Turbocharging Airbnb's Loyalty Program using Solana 📱🌱🤏🏼

Product Mock-ups showing how to kickstart a Global Rewards Marketplace for $10k, using Compressed NFTs & Solana Mobile

In Jan 2018 Brian Chesky asked Twitter what benefits they’d want from an Airbnb guest membership program.

The dominant responses were around gaining access to local life; through gyms, co-working spaces, restaurants, meetups, etc.

The traditional approach for building such a program involves a partnerships team, APIs, coupon codes, spreadsheets with revenue forecasts, and contracts with thousands of partners in over 100,000 cities that Airbnb operates in.

That’s incredibly tedious and will likely cost millions of dollars in people and processes to set up. That’s probably why 5 years since that tweet, they only seem to have got as far as a pilot in Japan.

Here’s a proposal on how they can do it globally using Solana’s compressed NFTs & mobile stack for just $10k 🤯

Allow 150 million travelers to export their stays (1 billion cumulative) as compressed NFTs and issue a crypto token (let’s call it AirCoin - $AIR) against $$ spent on the service.

By default, these would be held within their in-app wallet but members should be free to take them elsewhere.

Any merchant can accept them as payment without even having to speak with or integrate with Airbnb. This sets the market price for these tokens and NFTs.

Merchants are able to acquire new customers at an improved CAC, and Airbnb finds buyers for their reward tokens using an open market approach.

To understand the size of the opportunity we just need to look at the fact that US airline loyalty programs (which are privately traded tokens) have a larger market cap than the airline companies themselves.

Why Solana?

It’s the only chain where they can issue a billion NFTs to 150 million people without needing another IPO. The estimated cost of issuing a billion NFTs with compression is $10K. This is orders of magnitude better than the estimated $33B on Ethereum or $32M on Polygon, more context here.

The mobile stack and Saga phone enable a consumer-grade experience by abstracting out the wallet. More on wallets as a feature here.

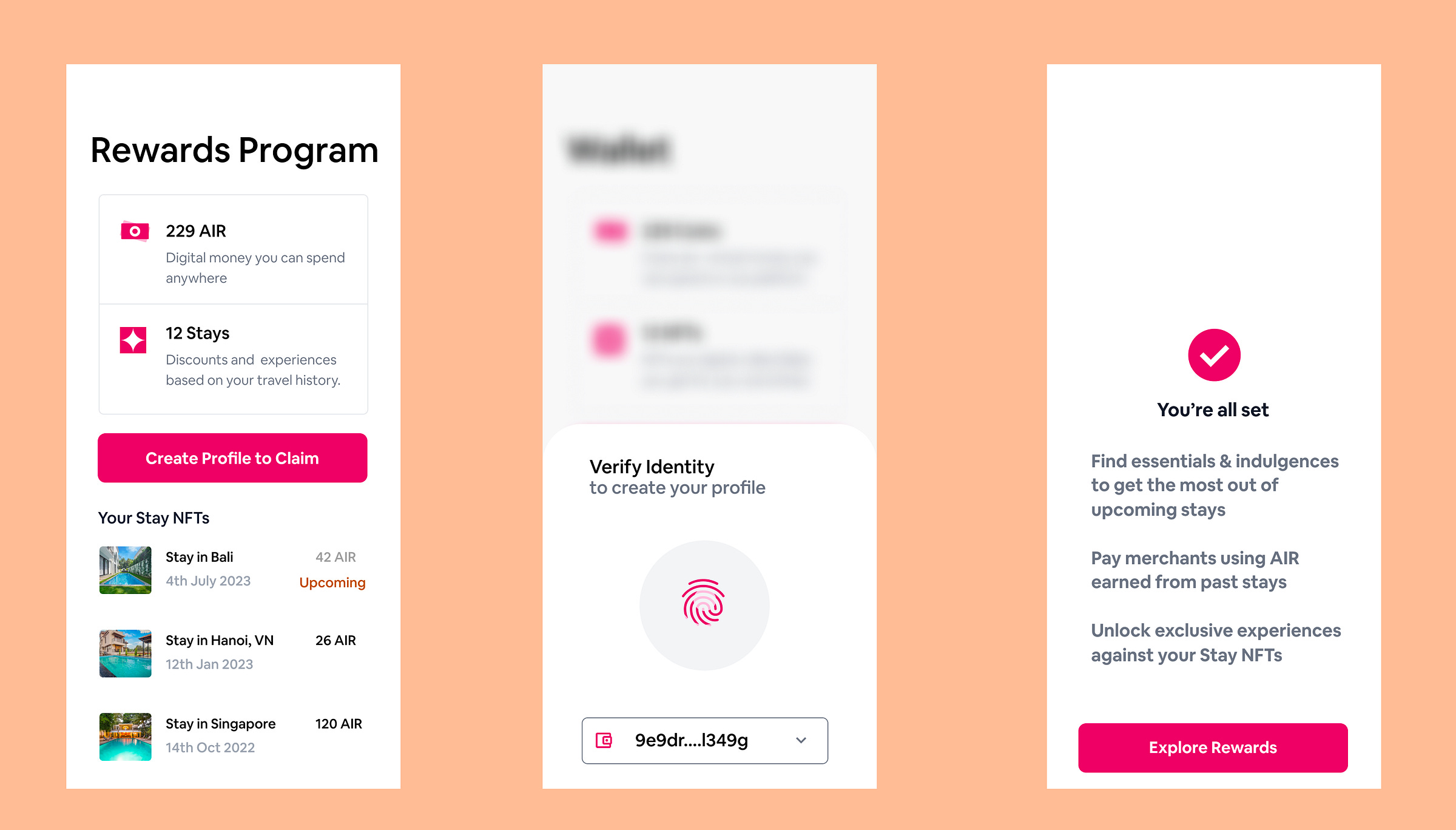

Product Mock-Ups

Here’s a proposal, with product mock-ups, showing how this would work.

Set Up: In-App Wallet

As a traveler, you opt-in to the marketplace by exporting your trips into an in-app self-custodial wallet.

You earn AIR rewards based on $$ spent on completed stays

You get a portable passport capturing your reputation as a traveler (trips, rating, etc), which any merchant can read (with your consent) and provide targeted offers and experiences.

Redemption Flow - Digital Products

You’ve got some AirCoins & Stay NFTs - now what? Let’s sort you out with some essentials from the rewards marketplace for your upcoming trip.

Buying an E-Sim

You just booked your Airbnb for Bali.

Next up, you need an e-sim to keep you connected while you’re there. You browse the in-app marketplace which shows you curated and relevant products.

Once you find the right product, you get redirected to their app/website and complete your purchase at a discounted price.

Why would an e-sim provider offer a discount against AIRCoins? Because their alternatives are expensive search ads or rigid partnerships.

The CAC for e-sim operators is anywhere between $10-$30, for an avg. purchase size of $20-$50. This means they spend almost 50% on making a sale.

I imagine they’d be open to this trade because it is likely to improve their CAC by providing highly qualified leads.

Thousands of merchants facing these odds can compete in this marketplace just by accepting AIRCoins, without ever needing to speak with or sign a contract with Airbnb.

And, it is a win-win even if they just burn the tokens, because it sets the floor for AIRCoins and improves unit economics for the merchants.

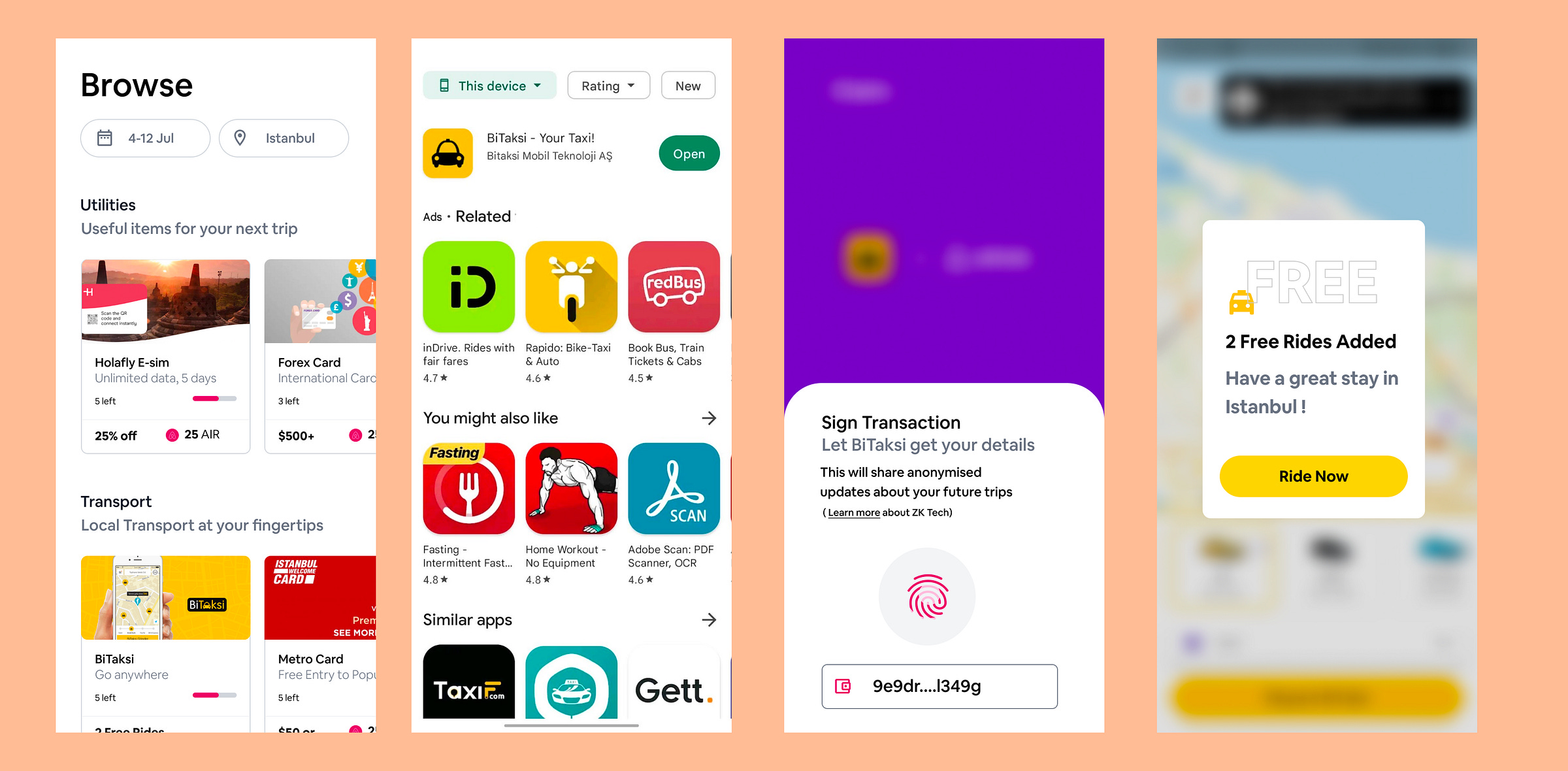

Booking a Cab

Let’s take another example of a similar purchase journey.

You’re excited about your upcoming trip to Istanbul, thinking about strong coffee, Turkish baths, cats, and maybe the hacker house. You’re not too worried about getting around because you’ve heard there’s a local Uber (BiTaksi).

But, you’re not sure how reliable it is and whether your credit card will be accepted. You don’t want to be stuck with this problem at the airport.

So, you fire up the Airbnb app to quickly check if there’s something to help you get started. And sure enough - BiTaksi is offering your first 2 trips for free.

Here’s how you claim it,

Click on the offer, this redirects you to the app store.

Download & launch the app

Connect your wallet. This will automatically allow BiTaksi to verify that you hold the NFT required to unlock this offer.

Book your ride and zip off.

There are 3 key ideas to unpack here,

The Airbnb and BiTaksi apps can both read your NFTs because they are connected to the Saga seed vault.

BiTaksi and Airbnb don’t need to speak with each other or sign any paper contracts because they’re using a shared computational platform. Airbnb can simply charge a listing or royalty fee on the sales in their marketplace.

Once you connect to BiTaksi, they can automatically read future updates from the NFTs that get added to your wallet; ideally using ZK tech which doesn’t reveal your exact trip information.

The economic motivation for BiTaksi to do this is similar to our previous e-sim example, it reduces their cost of acquisition. Additionally, they could restrict these based on length of stay (e.g. more than a week) to ensure they can generate more paid bookings once they drive trials and build trust.

Interestingly this also re-prices intermediaries instead of trying to replace them entirely, i.e. BiTaksi does pay Airbnb a discovery fee the first time. But they won’t need to do it every time because they can directly message your “wallet”. Spam is a real problem that can and will be addressed within this new paradigm through crypto-native concepts like staking and slashing.

IRL Local Experiences - Restaurants, Gyms, Co-working, etc.

This isn’t just about buying stuff through an app.

When you've reached your destination, you may want to dine at a specialty local restaurant, hit the gym, or visit a co-working space.

Let’s see what that experience would look like.

Local Gyms

You can purchase an access pass, using AirCoins, for a local gym during your stay. This would be issued as an NFT allowing the gym to authorize access and track usage independently. Services like Underdog Protocol can enable this out of the box for traditional businesses.

But why would a gym accept payment entirely in AirCoins?

Maybe it increases the likelihood of a conversion, or maybe they use a checkout solution like CandyPay which auto-magically settles all tokens in USDC, or they are happy to have exposure to AIR based on its liquidity and expected price action.

Different providers will have the freedom to make these trade-offs each day based on their CAC, expected conversion, and risk appetite.

Now, let’s look at a more intimate and involved local experience - accessing a “Chef’s Special” experience at a local restaurant.

Chef’s Special @ a Local Restaurant

Local restaurants can list exclusive experiences only available to select travelers, e.g. some experiences could be available only to travelers above a certain rating or those who have booked an Airbnb Luxe. These can be paid for using AirCoins, crypto, or fiat payments.

Once purchased members will receive their pass in a Dialect style smart messaging inbox within the Airbnb app. They are free to either list this on a secondary marketplace or make a reservation.

Merchant Experience

Now that we’ve seen what the experience looks like for travelers we’ll look at a few key experiences on the merchant side as well.

Token Management

Merchants who are listed on the Airbnb marketplace are basically taking a position on AirCoins. As a result, the first tool they need is a place to manage that exposure.

Merchants should be able to,

Track their balance across AirCoins, Crypto, and Fiat money

Follow AirCoin issuance and redemption by its central bank - Airbnb.

Buy or Sell AirCoins on the open market

Borrow from or lend to the larger DeFi and financial ecosystem

Burn AirCoins as part of marketing promos

View product sales across all marketplaces

Note, that the market price of AirCoin is different from both the issuance & redemption rate on Airbnb.

Say,

You earn 5 AIR for 1$ spent on Airbnb

You redeem 1$ for 20 AIR while booking on Airbnb.

the market will likely price AIR somewhere between that (e.g. 1$ = 10 AIR).

This is basically the market sharing the cost of the rewards program in return for access to highly qualified leads.

Today, this happens either through slow and rigid paper contracts signed by partnerships teams OR on Google/FB spends (soaking up 40% of all venture dollars).

Campaign Setup

Operationally, the most important activity is configuring these products for sale either using a tool provided by Airbnb or other app developers.

This would allow merchants to specify a broad set of criteria represented by a combination of NFTs held and stay information. Because all of this happens on an open platform (i.e. a blockchain), these could be NFTs issued by that brand or others!

For e.g. a gym could issue a special pass to those who are

staying in an Airbnb Luxe for more than 4 nights, and above a certain rating

have averaged 10k Steps on StepN

own an ASICS Sunrise Red NFT

This level of direct & permissionless targeting just isn’t possible today.

Merchants aren’t even restricted to tools made by Airbnb, anyone can build products and utilities to enable the market operations needed because all the NFTs are on a public blockchain. This ensures that while these products can have a viable revenue model, none of them (including Airbnb) can monopolize the rewards marketplace.

Here’s another example of a similar campaign creation workflow but powered by an independent operator, let’s call it Roamly.

A fast food joint in Istanbul can offer a special Cig Kofte coupon to anyone who’s in the city, is an NYC marathon finisher, and has attended Tomorrowland!

Key Trade-offs

This approach is a departure from the traditional platform playbook of monetizing a captive network.

In fact, it requires Airbnb to open up its network and allow other merchants and companies to have a direct relationship with its own customers.

This is not easy,

Airbnb won’t be able to guarantee the quality of the products and services listed. While they might be able to curate their own marketplace, they definitely can’t do it on 3rd party ones. Ideally, we see local co-operatives emerge to protect this new-found revenue stream and enforce standards suitable to their region.

The purchase experience won’t be standardized because customers will be redirected to various 3rd party websites and apps. Just like with app stores, we can hope that a good feedback mechanism will help the best products emerge on top.

The toughest barrier to overcome, Airbnb will be giving up the opportunity to charge a 20-30% listing fee and will need to settle for likely something under 5%.

And finally, they will be slightly vulnerable to vampire attacks on their customer base from competing accommodation booking platforms. Although I think this is overestimated because most travelers are already registered across a range of services.

We think spinning off the rewards program into an open economy instead of a platform allows Airbnb to provide the 11-star experience they aspire to while protecting their core asset (i.e. network of hosts and property listings).

Disclaimers

This post is not financial or investment advice. It is meant for informational & educational purposes only. Please do your own research about risks and compliance before buying, investing/ or trading.

This is a creative product visualization from a community blog. While we’d love to help make this reality, we’re not officially associated with any of the apps, or businesses mentioned here.

Awesome stuff!