The State of Solana ReFi — A Deep Dive

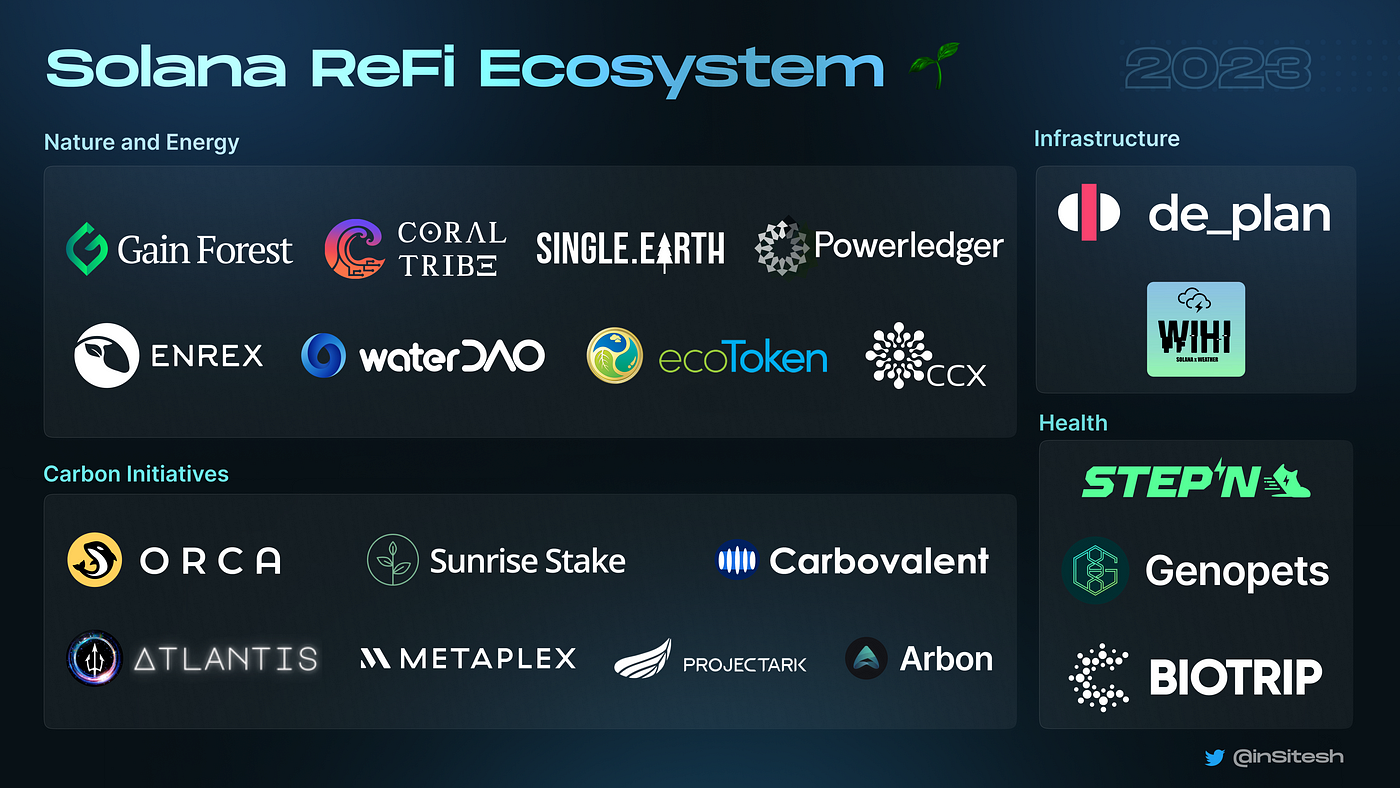

An overview of the current ReFi landscape on Solana, highlighting key players, trends, and ideas!

With global carbon markets surging to a record $851 billion in 2021 as per Refinitiv., it’s clear that carbon removal is on everyone’s minds. Big tech companies like Google, Facebook, and Stripe are leading the way with a $925 million plan to capture carbon pollution. But that’s just the beginning. ReFi is poised to revolutionize and expand the carbon market even further.

Join us as we delve deeper into the state of ReFi in Solana, exploring the key players and trends that shape the ecosystem. This essay offers a comprehensive overview of the Solana ReFi space, providing a deeper into the various projects. By understanding the unique offerings of Solana and comparing it to other ReFi ecosystems, we gain a better understanding of what more can be built in the space.

ReFi — The Intersection

Let’s first understand what ReFi is all about. ReFi, short for Regenerative Finance, is an experimental concept that incentivizes reducing carbon emissions, regenerating the environment, and ultimately reversing climate change. Think of it as the offspring of a marriage between Web3 and Sustainability. 👨👩👧

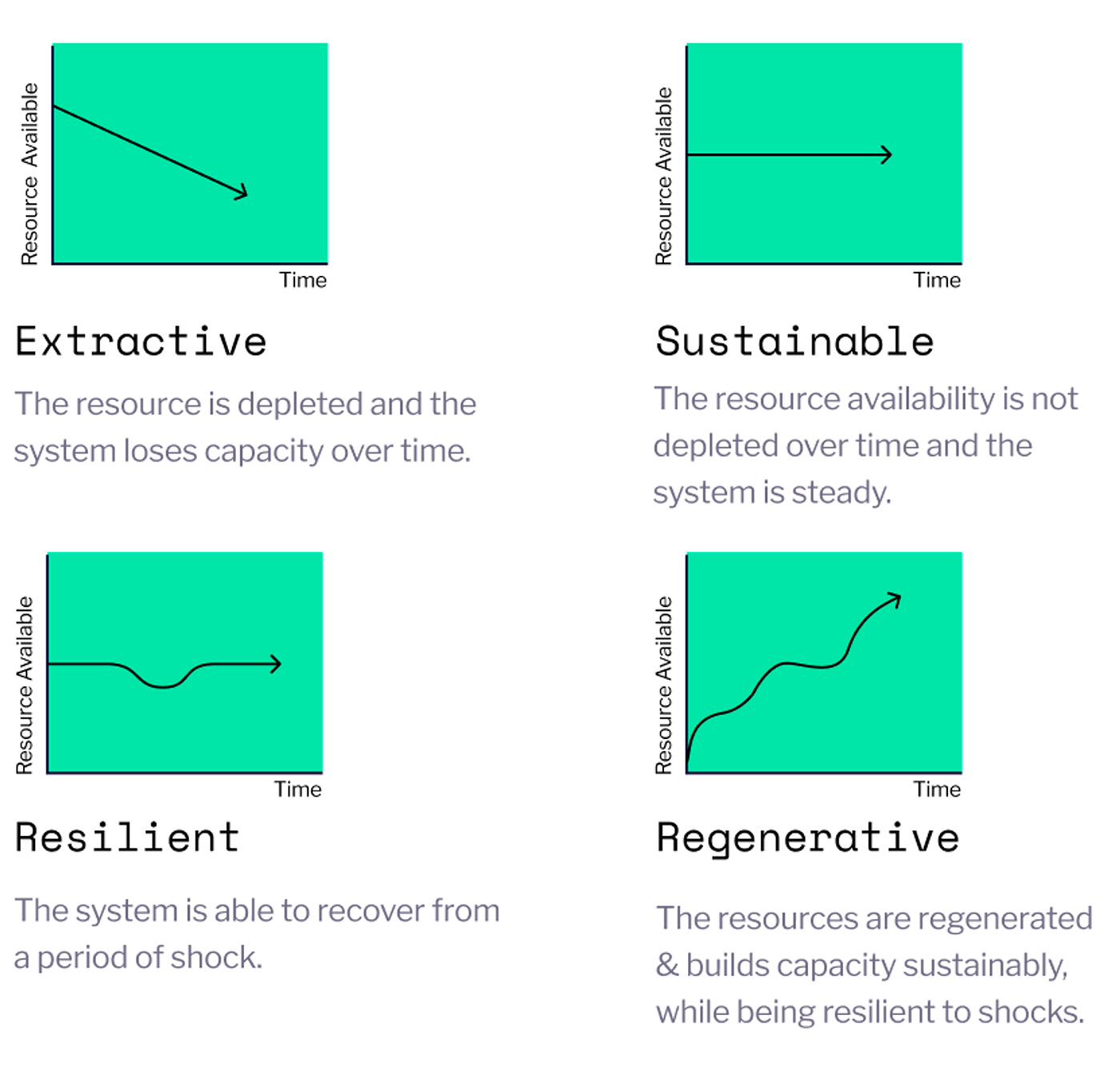

Have you ever stopped to think about the different systems that govern our world? There are those that extract resources without regard for the future, leading to eventual depletion and a decrease in overall capacity. Then there are those that are resilient, able to recover from shocks, and maintain stability over time. And of course, there are sustainable systems, in which resource availability remains steady and the system remains stable.

But there is one more type of system that goes beyond sustainability. It is the regenerative system, one that not only maintains stability but continues to grow over time. This is a system that is both durable and non-extractive, constantly replenishing its resources and allowing for long-term growth.

Why do we need Web3 or Blockchain here? The same reasons we need DeFi: Open, Transparent, and Composable!

DeFi allows for the creation of permissionless micro-markets, where anyone can launch a token and create their own market. Similarly, ReFi enables the creation of on-chain carbon markets, where companies can simply tokenize their carbon assets and start offsetting carbon immediately, without the need for any brokers and investment bankers. Not only that but also DAOs play a crucial role in ReFi, with the popular ones being ReFi DAO and KlimaDAO moving the ReFi movement forward.

Why ReFi?

Trackability: With traditional carbon offsetting, it’s hard to know if the purchased offsets are actually resulting in real carbon reductions. However, in ReFi with the help of blockchain, every transaction is recorded on the ledger, providing a level of transparency and trackability that is unmatched in traditional carbon markets.

Every time a carbon credit is created, it is assigned a unique identifier that is recorded on the blockchain. This identifier can be used to track the credit’s entire lifecycle, from creation to retirement. Additionally, the use of smart contracts ensures that the credits are used for their intended purpose and are retired once they have been used, preventing double-counting or fraud.Markets Creation: DeFi allows for the creation of permissionless micro-markets, where anyone can launch a token and create their own market. Suppose you are launching your token; you can simply go to DEXs like Uniswap or Orca, list on these exchanges, add liquidity to the token pairs, and boom, you have created your own market, where thousands can trade your tokens! For example, Toucan Protocol enables tokenized carbon assets to be traded in its protocol.

We have mentioned the word Carbon Credits quite a few times in the last paragraphs, now it’s the time to understand what they really are…

Carbon Credits

Imagine that you and your friends are playing a game where you’re trying to collect as many stickers as possible. But there’s a catch — some of the stickers are worth more points than others, and there are only a limited number of high-value stickers available.

If one of your friends has a bunch of high-value stickers, they might be hesitant to use them all up for fear of running out. You really want to get more points, so you make a deal with your friend — you’ll trade them some of your lower-value stickers in exchange for some of their high-value stickers.

This is kind of like what carbon credits are. Companies that produce a lot of pollution, like carbon dioxide, are like the players trying to collect as many stickers as possible. But instead of points, they’re trying to reduce their carbon footprint. The high-value stickers are like carbon credits — they represent a certain amount of carbon reduction that a company can use to offset its own carbon emissions.

Just like in the sticker game, there are only a limited number of carbon credits available. Companies that want to keep polluting past their limit can buy carbon credits from other companies or organizations that have reduced their carbon emissions below their allocated limit. By purchasing these credits, the company can offset its own emissions and become more environmentally responsible.

The goal of carbon credits is to encourage companies to reduce their carbon footprint by creating a financial incentive to do so. Just like in the sticker game, where you might be willing to trade some of your lower-value stickers for high-value stickers, companies might try to find ways to reduce their carbon footprint in order to access more carbon credits and offset their own emissions.

Why would any institution look to tokenize its carbon credits?

Access to untapped liquidity: Tokenization allows institutions to access untapped liquidity from a vast network of global investors, DAOs, and treasuries looking for yield at a low cost.

Reduce operational costs: Tokenizing real-world assets and collateral on Solana can reduce underwriting and funds’ back office costs significantly. Because tokenization involves automating many of the traditional processes involved in issuing, tracking, and trading assets, institutions can reduce the time and resources required to manage their carbon credits. By leveraging the benefits of blockchain technology, such as smart contracts and automatic settlements, institutions can streamline their operations and reduce their operational costs.

Be future-ready: Be a leader in the revolution of an open, decentralized, and transparent carbon credit market with built-in secondary markets to enhance the liquidity of otherwise illiquid assets.

Why is Solana the perfect blockchain for ReFi?

Performant:

With competitively low fees (<$0.001) and high speed (65k TPS i.e. Transactions Per Second), and a 1–2 second confirmation time, Solana is one of the most performant blockchains with the best user experiences. For reference, the most popular centralized network, VISA, processes 60k trades per second, and Ethereum processes 15–30 TPS. High speed and low cost make it perfect for ReFi use cases. With the launch of a second validator client by Jump Crypto, Firedancer, the performance and reliability of the network will further increase significantly.Vibrant NFT Ecosystem:

Solana is the second-largest ecosystem for NFTs doing ~14% of all sales volume, with more than 8 Million+ NFT wallets and 23 Million+ NFTs already being minted. Solana is the most technically prepared and battle-tested blockchain for the next wave of adoption, and the primitives needed for most NFT-Fi use cases have already been built. With account compression launching soon, the data storage cost will be reduced significantly, allowing large collections of NFTs to be minted cheaply. Compressed NFTs allow an issuer to mint 1 Million tokenized assets for ~5 SOL, which will be a game-changer for NFTs meant to represent carbon credits.

3. DEXs:

DEXs on the Solana network have processed more than $55 Billion in volume, and Solana was the first blockchain to launch an on-chain native central limit orderbook. Openbook, along with the newly launched orderbook DEX, Phoenix by Ellipsis Labs, which can cater to specific use cases like high-frequency carbon markets trading. Further, Solana has one of the most reliable oracles with sub-second price updates like Pyth and Switchboard, which enables the publishing of real-world data.

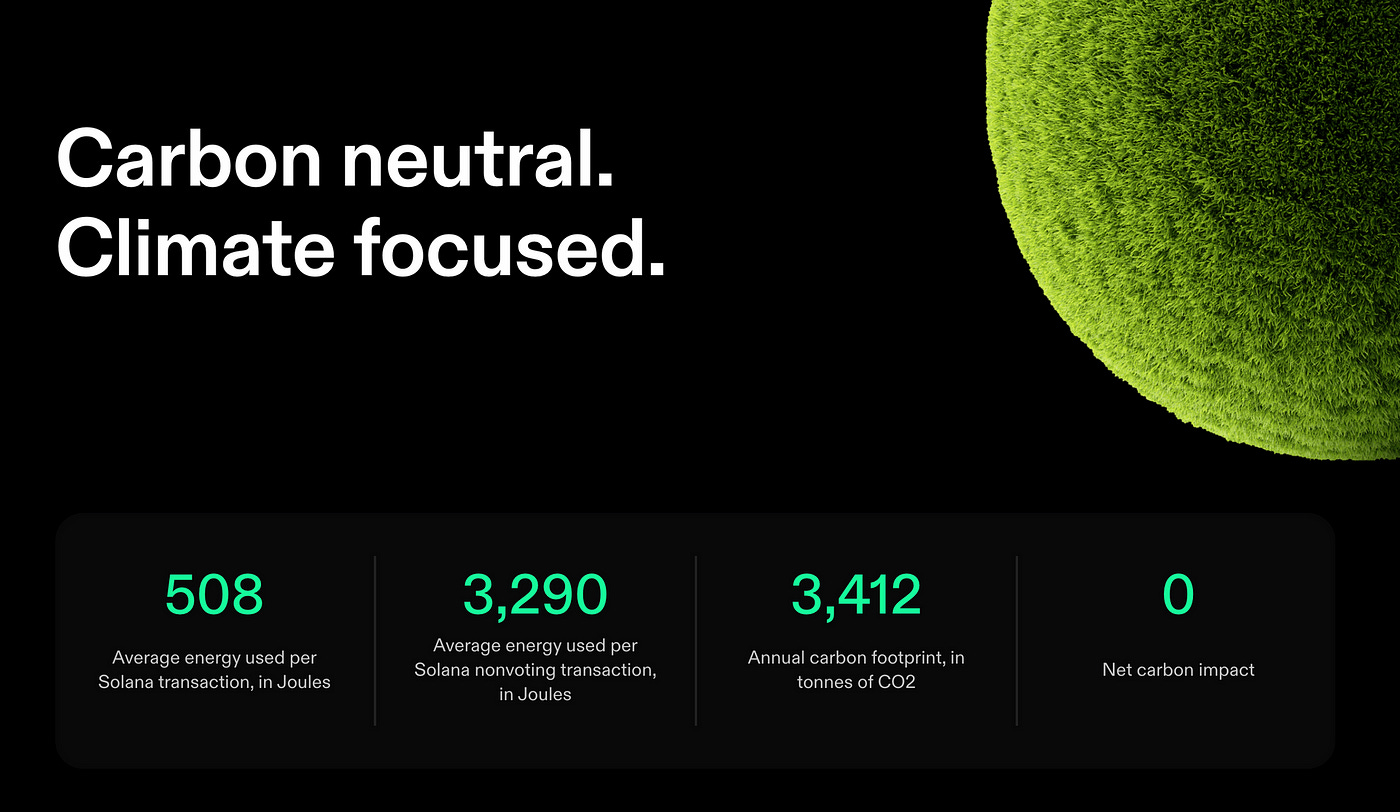

4. Solana — The Carbon Neutral Chain:

Unlike other Proof-of-Work blockchains, Solana transactions are very efficient, one [non-voting] transaction on Solana uses an average of 3,290 joules, which is 43.78x lower than a transaction on Ethereum. and this makes the entire Solana network carbon-neutral. Solana Foundation is committed to keeping the network carbon neutral through the purchase of annual offsets and by providing the community with tools and resources to help lower their emissions.

5. Growing ReFi community:

While the ReFi community on Solana is still very nascent, but it’s growing fast. For a fact, in Breakpoint 2022, there was a ReFi-focussed meet-up which further sparked the interest in the community.

Now that we’ve delved into the basics of carbon credits and ReFi, let’s explore the incredible projects on Solana that aim to address climate change in diverse ways through their innovative solutions.

ReFi Projects on Solana

The ReFi ecosystem on Solana is still in its early stages but has shown immense potential for growth. Despite being relatively new, there are several ReFi projects on Solana that are quickly gaining traction and building innovative solutions. Let’s dive in…

Nature and Energy ⚡

Gainforest.earth:

GainForest is a platform that uses cutting-edge technology, including satellite imaging, drones, and machine learning, to verify and reward sustainable environment management. With their decentralized fund, they seek to transform donations into investments with impact NFTs by giving contributors a non-fungible and dynamic impact certificate (NFTrees) that gathers real-time data and records their impact over time.

It is powered by auditable internal machine learning that assesses environmental effects and offers nearby communities real-time compensation for their environmental stewardship initiatives. GainForest is multichain and funds are allocated to approved projects and given only when conservation goals are met. They are also working towards allowing anyone to contribute to their research and create transparent projects.

GainForest is a notable player in the ReFi crypto space, having executed numerous pilot projects across three continents and garnered recognition from esteemed organizations such as the World Economic Forum and the XPRIZE Rainforest competition. Their unwavering commitment to safeguarding and revitalizing the environment makes them a promising force to reckon with.

2. Coral Tribe:

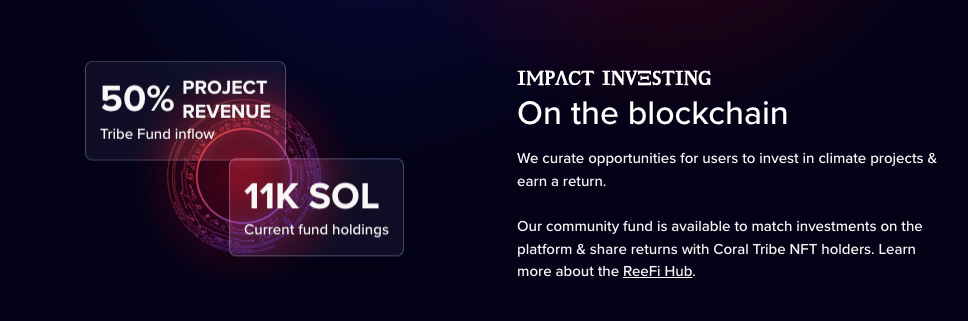

The Coral Tribe community has played a vital role in the successful planting of over 1,550 corals, benefiting more than 4,500 individuals through various means such as education, scientific research, job creation, and diving. Coral Tribe is a Web3 impact investment platform that aims to make impact investing accessible to everyone through its NFTs. Through their impact investment initiatives, Coral Tribe has contributed to the growth of one of the biggest Web3 environmental brands globally. Recently Coral Tribe has also partnered with Solana Foundation to move the ReFi community forward which marks a big milestone for the entire community.

With a community of individuals who are passionate about art, technology, and environmental action, Coral Tribe has an expert council that carefully curates impact investments for the Tribe. Investors on the platform can invest in climate projects and receive a return, with a community fund available to match investments made and split profits with owners of Coral Tribe NFTs.

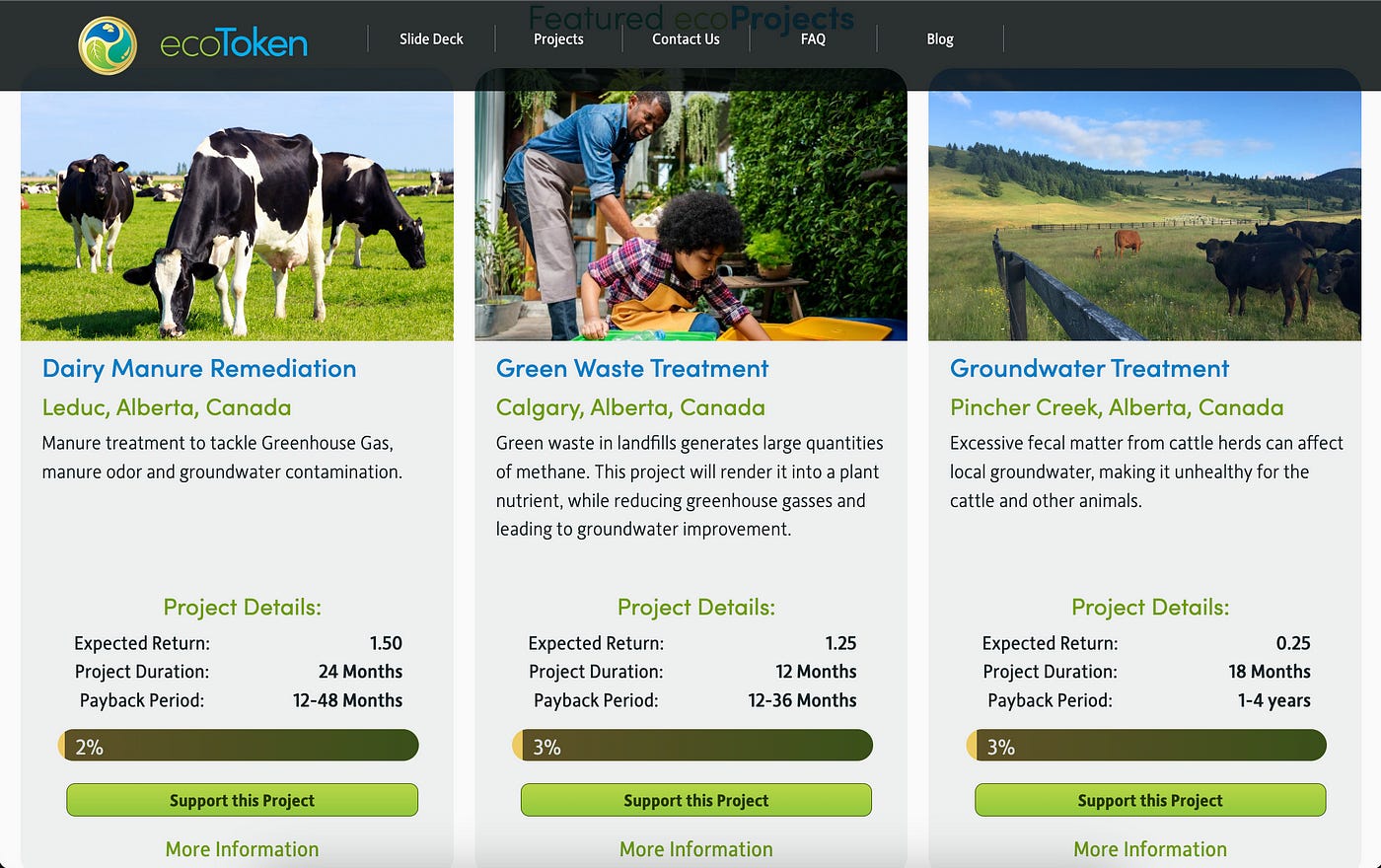

3. Eco-Token:

The EcoToken is a utility token that aims to create an open and freely traded market for environmental credits. It serves as a starting point for sustainable projects and fills the financial gap for projects with a localized impact by rewarding people who provide the capital. The platform promotes local organizations seeking to improve the world and lets individuals pre-fund upcoming projects.

Water DAO, an offshoot of Eco-token, is working to address the major issues of resource management and water scarcity. It is based on the Solana and Regen Ledger blockchains and provides a verifiable water credit process that can be given to eligible projects, encouraging sustainable water resource management and rewarding clean water producers.

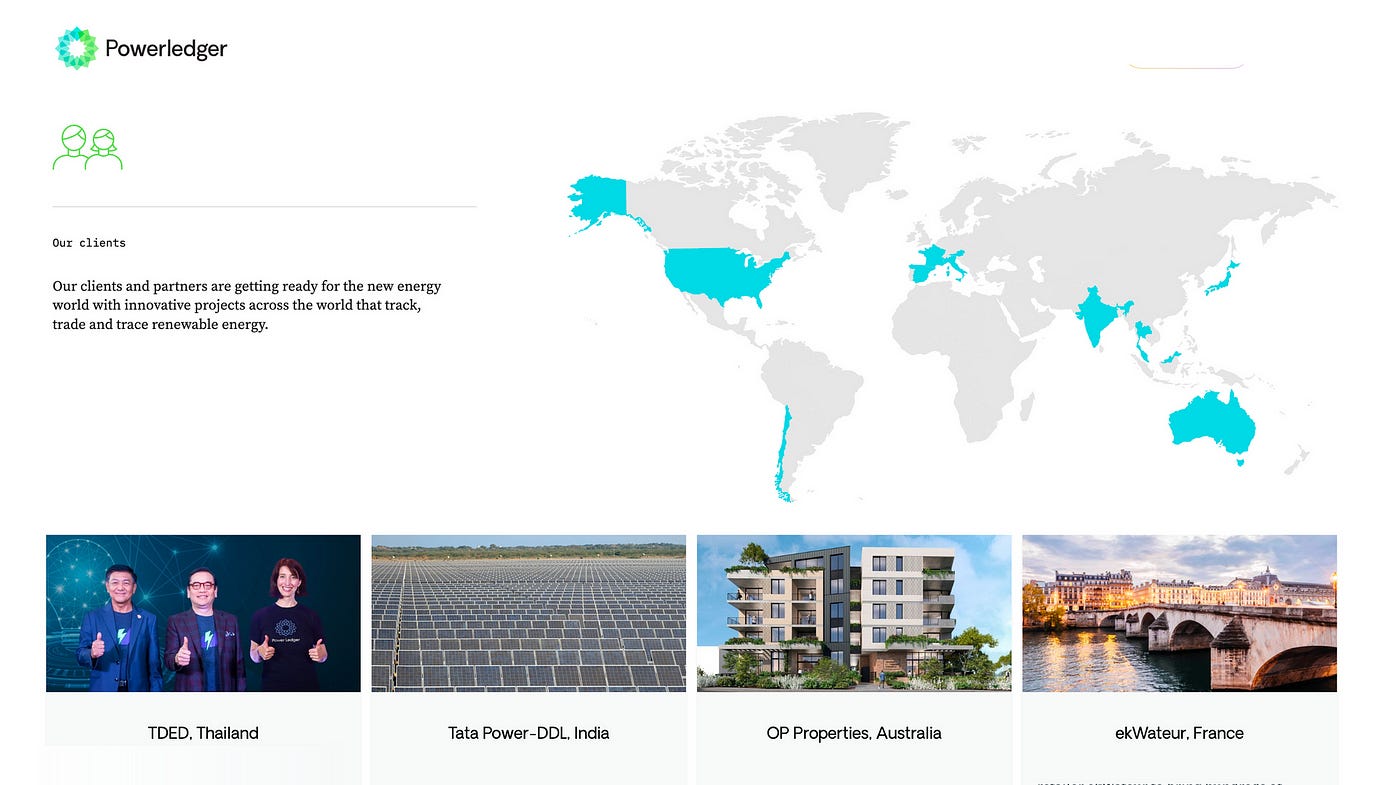

4. Powerledger:

Powerledger is a company that helps track, trace, and trade renewable energy. They promote a sustainable energy system by creating a trustless system for commercial transactions within the energy sector. Their technology enables households, organizations, and the grid itself to trade energy in real time, promoting a flexible power system. They have clients in 12 countries and have received global recognition for their technology, including winning Sir Richard Branson’s international Extreme Tech Challenge in 2018.

5. Single Earth:

Single Earth is an organization that encourages landowners to safeguard their forests and other natural resources in order to protect the environment. Using satellite data and machine learning, they assess ecological traits and work to safeguard the habitats of 270 species. Through their efforts, over 8 million hectares of forests are now growing and sequestering 130 million tons of CO₂ each year. They have also developed a virtual measurement unit called MERIT to symbolize the importance of environmental preservation, and the token also supports their nature preservation efforts.

Projects with Carbon Initiatives

Orca:

The leading AMM on Solana has committed 20% of fees earned by the treasury to organizations working to protect the environment via the Orca Climate Fund. It has already announced its first donation of $550k to Ocean Conservancy and worked closely with them to determine which of its current initiatives will benefit the most from the additional funds. Read more about the Orca climate fund.

2. Sunrise Stake:

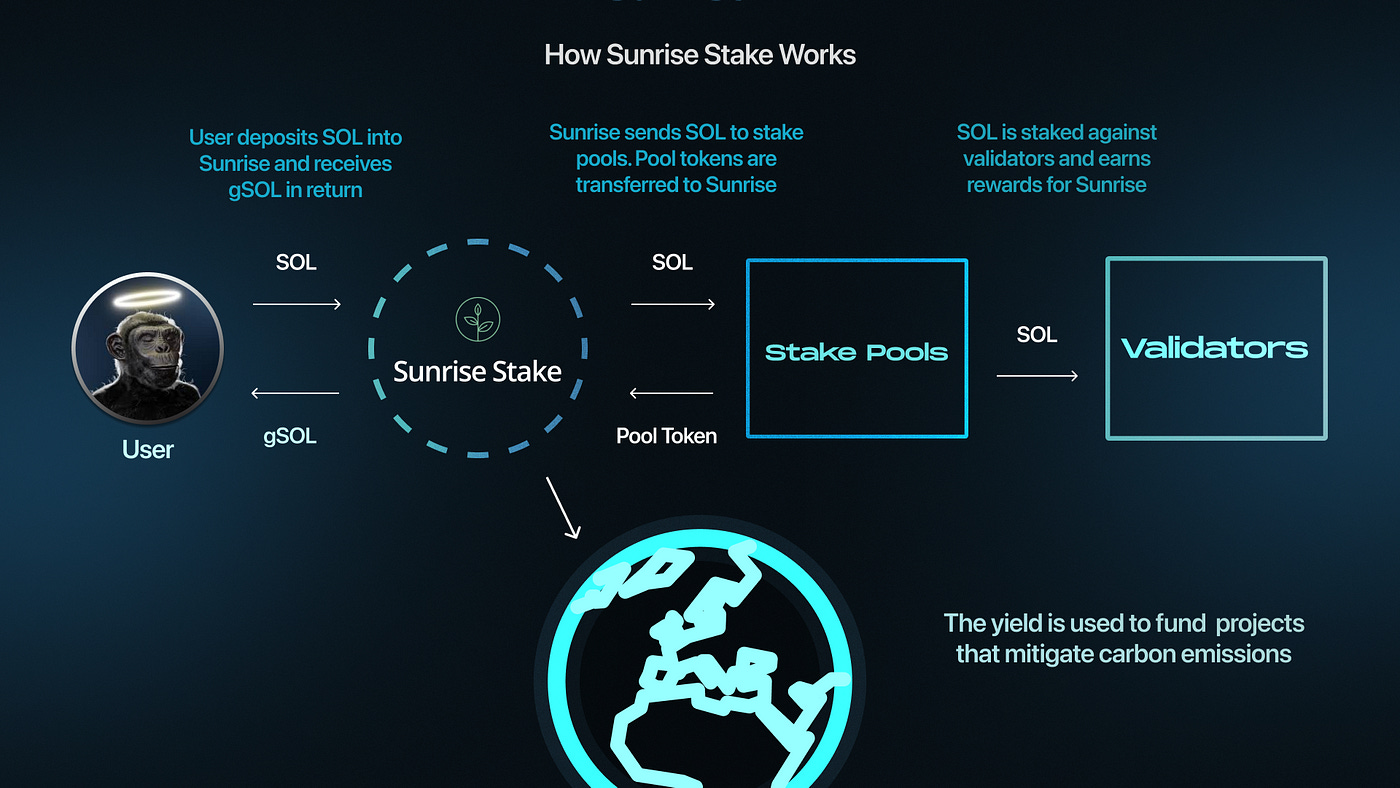

It’s a ReFi staking protocol that directs staking yield to climate-positive projects and is one of the first ReFi projects on the Solana blockchain. It allows users to offset their carbon emissions or donate to regenerative impact projects by staking their SOL tokens. With Sunrise DAO, users can guide their funds to climate projects on Solana and beyond. Sunrise is a non-custodial solution, built on Marinade Finance's audited and trusted staking smart contract.

The yield earned by staking SOL tokens is sent to climate projects, as governed by the Sunrise DAO. Sunrise is on a mission to empower users to make a positive impact on the environment, with a roadmap that includes launching on mainnet, introducing green staking pools, governance, and gSOL integrations.

Sunrise Stake also won the Climate award in the Solana Grizzlython Hackathon making it a huge win for the ReFi community going forward!

3. Carbovalent:

Carbovalent (launching soon) is a blockchain infrastructure that aims to unlock scale for the voluntary carbon markets by reimagining carbon assets for a net-zero future. Carbovalent leverages Solana’s capabilities to achieve the Carbon Asset Life Cycle which unlocks ReFi applications of assets while impacting and incentivizing communities.

Carbovalent’s infrastructure works in this way:

Source: Initial screening and review of pre-bridge carbon credits by a Sourcing Standard made by Carbovalent.

Bridge: Migrate immobilized verified carbon credits to the Carbovalent on-chain registry using the Morpheus Carbon Bridge.

Track: The API-backed on-chain registry serves as a data oracle housing all bridged credits and their metadata returning project information and others metrics.

Trade: Buy, sell, and trade carbon assets and derivatives instantly via the Carbovalent DEX powered by the OpenBook.

Retire: Offset carbon by retiring credits on-chain.

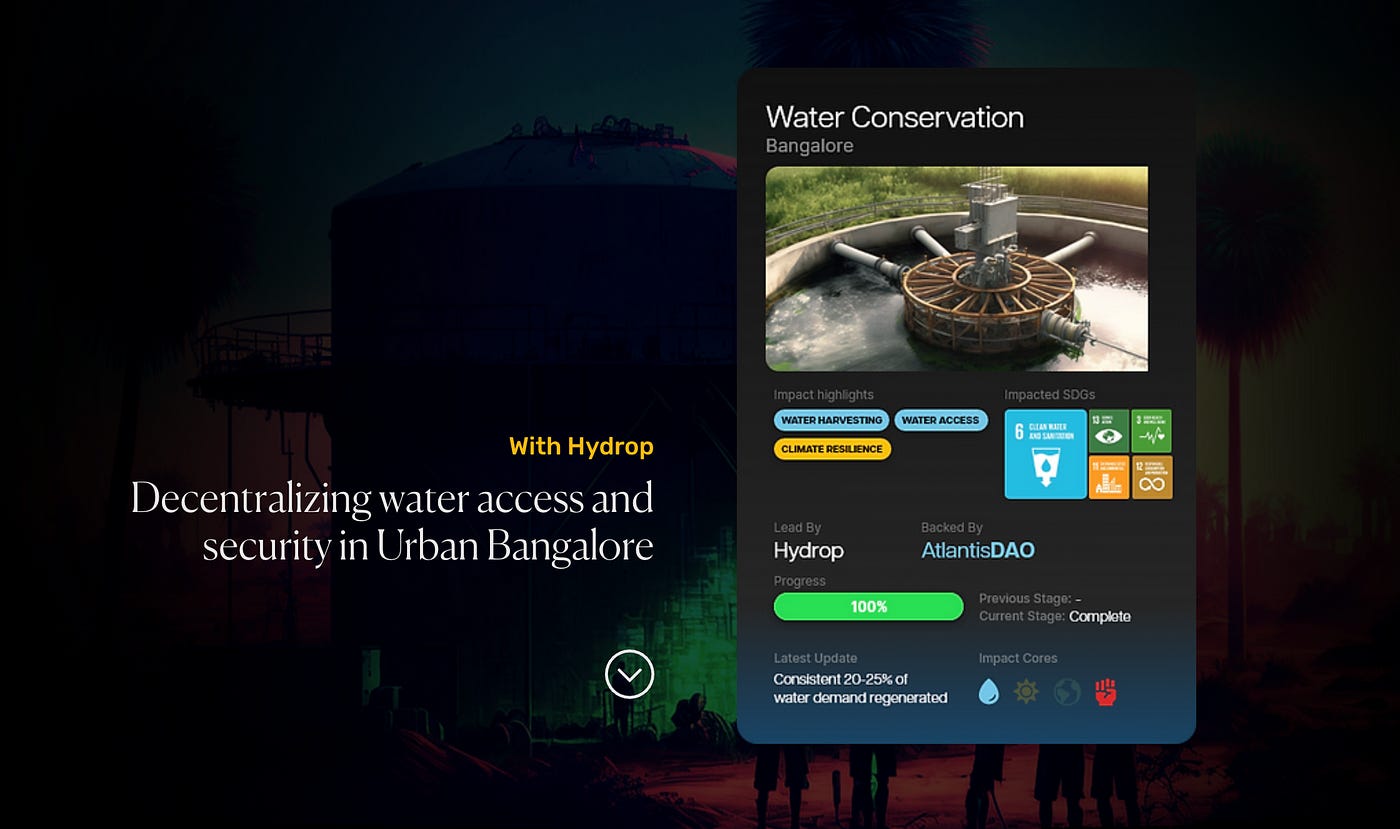

4. Atlantis:

Atlantis is a peer-to-peer impact network that helps builders, entrepreneurs, and creators in the fields of environmental and social impact. Their objective is to create and create tools that assist these changemakers in setting up, assessing, and proving the effectiveness of their projects. Atlantis primarily focuses on NGOs, Impact DAOs, and companies in the social impact and climate tech sectors.

They enable climate founders, initiatives, and enterprises to establish a track record of social and environmental impact that can be independently verified. Atlantis believes that combating social injustice and climate change necessitates hyper-collaboration, and its platform intends to make it simpler and more profitable for communities and businesses to work together to create a more resilient and equitable future.

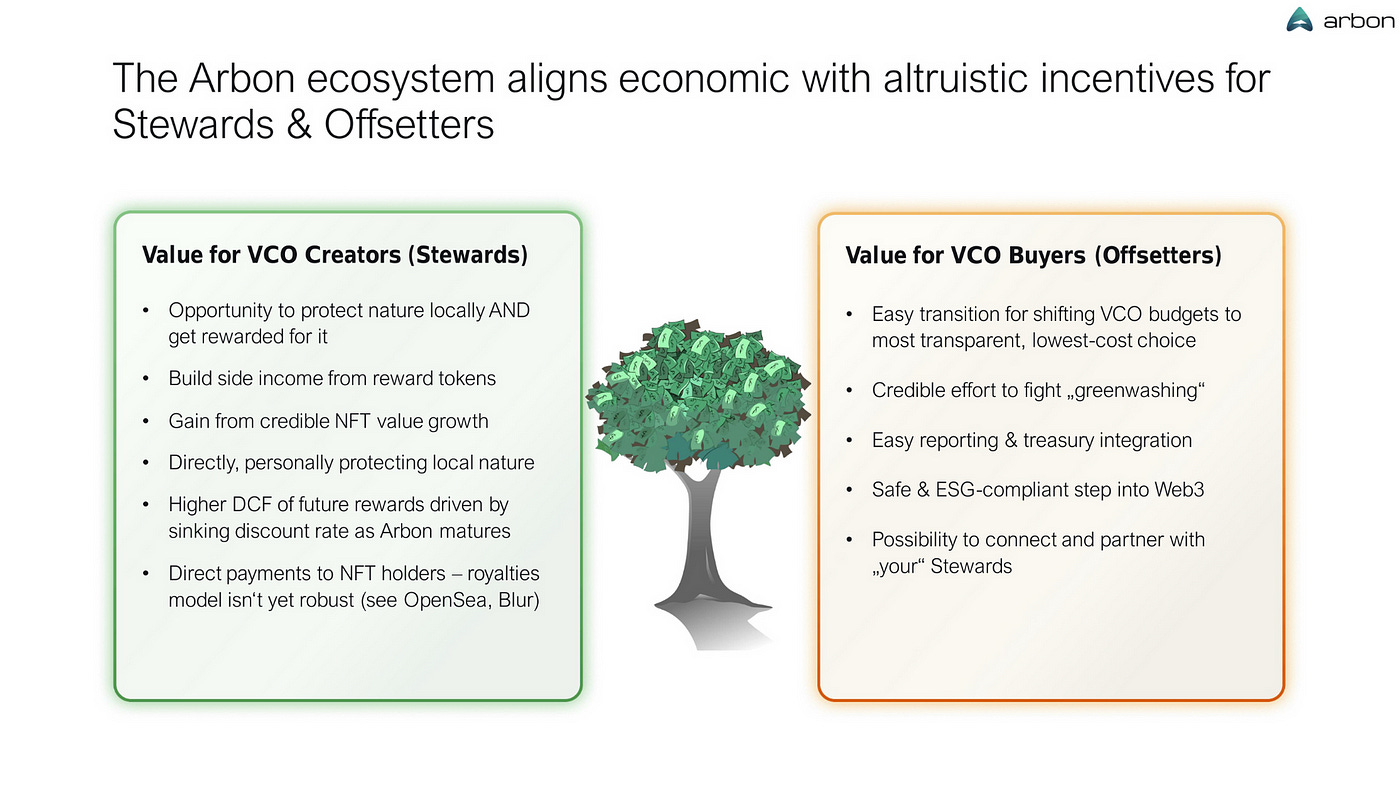

5. Arbon:

With the use of a computer vision-assisted oracle network to enable trustworthy measurement, reporting, and verification, the Arbon project aims to improve the global carbon market. Arbon’s network generates a value exchange between its carbon offset token and its parcel NFTs (COT). In order to undermine trust-based industries, starting with the $80 billion Forestry COs industry, the project merges Web3 and AI approaches. The platform employs automated consensus data validation and transparently logs outcomes on the blockchain to achieve ground-breaking innovation, including lower costs, more accurate data, and results that are accessible to all audiences, including retail customers.

Arbon has won the third prize in the DeFi track of the Grizzlython Hackathon. You can check out their deck to learn more.

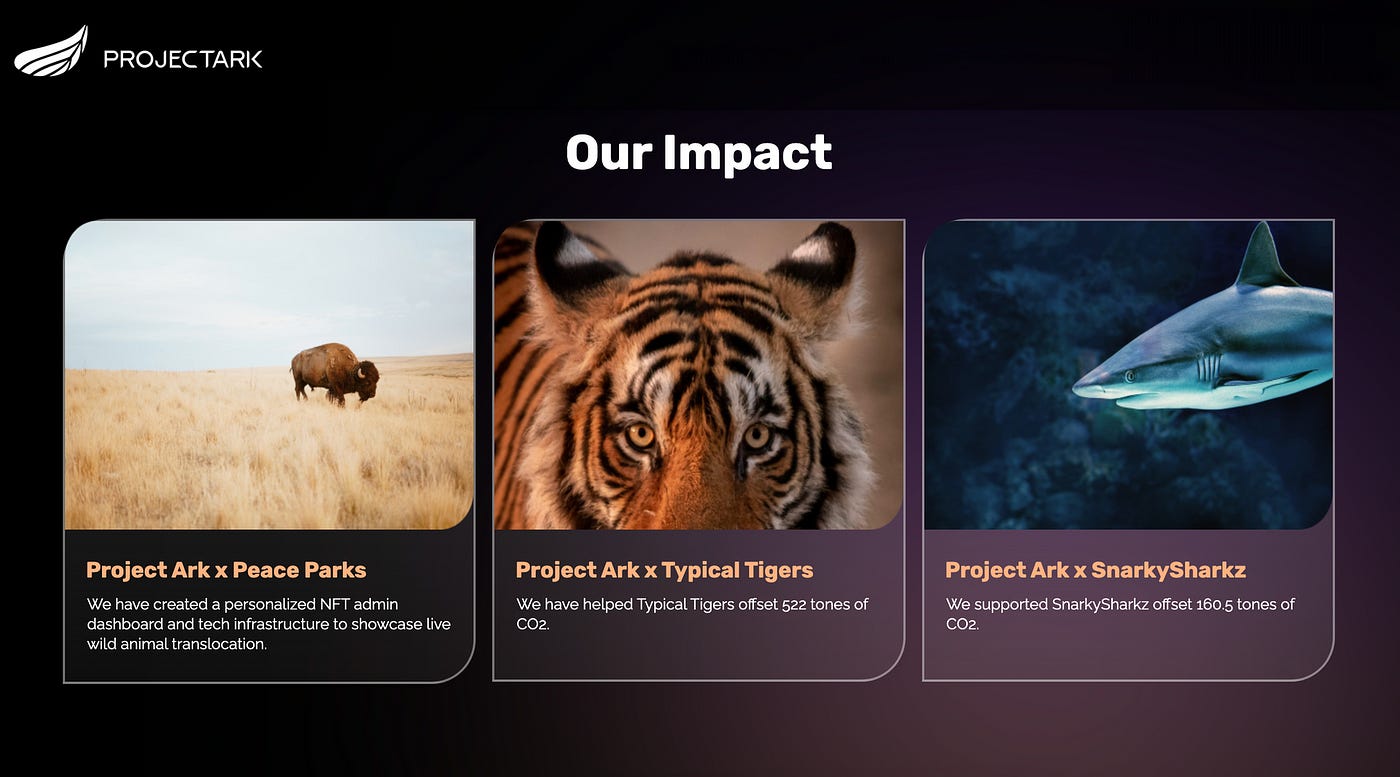

6. Project Ark:

Project Ark was developed in collaboration with WWF Panda Labs. The platform provides customized services with the goal of developing carbon-neutral NFT collections, integrating impact, and establishing the necessary framework for the production and independent sale of NFTs.

The platform is made up of three primary parts:

GreenTech Labs — A set of tools and smart contracts to make it easier to create, own, transfer, and fractionalize NFTs. Project Ark collaborates with their team to co-create new NFT features, such as real-world data NFTs, dynamic generation NFTs, geographical NFTs, auditory acoustic NFTs, carbon-neutral NFTs, and others.

Studio — A one-stop shop for autonomously designing, marketing, and selling Green Impact NFTs. Project Ark assists companies, groups, and foundations in utilizing Web3 advances and promoting impact in the real world.

Their accelerator program makes use of its network and technologies to help excellent projects get their impact on NFT concepts off the ground. So that they may concentrate on changing the world, they select the best initiatives and ideas and offer them technical and marketing platforms.

Projects with Indirect Carbon Impact — Focused on Health 🧪

StepN: A web3 lifestyle app, has managed to shrink its users’ carbon footprint by ~12 million tonnes by incentivizing them to walk more. StepN is an innovative platform that encourages people to exercise outside by giving them NFT sneakers as the game currency. This can be spent in-game or exchanged for actual money.

Despite a significant drop in its monthly active users (now less than 100k), StepN reached a phenomenal peak of over 700,000 monthly active users in May 2022, demonstrating how technology can incentivize positive behavior and drive real-world impact on the environment.

STEPN has committed to donating $100,000 every month towards carbon removal in honor of Earth Day. The funds will be used to purchase Carbon Removal Credits on the blockchain through Nori, which helps connect carbon removal suppliers to environmentally conscious companies and individuals.GenoPets:

Genopets is a mobile RPG (Role Playing Game) that rewards players for physical and mental exercise. By taking care of a digital avatar, players can transform their real-world movement and cognitive effort into in-game progression to upgrade and evolve their Genopet NFT. The game also allows players to customize their Genopet in their likeness, making it unique and valuable.Biotrip:

BIOCASE, a Latin American biopharmaceutical company, had launched a new utility token called BIO TRIP. The token can only be used to purchase products from BIOCASE, which were aimed to help patients with mental disorders and serious psychiatric issues. Though currently, their twitter has been very inactive for a while showing no such activity on their website.

Digital Infrastructure 🌐

de_plan:

de_plan creates solutions for ReFi builders and products that bridge the gap between Web3 and IRL, enabling the development of apps on top of their infrastructure. Their goal is to enable local solutions to address local challenges, by creating products that bridge the gap between the online world and the physical world. By leveraging geospatial data and focusing on the hyperlocal level, they empower communities to shape their environments and tackle issues like climate change and urban development.This cooperative of urbanists, environmentalists, and planners created Ostrom, a community-based approach to land regeneration, and Proto, an API for spatial data and proof-of-location. Proto also recently won 4th place in the Mobile track in the Solana Grizzlython Hackathon. A promising project bridging the Web3 and IRL gap on Solana which we love to see!

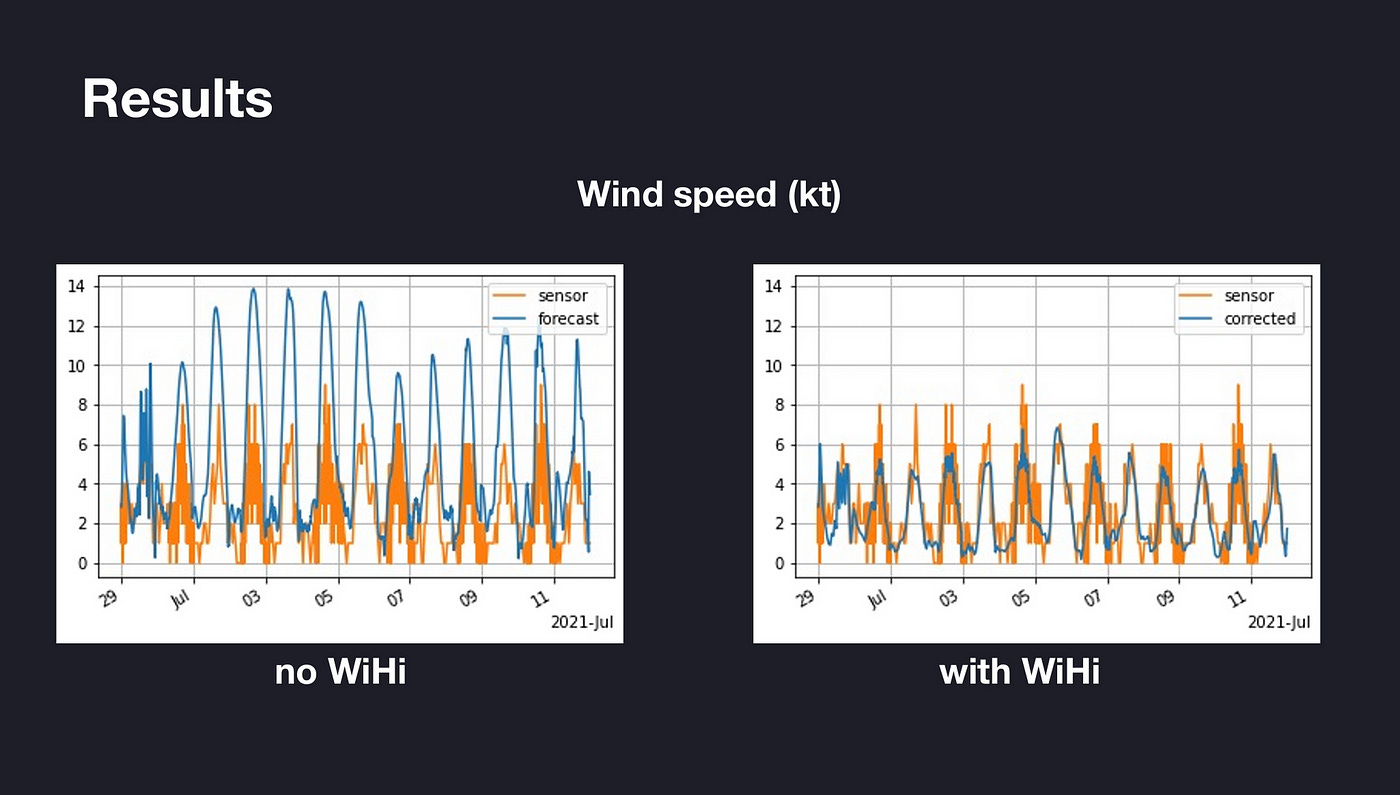

WiHi:

WiHi is a weather forecasting service that uses a decentralized approach. Instead of providing a direct solution to the weather problem, WiHi incentivizes collaboration to find a comprehensive solution. This involves improving data acquisition, weather modeling, nowcasting, and geographic representation. Here’s how it works: people can set up WiHi-enabled weather stations that send data to WiHi. In exchange for sending data, the stations receive WiHi tokens. The amount of tokens received is based on how much the forecast improves.WiHi has partnered with weather station manufacturer Intellisense Systems and weather forecast provider Weather2Umbrella to improve weather forecasting using real-time data. They have also been performing scientific outreach and will present their scheme to improve W2U’s forecasts at the European Meteorological Society Annual Meeting in Bonn, Germany.

Now that we have explored some of the existing projects in the Solana ecosystem, let’s shift our focus to the future and explore what can be built on Solana. Here are some of the most promising ideas that we could think about while trying to build ReFi for good.

What can be built on Solana?

From carbon point tokenization to green bonds and better cities, Solana’s potential for innovation is vast. By tapping into its capabilities, we can not only make significant progress in addressing environmental challenges but also create innovative financial instruments that offer greater transparency, security, and efficiency.

Let’s delve into some of the most promising ideas…

Web2 → Web3:

Many Web2 applications already have carbon off-setting programs, where users are allocated “energy points” based on their carbon footprint. By tokenizing these existing carbon points and bringing them onto the blockchain, we can create a more efficient and transparent system for tracking and managing carbon offsets. This is a viable opportunity to tap into. Think of this as “Carbon Points Tokenization as a Service”Greater transparency and cooperation in international carbon markets:

Market-based mechanisms, like carbon markets, have the potential to reduce emissions, but only if they are properly regulated. The absence of regulations poses a risk that carbon markets may not be effective and may even worsen the climate crisis by allowing companies to continue emitting carbon dioxide without taking concrete steps to reduce their emissions.

International cooperation is necessary for the success of carbon markets, especially in ensuring that emissions reductions in one country do not result in an increase in emissions in another. It is critical to have greater transparency in international carbon markets to ensure that emissions reductions are accurately measured and verified.

Carbon pricing, which involves putting a price on carbon emissions, can motivate companies to reduce their emissions. However, it is crucial to implement carbon pricing in a way that is fair and equitable, and that does not disproportionately affect low-income households or vulnerable communities.NFT Badges: NFTs NFT badges to celebrate the highest energy point collectors. Further, brands can also leverage NFTs to raise funds for carbon offsetting via premium carbon credit NFT sales.

Carbon Native Assets: Solana is still missing a native carbon asset like what exists on other blockchains such as Celo. This gap represents an exciting opportunity for developers to create new carbon native assets on Solana.

Green Bonds: Green Bonds are a huge market where bonds are issued by an organization for the purpose of financing or refinancing projects that contribute positively to the environment and/or climate. Bringing green bonds on-chain is the most viable opportunity.

One example is Polygon x GreenRock Energy, GreenRock Energy, a reputed company in the energy space (photovoltaic systems), issued green bonds with a volume of $25 million with the help of a tokenization company, token forge.Gitcoin-style grants for ReFi:

One potential approach to funding sustainability projects within the ReFi ecosystem is to adopt a Gitcoin-style grants model. Under this model, donation campaigns are launched where anyone can contribute, and donations are matched by a sponsor organization such as Orca Climate Fund. This would not only mobilize on-chain funds towards sustainability causes but also bring fiat capital into the crypto world as the platform gains more traction.

For instance, a Himalayan mountain conservation campaign could be launched on-chain, with all donations being transparently visible to the public, and matched by a climate foundation that was previously off-chain. By prioritizing transparency, this approach could help bring attention to sustainability efforts and promote greater public engagement.

To understand, how gitcoin-style grants work, check out our essayBetter cities: 🌆

A few years down the line, we might see a DAO coming together to raise funds in the form of an SPV (Special Purpose Vehicle) with a target of $10–100 Million. The basic idea would be to pick a barren land and convert that into a green city.

The city can be designed with high-end amenities, promoting sustainable living which is good for the environment and could generate significant returns through the increased value of the land. By combining tokenomics and powering everything via blockchain (payments, governance, financial services, etc.) — you get a better city on steroids!

One inspiring example of a self-sustainable township is Auroville, located in India. Auroville was founded with the objective of creating a universal town where people from different cultures and nationalities could live together in harmony. The township promotes sustainable living, with an emphasis on renewable energy and eco-friendly infrastructure.

The stuff of legends indeed!

Go-To-Market Strategies: How to get ReFi adoption on Solana

1. Tapping into the Web2 Giants

Be it a marketing gimmick or ESG requirements or part of their CSR activities or climate funds, almost every major company has budgets allocated to sustainability space. The ReFi projects on Solana or even Solana Foundation can simply target them as they don’t have high regulatory supervisions or high switching costs to move their operations to Web3, unlike payments or DeFi, where there are stricter regulatory regimes and requires a complete overhaul.

The best part is, once you tap into their climate/sustainability divisions, convincing these organizations to integrate Solana into their products and services would be much easier.

2. Partner with existing FinTechs in the sustainability space

For, e.g., SunFi is a fintech that operates in Lagos, Nigeria. SunFi is a mobile app that allows users to access clean energy products, such as solar panels and home battery storage systems, on a pay-as-you-go basis. This type of partnership could allow ReFi projects on Solana to offer financing solutions to SunFi’s users, creating a win-win scenario for both companies.

Patch: Patch is a platform that connects companies to vetted climate action projects across a range of technologies and geographies. This could help to increase awareness of Solana-based ReFi solutions and drive adoption among environmentally-conscious companies.

3. Bringing green bonds on-chain

Green Bonds are used to fund projects that have positive environmental or climate outcomes, such as renewable energy projects, clean transportation, or sustainable agriculture. Tokenized Green Bonds could offer an innovative and more transparent way of investing in green projects. They are more efficient to issue and trade and offer greater flexibility for investors. They can also provide an additional layer of security as the records are maintained on a blockchain.

Even Tokenized Green Bonds are being issued by governments; The Hong Kong Special Administrative Region Government has issued the world’s first tokenized green bond, which was distributed by a four-bank syndicate and settled on a private blockchain network using cash and securities tokens. (Read more about the HKSAR Government’s Inaugural Tokenised Green Bond Offering.)

Closing Thoughts

While ReFi is about the greater good of the world, the projects should also keep in mind — “financial sustainability” and be profit-oriented as well, instead of simply relying on grants/donations, which will be short-lived.

At the end of the day, these projects should transform into mature billion-dollar businesses with real revenues. That’s why it is crucial for ReFi projects to keep in mind the importance of financial sustainability and profitability while working towards the greater good of the world. By transforming into mature billion-dollar businesses with real revenues, these projects can make a significant impact and ensure their longevity.

The composable nature of tokenized carbon assets means that climate action can be embedded into other protocols and applications. This can unlock new use cases and demand channels, which can help support a robust financing ecosystem for environmental project development in the real world in the years to come…

Cheers for staying with us — are you excited about what’s next in Solana ReFi?!

Found it insightful? Share it with your friends! If you have any suggestions or want us to deep dive into your project, we would love to connect — Sitesh Sahoo and Yash Agarwal

References

A blueprint for scaling voluntary carbon markets (By Mckinsey)

The case for tokenized carbon (The Solana Podcast on YouTube)

Regenerative Finance (CoinMarketCap)

All the information and data about projects were taken from the respective projects’ docs or their websites with due credits. If we left something by mistake please reach out :)

Disclaimer: This essay is completely our personal perspective and thoughts on the Solana ReFi Ecosystem and is for educational purposes only. Given the comprehensive and informal nature of the essay, some amazing projects might have been missed or received lesser attention as compared to other projects. None of this is financial advice or any recommendation towards a particular project.