Building the ultimate loyalty rewards program

A new and vast design space for collaboration across brands

In this post, we’ll make the case for building the ultimate loyalty rewards program with help of the web3 paradigm of consumer-owned data.

It is possible that a few decades from now we get to the point where the default choice for any software product will be enabling consumers to hold and modify their own data. But it is not immediately obvious when or even how this transition will occur. In this essay, we’ll talk about why a consumer loyalty rewards network is a use case that can be significantly improved today using web3 technologies.

This essay is structured into the following broad sections:

Why loyalty rewards are important tools for business growth

The evolution of loyalty rewards and why collaboration between businesses is key to their success

How web3 technologies of consumer-owned data & token incentives provide superior collaboration infrastructure than the alternatives

And finally - if you’re looking to help build this, look out for the RFP section at the end of this essay.

Now, let’s dive in.

Why reward customer loyalty?

The reason why businesses care about rewarding customer loyalty is that over a longer period of time it can bring down the cost of customer acquisition. To survive and thrive every business needs to attract customers - without this nothing else matters. When many businesses compete for customer attention the cost attached with it increases. This cost is incurred through a mix of activities like marketing (promoting your brand across outdoor, print, and digital media), discounts (driving product trials through financial incentives), and partnerships (increasing distribution by working with complementary brands).

This competition doesn’t end after acquiring a customer once. Businesses also need to ensure that customers continue to transact with them. In an ideal scenario, a business would hope that the cost of every subsequent transaction is lower than the previous one. This will gradually increase margins and profits over a larger period of time allowing the business to invest in expansion or reward shareholders etc.

One of the popular ways of doing this is by sharing some of the value generated with the customers who are generating it. The most common implementation of this idea is loyalty rewards programs. The idea is simple - identify the customers who use your product/service the most (i.e. generate the highest revenue and hopefully profit for you). Offer them special treatment & a share in the value they generated with the hope that it drives them to continue using your service over others.

Loyalty programs can work really well for businesses because they:

Help form an emotional connect: Being recognized and feeling rewarded are some of the most primal human needs. If a business is able to forge connections that move beyond being transactional they are likely to see much higher stickiness and lower churn.

Help shape demand: Predictability of demand can really simplify business operations and finance. A well-designed loyalty program can go a long way here. It increases usage from existing customers so their behaviors should be easier to predict. The business also has insight into the supply & expiry of currency being spent (reward points).

Most efficient marketing spend: Instead of spending on broad reach or expensive performance marketing brands are putting value back directly in the hands of customers who have used the service. Hopefully, they have a delightful experience each time and that alone makes them more likely to keep coming back.

Design space to meet ever-rising expectations: Things that are delightful or novelty today become expectations tomorrow. It is not easy for the core product or service to keep evolving at that pace. Often it doesn’t need to - it is good enough for the purpose it serves (e.g. once uber ensures you always get a clean cab at a competitive price there isn’t much more they can easily do to significantly improve your ride experience). Loyalty programs are a great design space for brands to explore adjacent areas to improve the lives of their most loyal customers.

The evolution of loyalty programs

An important ingredient for the success of a loyalty program seems to be how many different benefits it can provide a customer outside of the core product/service offered by the brand. Below are a few reasons for this.

Specialization: Consumers desire best-in-class products and services for the money they spend. As a brand, this means seeking out these players that complement your offering and making them available to your customers. For example - while car rentals are a great reward for frequent fliers, it makes no sense for an airline to launch the service themselves instead of tying up with existing operators.

Diminishing returns: For most products and services, there is a limit to how good the core service can get for repeat customers. After this point, the only internal benefit to be offered is discounts that aren’t sustainable or rewarding. Brands need to look outside to find these adjacencies.

Better economics: Businesses are cyclical and distributing the cost across different players helps smoothen the impact of value sharing with customers.

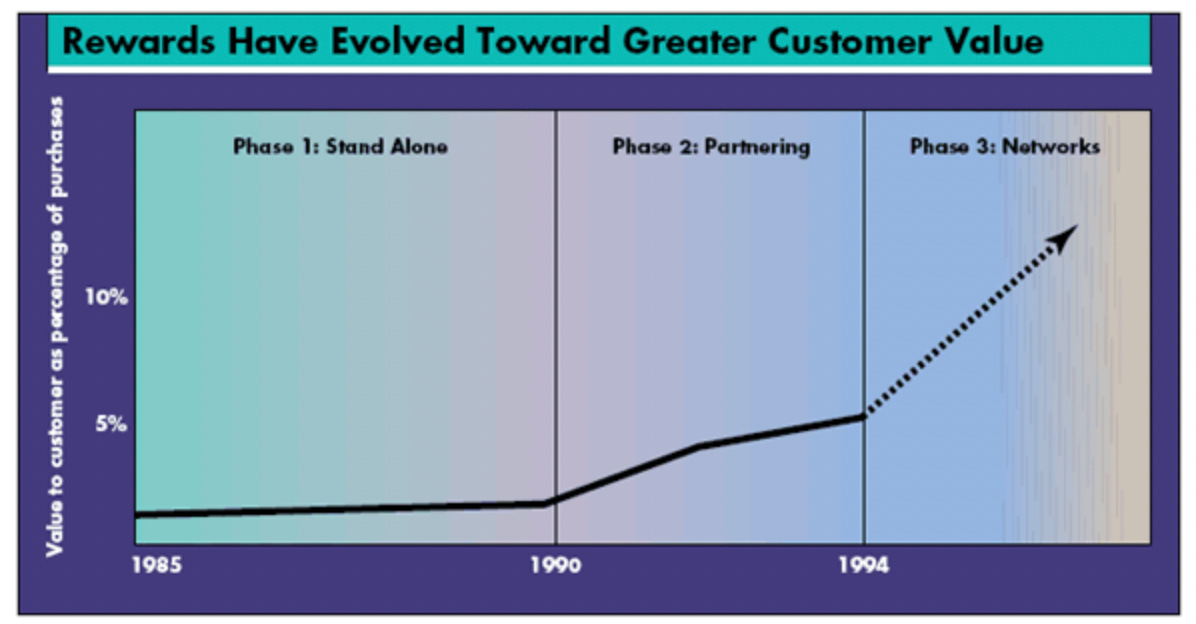

This image from an HBR article on loyalty programs captures how the infrastructure for collaboration between businesses has consistently gotten better over the last 3 decades.

Now that we’ve seen why collaboration and partnerships are essential to a well-designed loyalty program let’s take a closer look at the mechanism used to achieve this so far and some areas of improvement.

Direct Partnerships

This involves two or more brands working together on a specific product offering to each other’s customer base. A popular example of this is co-branded credit cards between banks & travel aggregators (e.g. MMT & ICICI, OLA & SBI, etc.) which provide consumers with added benefits and discounts while using their services. Beyond cards brands also explore custom offerings like the recent partnership between Amazon Prime & Uber in India.

Relative to reward networks these programs have the benefit of being more customizable. Brands can seek out partners who they think have the right customer base for them resulting in higher RoI and less cannibalization. The offering can be tailor-made to each brand’s strengths allowing for experiments, playing to their strengths & delivering a more controlled experience compared to networks.

However, this approach hasn’t really scaled. It is hard for brands to create rich & personalized experiences because data sharing between companies is not straightforward. Not only are there customer privacy concerns but brands would want to extract the most value by providing the least information about their customer base to anyone else. This results either in fragmented experiences restricted to each brand or sharing of aggregated transaction information which doesn’t allow for truly personalized experiences.

For example, let's look at the recent Prime day offer on Uber shown below.

A simple improvement to this could be that the discounts you get vary based on how long you have been a Prime member or how much you have spent on Amazon. However, there is currently no efficient way for Amazon and Uber to share this information. The result is expensive, margin diluting plain-vanilla discounts as the dominant benefit of loyalty program partnerships. This can be made much better for both consumers & brands by allowing them to plug into customer behavior in a manner that protects customer privacy.

The cost of running these partnership experiments is also pretty high. Each time a “partnerships team” within the company needs to evaluate a lot of questions about a partner before testing out a partnership. Does their customer base make sense for their product? Do they have sufficient scale where a successful partnership could benefit them? What is the potential impact of a successful partnership and how much of it can they capture? What are the risks of cannibalization, customer privacy, etc?

This process is slow and expensive for brands and results in clunky experiences for customers. Smaller brands are at the mercy of large platforms that dictate terms because of their scale. Larger brands are restricted to high-cost plain vanilla experiments. Consumers get fragmented and disconnected experiences that aren’t natively integrated into the product because data doesn’t flow seamlessly across platforms.

Imagine trying to deliver rich cross-brand experiences like:

A restaurant wants to reward someone who ordered more than 5 times a month from them through Zomato & Swiggy.

A movie star wants to offer premier tickets for his new movie to everyone who watched more than 10 of his movies online on any platform in the last 6 months.

A sneaker retail outlet wants to offer discounts to people who walk more than 3500 steps/day for the last 6 months.

A mall wants to offer free parking to anyone who spent more than 15,000 in a given month.

A comedian wants to give first access to IRL tickets to anyone who watched 30 mins of their IG live in the last month.

In the current approach, these experiments are unimaginable because of the friction and risks in making this information available. Later in this essay, we will look at how integrating with a well-designed crypto protocol can enable these experiments while preserving customer privacy.

Reward networks

The second and relatively more popular approach is brands participating in reward networks. These are typically run by credit card companies and banks which are intermediaries to all financial transactions. We’d argue that because sharing any kind of consumer behavior is impossible, loyalty programs have converged on rewarding money spent. This has uniquely positioned companies that aggregate this information to set up some of the most successful reward programs of the last decade.

This has worked well because it eliminates the data sharing and evaluation problem. Credit card companies already have our transaction information so there is no privacy risk. Money spent is a uniform metric across brands and easy to quantify and reward. It generates scale and diffuses CAC across many different businesses. This is especially useful for smaller brands that struggle to generate their own scale or effectively partner with larger brands.

This model is so good that other companies like CRED, Dineout & Magic-pin, etc. are trying to replicate these network effects. Only time will tell whether they are able to effectively aggregate the data that is readily available to financial intermediaries and design a superior rewards experience for them.

However, these programs suffer from the same limitation that rewards are based solely on aggregated metrics like money spent. Given the sheer number of participants, while these provide a higher breadth of rewards than direct partnerships, they are even more vanilla in that the rewards are mostly limited to discounts. It is infeasible for these brands to build deep experiences based on usage patterns within each product.

It is worth re-emphasizing that customers really care about these rich cross-brand experiences. Just look at this thread of Brian Chesky asking Twitter what they’d want from an Airbnb guest membership program. After discounts, the most requested features were partnerships! with uber, gyms, local experiences, etc.

The reason none of this has materialized is that a centralized approach to this is too bottlenecked. The Airbnb partnerships team will need to design experiments to test out which of these are viable. They need to answer questions like: do the economics work, is the service quality reliable, can it scale globally, etc. And they need to do this ahead of time, before starting a test. Additionally, for each integration, the Airbnb product will need to provide certain information to each partner, ensure customer privacy while doing so & taking service and feedback about each customer from each partner.

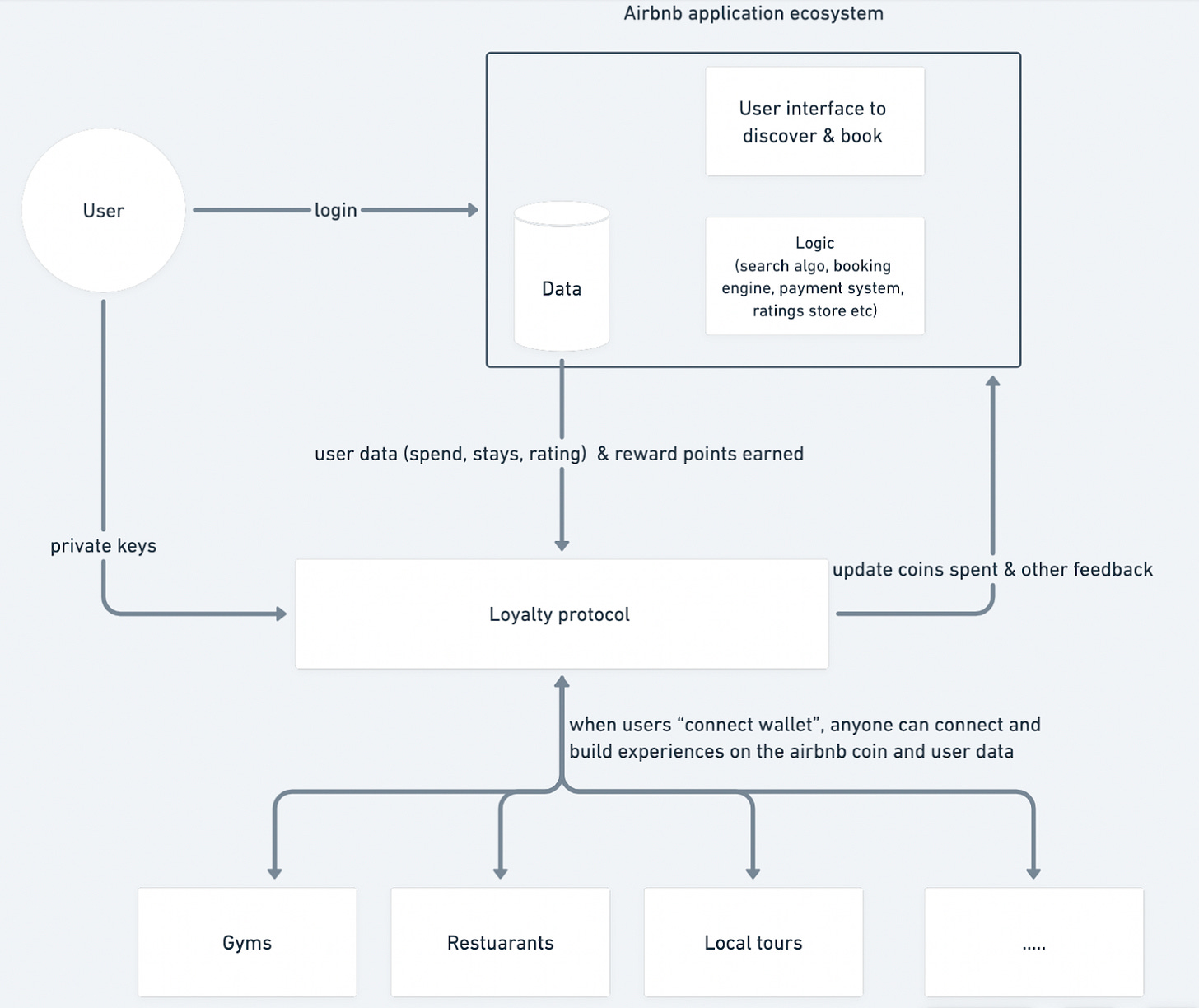

Here’s an alternate approach Airbnb can take using web3. Issue crypto reward coins representing how Airbnb values customer activity (e.g. 100 coins for a night- stay, 5 coins for a review). Allow consumers to export their travel history on-chain (places visited, frequency, amount spend, rating) and hold it in their wallet. Any brand can invite these customers to connect wallet and spend their Airbnb coins to use their products and services. The raw travel information helps brands select the kind of customers they want and what kind of offerings they will provide them.

This approach is not without its own challenges. Airbnb gives up control over the quality of partner service and assumes some brand risk because customers might blame Airbnb for a poor partner experience. Airbnb also returns ownership of data to customers meaning rival companies can come and build on top of this and potentially threaten their business.

However, our belief is that unlocking the power of the massive Airbnb network will enrich the lives of their consumers far more and create a different type of network effect - hard-to-replicate experiences for consumers & demand for the Airbnb coin. Once a network of brands that accept the Airbnb coin is formed around, that is nearly impossible to centrally replicate for any competitor. This is a direct result of the service that Airbnb has painstakingly built over the last decade and can’t be copied by issuing a coin. Keep in mind partners are subsiding this part of the Airbnb loyalty program. The acceptance of this coin over that of competitors will drive added value to anyone who uses Airbnb at zero cost to the company. It feels like this will give Airbnb a smaller piece of a much much larger pie - which is a better outcome for everyone involved.

Proposal: The ultimate consumer rewards program

We’ll now lay out a proposal for building out the first version of an open loyalty rewards program. Three key elements to achieve this are:

Open, consumer-owned data

Dynamic pricing

Marketplace for redeeming rewards

Open, consumer-owned data

The underlying premise of web3 is consumer-owned data. Today, platforms store information about us - our purchases, likes/dislikes, social connections, and all online activity. Our login is the platform’s way of giving us permission to access our own information - not the other way around. The paradigm shift in web3 is that our information, while generated on a product similar to a platform, is stored on the blockchain in our own wallet, secured by our private keys. Of course, the platform that generated it can keep a copy of it but root access shifting from platforms to consumers is key to everything we’ll talk about now. Most significantly because this data can now be provided to other applications at will by consumers without permission from the platforms where it originated.

Open data is the first and most critical element, everything depends on it. Today, information about our online lives is locked within the platform it is generated on. This means no one else can build on top of it even if we want them to. This is a major bottleneck to innovation. With a single platform as a custodian for this data, innovation is either restricted to the pace of the teams in that company working on it or the pace of partnerships/APIs provisioned by the company.

There are two ways in which data will start going online:

Web3 native applications

There will be projects that are built with this philosophy at their core, e.g. audius is putting creator-fan relationships on-chain in the context of music, mirror & wordcel are doing the same for long-form writing. These are currently small startups with negligible scale compared to incumbent platforms - but in the near future, some winners will emerge with sufficient critical mass which at the very least becomes a viable alternative for creators who care about self-sovereignty and force platforms to take note. I do realize it is unlikely that any of these will be able to immediately disrupt the network effects that these platforms have built over the last decade.

Platform pipes

Thankfully, we don’t need to rely only on web3 native projects to replace existing networks. A lot of forces will drive the creation of hybrid products which operate largely like the web2 products of today but consumer data is pushed on-chain. Here are a few reasons why:

National Data APIs: GoI is invested in building open standards for the internet - UPI, account aggregators, ONDC & NDHM are public goods that anyone can plug into. UPI disrupted closed wallets, ONDC will create an open seller network that anyone can plug into. It is plausible that the next step could be a standard for consumer data which can then be copied & synced on-chain with user consent.

Regulations: The second example is the EU's push on privacy. Regulators already mandate that platforms make consumer data available to consumers - this is a little-used feature and the quality of data is questionable but this is another orifice that consumers and developers can tap into to start migrating consumer data on-chain

Web2 platforms opt-in: Marketplaces, Payment & logistics solutions have powered the rise of D2C brands globally. As these brands achieve the scale they realize that reliance on marketplaces is both expensive and possibly fatal (they can get white-labeled). These brands have small, basic websites and use discounts and memberships to drive traffic. This network provides a real alternative to the choices of direct and marketplace - brands can create pipes that allow consumers to export their data on-chain and thus enabling them to organize loyalty programs well beyond the current “affiliate” & “partnerships” model. The same goes for smaller niche platforms that currently can’t compete with large marketplaces, e.g. in the travel space standalone brands like Treebo, lemon tree have struggled to compete with OTAs like MMT - these platforms will see value in opting into this network as it creates a viable third alternative that they don’t have today.

Platform winners: The winners of the last decade will be the last to fall, but with enough pressure from consumers, sellers and governments they will eventually have to opt in and find ways to co-exist with these networks, just like companies are building new businesses on top of UPI. In the absence of UPI, these companies would have most likely built products around their closed wallets - but with that replaced by UPI, they are now exploring credit, insurance, investment products, e-commerce, and other alternatives. With consumer data being taken out they will need to find other ways to uniquely add value and justify their take rates.

Dynamic pricing

Before we enter this section let’s understand what kind of data is likely to go on-chain. We don’t expect any application (web3 native or otherwise) to write all their data to public blockchains. It is technically inefficient and unnecessary. Instead, two things will happen: “Important” information will get put on-chain, e.g. an app like Instagram will allow you to put your followers & posts on-chain. But information about the kind of reels you watched will be aggregated instead of the full dump. Communities will have a significant voice (via tokens) to decide what is “important” instead of the decision being restricted to small teams within these companies.

Examples of what kind of information will you be able to take on-chain could be your taste in movies and music, stuff you buy, your social footprint & your travel info, etc. While these components largely capture our online consumption we’ve never had products that bring them all well together. A loyalty rewards program is an apt interim step towards building truly open consumption experiences.

Rewards Coins (FTs)

Brands already issue “coins” to consumers that are earnt by spending or engaging with their apps and can be redeemed either within the same products and services or with their partners. These coins are subject to the same demand-supply dynamics as any other currency or market.

Today, brands need to consider which actions should be rewarded and to what extent, what should be the validity and transferability of these rewards, and what is the conversion ratio for redeeming these rewards. They also need to create a spending sink for these rewards.

Allowing consumers to convert these coins into crypto tokens allows brands to outsource a lot of these problems. Brands still need to focus on the questions listed above but there’s a much sharper feedback loop available now. Assuming there is sufficient demand for your product other brands can swarm in and build products for your token holders reducing pressure on you. Arbitrageurs will help set a fair price for your coins depending on how easy/hard it is to get them and how useful that is and can be in the future. And consumers gain the option to sell for immediate liquidity

This dynamic is similar to how financial markets operate today. Financial actors price a company based on present and expected earnings. A small difference is that crypto-powered markets will be truly open to all from information availability to trade execution. That might not be the case yet but is a realistic goal the ecosystem is striving towards. And in the interim, web2 products will actually have a disproportionate edge over their web3 counterparts because they have much more established products, services, and network effects thus generating stronger demand for their reward coins.

Here’s a visual representation of the Airbnb example we looked at earlier,

NFTs - Rewards that are truly for you

A unique benefit of a crypto-powered consumer rewards network is that brands can recognize and reward much more than just aggregated spending. NFTs allow brands to tag truly unique consumer information and empower consumers to move this information across products and services online. The financial nature of these products also means that there is real-time market-driven pricing for access to this information.

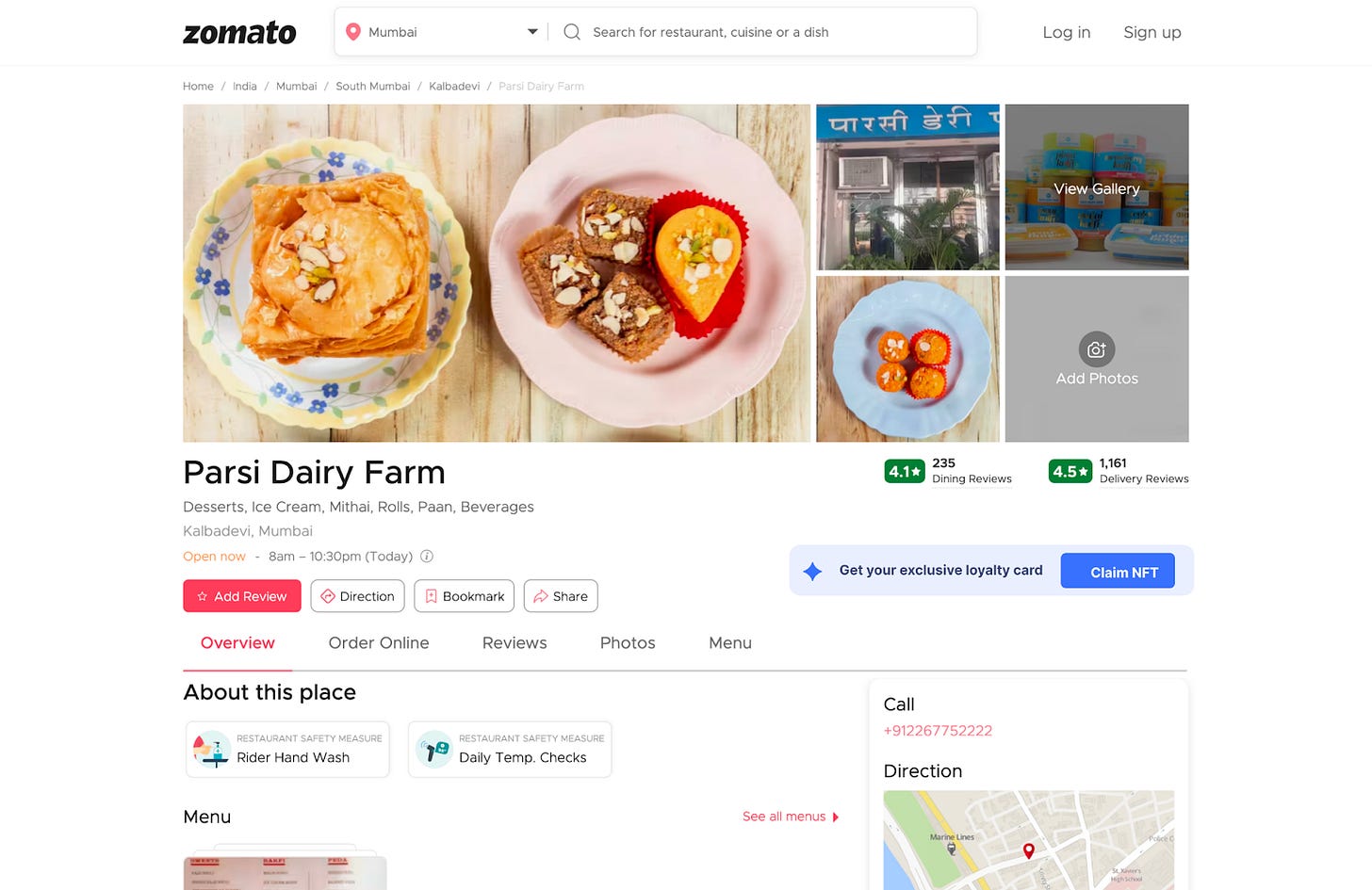

Here’s a simple example: I order from an iconic boutique ice cream brand every week on Zomato for a year. Zomato allows me to export this information on-chain capturing which ice cream I order the most, total spend, and order count. Let’s call this an NFT - because each consumer will have different “attributes”. The ice-cream brand is now launching a new flavor and they want to provide early access to & get feedback from their most loyal customers who enjoy their current Peach flavor.

Now, they have one of three options:

Make a generic social media announcement and have people line up. This is the simplest approach but disregards existing loyalty shown in favor of a FIFO system.

Use an opaque ad targeting system if it supports the custom segmentation they need. And incur extra costs to speak to their own customers.

Reach out to Zomato’s partnerships team, find a way to get this information without customer privacy issues & negotiate some commercials. If they decide to do this everything needs to be reconciled offline. At this point, it is really hard to decide how much they should pay for this because it is an experiment - how many people will show up, how much will they spend? At best they write it off as a marketing expense. Assuming Zomato entertains this request from a boutique ice-cream brand at all.

Allow customers to “connect wallet” and verify their loyalty to the brand through Zomato’s issued NFT. Those who do this get early access to try out the new flavor.

Here are some design mockups of what step #3 would look like:

The third approach is clearly superior for everyone involved. The ice cream brand can directly connect with its loyal customer base and get quality product feedback. Customers get rewarded for loyalty displayed in the past. And Zomato is seen as a platform that provides benefits beyond food ordering services for little-no incremental effort on their part.

To be fair, Zomato is trying to implement a similar construct on their service. I recently received a “personalized coupon code” that I could share with friends on behalf of an ice cream chain I order frequently from. While this may look similar on the surface it will be very restrictive. It is unlikely that a single system will be able to achieve the same level of customization and nuance that opening up the raw underlying data can do. It is also important to note that in the NFT approach the customers get to choose if they want to opt-in, sell or ignore the invitation. In a centralized approach, they don’t really have that choice.

The decision of whether to generate this information as a combination of (data, tokens) or embedded into an NFT is best left to individual judgment. The question is how intrinsically linked the reward experience is with the action. In the case of the Airbnb example, it might not be that closely linked but in the case of the boutique ice cream, it is. It will be interesting to see whether a single protocol supports both of these or whether distinct protocols emerge.

Marketplace for redeeming rewards

In the previous sections, we’ve looked at what information goes on-chain and the benefits of consumers being able to self-custody their data in open markets. In this third and final section, we’ll argue why the spending side of the rewards programs is also improved.

When consumers spend these coins for products and services the provider still has to pay the real cost of the product/service. This expected burn drives the current supply and partnership agreements surrounding these coins. If brands augment this with the crypto elements of open markets and data it allows other brands to enter much faster than through a permissioned partnerships model. Today brands need to negotiate terms of agreement before running the test. Instead, brands can come in and build on top of open rewards programs & market directly to customers.

If nothing else this creates a free-spending sink for your loyalty program as a brand and generates goodwill because there is no upside to the perks I can get for shopping with you. While there is no clear monetization approach right away you have to admit this looks more positive-sum than the current approach. At the very least you gain goodwill for free and save on redemption costs, and at best you can get market feedback and maybe acquire/build out your product roadmap based on what services your consumers like.

The other improvement in an open marketplace is capturing the CAC spread. If you look at it from a purely financial standpoint, a loyalty program is a discount earned for future use of services of a brand and its partners based on past usage of their services. Currently, this cost is distributed between the issuing brand and their selected partners. Adding a marketplace dynamic where any developer or brand can test their hypothesis is almost certainly going to reduce the net CAC. More so because every business goes through the cycle of growth and consolidation. During growth phases, businesses are more willing to spend money to test where and how they can acquire customers. During consolidation phases, it is more about finding efficiencies for channels that are proven through these tests. Today these tests are rate limited by whether partnership teams in each company can agree on something - in a crypto loyalty network they will move much faster.

For example - If a protein bar brand wants to run a test on whether people who walk regularly are more likely to pay for a subscription, they need to go via the APIs of major providers like Fitbit, Apple, and Google. Here’s what the documentation for google fit APIs looks like, notice the last step - “apply for verification” because google wants to make sure “sensitive customer info” is not leaked. Well, here’s an alternative - let each customer decide. In the world of consumer-owned data that we described, this would be a weekend experiment that someone could run and get real feedback on whether this works or not.

The high barrier to partnerships means that the barrier for collaboration is equally high, eliminating that will create an environment for rapid experimentation that will not only diffuse net CAC for stronger brands but create newer and richer experiences for consumers.

Rewarding consumer loyalty is an important tool for business growth. Today’s programs are limited by the infrastructure for collaboration. Web3 unlocks a whole new design space by putting data back in the hands of consumers. This allows for rich and truly personalized experiences across brands. Building this open data network is not trivial or a given. However, there are many faucets through which data will flow in to build this network. An open loyalty program will be more rewarding for customers and more efficient for brands.

Getting started - RFPs

If you’ve made it this far and are excited about the idea of an open consumer loyalty program, here are a few ways you can get involved with making it happen:

Proposal for a loyalty rewards protocol: If we’re right then there will be at least a few protocols that allow consumers to export their data from brands. Key considerations would be:

Is the data standard generic enough to support use cases across industries and brands? What trade-offs are necessary for a v1

Security vs Usability: How do we keep data consumer-owned and secure but make the product easy to use

Developer access: What kind of access would we need to provide to brands that want to build experiences on top of this protocol.

Early traction: How can we incentives developers, consumers & brands to use this protocol before/while the early rewards use-cases are built out.

What options and trade-offs exist for monetizing this protocol

Deep-dive: Achieving consumer-owned data. A deep dive into the state of data access for consumers.

Across geographies and industries, what tools do customers have to retrieve their data from the applications they use.

What is the fidelity of this data - is it usable for building out the use cases we discussed

What are cost and technical constraints - API access, rate limits, etc.

Are there any specific geographies or industries that provide superior data access?

Data Aggregation tool: Pick any product that provides high fidelity data access to consumers and build a simple way for consumers to export this data on-chain. Bonus points if it is scalable to other products.

Open marketplace design: Assuming there exists a protocol which is able to sufficiently aggregate consumer data, design mockups for a marketplace where consumers can discover and redeem rewards. Take a few specific use cases that are uniquely enabled by the open-data paradigm and visually depict what the discovery & purchase experience would look like for consumers.

Pitch document: If you had to bootstrap this project to 100k users how would you do it? What industry/brands would you focus on and why? What is the v1 product you’d launch? How would you get early traction? What would the first set of experiences be? Write a detailed pitch doc that you or other aspiring founders can use.

If you would like to work on any (or all) of these RFPs or found a project to build this out end to end Superteam would love to support you. Apply for a grant with FTX Superteam or a Superteam instagrant. If neither fits, just reach out via Twitter and we’ll work it out.

Thanks to Yash for making the design mock-ups & the cover image & to Kash for his feedback on this essay.