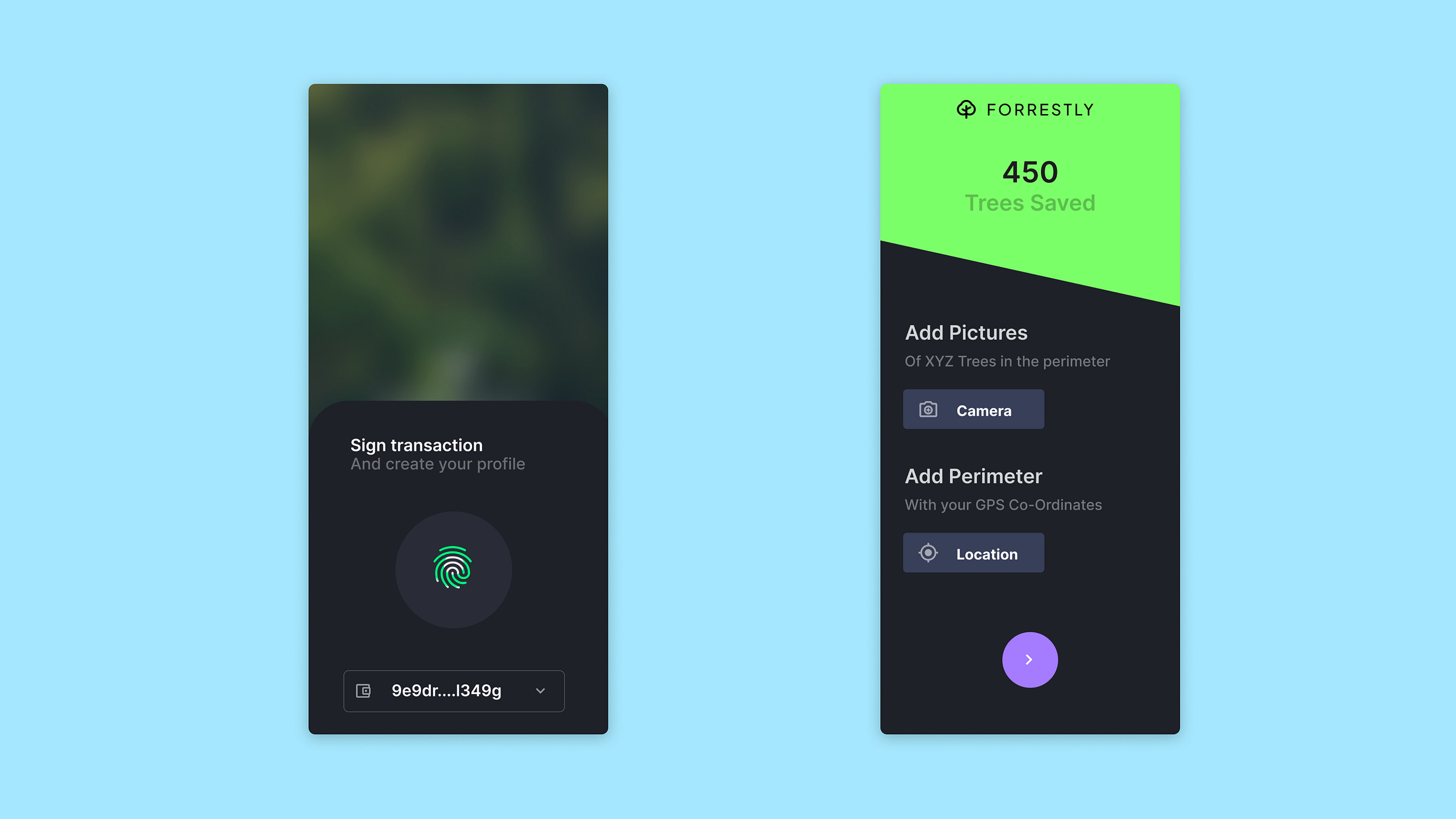

1. Onboarding

Three steps to start earning,

connect to your phone’s native wallet with your thumbprint

complete some basic KYC & payout terms

specify your interests and availability

2. Find gigs tailored for you

A curated feed that shows gigs,

similar to those you completed previously or from past sponsors

published by or popular with your connections

over a certain $ value or newly published

3. If possible, one-click to instantly download the gig onto your phone

Some gigs may require extra verification (e.g. drivers license) or a skill test/application - those mechanics will be built in over iterations. However, many could allow you to instantly download the gig app (which shares the same wallet) to get started. For e.g. crowdsourcing data for climate monitoring.

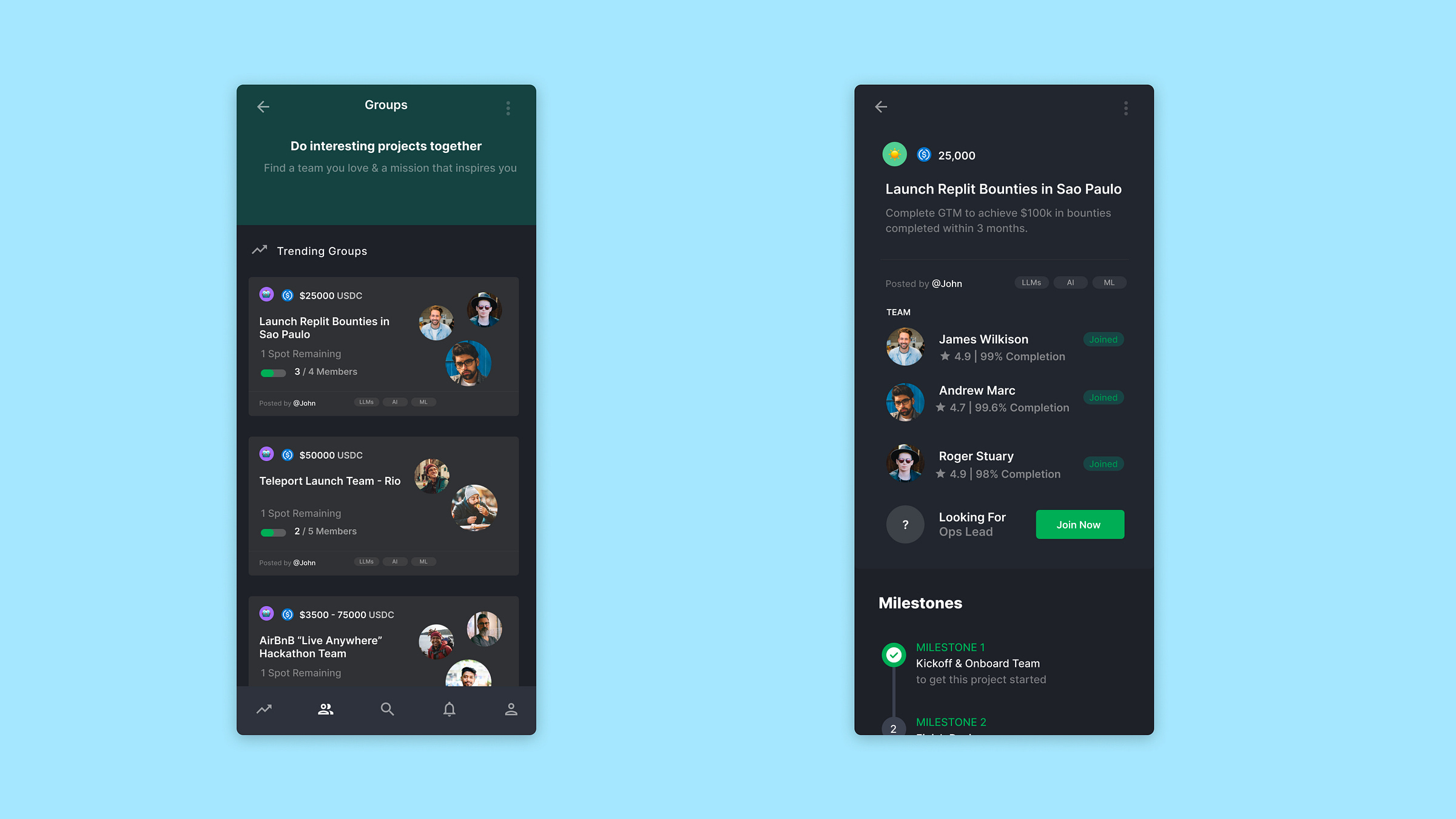

4. Or, Join a squad to complete a larger project

In some cases, a large piece of work is being published to this marketplace. One that requires a team of people with varied skills. A good example of this is global expansion of a product that works in a home market, or hosting physical hubs for global communities and events.

A useful way to think about this is as the productised version of finding a new markets launch team. Instead of doing it sequentially or pre-selecting markets - you can flash a bat signal and watch small, high agency teams emerge across the world.

Each mission would specify the total prize pool available, key milestones and success criteria and payout % per skill type, etc. In some cases this can be complemented with a light touch interview at the end of the application process. In other cases, multiple teams may just begin working and compete for a bounty.

5. Your earnings and reputation are built around an open marketplace, not a closed platform

The power of earning a global, internet native money (whether stablecoins, CBDCs or BTC/ETH/SOL etc) is that you benefit from the ecosystem effect. As adoption grows the suite of services, products and merchants available will grow exponentially faster than traditional systems or closed platform products.

The reputation you build will be accessible to sponsors across the open marketplace, secured by a combination of on-chain and off-chain products. This improves matching efficiency as the number of gigs increase.

The Way Forward: Earning Bundles

In summary, we’ve discussed three key elements in this essay,

Crypto phones will find PMF first with producers, not users.

The ability to send and receive money using only a smartphone will deepen global labour markets by allowing more people to participate & reducing the minimum transaction cost.

Stablecoins & other crypto-native tokens will increase the depth of financial services accessible because of their ecosystem effect.

Once employers see the $$ value of the work being unlocked at pilot scale, they will invest in accelerating the process.

Just like Meta & Google invested in making smartphones and the internet more accessible because it would drive value back to their core business lines, we think employers will invest in putting crypto phones in the hands of producers participating in an open marketplace of global gig work.

If you think about it, most platforms (like Uber, Zomato, Doordash) help their delivery/driver partners acquire phones, cars, etc needed to get work done on their platform.

This is a transition from a platform-linked gig experience to a marketplace led one. And it is made possible because of a new payment system that is software-native & global.

By no means are we saying that an independent payment system is alone sufficient to achieve this. Other challenges like KYC, reputation systems and talent matching need to be addressed. Just like platforms solved to achieve global scale, we think that they can be solved in the context of a marketplace once sufficient demand and supply is generated.

Request for Proposal

If you’d like to build this version of the future, we (Superteam & Solana foundation) are here to help you.

Here are 2 fundable RFPs you can apply for,

1. Backpack for earning, an xNFT enabled earning superapp.

The xNFT protocol & Backpack wallet show how one can build a crypto app ecosystem. It delivers great UX by abstracting out the wallet & blockchain interactions from individual apps to Backpack. And the xNFT protocol allows anyone to publish their apps without needing to be approved or straightjacketed.

Today, the Backpack wallet is a browser extension and the home to a range of xNFTs including casual games, NFT communities & marketplaces, DeFi apps, etc.

We think an Earning Superapp built on the xNFT protocol is a powerful product to accelerate the growth of earning bundles.

Ideally,

this is built as an android app which can easily be side-loaded on any existing $100-$200 dollar phone

it contains a wallet which is shared across all the xNFTs published to it

it pilots a reputation & KYC system that combines the best of web2 (national ID, drivers license, bank details) and crypto concepts

it is bootstrapped with a few types of xNFTs by potential sponsors

We’d recommend you apply for a $5,000 - $10,000 grant depending on the scope of work. You can always apply for bridge funding for new scope or unexpected situations once there is completed work on the table.

2. Build & Pilot “Gigster” for Saga

Convert the product mockups we shared earlier in the essay into reality. Build the Gigster app on Saga.

If you’re a talented team of developers interested in doing this, you’ll get all the product and design help you need to build this public good.

We’d recommend you apply for a $5,000 - $10,000 grant depending on the scope of work. You can always apply for bridge funding for new scope or unexpected situations once there is completed work on the table.

Many thanks to Yash B for designing the product mock-ups and images. And to Akshay BD for feedback on various drafts of this essay.